Water-based Battery Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

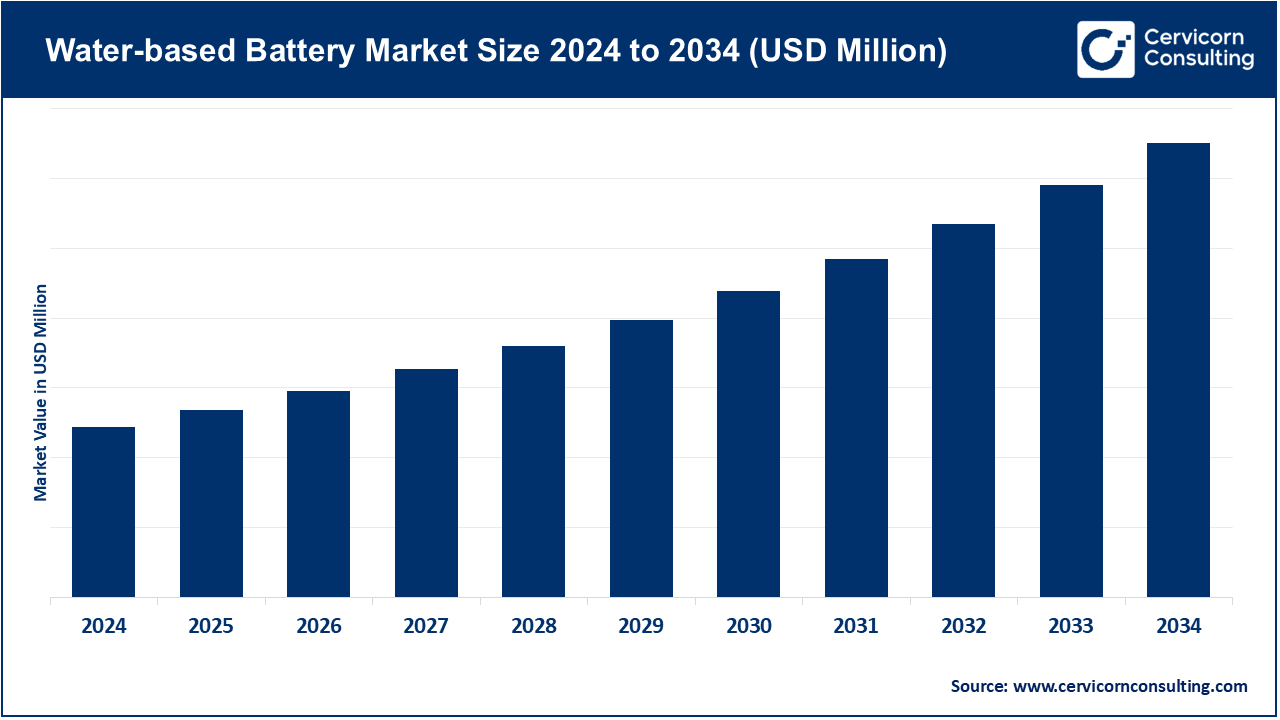

Water-based Battery Market Size

What is the Water-Based Battery Market?

“Water-based” or aqueous batteries refer to electrochemical energy storage systems that use water-based electrolytes — for example aqueous zinc, iron, or bromine systems — instead of organic, flammable solvent electrolytes found in many lithium-ion designs. They include several sub-types such as aqueous zinc-ion batteries, zinc-bromine flow batteries, iron-based flow batteries, and other aqueous flow or rechargeable chemistries.

These systems are particularly attractive for long-duration storage, grid-level stationary applications, and any deployment where safety, low cost, sustainability, and large-format scalability are priorities. The market spans component makers (electrolytes, membranes), system integrators, and project developers deploying containerized systems for utilities, commercial & industrial (C&I) customers, microgrids, and backup power. The global market for water-based batteries is at an inflection point as policy and industrial priorities shift toward non-flammable, abundant-materials energy storage.

Why Water-Based Batteries Are Important

Aqueous chemistries address several pain points of today’s grid and storage ecosystem. They are intrinsically safer since the electrolyte is non-flammable, rely on abundant and lower-cost materials like zinc, iron, salt, and water instead of cobalt or nickel, and offer long life and deep discharge designs — especially flow batteries with decoupled power and energy components.

These systems are well suited to long-duration energy storage (LDES), which is a crucial need as grids integrate larger shares of renewable energy. For utilities and policy makers focused on resilience, domestic manufacturing, and reducing environmental risks, water-based technologies present a compelling alternative or complement to lithium-ion systems, especially for multi-hour to multi-day storage and for deployments where fire risk is unacceptable. Several firms are commercializing modular systems intended for gigawatt-scale rollouts, making aqueous batteries a rising pillar in the global transition to sustainable energy infrastructure.

