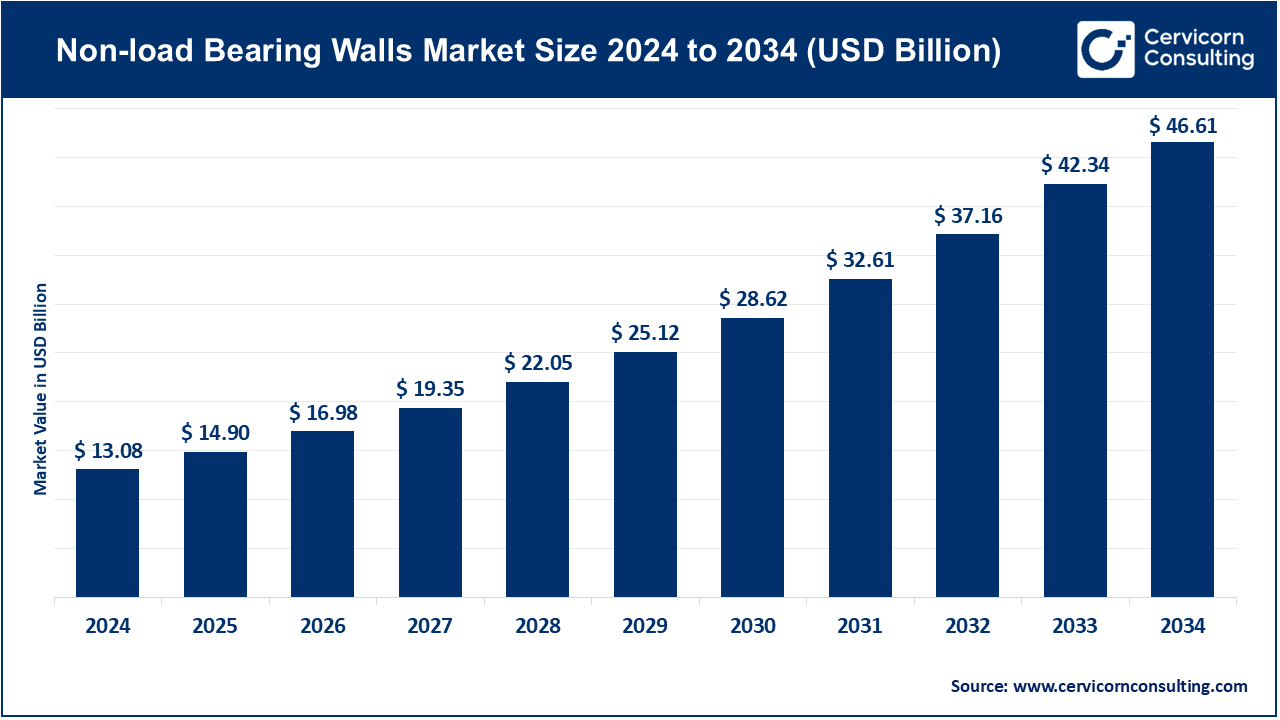

Non-load Bearing Walls Market to Reach USD 46.61 Bn by 2034

Non-load Bearing Walls Market Overview

The global non-load bearing walls market was valued at USD 13.08 billion in 2024 and is projected to grow to approximately USD 46.61 billion by 2034, with a compound annual growth rate (CAGR) of 13.55% from 2025 to 2034. The market has witnessed significant growth over the past few years due to rapid urbanization, increasing construction activity, and the demand for flexible and lightweight building materials.

Non-load bearing walls, primarily used for partitioning and dividing spaces without carrying any structural load, are essential in modern construction due to their versatility, ease of installation, and cost-effectiveness. As the construction sector continues to evolve, factors such as the growing preference for modular and prefabricated buildings, advancements in materials technology, and increasing awareness about energy efficiency have contributed to the demand for non-load bearing walls. Additionally, the growing residential and commercial real estate market, coupled with rising disposable income and population growth, has further driven the expansion of this market globally.

