Single-Use Bioprocessing Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

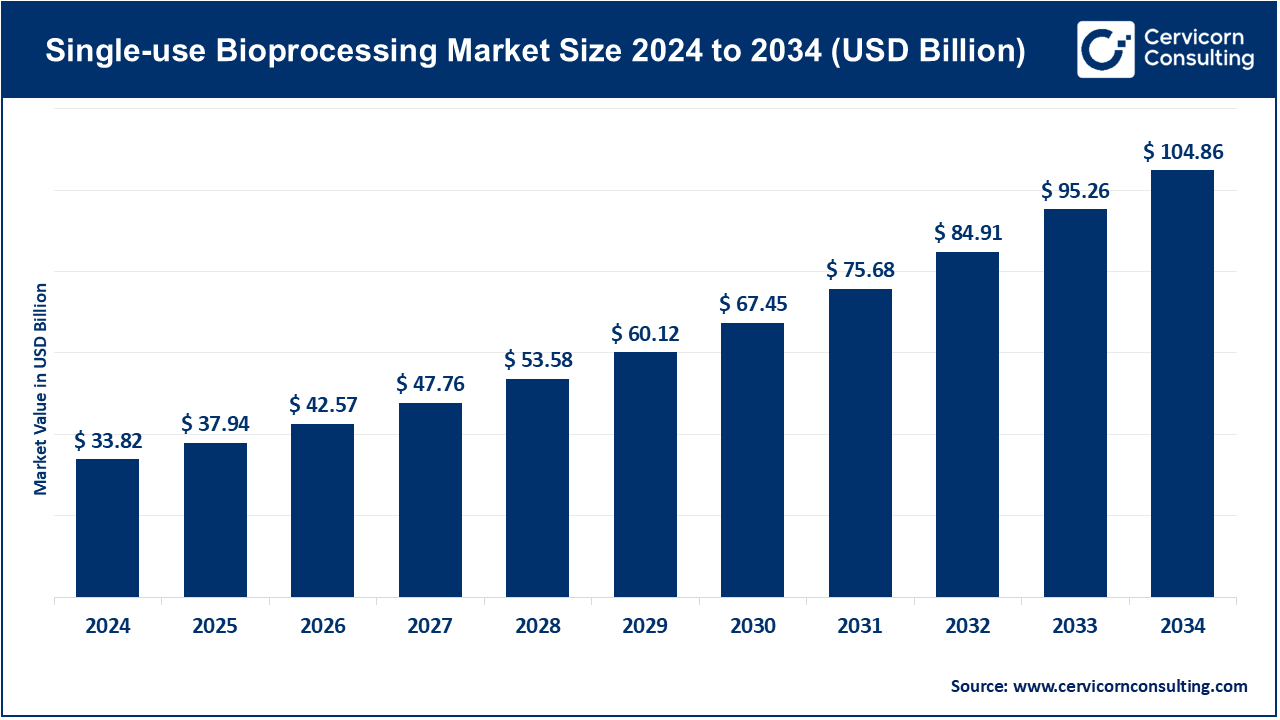

Single-Use Bioprocessing Market Size

Single-Use Bioprocessing Market Growth Factors

The growth of the single-use bioprocessing market is propelled by several critical factors: the rapid expansion of biologics and biosimilars, increasing demand for flexible and scalable production systems, and the shift toward contract manufacturing and multiproduct facilities. The need to reduce operational costs and turnaround times has encouraged widespread adoption of disposable, pre-sterilized systems that eliminate the need for cleaning and validation. Additionally, sustainability goals, reduced water and energy consumption, and the surge in cell and gene therapy production are accelerating market adoption. Post-pandemic supply-chain resilience strategies, coupled with continuous innovations in materials, automation, and closed-system operations, have positioned single-use technologies as the backbone of next-generation biomanufacturing.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2447

What Is the Single-Use Bioprocessing Market?

The single-use bioprocessing market encompasses disposable, polymer-based equipment and components used across both upstream and downstream biomanufacturing. These include single-use bioreactors, mixers, tubing, filters, connectors, bags, chromatography systems, and sensors—all designed for one-time use within a production run. Unlike traditional stainless-steel systems, single-use solutions eliminate cross-contamination risks, cleaning validation requirements, and downtime between production batches. This approach allows rapid changeovers and efficient multiproduct operations—ideal for both clinical and commercial-scale biologics production.

Single-use bioprocessing systems are now integrated throughout the entire manufacturing chain—from seed culture and fermentation to filtration, purification, and final fill-finish operations. The market includes not only the hardware but also the consumables, system integration, automation solutions, and validation services essential for end-to-end process optimization.

Why Is Single-Use Bioprocessing Important?

Single-use technologies are central to the modernization of the biopharmaceutical industry. They offer flexibility, scalability, and sustainability benefits that traditional systems cannot match. These systems significantly reduce setup and cleaning times, lower water and energy use, and minimize contamination risks. For emerging biotech companies, they lower capital expenditure, allowing faster facility construction and rapid product development.

