U.S. Renewable Diesel Market Revenue, Global Presence, and Strategic Insights by 2034

U.S. Renewable Diesel Market Size

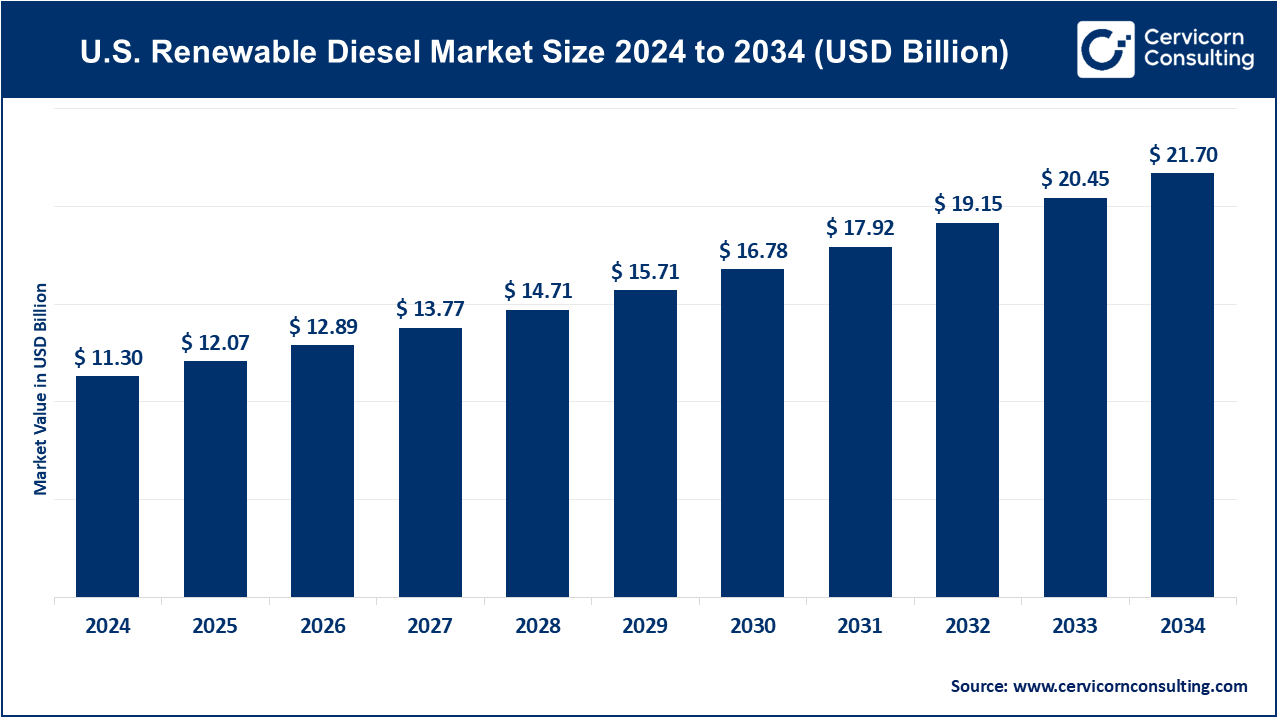

The U.S. renewable diesel market size was worth USD 11.30 billion in 2024 and is anticipated to expand to around USD 21.70 billion by 2034, registering a compound annual growth rate (CAGR) of 6.74% from 2025 to 2034.

What Is the U.S. Renewable Diesel Market?

The U.S. renewable diesel market represents the entire ecosystem involved in the production, distribution, and use of renewable diesel—an advanced, drop-in replacement for conventional petroleum diesel. Renewable diesel is produced through hydrotreating or hydro-processing of renewable feedstocks such as:

- Used cooking oil

- Inedible corn oil

- Animal fats and tallow

- Waste vegetable oils

- Residual fats, greases, and other lipid-rich waste streams

Unlike biodiesel (FAME), renewable diesel has the same molecular structure as petroleum diesel. This means:

- It is fully compatible with existing engines

- It requires no infrastructure upgrades

- It can be blended or used as 100% RD

- It burns cleaner and has lower lifecycle greenhouse-gas emissions

The market includes feedstock supply chains, renewable diesel refineries, distribution networks, policy incentives, and end-user segments such as trucking, municipal fleets, industrial machinery, marine transport, and aviation (as co-processed SAF).

Get a Free Sample: https://www.cervicornconsulting.com/sample/2405

Why It Is Important

The importance of renewable diesel in the U.S. energy transition can be summarized across four dimensions:

1. Rapid Decarbonization Without Fleet Replacement

Renewable diesel delivers major lifecycle GHG reductions—often 50–80% depending on feedstock—while enabling fleets to cut emissions immediately, without replacing engines or upgrading fuel infrastructure.