What is the Non-load Bearing Walls Market?

The non-load bearing walls market involves materials and solutions used to construct partition walls that do not carry any structural load from the building’s roof or floors. Unlike load-bearing walls, which support the weight of the structure, non-load bearing walls are used primarily for dividing interior spaces, such as in offices, residential buildings, and industrial settings. They are generally made from materials like gypsum, metal, glass, wood, and lightweight concrete. Non-load bearing walls are crucial in modern construction, offering flexibility in design, ease of modification, and cost savings. They are a vital element in both residential and commercial projects, including office buildings, hospitals, schools, and factories.

Why is the Non-load Bearing Walls Market Important?

The non-load bearing walls market is significant because it plays a crucial role in shaping the interior spaces of buildings. As construction projects become increasingly complex, with an emphasis on flexibility and space optimization, non-load bearing walls offer a practical solution. These walls allow for easy reconfiguration of interior layouts without affecting the structural integrity of the building. Furthermore, the rise in demand for energy-efficient, sustainable, and acoustically insulated building materials has further elevated the importance of non-load bearing walls. Their ability to provide thermal insulation, soundproofing, and fire resistance without adding unnecessary weight to the structure has made them a preferred choice in various construction applications.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2318

Key Companies in the Non-load Bearing Walls Market

Saint-Gobain S.A.

- Specialization: Saint-Gobain is a global leader in the manufacturing of construction materials, including insulation, glass, and drywall products. The company specializes in providing solutions for energy-efficient and sustainable building projects.

- Key Focus Areas: Sustainability, innovation in material science, energy efficiency.

- Notable Features: Extensive product range, commitment to environmental stewardship, global presence.

- 2023 Revenue (approx.): $50.5 billion.

- Market Share (approx.): 10-12%.

- Global Presence: Saint-Gobain operates in over 70 countries, making it one of the leading players in the global non-load bearing walls market.

USG Corporation

- Specialization: USG is renowned for its high-performance building materials, including gypsum board, which is widely used in non-load bearing wall applications.

- Key Focus Areas: Drywall products, acoustic ceilings, and fire-rated solutions.

- Notable Features: Extensive research into new building technologies, industry leadership in drywall manufacturing.

- 2023 Revenue (approx.): $4.5 billion.

- Market Share (approx.): 6-8%.

- Global Presence: USG has a strong presence in North America, Europe, and emerging markets in Asia.

Knauf Insulation GmbH

- Specialization: Knauf Insulation is a key player in the production of insulation materials, including those used in non-load bearing walls for thermal and acoustic insulation.

- Key Focus Areas: Insulation solutions for sustainable and energy-efficient buildings.

- Notable Features: Strong commitment to environmental sustainability, innovation in insulation products.

- 2023 Revenue (approx.): $3 billion.

- Market Share (approx.): 4-6%.

- Global Presence: Knauf Insulation operates in over 35 countries worldwide, focusing on energy efficiency and reducing carbon footprints.

Armstrong World Industries, Inc.

- Specialization: Armstrong manufactures ceiling and wall solutions, including non-load bearing partitions, that contribute to both functionality and aesthetic appeal in commercial and residential buildings.

- Key Focus Areas: Acoustics, design flexibility, and sustainable building materials.

- Notable Features: Known for acoustical ceiling solutions and innovative partitioning systems.

- 2023 Revenue (approx.): $1.2 billion.

- Market Share (approx.): 3-5%.

- Global Presence: Armstrong operates globally with a focus on North America and Europe.

CertainTeed Corporation

- Specialization: CertainTeed is a leading manufacturer of building materials, including drywall, insulation, and non-load bearing wall systems.

- Key Focus Areas: Energy efficiency, acoustic performance, sustainable construction.

- Notable Features: Industry-leading solutions for residential and commercial buildings.

- 2023 Revenue (approx.): $6.5 billion.

- Market Share (approx.): 8-10%.

- Global Presence: CertainTeed operates across North America, Europe, and Asia.

