Sand Battery Market Revenue, Global Presence, and Strategic Insights by 2034

Sand Battery Market Size

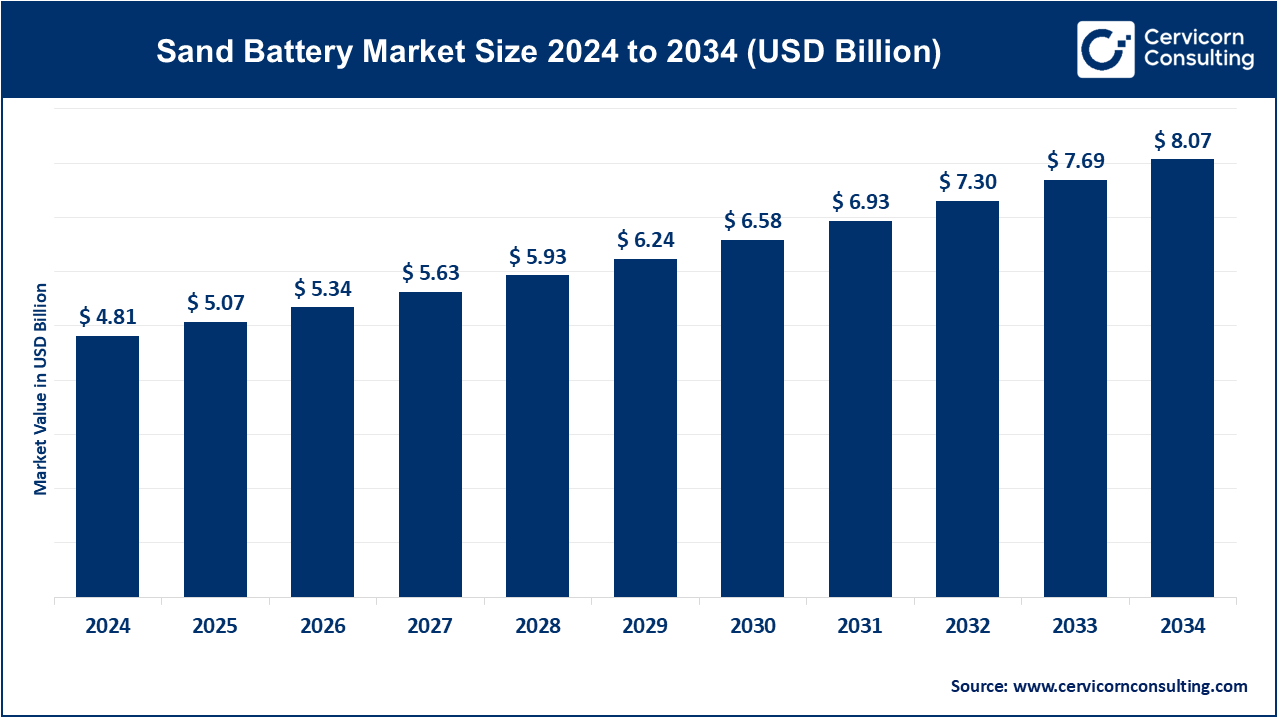

The global sand battery market size was worth USD 4.81 billion in 2024 and is anticipated to expand to around USD 8.07 billion by 2034, registering a compound annual growth rate (CAGR) of 5.31% from 2025 to 2034.

What is the Sand Battery Market?

The sand battery market refers to the segment of the thermal energy storage industry that utilizes sand—or other low-cost granular materials—as the primary medium for storing heat. In a sand battery, surplus renewable electricity or waste heat is converted into thermal energy and stored in a large, insulated cylinder filled with sand. Due to its high specific heat capacity and ability to handle extremely high temperatures (typically between 500°C and 600°C or even higher), sand can store large amounts of heat for extended durations, making it ideal for district heating networks, industrial processes, and seasonal storage applications.

The market sits at the intersection of renewable energy storage, electrified heating, district heating optimization, and industrial decarbonization, and is rapidly gaining momentum as countries accelerate their transition away from fossil fuels.

Sand Battery Market — Growth Factors

Rapid decarbonization policies, the rise of intermittent renewable energy generation, and the need for low-cost long-duration energy storage are the major forces driving the sand battery market forward. Governments across Europe, North America, and APAC are pushing for clean heat solutions, incentivizing technologies that can replace natural gas and coal in district heating and industrial processes.