Moreover, during global health crises such as the COVID-19 pandemic, single-use systems enabled vaccine manufacturers to scale up production within months instead of years. Their modular, plug-and-play design allows quick deployment of biomanufacturing capacity anywhere in the world—critical for addressing both global pandemics and localized therapeutic needs.

From an environmental and operational standpoint, single-use systems contribute to efficient resource utilization, reduced carbon footprint, and enhanced process reproducibility. Their adaptability also makes them crucial for smaller batch production required for personalized medicine, cell therapies, and rare-disease treatments.

Top Companies in the Single-Use Bioprocessing Market

Below are the leading companies shaping the global single-use bioprocessing landscape, including their key areas of specialization, features, financial highlights, and global presence.

1. Thermo Fisher Scientific

Company and Specialization:

Thermo Fisher Scientific is a global leader in life sciences tools and services, offering an extensive range of products spanning laboratory equipment, reagents, diagnostics, and bioproduction solutions. In the single-use bioprocessing space, Thermo Fisher specializes in filtration systems, bioreactors, mixing technologies, and integrated single-use assemblies.

Key Focus Areas:

The company focuses on providing complete bioprocessing solutions that integrate upstream and downstream workflows. Its strategy includes continuous innovation, strategic acquisitions, and partnerships with contract manufacturing organizations (CMOs and CDMOs) to strengthen its global bioproduction footprint.

Notable Features:

Thermo Fisher’s vast product portfolio enables clients to transition seamlessly from research to commercial manufacturing. It emphasizes modularity, automation, and scalability—critical aspects for companies seeking rapid process deployment.

2024 Revenue:

Thermo Fisher reported total company revenue of approximately USD 42.88 billion in 2024.

Market Share and Global Presence:

Thermo Fisher holds a strong position in the single-use market through its global distribution network and service infrastructure, with operations in over 50 countries across North America, Europe, and Asia-Pacific.

2. Sartorius AG (Sartorius Stedim Biotech)

Company and Specialization:

Sartorius AG, through its subsidiary Sartorius Stedim Biotech, is one of the foremost specialists in single-use bioprocessing. The company provides end-to-end solutions covering filtration, fluid management, bioreactors, and cell culture technologies.

Key Focus Areas:

Sartorius focuses on delivering fully integrated, disposable bioprocessing systems and has a strong emphasis on continuous processing and digitalized automation. Its extensive product line supports both laboratory-scale development and large-scale GMP manufacturing.

Notable Features:

Sartorius stands out for its commitment to innovation and sustainability. The company’s Biostat STR single-use bioreactors and Flexsafe bags are widely recognized for reliability, performance, and ease of integration into automated systems.

2024 Revenue:

Sartorius Stedim Biotech reported approximately €2.78 billion in 2024, contributing significantly to the Sartorius Group’s total sales of about €3.4 billion.

Market Share and Global Presence:

As one of the market leaders, Sartorius maintains a dominant share in upstream single-use bioreactors and consumables. Its operations extend across Europe, North America, and Asia-Pacific, with manufacturing hubs strategically located to serve global biopharma clients.

3. Merck KGaA (MilliporeSigma)

Company and Specialization:

Merck KGaA, operating under the MilliporeSigma brand in North America, is a global science and technology leader. The company’s Life Science segment delivers high-performance single-use filtration, chromatography, and purification systems used across biopharmaceutical manufacturing.

Key Focus Areas:

Merck emphasizes process efficiency, filtration innovation, and downstream purification technologies. Its single-use offerings cater to monoclonal antibodies, vaccines, and emerging therapeutic modalities.

Notable Features:

The company’s Millipore Express filters and Mobius single-use systems are highly regarded for their reliability and performance. Merck also focuses on data-driven process optimization through automation and integrated analytics.

2024 Revenue:

Merck Group reported total revenue of €21.2 billion in 2024, with its Life Science division representing a major share of that total.

Market Share and Global Presence:

Merck is a key competitor in downstream consumables and filtration markets, with a particularly strong presence in Europe and North America, and expanding operations in Asia-Pacific.

4. Danaher Corporation (Cytiva & Pall)

Company and Specialization:

Danaher Corporation operates as a diversified life-sciences conglomerate and has become a dominant force in bioprocessing through its subsidiaries Cytiva and Pall Corporation. The company’s integrated offerings cover upstream bioreactors, filtration, purification, and process analytical technologies.

Key Focus Areas:

Danaher focuses on delivering complete bioprocess solutions, leveraging Cytiva’s expertise in biomanufacturing systems and Pall’s leadership in filtration and fluid management. Their joint innovations include advanced single-use assemblies and closed-system manufacturing solutions.

Notable Features:

Cytiva’s Xcellerex bioreactors and ReadyToProcess filtration lines are industry benchmarks. The company invests heavily in R&D to enhance automation, sensor integration, and data analytics within single-use systems.

