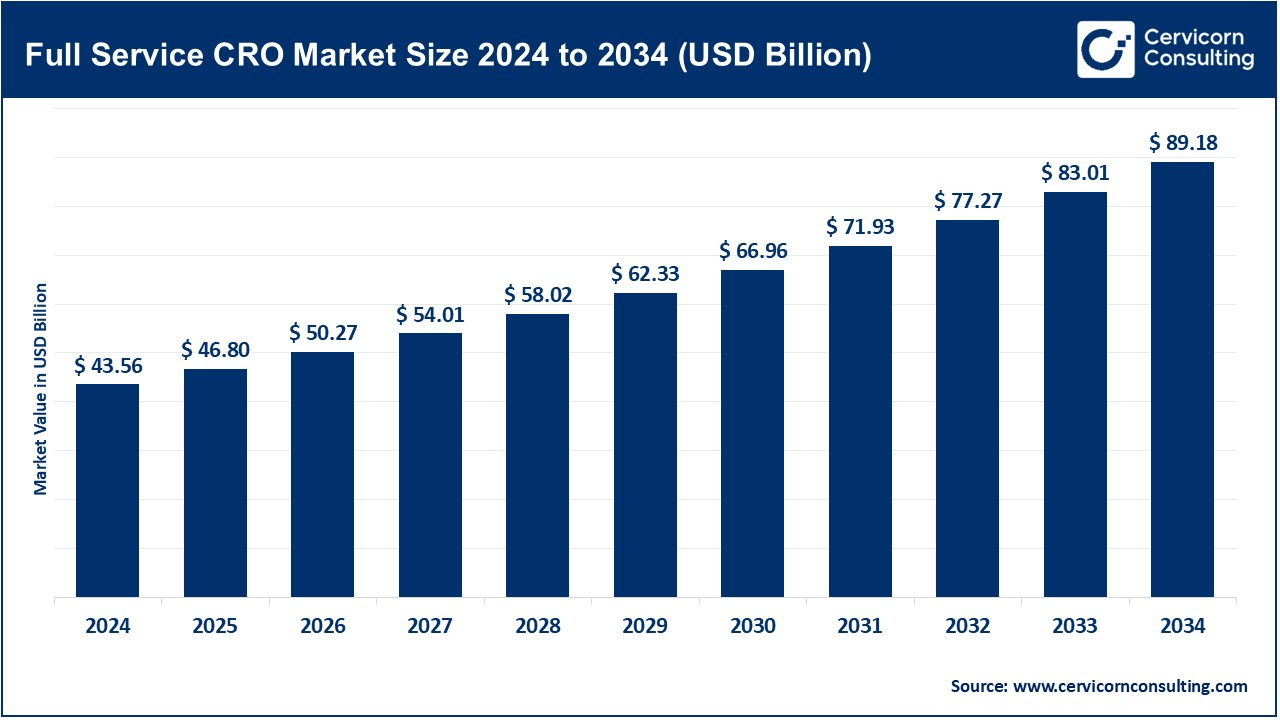

Full-Service CRO Market Forecast to Hit USD 89.18 Billion by 2034

Full Service CRO Market Size

The global full service CRO market size was worth USD 43.56 billion in 2024 and is anticipated to expand to around USD 89.18 billion by 2034, registering a compound annual growth rate (CAGR) of 7.42% from 2025 to 2034.

Introduction to Full-Service CROs

Full-service CROs (Contract Research Organizations) provide comprehensive services throughout the drug development process—from preclinical trials through regulatory submission and commercialization. Their offerings span clinical trials (Phase I–IV), bioanalytical testing, data management, pharmacovigilance, and post-market surveillance. These organizations serve as a critical extension of pharmaceutical and biotechnology companies’ R&D teams.

As clinical development grows in complexity and globalization, full-service CROs streamline operations, reduce timelines, and enhance regulatory compliance. The model is favored due to its scalability, efficiency, and integration of various expertise under one umbrella.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2615

Full Service CRO Market Growth Factors

The global full-service CRO market is expanding due to several key drivers. Complex therapies like biologics and gene/cell treatments require advanced clinical designs and real-world evidence, which full-service CROs are equipped to deliver. Increasing regulatory requirements and the need for specialized services have made outsourcing essential.

The cost of in-house clinical operations is often prohibitive, prompting companies to rely on CROs for scalability and expertise. Additionally, digital transformation—through AI, telemedicine, and decentralized clinical trial (DCT) platforms—is accelerating trial efficiency and patient engagement. These trends, coupled with the pharmaceutical industry’s push to reduce time-to-market, are boosting demand.

Moreover, globalization of clinical trials into emerging regions (Asia-Pacific, Latin America, Eastern Europe) is broadening access to patient populations, reducing costs, and increasing market penetration. Supportive regulatory reforms in countries like China and India are fostering a favorable trial environment. The market is expected to grow at a strong CAGR through the coming decade.

Why Full-Service CROs Are Important

The pharmaceutical industry faces increased pressure to deliver safe and effective therapies faster and at lower cost. Full-service CROs play a pivotal role in meeting these demands.

These CROs reduce the logistical burden by providing integrated solutions—from early discovery to late-phase clinical trials and commercialization. They streamline operations, consolidate vendors, and deliver standardized processes that reduce errors and speed up timelines.

Their expertise in regulatory compliance across multiple geographies enables faster approvals and minimizes costly delays. Additionally, they bring deep therapeutic experience and maintain large, global networks of trial sites and investigators.