The extremely low cost of sand as a storage medium, along with the simplicity, longevity, and safety of these systems, makes them attractive for utilities and industries seeking to reduce emissions without high capital outlays. Increasing renewable curtailment, electrification of heating, growth in industrial heat demand, expansion of district heating networks, and the global shift toward energy resilience all contribute to expanding the sand battery project pipeline. As modularization improves and commercial-scale installations validate the technology, investor confidence and industry adoption are rapidly increasing.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2403

Why Sand Batteries Are Important

Sand batteries are emerging as one of the most cost-effective solutions for long-duration energy storage, particularly in heating applications where lithium-ion and other electrochemical batteries are too expensive or inefficient. These systems provide multi-day, multi-week, or even seasonal heat storage, enabling utilities and municipalities to store excess renewable energy during periods of oversupply and release it during peak demand. This makes sand batteries highly valuable for stabilizing energy systems that rely heavily on wind and solar. For industries such as textiles, chemicals, food processing, and metal refining—where significant process heat is required—sand batteries offer a scalable path toward decarbonization.

Their use of abundant, non-toxic materials addresses supply-chain risks associated with lithium, cobalt, and nickel. Additionally, sand batteries can be deployed in remote or rural regions, increasing energy access and resilience without requiring rare materials or complex maintenance. Overall, sand batteries fill a critical gap in the energy storage landscape, especially in the emerging long-duration and seasonal storage segments.

Top Companies Profiled

1. Polar Night Energy

Specialization: Commercial sand-based thermal energy storage systems.

Key Focus Areas: District heating networks, power-to-heat integration, municipal utilities, and industrial heat storage.

Notable Features: Modular sand-filled steel silos, extremely high thermal retention, first commercially operational sand battery installations in Europe.

2024 Revenue: Not publicly disclosed (privately held).

Market Share: Considered the leading commercial supplier in the sand battery segment.

Global Presence: Primarily Finland, with expanding international interest.

2. Sila Nanotechnologies Inc.

(Note: This company is not a sand battery developer but was included in your list. It specializes in battery materials.)

Specialization: Silicon-based anode materials for lithium-ion batteries.

Key Focus Areas: EV battery materials, high-energy-density anodes, grid storage materials.

Notable Features: Next-generation battery materials, major funding rounds, partnerships with global EV manufacturers.

2024 Revenue: Not publicly disclosed.

Market Share: Strong presence in advanced materials, not directly in the sand battery market.

Global Presence: U.S.-based, supplying global EV manufacturers.

3. BrightSource Energy

Specialization: Concentrated solar power (CSP) and thermal storage engineering.

Key Focus Areas: Utility-scale solar-thermal plants, thermal energy integration, hybrid heat-and-power systems.

Notable Features: Tower-based CSP systems and large-scale thermal storage expertise.

2024 Revenue: Not disclosed (private).

Market Share: Significant presence in the CSP sector; a competitor in thermal storage innovation.

Global Presence: Active in the U.S., Middle East, Asia, and selective global CSP markets.

4. SolarReserve

Specialization: CSP systems with molten-salt thermal energy storage.

Key Focus Areas: Utility-scale solar power plants, thermal energy storage, dispatchable renewable energy.

Notable Features: Multi-hundred-MW thermal solar projects, expertise in long-duration thermal storage.

2024 Revenue: Not disclosed.

Market Share: Established developer in CSP plus storage.

Global Presence: Projects in the U.S., China, South Africa, and other international markets.

5. EnergyNest

Specialization: Modular solid-state thermal energy storage systems using engineered concrete.

Key Focus Areas: Industrial heat decarbonization, waste-heat recovery, CSP hybridization, and grid balancing.

Notable Features: ThermalBattery™ modular system, suitable for industrial steam and high-temperature heat.

2024 Revenue: Not publicly available.

Market Share: Leading player in alternative long-duration thermal storage solutions.

Global Presence: Europe-focused with active global partnerships.

Leading Trends and Their Impact

1. Demand for Long-Duration Thermal Storage

As grids incorporate increasing shares of renewables, long-duration storage—capable of holding energy for days or months—is becoming essential. Sand batteries are gaining advantage due to their very low cost compared with electrochemical batteries and molten-salt solutions.

Impact: They help utilities reduce renewable curtailment and offer reliable seasonal storage.

2. Electrification of Heat & Power-to-Heat Integration

Heavy industries and municipal heating networks are replacing fossil-fired boilers with electric heating elements.

