AI in Food Safety Market Trends, Growth Drivers and Leading Companies 2024

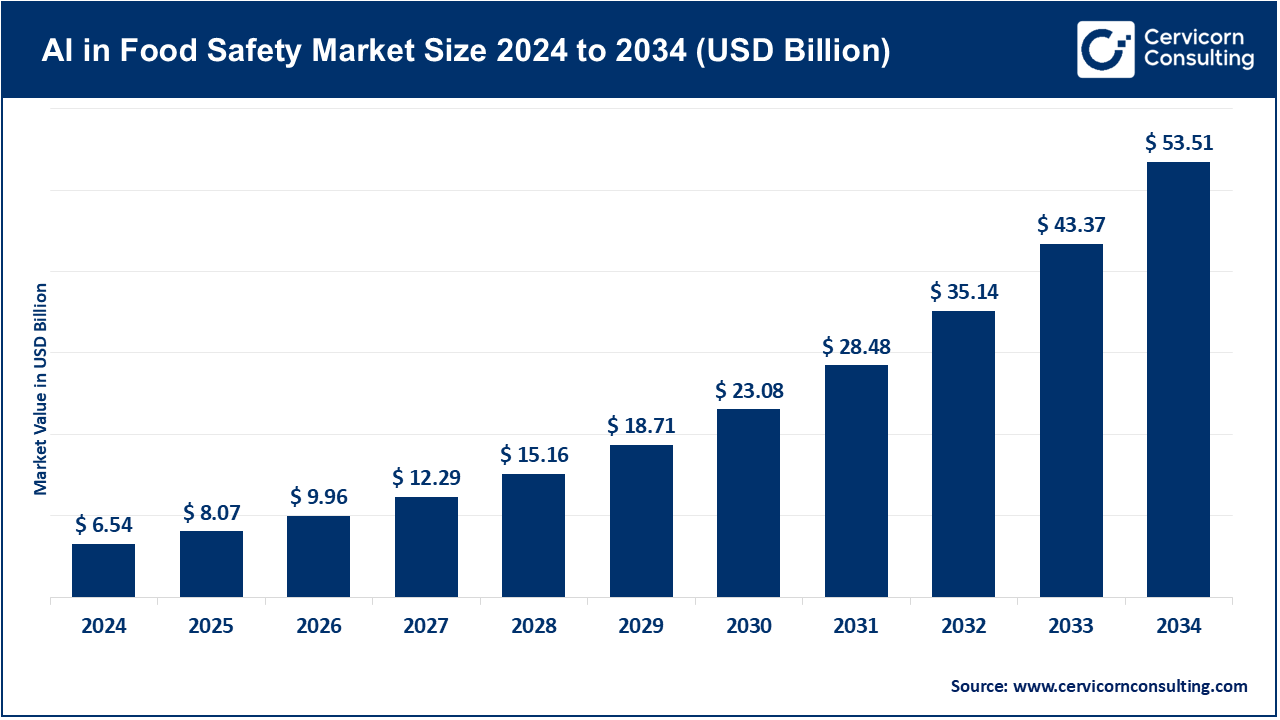

AI in Food Safety Market Size

What is the “AI in food safety” market?

The AI in food safety market covers software, hardware, and services that use artificial intelligence (machine learning, computer vision, natural language processing, anomaly detection, etc.) to prevent, detect, monitor, and manage food safety risks across the entire value chain — farming, processing, packaging, storage, logistics, and retail. Solutions include automated visual inspection (detecting foreign objects, spoilage, or packaging defects), predictive analytics for contamination/illness risk, anomaly detection in supply chain telemetry (temperature, humidity), traceability/forensics (linking lots to origin using AI-enhanced blockchain/ledger analytics), label and allergen checking, and regulatory compliance automation. The market includes vendors selling cloud AI platforms, edge devices with embedded models, data-integration services, and consulting/managed services to deploy, validate, and govern AI for food safety.

