Transportation Market Trends, Growth Drivers, Key Players, and Global Insights by 2034

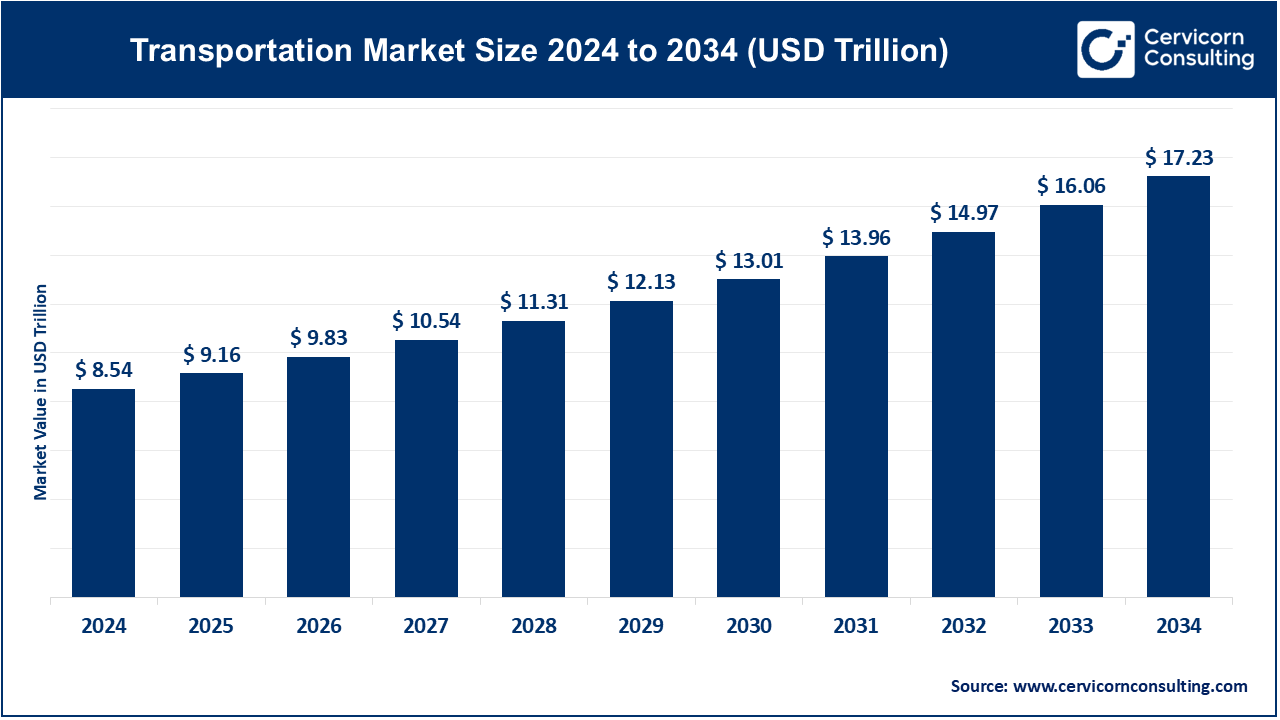

Transportation Market Size

The global transportation market size was worth USD 8.54 trillion in 2024 and is anticipated to expand to around USD 17.23 trillion by 2034, registering a compound annual growth rate (CAGR) of 7.27% from 2025 to 2034.

What is the Transportation Market?

The transportation market encompasses the movement of people and goods across different modes, including roadways, railways, airways, waterways, and more recently, urban air mobility (UAM) and autonomous transportation. It includes infrastructure development, vehicle manufacturing, logistics services, supply chain management, and associated technological platforms such as smart traffic management, mobility-as-a-service (MaaS), and electric vehicle (EV) networks. The market is segmented into passenger and freight transportation and is served by public, private, and hybrid systems. Key areas also include traditional transportation systems and innovative developments like electric vertical takeoff and landing (eVTOL) aircraft, hyperloop systems, drone deliveries, and autonomous cars.

Why is the Transportation Market Important?

The transportation market serves as the backbone of global economies. It facilitates trade, connects communities, enhances mobility, and supports the functioning of nearly every other industry. It significantly impacts economic development, energy consumption, and environmental sustainability. As populations grow and urbanize, the demand for efficient, reliable, and eco-friendly transportation systems is increasing. The transportation market also plays a pivotal role in supply chains and global trade. Moreover, it contributes to job creation, access to education and healthcare, and is an enabler of technological innovation across sectors. As global sustainability goals become more pressing, transforming the transportation landscape is central to achieving net-zero emissions targets and combating climate change.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2631

Transportation Market Growth Factors

The transportation market is experiencing accelerated growth due to a confluence of technological advancements, urbanization, policy support, and changing consumer preferences. Smart city initiatives, increased e-commerce penetration, and demand for faster, efficient logistics are fueling innovation. Electrification, automation, connectivity (5G), and shared mobility are transforming traditional models. Governments are investing heavily in infrastructure, clean energy transportation, and autonomous vehicle regulations. Additionally, venture capital and public-private partnerships (PPPs) are funding next-gen transport solutions like eVTOLs, hyperloop, and hydrogen-fueled mobility. The need to decarbonize and improve last-mile delivery is further propelling growth. Pandemic-driven digital transformation has also fast-tracked contactless, app-based transport solutions.

