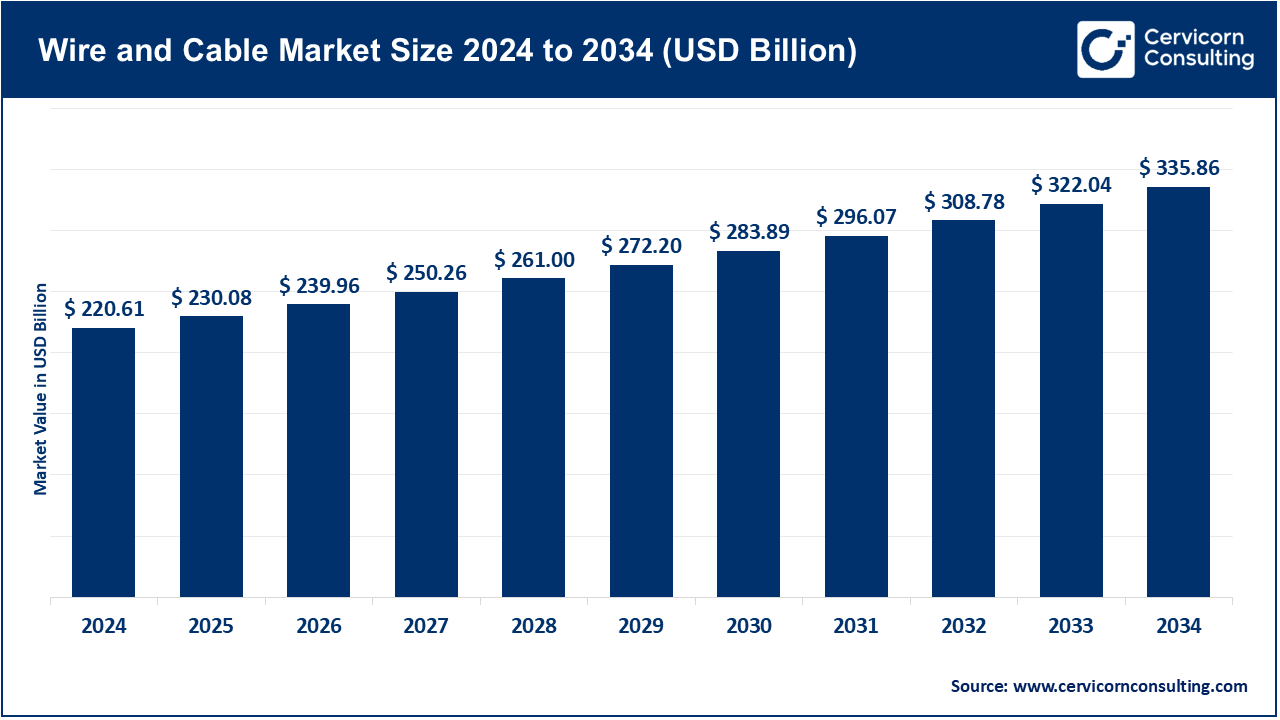

Wire and Cable Market Growth Drivers, Trends, Key Players & Regional Insights by 2034

Wire and Cable Market Size

Wire and Cable Market Growth Factors

Electricity and data are the twin lifebloods of modern economies, and the wire & cable market grows wherever either flows faster: grid modernization programs (HV, EHV, and HVDC build-outs; undergrounding; resilience upgrades), surging renewable capacity requiring new collector, export, and interconnector cables; data center proliferation and AI workloads demanding dense low-loss power distribution and high-fiber-count connectivity; 5G/FTTx rollouts and subsea cables that stitch cloud regions together; transport electrification (EVs, charging corridors, rail); industrial automation and building electrification; and national strategies to localize supply chains and secure critical infrastructure.

Add in higher copper/aluminum adoption, stricter fire-safety and halogen-free standards, and multiyear order backlogs for submarine and high-voltage factories—plus regulatory catalysts like the U.S. IIJA/IRA grid programs, Europe’s Grids Action Plan and offshore PCIs, India’s Green Energy Corridor and RDSS, China’s UHV investments, and Brazil’s record transmission auctions—and you get a structurally tight market with long-cycle capex visibility and pricing power in premium segments.

What is theWire and Cable Market?

