Automotive Electronics Market size, Innovations & Global Outlook 2024

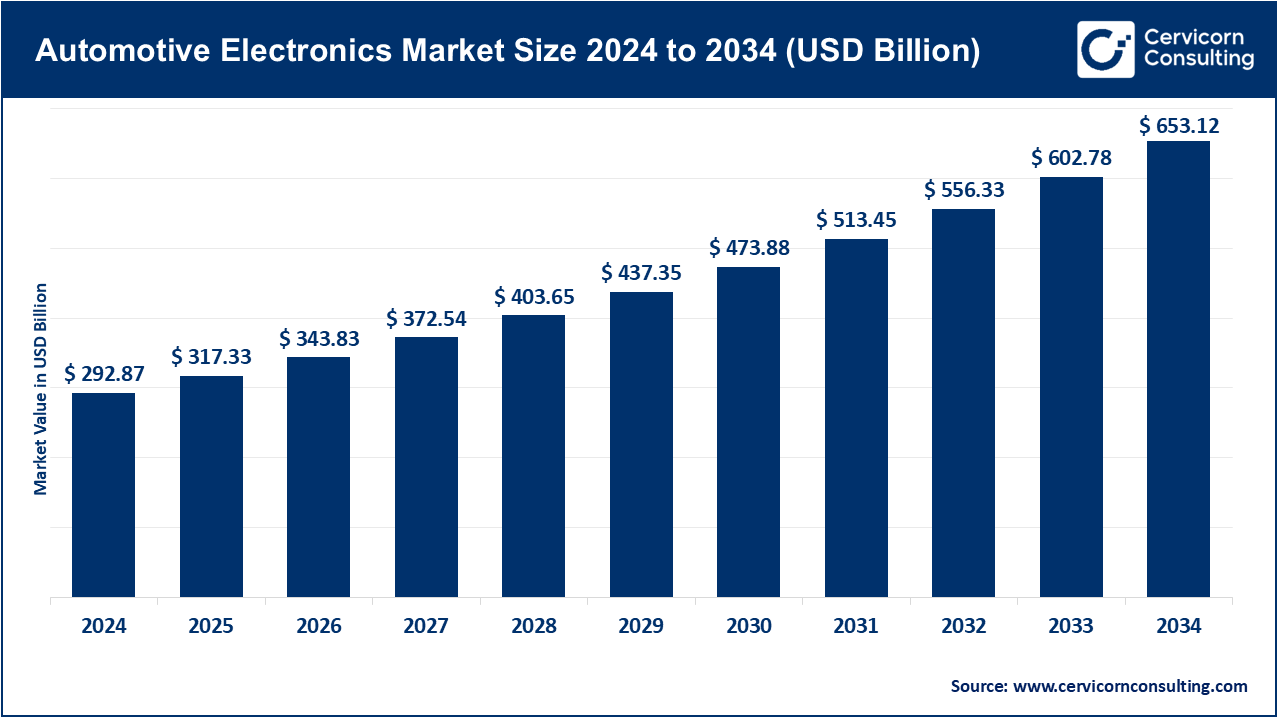

Automotive Electronics Market Size

The global automotive electronics market is set to surge from USD 292.87 billion in 2024 to over USD 653.12 billion by 2034, growing at an impressive CAGR of 9.2% during 2025–2034.

What Is the Automotive Electronics Market?

The automotive electronics market spans all electronic subsystems and components engineered into vehicles to elevate safety, performance, efficiency, comfort, and connectivity. Scope includes advanced driver-assistance systems (ADAS); body electronics (lighting, climate, seating, power windows, gateways); powertrain and power electronics (engine/traction inverters, DC/DC converters, on-board chargers, battery management systems); safety electronics (airbag control units, ABS/ESC, radar/camera ECUs); infotainment and HMI (instrument clusters, head units, head-up displays, voice control); connectivity (telematics control units, vehicle-to-everything modules, eSIM). Increasingly, these systems sit on centralized or “zonal” electrical/electronic (E/E) architectures powered by high-performance compute, enabling software-defined vehicles (SDVs) that can be updated over-the-air with new features and safety improvements.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2696

Why Is It Important?

Automotive electronics are the backbone of modern mobility. They slash accidents via active safety; compress emissions through precise control and electrification; and delight users with rich, connected experiences. For OEMs, electronics and software are strategic: they create differentiation, brand loyalty, subscription revenues, and total cost-of-ownership advantages. For regulators and society, they are the pathway to Vision Zero safety goals, decarbonization, and intelligent transport systems. For suppliers, they are a generational opportunity, as vehicles transition from hardware-centric products to AI-enabled, upgradable platforms.

