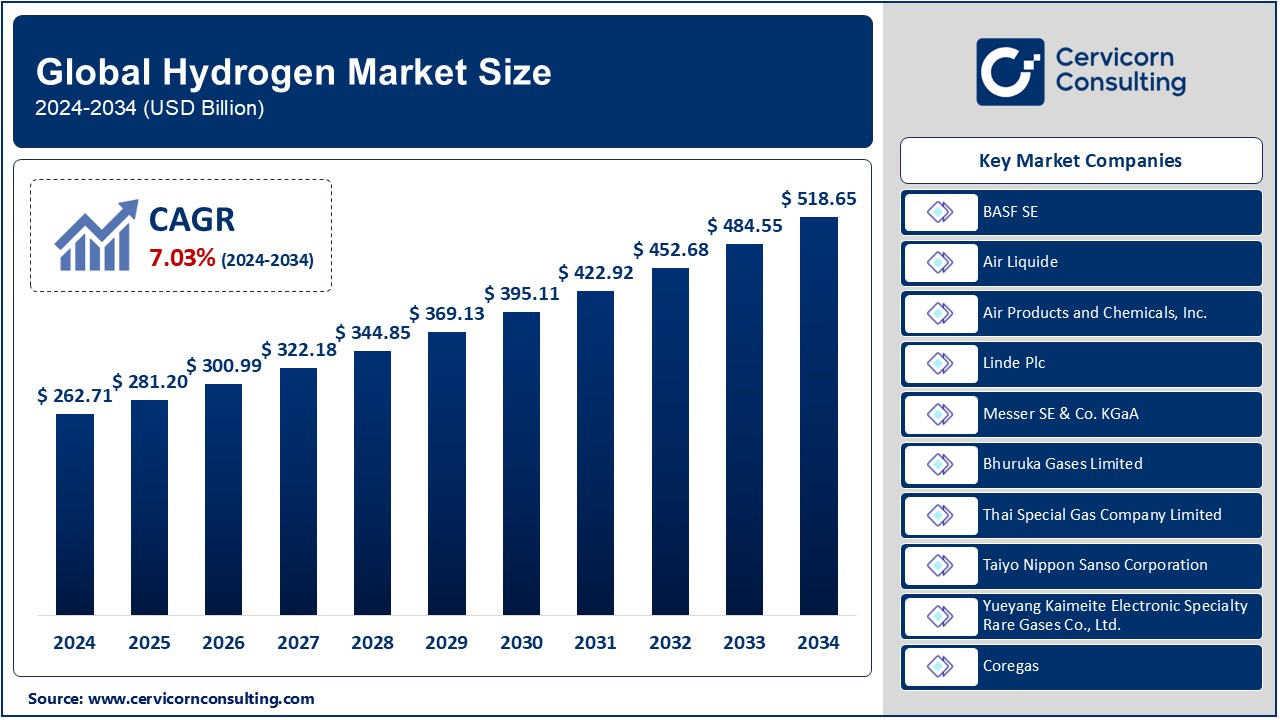

Hydrogen Market 2024 Growth Surges to $518 Billion Opportunity

Hydrogen Market Size

The global hydrogen market was worth USD 262.71 billion in 2024 and is anticipated to expand to around USD 518.65 billion by 2034, registering a compound annual growth rate (CAGR) of 7.03% from 2025 to 2034.

What is the Hydrogen Market?

The hydrogen market encompasses the production, distribution, storage, and application of hydrogen across industries, including energy, transportation, chemicals, and manufacturing. As a versatile energy carrier, hydrogen is produced primarily through processes like steam methane reforming (SMR), water electrolysis, and biomass gasification. It serves as a critical feedstock for refining, fertilizer production, and various chemical processes, while its emerging role in green energy underscores its transformative potential in combating climate change.

Why is the Hydrogen Market Important?

The hydrogen market is pivotal in the global shift toward sustainability and carbon neutrality. Hydrogen is a clean energy carrier, emitting only water vapor when used as a fuel, making it an attractive solution for decarbonizing sectors like heavy industry and transportation. It is also a crucial component in renewable energy storage systems, enabling better integration of intermittent sources like wind and solar. With the pressing need to meet global climate goals, hydrogen represents an essential pathway for reducing greenhouse gas emissions and achieving energy independence.

Hydrogen Market Growth Factors

The growth of the hydrogen market is driven by government incentives and investments, advancements in production technologies, increasing demand for clean energy, and its rising adoption in diverse sectors such as transportation, industrial processes, and energy storage. Key initiatives like net-zero emissions targets, renewable energy mandates, and the development of hydrogen infrastructure further fuel market expansion. Moreover, declining costs of electrolyzers and green hydrogen production are creating opportunities for widespread adoption.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2534

Hydrogen Market Top Companies

- BASF SE

- Specialization: Chemicals, hydrogen production, and fuel cell materials.

- Key Focus Areas: Developing hydrogen storage solutions and enabling hydrogen use in industrial applications.

- Notable Features: Integration of hydrogen into chemical production processes to lower carbon emissions.

- 2024 Revenue (approx.): $90 billion.

- Market Share (approx.): 12%.

- Global Presence: Operations across Europe, North America, Asia-Pacific, and the Middle East.

- Air Liquide

- Specialization: Industrial gases, hydrogen production, and distribution.

- Key Focus Areas: Green hydrogen production, hydrogen refueling stations, and industrial applications.

- Notable Features: Operates one of the largest hydrogen pipeline networks globally.

- 2024 Revenue (approx.): $30 billion.

- Market Share (approx.): 18%.