The wire & cable market covers the design, manufacture, and installation of conductors and optical media that transmit electricity or data. It spans low-, medium-, high- and extra-high-voltage power cables (overhead and underground), HVDC export and interconnector systems, submarine cables, building wire, industrial control and instrumentation cables, automotive and specialty cables, and telecom products (optical fiber, fiber optic cables, copper telecom cables). It is an upstream enabler for power grids, renewable plants, cities and buildings, factories, rail and e-mobility, cloud and telecom networks, and national defense.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2721

Why it is important

- Energy transition: Every GW of wind/solar needs kilometers of collector and export cables and new transmission to move electrons to load centers. Europe’s plans to double cross-border capacity by 2030 and commit hundreds of billions of euros to grids are direct demand signals for land and submarine cables.

- Digital economy: AI-era data centers require more power per rack and more fibers per link; hyperscalers and carriers respond with campus-scale power cabling, inside-plant LV/MV systems, and metro/long-haul fiber densification.

- Resilience & security: Governments are funding grid hardening (storm-resistant undergrounding; wildfire mitigation; black-start and interties). The U.S. DOE’s GRIP program and Transmission Facilitation tools exemplify this pivot.

- Industrial policy: Purchase-ahead measures (e.g., UK Ofgem’s £4 billion pre-ordering approval) aim to reserve factory slots for cables and transformers, a critical step in an overheated global order book.

Wire and Cable Market — Top Companies (Company, Specialization, Key Focus Areas, Notable Features, 2024 Revenue, Market Share, Global Presence)

1) Prysmian Group (Italy)

- Specialization: World leader across HV/EHV land and submarine power, HVDC export & interconnectors, offshore wind arrays, medium/low-voltage distribution, building wire, and telecom fiber/copper.

- Key Focus Areas: Grid interconnections, offshore wind export systems, large HVDC projects in Europe and North America.

- Notable Features: Global network of factories and cable-lay vessels; deep HVDC system integration; multi-year backlog across submarine capacity.

- 2024 Revenue: €17.0 billion.

- Market Share (indicative): ~6–8% of global wire & cable by revenue.

- Global Presence: Manufacturing and project delivery on every major continent; strong EMEA and North America footprint.

2) Sumitomo Electric Industries, Ltd. (Japan)

- Specialization: Power cables (incl. HV/HVDC), substation equipment, rectangular magnet wire for EV motors, and infocommunications (optical devices and wiring for data centers).

- Key Focus Areas: HVDC interconnectors, EV ecosystem conductors, optical/data-center solutions.

- Notable Features: Strong engineering for long-distance and submarine HV cables; diversified portfolio including automotive wiring harnesses.

- 2024 Revenue: Consolidated net sales ¥4,679.8 billion (~US$31.3 bn); Environment & Energy segment sales ¥1,081.3 billion (~US$7.01 bn).

- Market Share (indicative): Based on the Environment & Energy segment, ~2–3% of global wire & cable revenue.

- Global Presence: Extensive footprint across Japan, Asia, Europe, and the Americas.

3) Furukawa Electric Co., Ltd. (Japan)

- Specialization: Energy infrastructure power cables (extra-high voltage, underground, renewable), telecom/fiber, electronics & automotive systems.

- Key Focus Areas: Japan extra-high-voltage and undergrounding programs; renewable energy cables; data-center related products.

- Notable Features: Improving margins on higher-value cable systems; progress tied to domestic undergrounding and offshore wind supply chains.

- 2024 Revenue: ¥1,201.8 billion consolidated, with Energy Infrastructure (power cables) net sales ~¥130.9 billion.

- Market Share (indicative): Consolidated mix is diversified; power-cable share roughly <1% on a global revenue basis.

- Global Presence: Strong in Japan with international operations and exports.

4) Hengtong Optic-Electric Co., Ltd. (China)

- Specialization: Optical fiber & fiber-optic cable, power transmission cables (incl. submarine), and integrated system solutions.

- Key Focus Areas: China’s grid and telecom densification; global optical fiber supply; subsea projects.

- Notable Features: Large-scale fiber production, breadth across power and telecom, and participation in subsea/overseas tenders.

- 2024 Revenue: RMB 59.98 billion.

- Market Share (indicative): In fiber optics, Hengtong is a global top-tier vendor by volume; across the broader wire & cable market, revenue implies a low-to-mid single-digit percent share.

- Global Presence: Manufacturing bases and sales across Asia, EMEA, and the Americas.