Automotive Electronics Market Growth Factors

Market growth is propelled by tightening global safety and emissions standards; rapid electrification across passenger and commercial fleets (driving demand for traction inverters, on-board chargers, battery management systems, and high-voltage DC/DC converters); mass deployment of ADAS features (automatic emergency braking, adaptive cruise, lane keeping) on mainstream trims; the shift toward centralized/zonal E/E architectures and software-defined vehicles that enable over-the-air updates and recurring revenue models.

consumer expectations for always-connected infotainment, premium HMI, and seamless smartphone integration; advances in semiconductors (SiC/GaN for power density and efficiency, domain/zonal controllers, automotive-grade FPGAs and MCUs, AI accelerators for perception and sensor fusion); maturing V2X connectivity and telematics for safety and fleet optimization; growing use of digital twins and model-based development that compress time-to-market; and supportive industrial policy, incentives, and charging/5G infrastructure investments across leading regions.

Automotive Electronics Market Top Companies

Below is a compact, WordPress-friendly table you can sort or style with your theme. Update the 2024 Revenue and Market Share fields with your latest audited figures as needed.

| Company | Specialization | Key Focus Areas | Notable Features | 2024 Revenue | Market Share | Global Presence |

|---|---|---|---|---|---|---|

| Aisin Corporation | Drivetrain, chassis, braking, e-Axle modules | Hybrid/EV electrification, brake-by-wire, thermal & energy efficiency | Deep OEM integration; high-volume reliability; lightweight systems | Update with audited FY2024 | Notable in drivetrain & chassis subsystems | Manufacturing/R&D across Asia, Europe, North America |

| Altera Corporation (part of Intel) | Automotive-grade FPGAs & SoC platforms | ADAS/sensor fusion, in-vehicle networking, data pipelines for autonomy | Reconfigurable compute; fast time-to-feature via OTA-aligned hardware | Consolidated under Intel segment reporting (update) | Material share in programmable logic for auto | Global support footprint across NA, EU, APAC |

| American Axle & Manufacturing, Inc. | Driveline/drivetrain; e-drive systems | EV propulsion, e-Beam axles, NVH optimization, lightweighting | Integration of mechanical + power electronics; commercial & passenger | Update with audited FY2024 | Strong in driveline/e-drive supply | Manufacturing across Americas, Europe, Asia |

| Atmel Corporation (part of Microchip) | Automotive MCUs, touch/HMI, crypto/security | Body electronics, clusters, infotainment, secure connectivity | Low-power, AEC-Q grade MCUs; robust security IP; broad ecosystem | Consolidated under Microchip reporting (update) | Meaningful MCU share in auto subsystems | Global distribution and FAE support in NA/EU/APAC |

| Autoliv, Inc. | Passive & active safety electronics (airbags, restraints, ADAS) | Pedestrian protection, smart airbags, camera/radar integration | Safety leadership; system-level validation and global quality | Update with audited FY2024 | Leading share in automotive safety systems | Operations in 25+ countries; deep OEM coverage |

Leading Trends and Their Impact

1) Electrification at Scale

Electrification is now mainstream across passenger cars, buses, and logistics fleets. Power electronics using SiC and GaN deliver higher switching speeds and efficiency, extending range and enabling compact packaging. The impact: multi-year demand visibility for traction inverters, on-board chargers, HV DC/DC, battery management systems, thermal management controls, and functional safety semiconductors. Suppliers with robust automotive-grade qualification (AEC-Q), strong supply assurance, and aligned roadmaps win disproportionate share.

2) Software-Defined Vehicles (SDV) & Zonal Architectures

OEMs are consolidating dozens of ECUs into domain and zonal controllers wired via high-bandwidth Ethernet backbones. This reduces wiring weight, boosts compute headroom, and turns vehicles into platforms where features can be deployed over-the-air. Impact: electronics content per vehicle rises; cybersecurity, orchestration, and lifecycle management become critical; revenue shifts to software features, data, and services.

3) ADAS Expansion Toward Autonomy

Sensor suites (camera, radar, lidar), high-performance compute, perception AI, and HD mapping underpin ever-more capable assistance features. As regulatory bodies standardize key safety functions, ADAS penetration expands to mass-market segments. Impact: demand for sensor fusion ECUs, redundancy architectures, and rigorous functional safety (ISO 26262) escalates; compute suppliers diversify with accelerated AI pipelines.

