Hyperscale Computing Market Growth Drivers, Key Players, Trends & Regional Insights by 2034

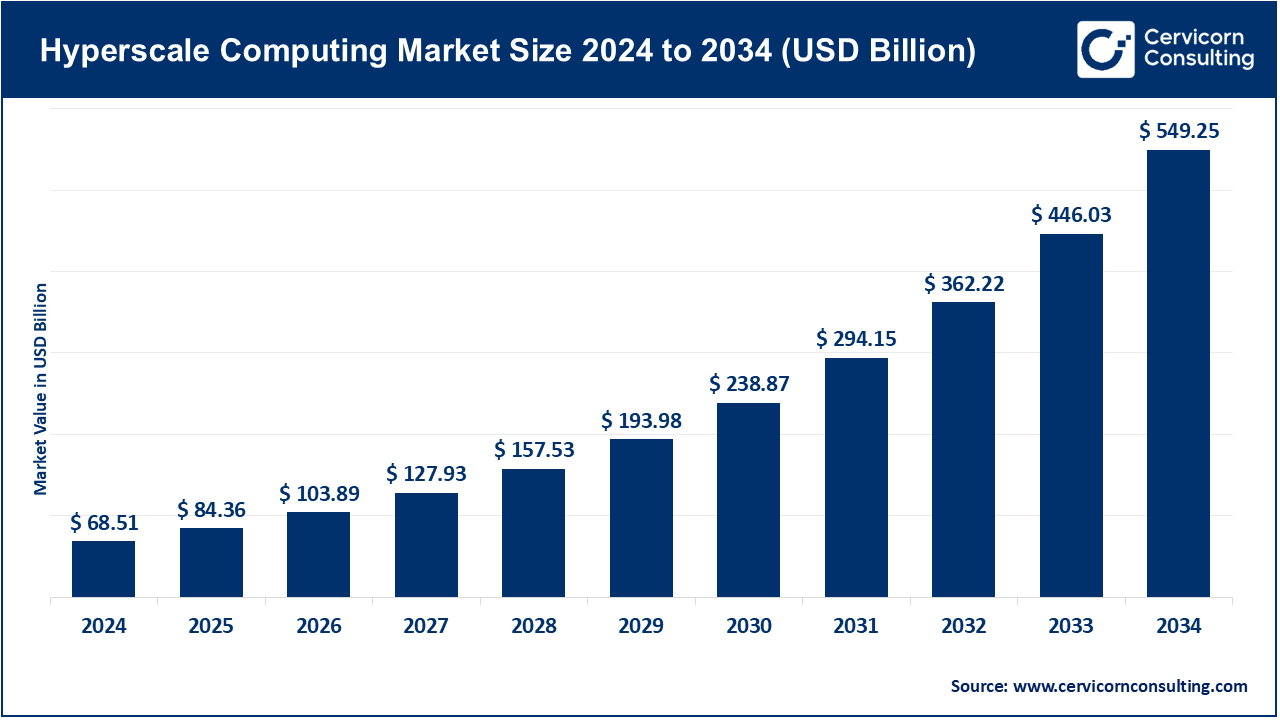

Hyperscale Computing Market Size

What is the Hyperscale Computing Market?

The hyperscale computing market refers to the ecosystem of cloud infrastructure providers that build and operate massive, software-defined environments designed to deliver compute, storage, networking, and advanced services at scale. These environments are powered by horizontally scalable clusters, custom silicon, high-bandwidth interconnects, and automation frameworks. Hyperscalers offer services across Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and increasingly AI-as-a-Service, enabling enterprises to consume resources elastically while minimizing capital expenditure. Dominated by major players such as AWS, Microsoft Azure, and Google Cloud, this market also includes specialized providers like Oracle and IBM, which cater to hybrid and regulated workloads.

Why is it Important?

Hyperscale computing underpins global digital transformation. By delivering scalable infrastructure and advanced capabilities on demand, it reduces time-to-market, shifts spending from CapEx to OpEx, and allows businesses to innovate faster. Hyperscalers have become critical for AI development, offering compute power for training and deploying large language models, edge services for low-latency applications, and compliance frameworks for data privacy regulations. For organizations across sectors—finance, healthcare, media, manufacturing—the ability to scale elastically is no longer optional; it’s a competitive necessity.