Top Companies in the Transportation Market (Urban Air Mobility Focus)

The advent of Urban Air Mobility (UAM)—a sub-segment within the broader transportation market—has introduced a new wave of innovation with eVTOL aircraft as a potential solution to urban congestion, faster commutes, and sustainable air travel. The following companies are at the forefront:

1. Joby Aviation

- Specialization: eVTOL aircraft for air taxi services.

- Key Focus Areas: Quiet, electric air transport; autonomy; commercial passenger service.

- Notable Features: Joby’s aircraft has a range of 150+ miles on a single charge and a top speed of 200 mph. It emphasizes minimal noise footprint.

- 2024 Revenue: Estimated at ~$45 million (primarily from U.S. Air Force contracts and development partnerships).

- Market Share: Among the top UAM firms in terms of investor backing and technical readiness.

- Global Presence: Based in the U.S., expanding operations via partnerships with Delta Air Lines and government contracts.

2. Archer Aviation

- Specialization: Development of fully electric eVTOL aircraft.

- Key Focus Areas: Short-haul urban flights; air taxi services; regulatory approvals.

- Notable Features: “Midnight” aircraft with a 100-mile range, optimized for back-to-back 20-mile trips with minimal charge time.

- 2024 Revenue: Estimated ~$40 million, with projections supported by United Airlines’ pre-orders.

- Market Share: Strong traction in the North American market, notable for its strategic airline collaborations.

- Global Presence: U.S.-based with international expansion plans through airport partnerships and inter-city travel solutions.

3. Lilium GmbH

- Specialization: Jet-powered eVTOL aircraft.

- Key Focus Areas: Regional air mobility; high-capacity vehicles; European deployment.

- Notable Features: Uses 36 electric jet engines with a projected 175 km range and 300 km/h speed; focus on business and regional mobility.

- 2024 Revenue: Estimated ~$25 million, mostly from tech licensing and early partnerships.

- Market Share: Leading the European eVTOL segment; strong presence in Germany and partnership with aviation authorities.

- Global Presence: Headquartered in Germany, expanding in France, Italy, Brazil, and the U.S.

4. Vertical Aerospace

- Specialization: Sustainable eVTOL development.

- Key Focus Areas: Aircraft certification; commercial operations; zero-carbon flights.

- Notable Features: “VX4” aircraft with a 100+ mile range; designed for four passengers and one pilot; low noise design.

- 2024 Revenue: Estimated ~$20 million with large pre-orders from American Airlines, Avolon, and Virgin Atlantic.

- Market Share: Fast-growing UK-based UAM player with strong backing from major aerospace firms.

- Global Presence: U.K.-based with North American and European expansion plans.

5. Volocopter

- Specialization: Multirotor eVTOL aircraft and cargo drones.

- Key Focus Areas: Air taxi services for megacities; logistics drones; ecosystem development.

- Notable Features: Fully electric; minimal noise emissions; strong regulatory progress with EASA.

- 2024 Revenue: ~$30 million, fueled by strategic partnerships and public-private urban mobility pilots.

- Market Share: Leader in the EU eVTOL market; expected to launch commercial services at the 2024 Paris Olympics.

- Global Presence: Germany-based with projects in Paris, Singapore, and Japan.

Leading Trends and Their Impact on the Transportation Market

1. Electrification of Transport

The global push toward net-zero emissions is accelerating EV adoption across all modes—cars, buses, trucks, ferries, and aircraft. Battery technology innovation and EV infrastructure are key enablers.