Water-Based Battery Market — Growth Factors

The water-based battery market is being driven by the demand for safer, lower-cost long-duration storage solutions that align with renewable energy integration, along with increasing policy support for sustainable and domestically sourced technologies. Advances in electrolyte formulations, electrode materials, and flow-battery architectures have significantly improved cycle life, efficiency, and scalability. Expanding grid-scale and commercial project pipelines, growing private and public R&D investment, and government incentives for non-lithium battery manufacturing are accelerating adoption. With global emphasis on grid resilience, reduced fire risk, and decoupled power-energy configurations, the market is projected to grow at double-digit CAGRs, evolving from hundreds of millions in 2024 toward multi-billion-dollar valuations by the early 2030s.

Water-Based Battery Market — Top Companies

Below are concise profiles of key players shaping the global water-based battery market.

ESS Tech, Inc.

Company: ESS Tech, Inc. (formerly ESS Inc.) develops long-duration iron flow battery systems.

Specialization: Iron-based flow batteries using water and salt electrolytes for grid and industrial energy storage.

Key Focus Areas: Utility-scale storage, renewable integration, and microgrid applications.

Notable Features: Uses abundant, non-toxic iron materials and non-flammable aqueous electrolytes, ensuring high safety and long service life. Its modular products include the Energy Warehouse and Energy Center systems.

2024 Revenue: Approximately USD 6.3 million.

Market Share & Global Presence: A recognized leader in iron flow batteries, with operations and partnerships across North America, Europe, and Asia-Pacific.

Zinc8 Energy Solutions (Now Abound Energy Inc.)

Company: Zinc8 Energy Solutions, recently rebranded as Abound Energy Inc., focuses on zinc-based energy storage technologies.

Specialization: Zinc-air and aqueous zinc flow systems for stationary, long-duration applications.

Key Focus Areas: Grid-scale projects, modular system design, and cost reduction.

Notable Features: Low-cost zinc materials and scalable system architecture that can support extended discharge durations.

2024 Revenue: Development-stage company; revenue primarily derived from pilot projects and technology development.

Market Share & Global Presence: Focused in North America, with pilot partnerships in Canada and the United States; smaller but innovative player in the zinc-based segment.

Redflow Limited

Company: Redflow Limited (ASX: RFX) is an Australian manufacturer of zinc-bromine flow batteries.

Specialization: Modular flow battery systems designed for telecoms, defense, and renewable microgrid applications.

Key Focus Areas: High depth-of-discharge performance, product durability, and off-grid energy storage.

Notable Features: 100% depth of discharge and high cycle endurance, with a focus on safety and recyclability.

2024 Revenue: Reported purchase orders and commitments totaling approximately USD 23 million; however, the company faced financial restructuring challenges during 2024.

Market Share & Global Presence: Strong footprint in Australia and the United States with notable installations in telecom and renewable sectors.

Primus Power

Company: Primus Power designs and develops zinc-based flow batteries for long-duration energy storage.

Specialization: Flow batteries that decouple energy capacity from power rating, enabling multi-hour discharge.

Key Focus Areas: Grid-scale projects, renewable energy support, and reducing levelized cost of storage.

Notable Features: Robust flow design, scalable containerized systems, and long operational lifespans.

2024 Revenue: Private company; financial data not publicly disclosed, though active in project partnerships and pilot deployments.

Market Share & Global Presence: Based in North America, with technology demonstrations and project collaborations globally.

Enerpoly AB

Company: Enerpoly AB is a Swedish innovator focused on aqueous zinc-based rechargeable battery technology.

Specialization: Water-based batteries emphasizing material circularity, cost efficiency, and safety.

Key Focus Areas: European manufacturing, sustainability, and scalable small-to-medium energy storage applications.

Notable Features: Non-toxic materials, recyclable components, and localized supply chains.

2024 Revenue: Private company; figures not publicly disclosed, with focus on R&D and pilot installations.

Market Share & Global Presence: Expanding presence in Europe through partnerships and technology demonstrations.

Leading Trends and Their Impact

1. Long-Duration Storage Demand

Utilities are seeking multi-hour to multi-day energy storage solutions to support renewable integration. Water-based flow batteries offer scalable long-duration capabilities, driving increased procurement interest. This trend is expected to strengthen as nations mandate higher renewable capacity targets.

2. Safety and Fire-Resilient Energy Systems

The non-flammable nature of aqueous electrolytes positions these batteries as safe alternatives to lithium-ion systems, especially for installations near populated or sensitive areas. This improves permitting timelines and reduces insurance and mitigation costs.

3. Sustainable and Domestic Supply Chains

Water-based batteries rely on abundant materials like zinc and iron, aligning with government policies promoting domestic manufacturing and reduced dependence on critical minerals such as cobalt and nickel. This makes them strategically valuable for national energy security.

4. Scaling and Cost Optimization

As manufacturing capacity expands, costs are expected to decline significantly. Economies of scale, improved electrode designs, and mass production of flow systems are projected to reduce the cost per kWh, helping these technologies compete with lithium-based systems.

5. New Business Models and Hybrid Systems

Energy service companies are adopting as-a-service models and hybrid systems that integrate flow batteries with solar and wind. These business models create multiple revenue streams from grid balancing, frequency response, and backup services.

