Biofertilizer Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

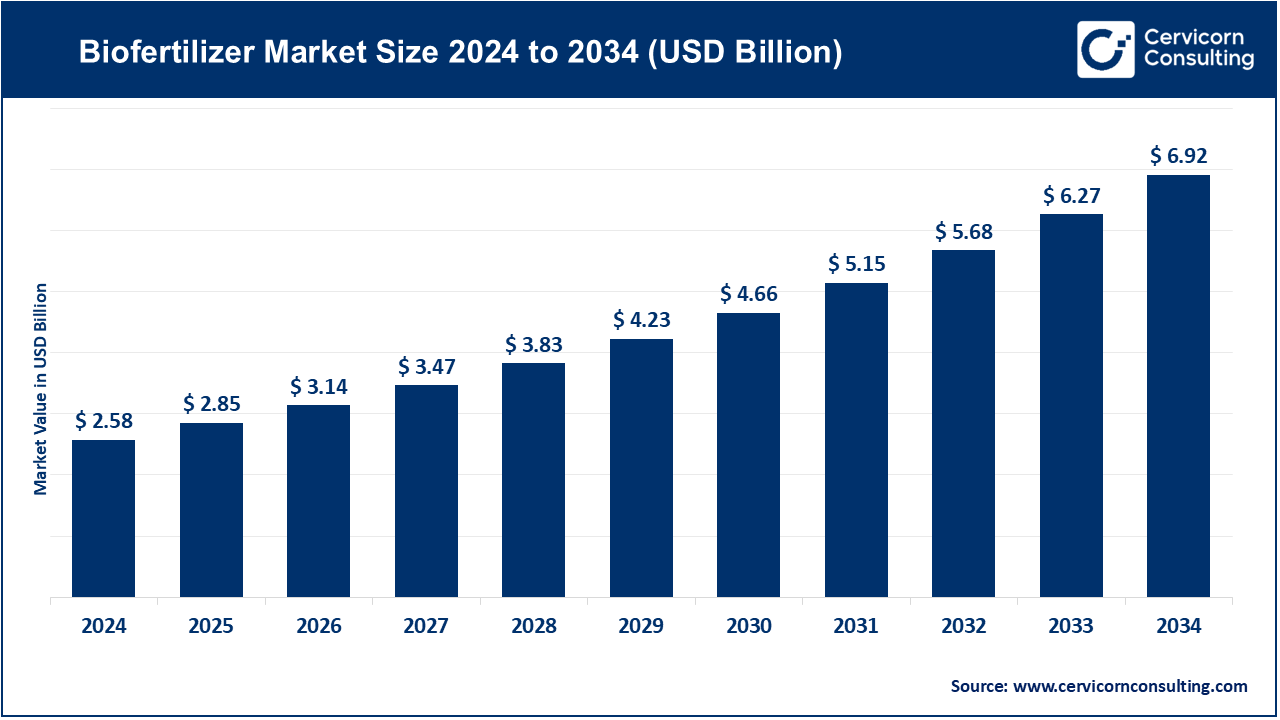

Biofertilizer Market Size

The global biofertilizer market size was worth USD 2.58 billion in 2024 and is anticipated to expand to around USD 6.92 billion by 2034, registering a compound annual growth rate (CAGR) of 10.37% from 2025 to 2034.

Biofertilizer Market Growth Factors

The biofertilizer market is being driven by a convergence of factors: rising global demand for sustainable and residue-safe food, stricter environmental regulations and incentives to reduce chemical fertilizer dependency, growing farmer awareness of soil health and long-term yield stability, rapid advances in microbial R&D and formulation technologies (making products more consistent and shelf-stable), expansion of distribution and agri-input retail channels, and stronger public and private investment into organic and regenerative farming programs.

These forces are amplified by region-specific pushes—such as government organic-farming subsidies and soil-health programs in India, harmonized fertilizer/product standards and circular-economy rules in the EU, and rising corporate sustainability commitments in North America and South America. Taken together, these demand drivers and enabling technologies underpin the market’s robust double-digit projected growth rate over the next decade.

What is the Biofertilizer Market?

The biofertilizer market covers products that contain living microorganisms—bacteria, fungi, algae, or combinations—intended to promote plant growth by improving nutrient availability, fixation, and uptake, or by stimulating plant physiological processes. Common product classes include nitrogen-fixers (such as Rhizobium), phosphate-solubilizing bacteria (PSB), Azotobacter, Azospirillum, mycorrhizal inoculants, and microbial consortia used for seed treatment, soil amendment, or foliar applications. The market comprises manufacturers, formulators, distributors, and service providers that package and deliver these biological inputs to farmers, agri-retailers, and integrators across field crops, fruits, vegetables, and horticulture.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2795

Why It Is Important

Biofertilizers matter because they help decouple crop productivity from ever-increasing chemical fertilizer use. They improve soil biological health, can reduce synthetic nutrient inputs (lowering costs and emissions), and support sustainable intensification—boosting yields per hectare while improving long-term soil fertility and reducing pollution from runoff or eutrophication. For regulators and retailers, biofertilizers are a tangible tool to meet climate, water quality, and circular-economy targets. For farmers, properly used biofertilizers can increase nutrient-use efficiency and crop resilience, especially when integrated with precision farming and good agronomic practices.