2024 Revenue:

Danaher reported USD 23.9 billion in 2024 total company revenue, with Cytiva alone contributing approximately USD 5 billion to its life sciences division.

Market Share and Global Presence:

Danaher (through Cytiva and Pall) holds one of the largest global shares in the single-use consumables and instrumentation market, serving clients in North America, Europe, China, Japan, and India.

5. GE Healthcare (Cytiva legacy)

Company and Specialization:

Before its acquisition by Danaher in 2020, GE Healthcare Life Sciences (now Cytiva) was a pioneer in bioprocessing technology. Today, while GE Healthcare operates independently as a medical technology company, Cytiva continues to represent GE’s legacy in the bioprocessing space under Danaher’s umbrella.

Key Focus Areas:

GE Healthcare focuses on diagnostics and medical imaging, but its former life-sciences division (now Cytiva) remains one of the most recognized names in single-use bioprocessing globally.

2024 Revenue:

GE Healthcare reported approximately USD 19.7 billion in total revenue in 2024.

Market Share and Global Presence:

GE Healthcare remains globally active in healthcare and diagnostics, while Cytiva maintains global leadership in bioprocessing technology under Danaher ownership.

Leading Trends and Their Impact

- Modular and Flexible Facilities:

Pre-validated, modular single-use facilities are redefining how biomanufacturing plants are built and operated. These setups cut construction time, reduce capital investment, and allow biopharma firms to deploy production capacity rapidly. - Rising Demand for Cell and Gene Therapies:

The growth of advanced therapies requires smaller, highly controlled batches. Single-use systems offer closed, sterile environments ideal for viral vector and cell-based manufacturing. - Integration of Automation and Digitalization:

The combination of single-use sensors, process analytical technology (PAT), and AI-driven control systems is improving batch consistency, reducing errors, and enabling predictive process control. - Sustainability Initiatives:

While disposability raises concerns about plastic waste, manufacturers are investing in recyclable materials, closed-loop disposal systems, and carbon-reduction initiatives to improve environmental performance. - Industry Consolidation:

Large players continue to acquire specialized firms to create comprehensive single-use ecosystems. This consolidation enhances integration but also raises entry barriers for smaller companies.

Successful Examples of Single-Use Bioprocessing Worldwide

- Vaccine Manufacturing Acceleration:

During the COVID-19 pandemic, companies worldwide leveraged single-use systems to produce vaccines and therapeutics faster than ever before. Modular facilities using disposable bioreactors enabled scalable, flexible production for mRNA and viral-vector vaccines. - Contract Development and Manufacturing Organizations (CDMOs):

Many CDMOs such as Lonza, WuXi Biologics, and Samsung Biologics have adopted single-use technologies to handle multiple clients and projects simultaneously, enhancing throughput and reducing downtime. - Regional Biomanufacturing in Asia:

India and Southeast Asian countries are increasingly adopting single-use systems in new biotech parks and vaccine facilities. Their affordability and flexibility make them ideal for scaling domestic production capabilities while meeting international quality standards.

Global Regional Analysis and Government Initiatives

North America (United States & Canada)

The U.S. government has taken proactive steps to modernize manufacturing infrastructure through initiatives such as the FDA’s Advanced Manufacturing Technologies (AMT) program, which promotes adoption of innovative, flexible production technologies. Additionally, policies promoting domestic biomanufacturing resilience have encouraged investment in single-use-enabled facilities. Canada is also investing in new biomanufacturing hubs equipped with disposable systems to strengthen its vaccine and biologics production capabilities.

Europe

The European Union is actively supporting biotechnology and biomanufacturing innovation through the Horizon Europe framework and related funding programs. Countries like Germany, France, and the UK are home to advanced facilities built around single-use systems. The EU’s emphasis on sustainability and carbon neutrality further aligns with the energy and water efficiency benefits of disposable technologies.

Asia-Pacific (China, India, Japan, South Korea)

Asia-Pacific has emerged as a fast-growing region for single-use adoption. China’s biopharmaceutical boom, supported by state investments and favorable regulations, has led to massive demand for modular, single-use-ready facilities.

India’s initiatives such as the BioE3 policy and Production Linked Incentive (PLI) schemes have encouraged biopharma innovation and manufacturing scale-up, with single-use systems serving as the backbone of these new infrastructures. Japan and South Korea, already leaders in biomanufacturing innovation, are further integrating single-use systems to enhance efficiency and flexibility.

Latin America & Africa

Emerging regions are beginning to adopt single-use bioprocessing to build local vaccine and biologics capacity. Governments, in collaboration with global health organizations, are investing in technology transfer and modular manufacturing projects that rely heavily on disposable systems. This approach enables cost-effective establishment of production units without the heavy infrastructure burden of stainless-steel facilities.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Insulin Delivery Devices Market Revenue, Global Presence, and Strategic Insights by 2034