2. Policy Alignment With National Carbon Goals

Federal and state-level fuel policies heavily promote renewable diesel due to its measurable carbon-intensity (CI) benefits. This aligns RD with:

- Renewable Fuel Standard (RFS)

- Low Carbon Fuel Standard (LCFS) markets

- Clean Fuel Production Credits

- State procurement and emissions mandates

3. Energy Security & Domestic Value Creation

RD production supports domestic manufacturing, feedstock collection industries, agricultural supply chains, and new refinery investments. Several large U.S. petroleum refineries have been converted into renewable diesel plants, preserving jobs and infrastructure.

4. Aviation & Shipping Transition Pathway

Renewable diesel plants increasingly co-produce renewable naphtha or SAF (Sustainable Aviation Fuel). RD infrastructure thus supports the decarbonization of hard-to-abate sectors.

U.S. Renewable Diesel Market — Growth Factors

The growth of the U.S. renewable diesel market is driven by aggressive decarbonization targets, expanding federal incentives, low-carbon fuel programs, and massive investments in refinery conversions that have rapidly boosted domestic production capacity. Corporate sustainability commitments, booming demand from logistics and municipal fleets, widening feedstock collection networks, and the integration of renewable diesel into multi-product biofuel refineries further amplify market expansion. Meanwhile, advancements in hydrotreating technology, the rise of SAF co-production, tightening sustainability standards, and competitive pressure among major energy producers accelerate innovation, feedstock diversification, and large-scale deployment across the country.

Top Companies in the U.S. Renewable Diesel Market

(Company, Specialization, Key Focus Areas, Notable Features, 2024 Revenue, Market Share)

1. Neste

Specialization

Global leader in renewable fuels, producing renewable diesel, SAF, and other hydrotreated bio-based products.

Key Focus Areas

- Large-scale global HVO/HEFA production

- Circular economy feedstocks (waste oils, residues)

- Expansion of U.S. supply channels

- SAF scale-up for aviation customers

Notable Features

- One of the world’s largest producers of renewable diesel and SAF

- Advanced supply-chain traceability programs

- Diverse global production footprint

2024 Revenue

Approximately EUR 20.6 billion (company-wide).

Market Share / Presence

Neste is a major contributor to U.S. RD imports and maintains a strong presence in North American low-carbon fuel markets. Its global footprint spans Europe, Asia, and North America.

2. Renewable Energy Group (REG)

Specialization

U.S.-based renewable diesel and biodiesel producer with strong feedstock procurement chains.

Key Focus Areas

- Waste and residue oil procurement

- RD and biodiesel refining

- Renewable chemicals

- Corporate sustainability partnerships

Notable Features

- Strong domestic supply network

- Vertically integrated feedstock collection

- Experienced in multi-plant operations

2024 Revenue

Industry estimates place REG’s 2024 revenue in the multi-billion-dollar range.

Market Share / Presence

REG remains a key U.S.-focused producer with established logistics and offtake agreements nationwide.

3. Valero Energy Corporation

Specialization

One of the largest U.S. refiners with major investments in renewable diesel through joint ventures and refinery conversions.

Key Focus Areas

- Renewable diesel production via joint ventures

- Integrated refining and distribution

- Expansion into SAF pathways

- Optimizing low-carbon fuel blending

Notable Features

- Major refining expertise and scale advantages

- Co-owner of the Diamond Green Diesel JV

2024 Revenue

Approx. USD 124 billion (total company revenue).

Market Share / Presence

Valero’s renewable diesel segment plays a substantial role in U.S. supply, with strong participation in RD distribution networks nationwide.

4. Darling Ingredients

Specialization

Global leader in rendering and collection of animal byproducts, used cooking oil, and other waste materials—key feedstocks for RD.

Key Focus Areas

- Feedstock collection and rendering

- Supply-chain integration

- Renewable diesel feedstock optimization

- SAF feedstock development

Notable Features

- Vertically integrated feedstock source for RD

- Co-owner of Diamond Green Diesel

2024 Revenue

Approx. USD 5.7 billion (consolidated).

Market Share / Presence

Darling plays an essential role in feedstock sourcing and downstream renewable diesel production through DGD.

5. Diamond Green Diesel (DGD)

Specialization

Joint venture dedicated to renewable diesel production at massive scale.

Key Focus Areas

- HVO/RD large-scale production

- Expansion of U.S. RD capacity

- Renewable naphtha and SAF-compatible outputs

Notable Features

- One of the largest RD producers in North America

- Utilizes extensive feedstock network from Darling

- Refinery operations integrated with Valero’s logistics

2024 Performance

Sold approximately 1.25 billion gallons of renewable diesel, representing a large share of U.S. RD output.