Growth factors

Multiple forces are converging to accelerate AI adoption in food safety: the massive digitization of the supply chain (IoT sensors, traceability data, and digitized records) which supplies the training data AI needs; rising regulatory pressure and faster recall cycles that reward automated risk detection; growing consumer demand for transparency and provenance; tighter retailer requirements for supplier controls.

The economics of reducing spoilage and recall costs (AI reduces waste and liability); falling costs of compute and more accessible cloud AI tools (making pilots cheaper to run); and the availability of verticalized AI products and managed services that lower integration hurdles for food companies. Together these create a high-growth environment for AI vendors, consultancies, and those applying the tech directly in plants, farms, and distribution centers.

Why is AI in food safety important?

Food-related illness outbreaks and recalls are costly — in human health, brand damage, and direct financial losses. Traditional inspection and lab-test regimes are slow, episodic, and often reactive. AI offers faster detection (computer vision on lines), earlier warning (predictive risk scoring from combined weather, logistics, and farm data), better traceability (linking contaminated lots back to source almost instantly), and automation of repetitive regulatory tasks (label checks, document review). Faster detection and smarter prevention reduce the scale of recalls, cut waste, improve consumer trust, and make compliance more efficient — all critical for large retailers, processors, and regulators. Recent advances in generative and foundation models also enable better ingestion of semi-structured regulatory text and faster synthesis for inspectors and operators.

AI in Food Safety — Top Companies

IBM Corporation

- Specialization: Traceability and analytics (IBM Food Trust), AI-enabled recall analytics, supply-chain provenance, hybrid-cloud AI deployments, and consulting-led AI implementations for food companies.

- Key focus areas: Blockchain and AI traceability, predictive analytics for recalls, regulatory data support (helping meet FDA FSMA requirements), and industry-specific consulting to operationalize AI in plants.

- Notable features: IBM Food Trust’s integration of ledger-based provenance with analytics; deep consulting bench (IBM Consulting) to deploy and validate AI models at enterprise scale.

- 2024 revenue (company-wide): ~$62.8 billion.

- Market share: Recognized in enterprise traceability and pilot programs, especially with combined blockchain and AI.

- Global presence: Extensive presence in North America, Europe, and Asia via consulting offices and enterprise deals.

Microsoft Corporation

- Specialization: Cloud AI platforms (Azure AI), industry-adapted models, Copilot/BI tools for analytics and reporting, edge IoT integration for plant-floor vision and telemetry.

- Key focus areas: Generative AI and industry-adapted models for operations, integration of Copilot into Power BI/Excel for insights, scalable cloud for hosting AI models and data lakes for traceability.

- Notable features: Strong low-code/no-code tooling, partner ecosystem for manufacturing and food retailers, and large enterprise sales footprint.

- 2024 revenue (company-wide): ~$245 billion.

- Market share: Major cloud/AI platform provider; widely adopted for AI workloads in food safety.

- Global presence: Strong in North America, EMEA, and APAC.

Google LLC (Alphabet Inc.)

- Specialization: Cloud AI and ML tools (Google Cloud Platform, Vertex AI), generative AI use-cases for food systems (product development, rapid prototyping), and supply-chain analytics.

- Key focus areas: AI infrastructure for model training (TensorFlow/Vertex), AI-driven product innovation and quality analytics, and cloud services for retailers and food firms.

- Notable features: Strong AI research and models, powerful data infrastructure, and case studies like AKA Foods using Google Cloud for rapid prototyping.

- 2024 revenue (company-wide): ~$350 billion.

- Market share: A top-three cloud provider for enterprise AI workloads, including food safety analytics.

- Global presence: Strong in North America, Europe, and expanding rapidly in Asia-Pacific.

Amazon Web Services (AWS)

- Specialization: Scalable cloud infrastructure for AI, edge-to-cloud IoT services, managed AI tooling, and industry-specific clean-room analytics for collaborative food-safety data use.