Hyperscale Computing Market Growth Factors

The hyperscale computing market is experiencing rapid growth due to several converging factors: the explosion of AI and machine learning workloads requiring GPU-rich clusters, modernization of legacy applications into cloud-native architectures, rising demand for global low-latency services, and the shift from CapEx-heavy infrastructure to flexible consumption models. Data residency regulations and government-backed cloud-first policies further accelerate adoption, as do innovations in custom silicon, networking fabrics, and serverless architectures. Collectively, these drivers position hyperscale as the backbone for the next generation of digital and AI-driven business models.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2708

Hyperscale Computing Market Top Companies Overview

Below is an analysis of the leading hyperscale computing companies, including their specialization, key focus areas, notable features, 2024 revenue, market share, and global presence.

Amazon Web Services (AWS)

- Specialization: Broadest IaaS/PaaS service catalog with leadership in storage, compute, and advanced AI services.

- Key Focus Areas: Generative AI (Bedrock), data lakes and analytics, IoT, HPC, security automation, serverless computing.

- Notable Features: Custom silicon (Graviton, Trainium, Inferentia), Nitro virtualization platform, global scale with 30+ regions and 100+ Availability Zones.

- 2024 Revenue: $108.3 billion.

- Market Share: Approximately 30–33% of global cloud infrastructure spend.

- Global Presence: Data centers in every major geography, extensive local zones and sovereign cloud options.

Microsoft (Azure)

- Specialization: Enterprise integration and hybrid cloud leadership, strong ecosystem ties with Microsoft 365 and Dynamics.

- Key Focus Areas: AI (Azure OpenAI), hybrid deployment (Azure Arc), SAP migration, security services, developer tooling.

- Notable Features: Integration with GitHub, Microsoft productivity tools, and SaaS platforms; 60+ regions worldwide.

- 2024 Revenue: Microsoft Cloud reported $168.9 billion (Azure not separately disclosed).

- Market Share: Around 22–25%.

- Global Presence: Extensive compliance-ready sovereign cloud infrastructure for public sector and regulated industries.

Google Cloud (GCP)

- Specialization: Data and AI-centric cloud solutions, industry leader in Kubernetes and analytics platforms.

- Key Focus Areas: Vertex AI, BigQuery, data engineering, security operations, open-source innovation.

- Notable Features: Proprietary TPU chips, robust AI/ML toolsets, Anthos for hybrid and multicloud strategies.

- 2024 Revenue: $43.23 billion.

- Market Share: About 11–12%.

- Global Presence: 40+ regions with growing sovereign and telco edge deployments.

Oracle Cloud Infrastructure (OCI)

- Specialization: Database-driven cloud strategy with high-performance computing and cost efficiency.

- Key Focus Areas: Autonomous Database, Exadata, AI, bare metal servers, cloud interconnects with Azure.

- Notable Features: Flat network architecture, low-cost egress, dedicated regions for compliance needs.

- 2024 Revenue: $39.4 billion (Cloud services and license support).

- Market Share: Roughly 3–4%, growing rapidly.

- Global Presence: Over 50 regions, strong partnerships with enterprises and public sector clients.

IBM

- Specialization: Hybrid and multicloud services with expertise in regulated industries and consulting-led transformations.

- Key Focus Areas: OpenShift-based hybrid architectures, watsonx AI for governance, security solutions.

- Notable Features: Deep integration with mainframe systems, strong governance and compliance frameworks.

- 2024 Revenue: $62.9 billion total; significant share from hybrid cloud services.

- Market Share: Low single digits; strongest presence in hybrid and industry-specific solutions.

- Global Presence: Extensive coverage across banking, government, and telecom sectors worldwide.