Market Share

DGD accounts for roughly one-quarter of total U.S. renewable diesel production capacity.

Leading Trends and Their Impact on the U.S. Renewable Diesel Market

1. Refinery Conversions and Mega-Scale Plants

A major trend is the conversion of traditional petroleum refineries into renewable diesel facilities. This delivers huge capacity gains and leverages existing infrastructure, creating cost advantages and accelerating deployment. The trend is reshaping regional fuel supply patterns, especially in the Gulf Coast and West Coast.

2. Policy-Driven Expansion (IRA & State LCFS Programs)

Federal tax credits, carbon-intensity scoring, and state-level low-carbon fuel markets make renewable diesel one of the most financially attractive clean fuels in the country. The transition toward lifecycle-based credits rewards producers that improve their supply chains and adopt cleaner feedstocks.

3. Feedstock Shortages and Diversification

As renewable diesel output grows, demand for fats, oils, and greases is outpacing supply. This is pushing companies to:

- Diversify feedstocks

- Expand waste-oil collection networks

- Develop novel feedstocks (algae oils, municipal waste lipids)

- Increase traceability to avoid sustainability controversies

4. Rising Interest in SAF Co-Production

Renewable diesel plants increasingly produce SAF or can be upgraded to produce aviation-grade fuel. As airlines face mandatory hard-target decarbonization, RD refineries gain new revenue pathways.

5. Supply Chain Transparency and ESG Pressures

Major corporate buyers require certified, transparent, and sustainable feedstock sourcing. Producers must comply with strict ESG and lifecycle emissions standards to maintain market access and credit eligibility.

Successful Examples of Renewable Diesel Projects Around the World

1. Diamond Green Diesel (United States)

The DGD joint venture is a leading example of successful scale-up, illustrating how vertical integration—feedstocks supplied by Darling and refining by Valero—produces cost-efficient, large-volume renewable diesel for U.S. markets.

2. Neste’s Global Renewable Diesel Platform (Europe & Asia)

Neste has built a globally integrated renewable diesel ecosystem, combining:

- Multi-continent production

- Robust logistics

- Advanced feedstock supply chains

Its expansion into the U.S. RD market shows how international producers can enhance local fuel decarbonization efforts.

3. California’s Renewable Diesel Adoption Model

California’s LCFS program has become a global case study. Renewable diesel has replaced petroleum diesel in many municipal and commercial fleet operations, demonstrating:

- High user acceptance

- Immediate emissions reductions

- Stable credit-driven demand

4. European HVO Rollouts

European refiners have extensively adopted HVO (hydrotreated vegetable oil), proving the scalability of renewable diesel and showing how policy consistency leads to long-term fuel market transformation.

Government Initiatives and Policies Shaping the U.S. Renewable Diesel Market

1. Inflation Reduction Act (IRA)

The IRA fundamentally reshaped renewable fuel economics by introducing:

- Clean Fuel Production Credit (45Z)

- Expanded tax incentives for low-carbon fuels

- Credits tied to lifecycle carbon intensity

- Prevailing wage and apprenticeship rules for bonus credits

This shifts the industry toward cleaner feedstocks and transparent supply chains.

2. Biodiesel and Renewable Diesel Blenders Tax Credits

Prior incentives provided tax relief for blending RD and biodiesel into the U.S. fuel supply. Although policy frameworks have evolved, these credits contributed to early market expansion and remain part of the broader incentive ecosystem.

3. Low Carbon Fuel Standards (LCFS)

State-level LCFS programs—especially California’s—create strong demand for low-carbon renewable diesel by rewarding fuels with lower carbon intensity. This significantly improves the economics of RD compared with fossil diesel in these regions.

4. Renewable Fuel Standard (RFS)

The federal RFS program requires obligated parties (refiners, importers) to blend renewable fuels into the national fuel pool. Renewable diesel generates RINs (Renewable Identification Numbers), which contribute to compliance and add commercial value for producers.

5. Sustainability and Traceability Regulations

Heightened focus on environmental integrity has increased scrutiny of feedstock sourcing. Producers must document:

- GHG calculations

- Deforestation-free supply chains

- Waste vs. virgin feedstock ratios

- Certification standards (ISCC, RSB, etc.)

Compliance ensures continued access to lucrative markets like California and emerging fuel procurement mandates.

6. Impact of These Policies on Market Structure

- Domestic production is increasingly favored over imports.

- Mega-scale U.S. plants are expanding rapidly.

- Producers are investing in more sustainable feedstock networks.

- Credit stability encourages long-term private capital investment.

- Lifecycle emissions accounting is becoming the new competitive frontier.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Injection Molding Market Growth Drivers, Trends, Key Players and Regional Insights by 2034