Small Molecule Injectable Drugs Market Growth, Trends, Key Players and Global Analysis by 2034

Small Molecule Injectable Drugs Market Size

What Are Small Molecule Injectable Drugs?

Small molecule injectable drugs are pharmacological agents characterized by low molecular weight, typically under 900 Daltons. These drugs are administered via injection—intravenous (IV), subcutaneous (SC), or intramuscular (IM)—and are designed to treat a wide array of medical conditions. They are often synthesized through chemical processes, distinguishing them from biologics, which are derived from living organisms. Common examples include antibiotics, chemotherapy agents, analgesics, anticoagulants, and antivirals. Their small size allows them to easily penetrate cell membranes, making them effective in targeting intracellular pathways.

Importance of Small Molecule Injectable Drugs

The significance of small molecule injectable drugs lies in their versatility and efficacy. They are pivotal in managing acute and chronic conditions, particularly in oncology, infectious diseases, cardiovascular disorders, and pain management. Their ability to deliver precise dosages ensures controlled therapeutic outcomes. Moreover, advancements in drug delivery technologies have enhanced their stability and patient compliance. As a result, these drugs remain integral to modern medical practice, offering reliable treatment options across various therapeutic areas.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2705

Growth Factors Driving the Market

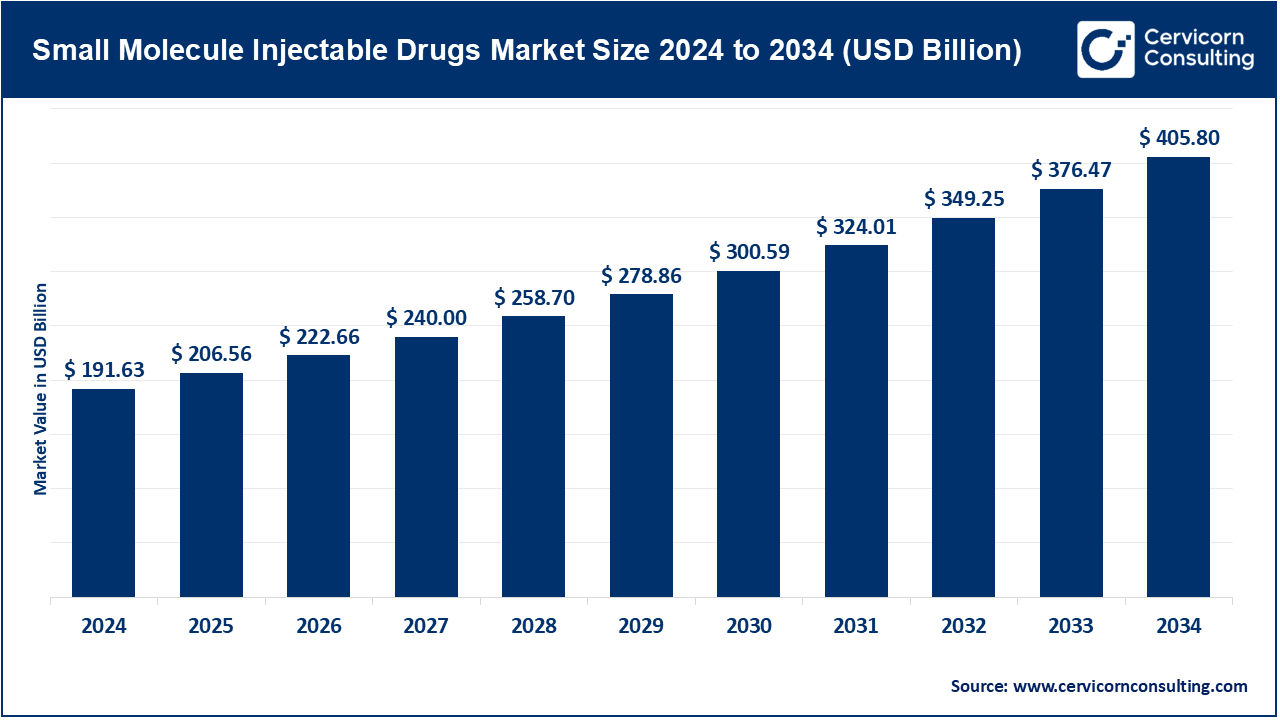

The small molecule injectable drugs market is experiencing robust growth, projected to reach approximately USD 408.69 billion by 2034, up from USD 194.64 billion in 2024, reflecting a compound annual growth rate (CAGR) of 7.7%. This expansion is attributed to several key factors:

- Rising Prevalence of Chronic Diseases: Conditions such as cancer, diabetes, and cardiovascular diseases necessitate long-term treatment regimens, driving demand for injectable therapies.

- Advancements in Drug Delivery Systems: Innovations in formulation and delivery technologies have improved the efficacy and safety profiles of injectable drugs.