- Global Presence: Strong presence in Europe, the Americas, and Asia-Pacific.

- Air Products and Chemicals, Inc.

- Specialization: Hydrogen production, gasification, and clean energy technologies.

- Key Focus Areas: Large-scale green and blue hydrogen projects, hydrogen liquefaction, and transportation.

- Notable Features: Leading player in hydrogen fuel infrastructure development.

- 2024 Revenue (approx.): $12 billion.

- Market Share (approx.): 10%.

- Global Presence: Operations span North America, Europe, and Asia.

- Linde Plc

- Specialization: Industrial gases and hydrogen production.

- Key Focus Areas: Green hydrogen production, carbon capture, and hydrogen liquefaction.

- Notable Features: Advanced hydrogen storage and fuel cell solutions.

- 2024 Revenue (approx.): $32 billion.

- Market Share (approx.): 20%.

- Global Presence: Strong presence in Europe, the Americas, and Asia-Pacific.

- Messer SE & Co. KGaA

- Specialization: Industrial gases and hydrogen solutions.

- Key Focus Areas: Hydrogen supply for industrial and mobility applications.

- Notable Features: Collaboration with global partners for hydrogen infrastructure development.

- 2024 Revenue (approx.): $4 billion.

- Market Share (approx.): 6%.

- Global Presence: Europe, Asia, and the Americas.

Leading Trends and Their Impact

- Green Hydrogen Revolution: The global push for renewable energy is driving the adoption of green hydrogen produced via water electrolysis powered by renewable energy. This trend reduces reliance on fossil fuels and mitigates carbon emissions, positioning hydrogen as a key element in achieving global decarbonization goals.

- Hydrogen Infrastructure Development: Governments and private players are investing heavily in hydrogen refueling stations, pipelines, and storage facilities. This infrastructure expansion facilitates the adoption of hydrogen fuel cell vehicles (FCEVs) and supports the growth of hydrogen in transportation and industrial sectors.

- Technological Advancements: Innovations in electrolyzer efficiency, hydrogen storage, and fuel cell technologies are reducing costs and enhancing performance. These advancements make hydrogen more accessible and economically viable across various applications.

- Cross-Sector Collaboration: Partnerships between energy companies, governments, and technology providers are accelerating hydrogen market development. For example, collaborations in hydrogen valleys are creating integrated ecosystems for hydrogen production and consumption.

- Policy and Regulation: Policies such as subsidies for green hydrogen, carbon pricing, and renewable energy mandates are catalyzing hydrogen adoption. These measures also encourage private investment and international trade in hydrogen.

Successful Examples of Hydrogen Market Initiatives Around the World

- Europe: The European Union’s Hydrogen Strategy aims to install at least 40 GW of electrolyzer capacity by 2030. Countries like Germany and the Netherlands are leading with hydrogen valleys, where production, distribution, and consumption are integrated.

- Japan: Japan’s Basic Hydrogen Strategy focuses on transitioning to a hydrogen-based society. Toyota’s hydrogen-powered Mirai and the Tokyo Hydrogen Fuel Cell Bus project are notable examples of success.

- United States: The U.S. Department of Energy’s Hydrogen Energy Earthshot initiative aims to reduce the cost of green hydrogen to $1 per kilogram by 2030. Projects like California’s hydrogen highways and large-scale hydrogen production in Texas demonstrate progress.

- Australia: Australia is a leading exporter of hydrogen, leveraging its vast renewable resources. The country’s National Hydrogen Strategy promotes the development of green hydrogen hubs and export capabilities.

- South Korea: South Korea’s Hydrogen Economy Roadmap focuses on deploying 6.2 million hydrogen-powered vehicles and building 1,200 refueling stations by 2040. Hyundai’s Nexo hydrogen SUV is a prominent example of success.

Regional Analysis and Government Initiatives

- North America:

- United States: Federal initiatives like the Inflation Reduction Act provide tax credits for clean hydrogen production, while state-level programs in California and Texas are developing hydrogen hubs.

- Canada: Canada’s Hydrogen Strategy targets net-zero emissions by 2050 with investments in green hydrogen production and export capabilities.

- Europe:

- The EU Green Deal emphasizes hydrogen as a cornerstone of its climate neutrality agenda. Countries like Germany, France, and Spain have allocated billions of euros for hydrogen infrastructure and R&D.

- The Hydrogen Backbone initiative plans to create a pan-European hydrogen pipeline network, facilitating cross-border trade.

- Asia-Pacific:

- Japan: The government’s commitment to hydrogen is evident in its Basic Hydrogen Strategy and investments in hydrogen supply chains and fuel cell technology.

- China: China leads in hydrogen production capacity, with policies supporting hydrogen use in transportation and heavy industry.

- South Korea: The Hydrogen Economy Roadmap aligns with government investments in infrastructure and technology development.

- Australia:

- The Australian government supports green hydrogen production through funding programs like the Australian Renewable Energy Agency (ARENA).

- Export partnerships with countries like Japan and South Korea are strengthening Australia’s position in the global hydrogen market.

- Middle East & Africa:

- Countries like Saudi Arabia and the UAE are investing in green hydrogen as part of their energy diversification strategies. Notable projects include Saudi Arabia’s NEOM green hydrogen initiative.

- South Africa is leveraging its platinum resources to develop hydrogen fuel cell technologies.

- Latin America:

- Brazil and Chile are emerging as leaders in green hydrogen, supported by abundant renewable resources. Chile’s National Green Hydrogen Strategy targets $2.5 billion in hydrogen exports by 2030.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Solar Photovoltaic (PV) Market Size, Share, and Forecast 2034