6. Technological Innovation

Breakthroughs in electrode coatings, membranes, and electrolyte chemistry are improving round-trip efficiency and energy density. This enhances system performance and expands use cases from grid-scale to commercial and residential energy storage.

Successful Examples Around the World

- ESS Tech (USA): The company has successfully deployed multiple iron-flow systems across commercial and industrial sites, proving the viability of long-duration, non-flammable storage in real-world conditions. Its modular systems demonstrate scalability from small sites to multi-megawatt installations.

- Redflow (Australia & US): Redflow’s zinc-bromine flow batteries have been deployed in renewable microgrids, telecom towers, and defense applications, achieving deep discharge and consistent performance across diverse environments. Despite financial challenges, its systems validate the commercial feasibility of aqueous flow batteries.

- Zinc-based Flow Pilots (Europe & North America): Numerous demonstration projects have validated aqueous zinc chemistries for grid stabilization and renewable integration, with pilot systems showing competitive cost and reliability compared to lithium-based alternatives.

Global Regional Analysis — Government Initiatives and Policies

North America

The United States and Canada are major hubs for water-based battery innovation. The U.S. Inflation Reduction Act (IRA) has accelerated funding for long-duration energy storage and domestic manufacturing, including non-lithium chemistries. Federal and state programs prioritize resilient and safe storage systems, giving aqueous technologies a clear policy tailwind. In addition, updated fire safety codes and permitting regulations favor aqueous electrolytes in urban or indoor deployments.

Europe

European Union policies emphasize circular economy principles, sustainability, and strategic autonomy in energy storage materials. Water-based batteries align perfectly with these objectives. Initiatives such as the European Battery Alliance and local green industry programs encourage flow battery pilot projects and localized production. Several European utilities have begun long-duration storage tenders that explicitly include aqueous systems, helping diversify Europe’s storage portfolio.

Asia-Pacific

Australia remains a prominent region for flow battery innovation, having hosted Redflow and other local pilot projects. Its energy transition roadmap encourages diversification beyond lithium-ion. In China, academic and industrial research on aqueous zinc-ion and iron-based systems is expanding rapidly, supported by state-led grid modernization efforts. India’s renewable integration programs are also exploring low-cost, safe, and long-duration storage solutions, with government tenders emphasizing domestic technology development.

Latin America and Africa

In regions with weaker grid infrastructure, water-based batteries are seen as durable, low-maintenance options for microgrids and rural electrification. Governments and development agencies are funding pilot programs to deploy safe, recyclable, and cost-effective energy storage technologies in off-grid communities.

Government Policies Shaping Market Adoption

Governments across the world are introducing policies that explicitly promote the adoption of sustainable, safe, and domestically sourced energy storage solutions.

- Research and Development Grants: Innovation agencies are providing funding for aqueous electrolyte development, materials recycling, and flow battery system design.

- Procurement Standards: Energy tenders increasingly require fire-safe, non-toxic, and recyclable energy storage solutions, favoring water-based chemistries.

- Manufacturing Incentives: Tax credits, subsidies, and low-interest financing are being offered to build local water-based battery factories, reducing reliance on imported lithium systems.

- Public-Private Partnerships: Collaborative demonstration projects between governments, utilities, and startups are accelerating commercialization by sharing performance data and reducing deployment risk.

Risks and Adoption Barriers

Despite their potential, water-based batteries face several challenges:

- Capital-Intensive Scale-Up: Manufacturing large-scale flow systems requires significant capital investment. Companies must secure consistent financing to transition from prototypes to mass production.

- Energy Density Limitations: Although improvements are ongoing, aqueous batteries still have lower energy density compared to lithium-ion, making them less ideal for portable or space-constrained applications.

- Market Awareness: Utilities and EPCs are accustomed to lithium-ion technologies. Building confidence in new aqueous solutions requires proven performance data and standardized certifications.

- Cost Competitiveness: Until manufacturing reaches scale, initial installation costs may remain higher, though lifetime cost advantages can offset these expenses over time.

Market Outlook and Data Snapshot

Industry reports estimate that the global water-based battery market was valued in the low hundreds of millions in 2024. Depending on the sub-segment (zinc-ion, iron flow, or zinc-bromine flow), compound annual growth rates are projected to exceed 20% between 2025 and 2034.

ESS Tech reported approximately USD 6.3 million in 2024 revenue, while Redflow secured purchase orders worth around USD 23 million in the same period. Development-stage firms such as Abound Energy (formerly Zinc8), Primus Power, and Enerpoly continue to focus on demonstration and commercialization rather than mass-market sales.

With the growing emphasis on safety, sustainability, and local supply chains, aqueous battery technologies are expected to occupy an increasingly important role in long-duration storage strategies across the globe. Policy support, technological maturation, and investor confidence will be key determinants of the market’s trajectory over the next decade.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Generative AI in Insurance Market Revenue, Global Presence, and Strategic Insights by 2034