AI Data Centre Market Growth Drivers, Trends, Key Players and Regional Insights by 2035

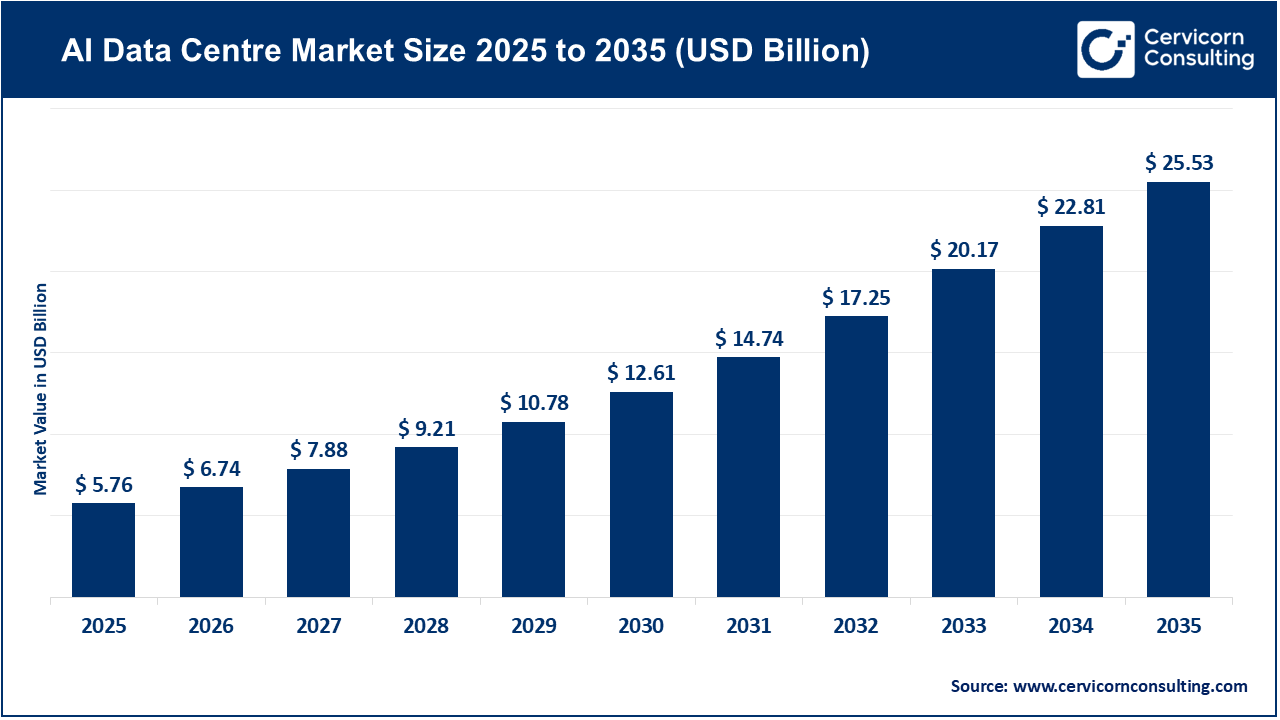

AI Data Centre Market Size

The global AI data centre market size was worth USD 5.76 billion in 2025 and is anticipated to expand to around USD 25.53 billion by 2035, registering a compound annual growth rate (CAGR) of 40.1% from 2026 to 2035.

What is the AI Data Centre Market?

The AI data centre market refers to the ecosystem of physical infrastructure, hardware accelerators, software stacks, networking systems, colocation services, and hyperscale campuses specifically designed to support artificial intelligence workloads — such as training large language models (LLMs), running generative AI inference at scale, powering recommendation systems, or enabling edge intelligence.

Unlike traditional data centres built primarily around CPUs and general-purpose computing, AI data centres prioritize GPU/TPU/AI-accelerator density, ultra-low-latency interconnects (InfiniBand, NVLink), liquid cooling, and massive storage throughput. They are engineered to handle:

- High-intensity compute cycles for AI training

- Real-time inference for global AI applications

- Hybrid cloud and on-prem AI workloads

- Energy-efficient model hosting

- Scalable distributed AI clusters

Get a Free Sample: https://www.cervicornconsulting.com/sample/2409

Why the AI Data Centre Market is Important

AI data centres are the backbone of the global AI economy. They determine the speed at which AI models can be trained, deployed, and scaled. Their efficiency directly influences:

- The cost of operating AI services

- The sustainability and energy footprint of AI

- The competitiveness of cloud providers and enterprises

- National AI capability and digital sovereignty

- Innovation across every industry

In other words, AI can only advance as fast as the data centres that support it.