Biofertilizer Market — Top Companies

Novozymes

- Specialization: Industrial enzymes and microbial solutions for agriculture, including biofertilizers and biostimulants.

- Key Focus Areas: Microbial R&D, strain development, scalable fermentation and formulation, precision application, and partnerships with seed companies and agri-input providers.

- Notable Features: Industry-leading R&D capabilities, advanced industrial fermentation capacity, and a robust global sales and distribution network ensuring quality and consistency.

- 2024 Revenue: Approximately USD 4.15 billion (including broader enzyme and biotechnology operations).

- Market Share & Global Presence: A leading global footprint with facilities and partnerships across North America, Europe, Latin America, and Asia-Pacific.

Lallemand Inc.

- Specialization: Production and commercialization of beneficial microorganisms (yeasts and bacteria) for agriculture, animal nutrition, and industrial applications.

- Key Focus Areas: Biofertilizers and microbial inoculants, seed treatments, biostimulants, and microbial solutions customized to crops and climates.

- Notable Features: Privately held, diversified across food, brewing, and agriculture sectors, enabling innovation and cross-application of microbial expertise.

- 2024 Revenue: Not publicly disclosed; estimated multi-regional operations with significant agricultural input share.

- Global Presence: Active in North America, Europe, Asia-Pacific, and Latin America through local subsidiaries and partnerships.

National Fertilizers Limited (NFL)

- Specialization: A state-owned fertilizer producer in India manufacturing urea and diversifying into biofertilizers and organic inputs under national agricultural programs.

- Key Focus Areas: Promoting integrated nutrient solutions, leveraging government channels, and expanding farmer outreach through training and demonstration programs.

- Notable Features: Strong domestic presence with a large network of dealers and distributors supported by government initiatives.

- 2024 Revenue: Reported consolidated net sales above USD 3 billion, reflecting overall fertilizer and input operations.

- Market Share & Presence: Major influence in India’s fertilizer and bio-input sector with export potential under government-backed initiatives.

Gujarat State Fertilizers & Chemicals Ltd. (GSFC)

- Specialization: Manufacturer of fertilizers, chemicals, and bio-based products with a growing focus on biofertilizers and sustainable solutions.

- Key Focus Areas: Diversification into organic and biological fertilizers, expansion of regional manufacturing, and farmer training programs.

- Notable Features: Strong base in Gujarat and neighboring Indian states, backed by research collaborations and farmer service centers.

- 2024 Revenue: Over USD 2 billion across all product segments.

- Market Share & Global Presence: Regional leader with growing export activities and strategic domestic expansion.

Rizobacter Argentina S.A.

- Specialization: Leading Latin American producer of microbial seed inoculants, biofertilizers, and crop-enhancement technologies.

- Key Focus Areas: Rhizobium-based inoculants for legumes, seed treatment solutions, and agronomic technical support.

- Notable Features: Deep R&D in microbial technologies, high penetration in soybean and legume markets, and strong partnerships with regional agribusinesses.

- 2024 Revenue: Estimated near USD 300–400 million based on group-level agricultural biotechnology revenues.

- Market Share & Global Presence: Market leader in Argentina with exports to multiple Latin American and global markets.

Leading Trends and Their Impact

1. Microbial Consortia and Precision Formulations

Companies are transitioning from single-strain inoculants to multi-strain microbial consortia designed for functional synergy. Advanced formulations—such as encapsulated or liquid carriers—extend shelf life and field viability.

Impact: Enhanced field reliability and broader crop applicability encourage farmer trust and repeat adoption.

2. Digital Agriculture and Targeted Deployment

Integration of biofertilizers with soil-testing tools, remote sensing, and digital advisory platforms allows targeted application where they are most effective.

Impact: Improved nutrient efficiency, higher return on investment, and data-driven product validation.

3. Regulatory Harmonization

Regions like the EU have established standardized frameworks for biofertilizer registration, ensuring consistent quality, safety, and efficacy across markets.

Impact: Easier cross-border trade, improved product credibility, and a more competitive international market.

4. Public Policy and Subsidy Alignment

Government programs in emerging economies link biofertilizer promotion with sustainable agriculture schemes and soil health initiatives.

Impact: Broader farmer outreach, increased funding, and accelerated commercialization of local biofertilizer production.