5) Leoni AG (Germany)

- Specialization: Automotive cables and solutions (high-voltage e-mobility cables, special cables).

- Key Focus Areas: High-voltage cable systems for EVs, thermal management lines, and specialty conductors for new mobility platforms.

- Notable Features: Deep OEM integration in Europe and beyond; sharpened focus post-restructuring.

- 2024 Revenue: ~€5 billion consolidated sales.

- Market Share (indicative): Within automotive cable niches, significant share; across total wire & cable, ~1–2% by revenue.

- Global Presence: European core with manufacturing/engineering spread across Central & Eastern Europe, North Africa, and other regions.

Leading Trends and Their Impact

- HVDC & Interconnectors Go Mainstream – Europe aims to double cross-border capacity by 2030, accelerating HVDC links and offshore hybrid interconnectors. This cements multi-year demand for ±320–525 kV cable systems.

- Offshore Wind Export & Array Cables Scale Up – Grid connection is now the pacing item for offshore wind. Flagship projects like the Tyrrhenian Link and Coastal Virginia Offshore Wind highlight the role of cables as bottlenecks.

- Data Center & AI Power + Fiber Boom – Hyperscale campuses are driving medium-voltage distribution, fire-safe LV building wire, and ultra-high-fiber-count cables. Demand for ribbon fiber, bend-insensitive G.657, and low-loss links is rising.

- Urban Undergrounding & Resilience – Municipal utilities are undergrounding feeders and reinforcing substations to mitigate wildfires and storm outages.

- EV & e-Mobility Electrification – EV production and charging corridors drive high-voltage automotive cables, magnet wire, and high-amperage flexible conductors.

- Supply-Chain Sovereignty & Pre-Booking – Governments and TSOs are reserving manufacturing capacity years ahead to mitigate bottlenecks, reshaping procurement.

- Materials & Sustainability – Copper price volatility supports aluminum substitution; halogen-free, low-smoke, and recyclable products are becoming industry standards.

Successful Examples of Wire and Cable Projects Around the World

- Tyrrhenian Link (Italy) – A flagship HVDC submarine interconnector connecting Sardinia, Sicily, and Campania (~1,500 km).

- Coastal Virginia Offshore Wind (USA) – One of the largest U.S. offshore wind projects; export cable packages illustrate the complexity of modern grid connections.

- SEA-ME-WE-6 & 2Africa (Global) – Massive subsea telecom cables expanding connectivity between Europe, Africa, the Middle East, and Asia.

- Brazil Transmission Auctions – Multi-billion-real concessions adding thousands of kilometers of new lines and substations in 2024 alone.

- Global & Regional Analysis — Government Initiatives and Policies Shaping the Market

North America

The U.S. is deploying federal programs like DOE’s GRIP (Grid Resilience and Innovation Partnerships) and Transmission Facilitation Program. Offshore wind and interconnectors in the Northeast and Mid-Atlantic drive HVDC export cable demand. Canada’s interprovincial interties and AI-era data centers add localized demand.

Europe

The EU’s “Action Plan for Grids” and Offshore Projects of Common Interest (PCIs) focus on doubling cross-border capacity by 2030. Financing from the EIB, permitting reforms, and pre-ordering schemes like the UK Ofgem’s £4 billion approval secure supply chains. The North Sea offshore wind hubs and interconnectors provide multi-year cable backlogs.

Asia-Pacific

China continues investing in UHV AC/DC transmission and urban undergrounding, alongside massive fiber rollouts. Japan is reinforcing grids for offshore wind integration. India’s Green Energy Corridor and RDSS support HV/MV/LV cable demand. Southeast Asia builds ASEAN Power Grid links and new data centers in Singapore, Malaysia, and Indonesia.

Middle East

Saudi Arabia’s Vision 2030 drives grid expansion, while the GCC interconnector is undergoing upgrades. HVDC converter expansions and plans for regional super-grid links add future cable demand.

Latin America

Brazil leads with multi-year ANEEL transmission auctions, bringing billions in new investment and thousands of kilometers of transmission lines. Renewables and data centers in Chile, Colombia, and Mexico also boost cable requirements.

Africa

Subsea projects like 2Africa are transforming connectivity across the continent, while terrestrial electrification programs drive MV distribution and rural lines. Governments and multilateral agencies are supporting cable upgrades with modern standards.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Construction Technology Market Growth, Trends, Key Players and Global Analysis by 2034