AI Data Centre Market Growth Factors — Single Paragraph

The AI data centre market is expanding rapidly due to accelerating enterprise adoption of generative AI, surging demand for foundation-model training, increased deployment of GPU and custom AI accelerator clusters, advancements in high-bandwidth networking, rising utilization of hybrid and cloud-based AI compute, government incentives for domestic semiconductor and AI infrastructure, growth in edge AI applications requiring localized micro-data centres, energy-efficient cooling innovations such as liquid and immersion cooling, falling hardware costs per teraflop, and the strategic push by hyperscalers to build global AI megacampuses that support multi-tenant workloads and real-time inference delivery.

Top Companies in the AI Data Centre Market

1. NVIDIA Corporation

Specialization:

High-performance GPU accelerators, AI-optimized networking (Mellanox), DGX systems, and full-stack AI software (CUDA, cuDNN).

Key Focus Areas:

- GPU leadership for AI training and inference

- Integrated AI platforms (DGX, HGX)

- Partnerships with hyperscalers and enterprises

- Systems for large-scale model training workloads

Notable Features:

- Industry-leading data-centre GPUs like the H100 and Blackwell family

- End-to-end AI ecosystem from hardware to software

- Strong presence in hyperscaler AI clusters

2024 Revenue:

Approximately $60.9 billion.

Market Share:

Dominant share of the global AI accelerator market.

Global Presence:

Headquartered in the U.S. with wide deployment across North America, Europe, and Asia in cloud and enterprise environments.

2. Intel Corporation

Specialization:

Server CPUs, AI accelerators (Gaudi family), networking, storage, and system platforms for enterprise AI.

Key Focus Areas:

- AI-integrated CPUs

- Growth of Gaudi AI accelerators

- Data-centre platform leadership

- Foundry services and ecosystem partnerships

Notable Features:

- Huge installed CPU footprint in global servers

- Expanding AI-focused silicon roadmap

- Moves toward disaggregated and composable architectures

2024 Revenue:

Approximately $53.1 billion.

Market Share:

Strong in general-purpose server CPU market; increasing share in AI-accelerator systems.

Global Presence:

Massive worldwide manufacturing, supply chain, and enterprise customer reach.

3. IBM Corporation

Specialization:

Enterprise AI platforms (Watson), hybrid cloud, AI governance, and AI-optimized enterprise systems.

Key Focus Areas:

- Responsible AI adoption

- Hybrid cloud + AI orchestration

- Industry-specific AI deployment

- Data governance and model oversight

Notable Features:

- Deep industry relationships in finance, healthcare, and government

- Strong AI consulting and managed services footprint

- Highly secure and regulated-environment specialization

2024 Revenue:

Approximately $62.8 billion.

Market Share:

A leader in enterprise AI system integration, hybrid cloud, and consulting for data-centre modernization.

Global Presence:

Operations in over 170 countries.

4. Google LLC

Specialization:

Cloud TPUs, hyperscale AI data centres, Google Cloud AI (Vertex AI), and internal AI infrastructure powering products like Search, Gemini, and YouTube.

Key Focus Areas:

- Custom AI chips (TPU v5, v6)

- Global AI data-centre expansion

- Managed AI/ML services for enterprises

- Foundation-model innovation

Notable Features:

- One of the world’s largest AI training infrastructures

- Proprietary TPU pods optimized for large-model training

- Leadership in AI-first cloud services

2024 Revenue:

Alphabet’s total 2024 revenue was approximately $350 billion.

Market Share:

Major share of hyperscaler AI infrastructure through Google Cloud.

Global Presence:

Sprawling worldwide data-centre network including major expansions in India, Europe, and the U.S.

5. Microsoft Corporation

Specialization:

Azure AI infrastructure, hyperscale GPU megaclusters, custom AI data-centre designs, and deep integration with OpenAI.