Hyperscale Computing Market Leading Trends and Their Impact

- Generative AI as the Core Growth Driver

AI training and inference require hyperscale infrastructure, fueling demand for high-performance compute and large-scale storage. Hyperscalers are launching specialized AI services, GPU clusters, and model-tuning environments to meet this surge. - Custom Silicon for Performance and Efficiency

Hyperscalers now differentiate with proprietary chips such as AWS Graviton and Trainium, Google TPUs, and Microsoft Maia AI accelerators. These innovations lower costs, improve efficiency, and enhance performance for AI and general-purpose workloads. - Multicloud and Portability by Design

Organizations demand flexibility to avoid vendor lock-in. EU regulations and frameworks like GAIA-X drive interoperability. Kubernetes, containerization, and open APIs enable seamless movement of workloads across platforms. - Sovereign Cloud for Compliance

Data sovereignty and privacy regulations require localized infrastructure. Hyperscalers are launching region-specific data centers and offering services like customer-managed encryption keys to meet compliance demands. - Hybrid and Edge Expansion

Hyperscalers are extending their control planes to customer premises and edge locations. Offerings like AWS Outposts, Azure Arc, and Anthos enable consistent governance across hybrid environments, supporting low-latency AI inferencing. - FinOps and Cost Optimization

With AI workloads increasing costs, organizations are adopting FinOps practices for better visibility and optimization. Transparent pricing for AI tokens and model inference is becoming critical for enterprise decision-making.

Successful Examples of Hyperscale Computing Worldwide

- Netflix on AWS: Supports streaming to millions globally using AWS services for compute, storage, and global distribution, ensuring high availability and low latency.

- Spotify on Google Cloud: Migrated from on-prem to GCP, leveraging BigQuery and Kubernetes to deliver personalized streaming experiences.

- Coca-Cola on Azure: Adopted Azure to accelerate digital transformation, including large-scale SAP migrations and AI-powered marketing initiatives.

- National Australia Bank on AWS: Implemented a cloud-first strategy, modernizing core banking applications while ensuring regulatory compliance.

- Deutsche Bank with Google Cloud: Collaborated to build advanced analytics and AI capabilities for financial services with stringent security requirements.

Global and Regional Analysis with Government Initiatives

North America

Market Overview: The largest hyperscale region driven by AI R&D, enterprise modernization, and advanced digital services.

Policies: Federal programs like FedRAMP drive cloud adoption for government agencies, while state-level privacy laws reinforce security compliance.

Key Players: AWS leads with massive market share; Azure leverages enterprise relationships; Google dominates AI-driven use cases.

Europe

Market Overview: Strong focus on data sovereignty and multicloud compliance.

Policies: The EU Data Act mandates portability and reduces switching costs; GAIA-X promotes interoperability.

Impact: Hyperscalers are introducing sovereign cloud solutions and data boundary features to comply with European regulations.

Asia-Pacific (APAC)

Market Overview: Fastest-growing region with booming demand in fintech, telecom, and government sectors.

Policies: India’s DPDP Act and MeitY guidelines drive cloud adoption; China enforces strict data localization laws; Japan and Singapore provide advanced compliance frameworks.

Impact: Hyperscalers expand local data centers and sovereign regions while partnering with telecom and government entities.

Middle East & Africa (MEA)

Market Overview: High growth driven by national digitalization programs in Saudi Arabia, UAE, and South Africa.

Policies: Cloud-first policies and privacy laws encourage hyperscale adoption in government and energy sectors.

Impact: Vendors deploy sovereign regions and industry-specific solutions to align with regulatory frameworks.

Latin America

Market Overview: Emerging hyperscale hub powered by fintech and e-commerce growth.

Policies: Brazil’s LGPD and similar data privacy laws in the region shape cloud architecture requirements.

Impact: Cloud providers invest in regional data centers to reduce latency and comply with localization laws.

Hyperscale Computing Market Dynamics and Financial Highlights

- AWS: $108.3 billion revenue, ~30–33% market share.

- Microsoft (Azure): Microsoft Cloud reached $168.9 billion; Azure estimated at ~$75 billion annualized.

- Google Cloud: $43.23 billion revenue, ~11–12% share.

- Oracle: $39.4 billion from cloud services and license support; OCI growing rapidly.

- IBM: $62.9 billion total revenue with strong hybrid cloud and AI services.

Future Outlook for Enterprises

- AI Compute Scarcity: High demand for GPUs and AI accelerators will make capacity planning critical.

- Regulatory Pressure: Compliance for data sovereignty and cloud portability will influence architecture decisions.

- Hybrid Edge Strategy: Enterprises will distribute AI inference across edge and cloud for performance and cost efficiency.

- Cost Management: Token-based AI pricing models will require robust FinOps capabilities for budgeting and optimization.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Enterprise Artificial Intelligence Market Key Players, Trends, and Regional Insights by 2034