- Key focus areas: Cloud compute for training/inference, AWS Clean Rooms for collaborative analytics across supply-chain partners, edge devices, and managed ML services.

- Notable features: Massive scale supporting heavy ML experiments, broad set of managed services for IoT, analytics, and ML, plus internal applications in Amazon warehouses for spoilage tracking.

- 2024 revenue (company-wide): ~$638 billion (Amazon total), ~$107.6 billion (AWS).

- Market share: Largest global cloud provider, dominant in AI/IoT deployments relevant to food safety.

- Global presence: Global data center footprint, with leadership in North America and strong presence in Europe and Asia-Pacific.

SAP SE

- Specialization: Enterprise resource planning and supply-chain traceability solutions (SAP Business Network Material Traceability).

- Key focus areas: Material traceability, product genealogy, compliance and sustainability reporting, integration of operational data with ERP systems.

- Notable features: Deep integration with ERP systems, global supplier network through SAP Business Network, and traceability modules tailored to batch/lot management.

- 2024 revenue (company-wide): ~€34.18 billion.

- Market share: Strong in enterprise supply-chain software; a go-to vendor for ERP-integrated food safety systems.

- Global presence: Strong in Europe and North America, with growth in Asia-Pacific.

Leading trends and their impact

- Computer vision on the line: Cameras and ML models detect foreign objects, mislabeling, packaging defects, and spoilage in real time — reducing recalls and waste.

- Edge AI and IoT telemetry: Edge devices detect temperature excursions or abnormal vibrations immediately, protecting cold chains.

- Traceability and provenance analytics: AI layered onto blockchain/ledger datasets accelerates root-cause analysis during outbreaks.

- Regulatory AI assistants: Regulators use AI to triage inspections and analyze safety data, increasing inspection efficiency.

- Generative AI for knowledge work: Automates report summaries and corrective-action templates, lowering adoption barriers.

- Data collaboration platforms: Tools such as AWS Clean Rooms enable safer cross-company analytics, improving systemic risk detection.

Successful examples from around the world

- Walmart + IBM Food Trust: Reduced traceability times from days to seconds, pioneering modern food-traceability adoption.

- IBM + iFoodDS: Helped Latin American firms integrate traceability tools for compliance and recalls.

- AKA Foods + Google Cloud: Accelerated product prototyping and sensory data integration for quality improvements.

- Amazon warehouses: AI-driven spoilage detection systems reduce inventory losses and improve safety.

- FDA Elsa AI: U.S. regulators use AI tools internally to process data and prioritize inspections more effectively.

Global regional analysis

North America

High adoption of cloud AI and strict regulatory scrutiny. FDA’s use of AI tools and FSMA requirements are driving strong adoption of traceability and predictive analytics.

Europe

Focused on fraud detection, authenticity, and transparency. The EU AI Act introduces strict rules for high-risk AI systems, ensuring compliance and accountability but also encouraging enterprise-grade solutions.

Asia-Pacific

Rapid adoption in China through government-led modernization. India’s FSSAI promotes digital portals for imports and inspections. Both markets are expanding cloud and edge AI deployments.

Latin America & Middle East / Africa

Adoption led by retailer-driven consortiums and pilot projects. Expansion depends heavily on infrastructure investment and regional regulatory alignment.

Government initiatives and policy trends

- Regulatory modernization: Agencies like the FDA are adopting AI to process safety data and triage inspections.

- AI governance frameworks: The EU AI Act sets standards for transparency and documentation of high-risk AI systems.

- Traceability rules: FSMA and similar mandates worldwide are pushing demand for AI-based traceability analytics.

- Innovation sandboxes: Regulators in the UK and elsewhere are testing emerging AI systems for food safety under controlled environments.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: On-Demand Healthcare Market Key Players, Trends, and Global Outlook by 2034