Key Focus Areas:

- Azure AI Foundry and AI supercomputers

- GPU partnerships with NVIDIA

- Custom silicon (Azure Maia / Cobalt)

- Integrated enterprise generative AI applications

Notable Features:

- AI “megafactory” concepts for hyperscale training

- Heavy global capex deployment into AI campuses

- Alignment with OpenAI for frontier model development

2024 Revenue:

Approximately $245.1 billion.

Market Share:

Among the largest global providers of AI compute capacity.

Global Presence:

Azure data centres across all major regions, with strong expansion in APAC and Europe.

Leading Trends in the AI Data Centre Market and Their Impact

1. Rise of Specialized AI Accelerators

Companies are shifting from general-purpose CPUs to GPUs, TPUs, and AI-specific ASICs.

Impact: Dramatically improved performance, lower inference costs, and deeper vertical integration.

2. Design of Purpose-Built AI Mega Data Centres

High-density rack deployments, liquid cooling, and exascale storage architectures are becoming standard.

Impact: More efficient training environments and reduced operational bottlenecks.

3. Surge in Hyperscaler Capital Investments

Microsoft, Google, and others are investing tens of billions into AI data-centre expansion.

Impact: Faster global capacity rollout and rapid regional digital transformation.

4. Energy Efficiency and Sustainability Mandates

Liquid cooling, heat reuse, and renewable-power sourcing are now essential.

Impact: Reduced carbon footprint and compliance with new energy regulations.

5. AI-Optimized Networking & Composable Infrastructure

AI clusters now depend on extremely high-bandwidth networking fabrics.

Impact: Better cluster performance and improved resource utilization.

6. Distributed Edge AI Data Centres

AI inference is moving closer to end users via compact, decentralized micro-centres.

Impact: Lower latency for applications like autonomous systems and smart cities.

7. National AI Compute Strategies

Countries are issuing policies to secure domestic AI compute capacity.

Impact: Government incentives are reshaping regional investment patterns.

Successful AI Data Centre Examples Around the World

Microsoft AI Megafactories (USA)

Microsoft has built next-generation “AI megafactories” — ultra-dense GPU clusters with liquid cooling and industrial-scale power design, supporting enterprise and OpenAI training workloads.

Google TPU AI Infrastructure (Global)

Google’s TPU pods demonstrate the efficiency of custom-designed AI accelerators powering products like Search, Ads, Gemini, and other AI services.

NVIDIA DGX SuperPOD Installations (Global Colocation Operators)

Many enterprise and research supercomputers use NVIDIA DGX SuperPODs, enabling turnkey AI training clusters with validated designs.

India’s Emerging AI Data Centre Hubs

Major technology companies are building large AI campuses across India, driven by supportive state and national policies, digital transformation, and surging AI adoption.

Telco & Financial-Services Private AI Clusters

Banks and telecom companies in Europe, North America, and APAC are deploying private AI data centres for secure, compliance-driven model training.

Global Regional Analysis & Government Initiatives

North America

Government Influence

- Semiconductor and digital infrastructure incentives

- Federal and state support for hyperscale campus development

- Regulations encouraging clean energy adoption

Market Dynamics

- Largest global hub for AI data-centre investment

- Rapid expansion by hyperscalers and GPU-cloud startups

Europe

Government Influence

- Strict energy-efficiency and emissions regulations

- New sustainability reporting requirements for data centres

- Incentives for renewable-powered digital infrastructure

Market Dynamics

- Strong demand for energy-efficient AI facilities

- Expansion limited by land and power constraints in some regions

Asia-Pacific

India

- National AI missions and policies supporting compute infrastructure

- Major private investments from hyperscalers and industrial groups

- Rapidly emerging as a global AI data-centre hub

China

- Government-backed cloud & AI infrastructure expansion

- Strong focus on domestic chips and data sovereignty

Singapore, Japan, South Korea

- Mature digital markets

- High regulatory focus on sustainable, efficient facilities

Middle East & Africa

Government Influence

- AI diversification strategies in UAE & Saudi Arabia

- National visions supporting digital mega-projects

Market Dynamics

- Rapid growth with large-scale government-backed deployments

- Africa growing through regional edge AI hubs

Latin America

Government Influence

- Data sovereignty laws driving local AI hosting

- Incentives for cloud region expansion

Market Dynamics

- Steady growth led by cloud providers and regional enterprises

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Liquid Biopsy Market Revenue, Global Presence, and Strategic Insights by 2034