Impact: Sand batteries become an efficient medium to absorb and store renewable electricity for later heat use.

3. Rapid Modularization

Vendors are developing factory-built modules that can be shipped and installed with minimal on-site construction.

Impact: Reduced deployment time and costs, enabling commercial rollouts.

4. Supportive Clean Heat Policies

Governments are incentivizing decarbonized heating solutions through grants, subsidies, and innovation funding.

Impact: Faster adoption among district heating operators and municipal utilities.

5. Hybridization with CSP and Industrial Systems

CSP developers and industrial energy users are exploring sand storage as an alternative to molten salt or concrete.

Impact: Broadens the applicability of sand batteries to high-temperature processes and integrated energy systems.

Successful Sand Battery Deployments Worldwide

Finland – Utility-Scale Sand Battery Rollout

Polar Night Energy has become the global pioneer for commercial sand battery installations. Deployments in Finnish municipalities such as Kankaanpää and Pornainen support district heating networks by storing renewable electricity as heat. These installations demonstrate long-duration storage capabilities and strong thermal retention performance, positioning Finland as the most advanced market.

District Heating Trials Across Northern Europe

Municipal district heating operators in Northern Europe are engaging in feasibility studies and small pilots to evaluate sand battery integration. The region’s cold climate and heat infrastructure make it highly suitable for sand-based thermal storage adoption.

Industrial Heat Storage Demonstrations

Although not always sand-based, companies like EnergyNest have shown that modular thermal storage can reduce industrial greenhouse gas emissions significantly. This success paves the way for sand battery commercialization in sectors requiring 200–600°C process heat.

CSP and Thermal Storage Hybrids

BrightSource Energy and SolarReserve’s large CSP installations validate the value of pairing solar generation with high-temperature thermal storage. While these use molten salt instead of sand, they demonstrate the scalability—and commercial benefits—of thermal energy storage systems at utility scale.

Global Regional Analysis

Europe

Europe is the current leader in sand battery development and deployment.

Key Drivers:

- Mature district heating infrastructure.

- Strong decarbonization mandates (e.g., Fit for 55, Clean Heat for All).

- Abundant renewable power and corresponding curtailment challenges.

- Government funding for innovative storage technologies.

Nordic countries, especially Finland, Denmark, and Sweden, are scaling demonstration and commercial sand battery projects.

North America

Interest in sand batteries is growing, primarily for industrial heat decarbonization and long-duration energy storage solutions.

Supporting Factors:

- U.S. federal incentives for industrial decarbonization.

- Department of Energy (DOE) support for long-duration storage R&D.

- Rising renewable penetration in U.S. states such as California, Minnesota, and Texas.

District heating is less widespread than in Europe, limiting adoption in the municipal heating segment but creating opportunities in industrial clusters.

Asia-Pacific (APAC)

APAC holds huge potential due to its industrial intensity and rapid energy transition strategies.

Key Markets:

- China: Scaling CSP deployment and experimenting with advanced thermal storage.

- India: High solar generation growth and industrial decarbonization efforts create opportunities for sand battery adoption.

- Australia: Strong renewable energy growth and interest in long-duration storage across remote communities.

Governments in APAC are also encouraging electrification of heat and exploring cost-effective thermal storage technologies.

Middle East & Africa

The Middle East has emerging opportunities in industrial heat and CSP hybrid systems.

Drivers:

- Growing CSP installations.

- Availability of sand-like thermal media.

- Industrial demand for high-temperature heat.

Africa, especially South Africa, is exploring thermal storage technologies for grid stability and renewable integration, which could extend to sand batteries as cost structures decline.

Latin America

Countries such as Chile and Brazil are expanding renewables rapidly and evaluating long-duration storage options. CSP development in Chile positions the region for potential sand battery adoption in the mining and industrial sectors.

Government Initiatives and Policies Shaping the Market

Governments worldwide are increasingly focusing on:

- Long-duration energy storage targets.

- Industrial decarbonization mandates.

- Renewable energy integration requirements.

- Clean heat subsidies.

- Funding for pilot and demonstration projects.

- Tax incentives for carbon-neutral heat production.

Such policy frameworks play a crucial role in reducing financial risk for early-stage sand battery projects and accelerating global commercialization.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Modified Starch Market Growth Drivers, Trends, Key Players and Regional Insights by 2035