5. Industry Consolidation and Partnerships

Major enzyme producers, seed companies, and agri-biotech firms are entering joint ventures or acquisitions to integrate microbial products into seed treatments and nutrient packages.

Impact: Expanded market access, better distribution, and increased R&D resources.

6. Focus on Sustainability Metrics

Agribusiness buyers and regulators now emphasize measurable outcomes—like reduced nitrogen runoff, improved soil carbon, or verified yield increases—linked to biofertilizer use.

Impact: Firms offering quantifiable sustainability benefits gain a clear competitive edge.

Successful Global Examples

India

India’s success with Rhizobium inoculants in pulse and oilseed production demonstrates how government-supported distribution and farmer education can scale adoption. Biofertilizers have become integral to national integrated nutrient management programs, supported by farmer training and demonstration initiatives.

Brazil and Argentina

In South America, the use of Bradyrhizobium inoculants for soybeans has nearly replaced synthetic nitrogen fertilizer use in many areas, offering a global model for cost-effective, sustainable farming. Local companies like Rizobacter and Embrapa-led initiatives have built strong research and extension networks.

European Union

Harmonized regulations under the EU Fertilising Products Regulation have increased confidence in microbial fertilizers. European manufacturers are aligning biofertilizers with biostimulants to create holistic nutrient and growth packages for organic and conventional farming systems.

North America

Innovative partnerships between seed giants and biotech companies have led to bundled microbial seed coatings that deliver consistent performance. Advanced R&D, precision application, and regulatory oversight have spurred higher adoption among large-scale growers.

Global Regional Analysis

Asia-Pacific

- Market Overview: Rapidly growing due to government-backed programs, farmer cooperatives, and organic certification schemes.

- Government Initiatives: India’s Paramparagat Krishi Vikas Yojana (PKVY) and other organic missions provide subsidies, training, and procurement support for biofertilizers.

- Key Drivers: High population pressure on arable land, declining soil fertility, and efforts to reduce chemical fertilizer imports.

Europe

- Market Overview: Driven by regulatory pressure to reduce chemical input dependency and strong consumer demand for sustainable food.

- Policy Environment: The Fertilising Products Regulation (2019/1009) provides a harmonized framework for product certification and market access, promoting innovation in biological inputs.

- Key Drivers: Carbon neutrality targets, sustainable farming incentives, and organic farming expansion.

North America

- Market Overview: Mature but expanding due to precision agriculture and corporate sustainability goals.

- Key Drivers: Investment in microbial R&D, high technology adoption, and partnerships between agri-tech companies and research institutions.

- Market Impact: Widespread use in corn, soy, and specialty crops; greater focus on yield data and ROI validation.

Latin America

- Market Overview: Home to some of the world’s most successful biofertilizer applications, particularly in soybean cultivation.

- Key Drivers: Strong local expertise, favorable soil conditions, and government recognition of inoculants as cost-saving alternatives to chemical nitrogen.

- Market Impact: Companies from Argentina and Brazil export biofertilizer technologies to neighboring countries.

Africa

- Market Overview: Emerging market with significant potential. Pilot projects led by NGOs and public-private partnerships are promoting smallholder access to biofertilizers.

- Key Drivers: Need for low-cost, sustainable inputs, limited access to synthetic fertilizers, and donor-funded agricultural sustainability programs.

- Challenges: Limited distribution infrastructure, product storage constraints, and farmer awareness gaps.

Government Initiatives and Policies Shaping the Market

- India: Programs such as the Paramparagat Krishi Vikas Yojana (PKVY) and Mission Organic Value Chain Development for North Eastern Region (MOVCDNER) integrate biofertilizers into organic-farming support schemes. These programs offer financial aid to producers, promote certification, and enhance farmer training.

- European Union: The EU Fertilising Products Regulation (2019/1009) provides standardized product definitions and safety protocols, simplifying market access across member states.

- United States: Federal and state-level support for sustainable agriculture encourages microbial input adoption through research grants, extension programs, and organic certification incentives.

- Latin America: National agricultural institutes in Brazil and Argentina actively promote microbial technologies, offering technical guidance and farmer training through public-private partnerships.

- Africa and Asia-Pacific: International development organizations support pilot initiatives to distribute microbial inoculants, with long-term goals of strengthening regional biofertilizer production capabilities.

Key Takeaways for Stakeholders

- For Companies: Investing in research, reliable formulations, and partnerships with seed or input distributors enhances product credibility and farmer trust.

- For Policymakers: Clear quality standards, certification processes, and farmer education programs are vital for scaling adoption.

- For Investors: Firms with proven microbial strains, scalable fermentation capabilities, and regional partnerships are well-positioned for long-term growth.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Medical Disposables Market Growth Drivers, Trends, Key Players and Regional Insights by 2034