4) Connected Infotainment & Premium HMI

Immersive displays, voice assistants, app ecosystems, and seamless smartphone projection have become baseline expectations. The impact: sustained growth in head units, digital clusters, advanced audio, and vehicle cloud platforms; differentiation pivots to UX quality, latency, and long-term update cadence.

5) Cybersecurity & Safety by Design

With more connectivity comes higher cyber risk. Secure boot, hardware roots of trust, intrusion detection, and continuous patching are table stakes. The impact: embedded security silicon/IP and lifecycle security services grow rapidly; suppliers with end-to-end safety/cyber stacks reduce OEM integration burden.

6) Cost & Supply Chain Resilience

Post-shortage strategies favor second-sourcing, regionalization, and longer visibility forecasts. The impact: partnerships, multi-foundry strategies, and standardization around reusable platforms/zonal controllers; vendors who guarantee delivery and PPAP/ASPICE discipline gain preferred status.

What Are Some Successful Examples of Automotive Electronics Around the World?

- Tesla – Pioneered large-scale over-the-air updates, centralized compute, and high-integration power electronics across its EV lineup, proving the SDV model commercially.

- Toyota – Industrialized hybrid power electronics and robust battery management at global scale, setting benchmarks for reliability and efficiency.

- BMW – Advanced infotainment/HMI and ADAS in premium segments; fast iteration of digital services and connected features drives differentiation.

- Hyundai–Kia – Aggressive EV roadmap with 800-V architectures, efficient inverters, and expanding ADAS suites across accessible price points.

- Volvo – Safety-first brand identity backed by active safety electronics, redundant sensing, and driver monitoring features.

- BYD – Vertical integration of batteries and power electronics enables compelling cost/performance, catalyzing mass adoption in APAC and beyond.

- Rivian & commercial EV makers – Fleet-oriented telematics, thermal control, and OTA-optimized E/E architectures demonstrate strong TCO value in logistics.

Global Regional Analysis Including Government Initiatives and Policies

Asia–Pacific (APAC)

APAC leads in production scale and electronics content per vehicle, anchored by China, Japan, and South Korea. Policy thrusts include generous EV purchase incentives and VAT relief, accelerated charging infrastructure rollouts in metropolitan clusters, local semiconductor/ecosystem development programs, and safety feature standardization for new vehicles. China’s industrial policy emphasizes NEVs (new energy vehicles) and domestic supply chain depth from batteries to power semiconductors. Japan focuses on next-gen power devices, hydrogen/e-fuel pilots, and export competitiveness. South Korea leverages its display, memory, and foundry strengths to push connected infotainment and ADAS compute. Impact: sustained demand across power electronics, domain/zonal controllers, and connected services platforms, with localization shaping sourcing decisions.

North America

The region’s mix of legacy OEMs and EV-first disruptors accelerates SDV adoption, OTA business models, and high-voltage architectures. Federal and state incentives target EV purchases, charging infrastructure, and clean manufacturing (including on-shoring of battery and semiconductor capacity). Safety regulators push broader deployment of AEB and driver monitoring. Impact: rising electronics content per vehicle, rapid ramp of SiC modules, and demand for automotive-grade compute and cybersecurity. Suppliers able to co-develop software stacks with OEMs gain advantage.

Europe

Europe’s regulatory environment is the world’s most stringent on safety and emissions, catalyzing electronics adoption in ADAS, electrification, and cybersecurity compliance. National policies fund charging corridors, grid upgrades, and R&D for wide-bandgap semiconductors. Euro-level initiatives encourage semiconductor sovereignty and resilient supply chains. Impact: premium OEMs drive high-spec architectures, while mass-market brands standardize ADAS and connected features. Electronics suppliers with strong functional safety, data privacy, and lifecycle security credentials are favored.

Latin America

Market adoption is heterogeneous. Mexico’s manufacturing base benefits from North American integration and nearshoring, boosting regional electronics content. Brazil advances flex-fuel and nascent EV policies while standardizing core safety electronics. Impact: steady growth in body electronics, telematics, and entry-level ADAS; opportunities for suppliers with cost-optimized, robust platforms.

Middle East & Africa (MEA)

Electrification is early but accelerating in wealthier Gulf states, supported by pilot charging corridors and smart-city programs. South Africa remains an automotive hub for assembly and export. Impact: premium safety/infotainment packages lead in the Gulf; commercial telematics and fleet safety electronics show attractive ROI in logistics and mining.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: General Delivery Transportation Market Revenue, Market Share & Innovations (2025 – 2034)