- Aging Global Population: An older demographic is more susceptible to chronic illnesses, thereby increasing the need for injectable medications.

- Government Initiatives and Healthcare Spending: Increased healthcare budgets and supportive policies in various regions have facilitated access to injectable therapies.

- Improved Manufacturing Processes: Enhanced production techniques have led to cost reductions and increased availability of injectable drugs.

Leading Companies in the Market

Several pharmaceutical giants dominate the small molecule injectable drugs market:

1. Pfizer Inc.

- Specialization: Oncology, Vaccines, Pain Management

- Key Focus Areas: Research and development of innovative small molecule injectables, particularly in cancer therapeutics.

- Notable Features: Strong pipeline of oncology drugs, extensive global distribution network.

- 2024 Revenue: Approximately USD 81.3 billion

- Market Share: Significant presence in North America and Europe

- Global Presence: Operations in over 125 countries

2. Merck & Co., Inc.

- Specialization: Immuno-oncology, Infectious Diseases

- Key Focus Areas: Development of small molecule injectables for cancer and infectious diseases.

- Notable Features: Pioneering immunotherapy agents, strong research capabilities.

- 2024 Revenue: Approximately USD 59.2 billion

- Market Share: Leading position in oncology injectable market

- Global Presence: Extensive operations worldwide

3. Teva Pharmaceutical Industries Ltd.

- Specialization: Generic Pharmaceuticals, Neurology

- Key Focus Areas: Production of generic small molecule injectables, particularly in neurology.

- Notable Features: Cost-effective solutions, broad product portfolio.

- 2024 Revenue: Approximately USD 16.7 billion

- Market Share: Strong presence in generic injectable segment

- Global Presence: Operations in over 60 countries

4. Novartis AG

- Specialization: Cardiovascular, Ophthalmology

- Key Focus Areas: Development of small molecule injectables for cardiovascular and eye diseases.

- Notable Features: Innovative drug delivery systems, strong R&D pipeline.

- 2024 Revenue: Approximately USD 53.2 billion

- Market Share: Notable presence in Europe and Asia

- Global Presence: Operations in over 140 countries

5. AstraZeneca plc

- Specialization: Respiratory, Oncology

- Key Focus Areas: Research and development of small molecule injectables in oncology and respiratory diseases.

- Notable Features: Strong oncology portfolio, focus on precision medicine.

- 2024 Revenue: Approximately USD 44.3 billion

- Market Share: Significant presence in global oncology market

- Global Presence: Operations in over 100 countries

Leading Trends and Their Impact

1. Shift Towards Outpatient Care

There is a growing trend towards administering injectable therapies in outpatient settings, reducing healthcare costs and improving patient convenience. This shift is facilitated by advancements in drug formulations and delivery devices.

2. Personalized Medicine

The move towards personalized medicine involves tailoring treatments based on individual genetic profiles. This approach enhances the efficacy of small molecule injectables and minimizes adverse effects.

3. Regulatory Changes

Government initiatives influencing drug pricing and reimbursement policies are impacting the market. While aimed at reducing healthcare costs, these changes may affect the profitability of small molecule injectable drugs.

4. Technological Advancements

Innovations in drug delivery technologies, such as pre-filled syringes and wearable injectors, are enhancing the administration of small molecule injectables, improving patient adherence and outcomes.

Successful Examples Worldwide

- Mounjaro (tirzepatide): Developed by Eli Lilly, this injectable drug has shown significant efficacy in managing type 2 diabetes and obesity, marking a breakthrough in metabolic disease treatment.

- Keytruda (pembrolizumab): Merck’s immuno-oncology agent has revolutionized cancer treatment, offering durable responses in various malignancies.

- Enbrel (etanercept): AstraZeneca’s injectable biologic has been a mainstay in treating autoimmune disorders, demonstrating the potential of injectables in chronic disease management.

Global Regional Analysis

North America

The North American market is the largest for small molecule injectable drugs, driven by high healthcare expenditure, advanced medical infrastructure, and a significant patient population. Regulatory agencies play a crucial role in drug approval and market dynamics.

Europe

Europe exhibits strong demand, particularly in oncology and infectious diseases. Countries with robust healthcare systems and supportive policies contribute to market growth.

Asia-Pacific

The Asia-Pacific region is experiencing rapid growth due to increasing healthcare access, rising chronic disease prevalence, and expanding pharmaceutical manufacturing capabilities.

Latin America and Middle East & Africa

These regions are emerging markets with growing healthcare needs and improving infrastructure, presenting opportunities for market expansion.

Government Initiatives and Policies

Governments worldwide are implementing policies to regulate drug pricing and ensure accessibility. Such initiatives are reshaping the market landscape, influencing pricing strategies and market access for pharmaceutical companies.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Orthodontics Market Growth Trends, Leading Companies & Regional Insights by 2034