By leveraging real-world data, AI-driven analytics, and decentralized trial technologies, full-service CROs enhance patient recruitment, protocol optimization, and data quality. Their ability to manage global, multi-center studies while maintaining consistency and regulatory adherence makes them indispensable to modern drug development.

Top Companies Snapshot

1. Medpace

Medpace is a mid-sized global CRO with an integrated business model that includes central laboratories, imaging services, and a Phase I unit. The company focuses on therapeutic areas such as oncology, cardiology, and metabolic diseases. Its strength lies in its centralized operations and hands-on project management. Medpace has a presence in 40+ countries and ranks among the top 10 CROs globally, with estimated 2024 revenues exceeding $1 billion.

2. Laboratory Corporation of America (Labcorp)

Labcorp’s drug development division is a top-tier CRO specializing in central laboratory services, diagnostics, and toxicology studies. Its infrastructure supports a significant portion of FDA-approved new drugs. With revenues in the biopharma segment contributing to a broader $14+ billion business, Labcorp’s CRO services are vital for large pharma and biotech clients. Its capabilities extend across North America, Europe, and emerging markets in Asia.

3. ICON plc

Headquartered in Ireland, ICON offers full-service clinical, commercial, and regulatory support services across 50+ countries. Following its acquisition of PRA Health Sciences, ICON has emerged as one of the leading global CROs. It specializes in adaptive trial design, decentralized trials, and real-world evidence. ICON’s extensive workforce and integrated platforms drive efficiency and trial success across all phases of development.

4. IQVIA Inc.

IQVIA is the world’s largest full-service CRO, formed from the merger of Quintiles and IMS Health. It offers deep capabilities in clinical trial management, advanced analytics, real-world data (RWD), and technology-enabled solutions. IQVIA has a global workforce exceeding 80,000 and operates in more than 100 countries. Its scale and data infrastructure allow for highly personalized and efficient trial design, with revenues estimated around $12 billion.

5. Syneos Health

Syneos Health is unique in its integration of clinical development and commercialization services. It offers Phase I–IV trials, medical affairs, and post-launch marketing support. Known for its expertise in CNS, oncology, and infectious diseases, Syneos supports both biotech startups and major pharmaceutical companies. With a growing global presence and estimated revenues of around $6 billion, Syneos is a critical player in bridging science and market delivery.

Leading Trends & Their Impact

Several trends are reshaping the full-service CRO landscape:

- Decentralized Clinical Trials (DCTs): These trials use telemedicine, home nursing, and wearable devices to conduct studies remotely, improving patient recruitment and retention.

- Artificial Intelligence and Machine Learning: AI is enhancing site selection, protocol optimization, and patient matching, reducing trial costs and durations.

- Real-World Evidence (RWE): Regulators and payers increasingly demand RWE; CROs now integrate claims data, EHRs, and patient-reported outcomes into trial designs.

- Specialized Therapeutics: Precision medicine, oncology, and cell/gene therapies demand CROs with niche expertise and flexible delivery models.

- Consolidation: Mergers and acquisitions are creating large-scale CROs capable of serving clients across geographies and therapeutic areas.

- Geographic Expansion: Growth in Asia-Pacific, Latin America, and Eastern Europe is enabling faster, more cost-effective trials in new patient populations.

These trends are driving CROs to invest in technology, diversify offerings, and expand geographic reach.

Successful Examples

- ICON’s acquisition of PRA Health Sciences created a global giant with expanded digital and decentralized capabilities.

- Labcorp’s acquisition of Toxikon enhanced its preclinical safety services, boosting its full-pipeline support.

- IQVIA’s partnership with argenx for autoimmune trials demonstrated its strength in real-world data and safety surveillance.

- Veeda’s acquisition of Heads (Europe) represents a strategic move by an Indian CRO to gain foothold in oncology and expand into European markets.

- Medpace’s decentralized oncology trial pilot showed improved retention through remote monitoring and patient-centered engagement.

These cases reflect how full-service CROs evolve to meet industry demands and deliver value through integrated services, global infrastructure, and digital innovation.

Global Regional Analysis

North America

North America dominates the full-service CRO market with the highest revenue share, driven by a strong pharmaceutical base, advanced trial infrastructure, and robust FDA regulatory framework. The U.S. accounts for the majority of outsourced clinical research spend globally. Innovation in decentralized trials, RWE, and AI is heavily concentrated here.

Europe

Europe holds the second-largest market share. Countries like the UK, Germany, and Ireland host key CRO operations due to regulatory alignment, strong healthcare systems, and access to skilled researchers. The implementation of the EU Clinical Trials Regulation has harmonized processes and improved trial transparency.

Asia-Pacific

Asia-Pacific is the fastest-growing region due to its large patient pool, cost advantages, and improving regulatory environments. China and India have introduced reforms to streamline trial approvals, and countries like South Korea and Japan have become innovation hubs. Many global CROs are expanding operations here to capitalize on growth.

Latin America

Latin America offers moderate growth with increasing investments in clinical infrastructure. Brazil, Argentina, and Mexico are popular trial sites due to diverse patient demographics and improving IRB processes. Regulatory modernization is enhancing competitiveness.

Middle East & Africa

This region is still emerging but presents potential in markets like the UAE, Saudi Arabia, and South Africa. Governments are investing in healthcare research, creating new opportunities for trial conduct in niche populations and disease areas.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Personalized Medicine Market Size to Reach USD 1,094.83 Billion by 2034