Leading Trends and Their Impact

The non-load bearing walls market is influenced by several key trends that are shaping the future of the industry:

- Sustainability and Energy Efficiency: With a growing emphasis on green buildings, non-load bearing walls are becoming increasingly important in meeting sustainability targets. Lightweight and energy-efficient materials are being used to create partition walls that contribute to the overall energy efficiency of a building. Insulated non-load bearing walls are also being used to reduce energy consumption and improve thermal comfort.

- Prefabrication and Modular Construction: The rise of prefabricated and modular construction techniques is driving demand for non-load bearing walls. These walls are ideal for factory fabrication and easy on-site assembly, which can significantly reduce construction time and costs. As a result, non-load bearing walls are gaining popularity in both residential and commercial projects.

- Acoustic Performance: As urbanization leads to denser living spaces, there is an increasing demand for noise control solutions. Non-load bearing walls made from materials with superior acoustic properties are in high demand, especially in commercial buildings like offices and hotels.

- Customization and Design Flexibility: Non-load bearing walls offer great flexibility in design, making them a preferred choice for modern architectural styles. These walls can be customized to meet aesthetic needs, making them a go-to option for interior partitions in residential, commercial, and industrial buildings.

Successful Examples of Non-load Bearing Walls Around the World

Non-load bearing walls are extensively used in both commercial and residential projects across the globe. Here are some successful examples:

- The Shard, London, UK: The Shard, one of the tallest buildings in Europe, utilizes non-load bearing walls extensively in its interior design to create flexible office spaces. The lightweight and durable nature of these walls allows for easy reconfiguration as tenant needs change.

- Apple Park, Cupertino, USA: Apple’s corporate headquarters features a highly innovative use of non-load bearing walls in the interior partitions of its vast open-plan offices. The walls help in creating efficient workspaces while allowing for flexibility in design.

- The Burj Khalifa, Dubai, UAE: The tallest building in the world also features non-load bearing walls, especially in its office and residential floors, contributing to space optimization and design flexibility.

Regional Analysis and Government Initiatives

North America: The non-load bearing walls market in North America is experiencing steady growth due to the increasing demand for residential and commercial real estate. The U.S. government has implemented several initiatives to promote sustainable construction practices, such as LEED certification, which has positively influenced the adoption of energy-efficient non-load bearing wall systems.

Europe: In Europe, strict environmental regulations and a growing focus on green buildings are driving the demand for sustainable non-load bearing walls. Countries like Germany and the UK have adopted policies to encourage energy-efficient building practices, further boosting the market for non-load bearing walls.

Asia-Pacific: The rapid urbanization in countries like China, India, and Japan is fueling the demand for non-load bearing walls. Governments in the region are investing heavily in infrastructure development, which includes the use of non-load bearing walls in residential, commercial, and industrial sectors. China’s focus on eco-friendly building materials is also contributing to the growth of this market.

Latin America and Middle East: In Latin America, countries like Brazil are seeing a rise in residential and commercial construction, which is expected to drive the demand for non-load bearing walls. The Middle East, particularly in Dubai, is witnessing a boom in high-rise buildings where non-load bearing walls play a key role in optimizing space usage and interior design. Governments in these regions are focusing on sustainable construction methods to reduce carbon footprints, which is benefiting the non-load bearing walls market.

Government Initiatives and Policies Shaping the Market

Governments worldwide are enacting policies that promote sustainable construction practices and the adoption of energy-efficient building materials. These policies include:

- Energy Efficiency Codes: Many countries have updated their building codes to mandate energy-efficient construction practices, including the use of insulated non-load bearing walls for better thermal performance.

- Incentives for Green Buildings: Governments in North America, Europe, and Asia provide financial incentives for adopting green building practices, such as tax credits for energy-efficient construction.

- Sustainability Regulations: Regulations in countries like Germany and the UK are pushing for the use of sustainable materials in construction, further promoting the growth of the non-load bearing walls market.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Decision Intelligence Market: Growth, Key Players, and Future Trends (2023-2033)