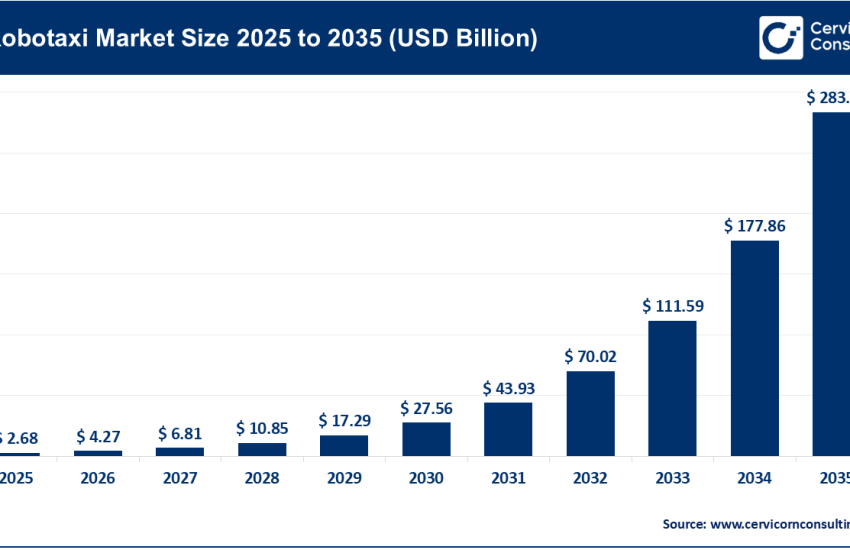

2. Autonomous and Connected Vehicles

Self-driving tech is revolutionizing logistics and personal mobility. AVs are being tested in controlled environments, with implications for ride-hailing, delivery, and fleet services.

3. Urban Air Mobility (UAM)

UAM represents a leap forward in reducing congestion and transforming commute times. The progress of eVTOL aircraft is shaping new regulations, infrastructure (vertiports), and business models.

4. Mobility-as-a-Service (MaaS)

Digital platforms enabling seamless travel across various modes (bikes, trains, cars) via one app are reshaping urban transportation—enhancing efficiency, reducing costs, and promoting sustainability.

5. Sustainable Logistics and Smart Freight

Green supply chains, smart warehousing, drone deliveries, and electric fleets are trends in the freight and logistics space. Carbon-neutral logistics is gaining regulatory and commercial momentum.

6. Government and Regulatory Support

Policy initiatives supporting green transport, subsidies for EVs, low-emission zones, and public-private partnerships are vital drivers. The EU, China, and the U.S. are leading regulatory frameworks.

7. Data-Driven Operations and AI

Predictive analytics, IoT, and AI-powered traffic systems are enhancing safety, reducing congestion, and improving route efficiency in real-time.

Successful Examples of the Transportation Market Around the World

• Singapore – Smart Urban Mobility

Singapore’s Land Transport Authority (LTA) has integrated contactless fare systems, AI-driven traffic lights, and autonomous shuttle testing in real urban environments. It’s a global model for seamless intermodal mobility.

• Norway – Electric Vehicle Leadership

Norway leads the world in EV penetration (over 80% of new car sales), driven by tax breaks, EV-only lanes, and dense charging networks. Its ferry services are also going electric.

• China – High-Speed Rail and E-Mobility

China has built the world’s largest high-speed rail network and leads in EV production and sales. Its cities are deploying smart transportation systems powered by 5G and AI.

• Germany – Volocopter and Urban Air Mobility

Germany is piloting urban air mobility through Volocopter, aiming to launch commercial eVTOL taxi services during the 2024 Paris Olympics, with support from EU aviation authorities.

• United Arab Emirates – Hyperloop Testing

Dubai and Abu Dhabi are investing in hyperloop systems in partnership with Virgin Hyperloop, with plans for ultra-fast passenger and cargo transit.

• United States – EV and UAM Ecosystem

California and Texas are leading in electric vehicle adoption, charging infrastructure, and eVTOL testing. Joby, Archer, and others are collaborating with NASA and the FAA.

Global Regional Analysis: Government Initiatives and Policies Shaping the Market

North America

- Initiatives: U.S. Bipartisan Infrastructure Law allocates $1.2 trillion with significant investments in rail, EV charging, and public transit.

- Policies: Tax credits for EV buyers (up to $7,500); regulatory support from FAA for eVTOL testing.

- Impact: Boost in clean tech innovation; increased public-private mobility pilots.

Europe

- Initiatives: EU’s Green Deal and Fit for 55 plan mandate a 55% emissions cut by 2030.

- Policies: Ban on ICE (internal combustion engine) vehicles by 2035; grants for EV infrastructure and green logistics.

- Impact: Rapid EV adoption, urban air mobility pilots, cross-border electric rail projects.

Asia-Pacific

- Initiatives: China’s 14th Five-Year Plan emphasizes electric mobility, AI in transport, and smart city development.

- Policies: Subsidies for EV manufacturers; high-speed rail integration; smart freight zones.

- Impact: Dominance in battery production; leadership in green mobility exports.

Latin America

- Initiatives: Electric bus deployments in Colombia, Chile, and Mexico.

- Policies: Low-carbon transport policies supported by the Inter-American Development Bank.

- Impact: Urban air quality improvement; shift from diesel fleets to EVs in megacities.

Middle East & Africa

- Initiatives: Saudi Arabia’s NEOM project includes autonomous and electric mobility at scale.

- Policies: Vision 2030 promotes smart logistics and transport modernization.

- Impact: Infrastructure-led transformation, early adoption of high-tech transit models.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Advanced Driver Assistance Systems (ADAS) Market Size, Growth Trends, and Forecast 2024-2034