Sodium Carbonate Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Sodium Carbonate Market Size

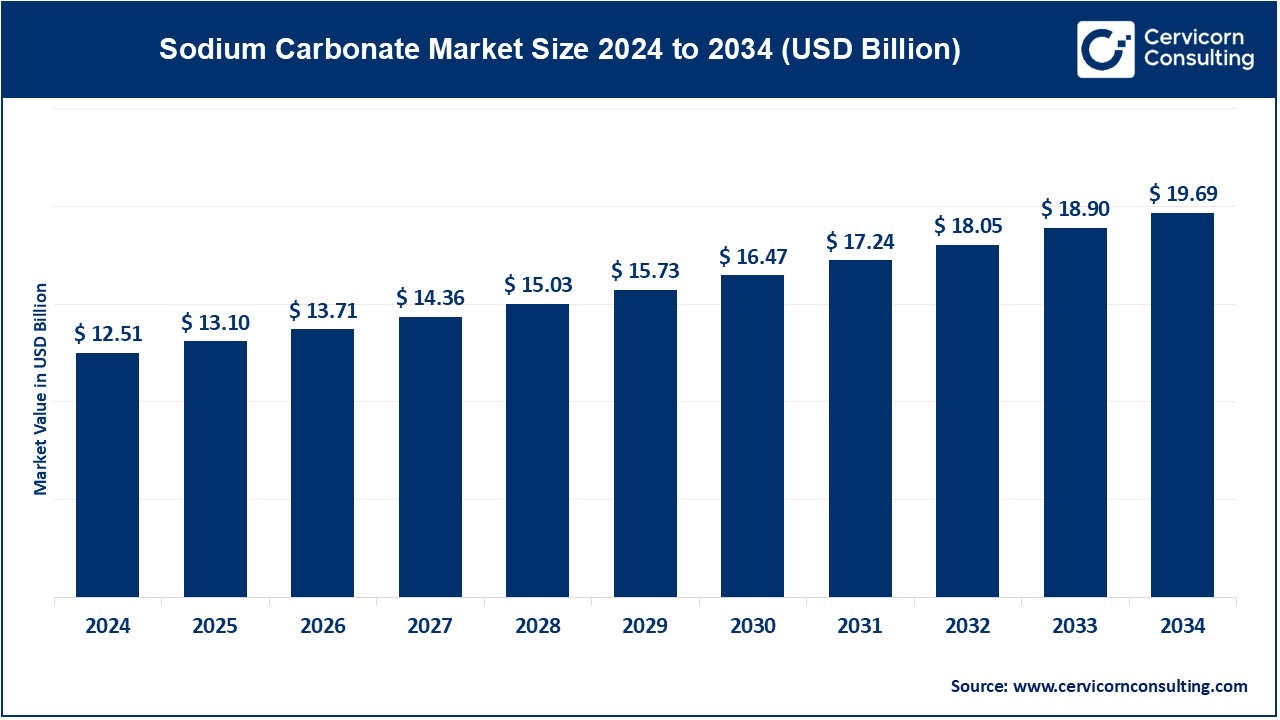

The global sodium carbonate market size was worth USD 12.51 billion in 2024 and is anticipated to expand to around USD 19.69 billion by 2034, registering a compound annual growth rate (CAGR) of 4.64% from 2025 to 2034.

What Is the Sodium Carbonate Market?

The sodium carbonate market covers the production, processing, distribution, and utilization of sodium carbonate (Na₂CO₃) — commonly known as soda ash. It includes two major categories:

- Natural soda ash, extracted from trona ore, mainly in the U.S. and Turkey.

- Synthetic soda ash, produced primarily using the Solvay process.

Sodium carbonate is indispensable in glass manufacturing, detergents, chemicals, water treatment, pulp & paper, textiles, and pharmaceutical & food-grade bicarbonate production. The market includes mining companies, chemical producers, downstream processors, and global trading networks that supply industries across North America, Europe, China, India, Africa, and the Middle East.

The sodium carbonate market is shaped by raw material availability, technological processes, environmental regulations, energy prices, shipping logistics, and global demand patterns. With both mature and emerging end-use industries, the market continues its long-term expansion and strategic shifts.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2402

Why Is Sodium Carbonate Important?

Sodium carbonate is a core industrial chemical used across essential sectors:

- Glass Production (the largest application) — Soda ash reduces silica’s melting temperature, making glass production more energy-efficient. It is used in flat glass (construction, automotive), container glass (bottles, packaging), solar PV glass, and specialty glass.

- Detergents & Cleaning Chemicals — A primary ingredient for alkalinity control and stain removal.

- Chemical Manufacturing — Used to produce sodium silicates, sodium phosphates, and various industrial chemicals.

- Environmental Applications — Used in flue-gas desulfurization, water softening, and wastewater treatment.

- Food & Pharmaceuticals — As sodium bicarbonate for baking, pharmaceuticals, effervescents, and healthcare applications.

Its widespread applications mean that soda ash availability impacts multiple industries, including construction, consumer products, renewable energy, and manufacturing. As solar and EV industries grow, soda ash becomes even more crucial for specialized glass and energy-related components.

Sodium Carbonate Market Growth Factors

The global sodium carbonate market is experiencing steady growth driven by increasing demand from the glass industry, especially for solar PV glass, automotive glass, and construction applications, rising consumption in detergents, growing requirements in chemical manufacturing, and expanding applications in environmental treatment.

Further growth is supported by the shift toward natural soda ash which has lower production costs and carbon emissions compared to synthetic soda ash; significant investments in trona mining and process optimization across major producing regions such as the U.S. and Turkey; emerging market expansion in India, Southeast Asia, Africa, and the Middle East; government policies promoting industrialization and renewable energy; and ongoing technological improvements that enhance production efficiency and reduce emissions — collectively strengthening market competitiveness and supporting long-term global demand.

Top Companies in the Sodium Carbonate Market

Including: Solvay SA, Tata Chemicals Limited, Ciner Group, FMC Corporation, Nirma Limited

Below is an expanded competitive analysis including specialization, key focus areas, notable features, 2024 revenue, market presence, and market share indicators.

1. Solvay SA

Specialization

Solvay is a major global chemicals company with a significant soda ash and sodium bicarbonate segment. It produces dense soda ash, light soda ash, and bicarbonate products for food, pharmaceutical, and industrial applications.

Key Focus Areas

- Innovation in sustainable chemical processes

- Specialty bicarbonates for healthcare, food, and environmental markets

- Product-level sustainability reporting

- Process optimization and global distribution

Notable Features

- One of the oldest and most technologically advanced soda ash producers

- Strong R&D capabilities

- Broad end-use diversification

- Long-standing global partnerships with major glass and chemical manufacturers

2024 Revenue (Company-Level)

- Approx. €4.7 billion in 2024 (overall revenue; soda ash is one part of the business)

Market Share & Global Presence

Solvay holds a significant share of the European and global synthetic soda ash market, with operations in Europe, North America, South America, and Asia.

2. Tata Chemicals Limited

Specialization

One of the world’s major producers of soda ash, serving both domestic Indian demand and global markets. It also produces sodium bicarbonate, caustic soda, specialty chemicals, and consumer products.

Key Focus Areas

- Enhancing soda ash production capacity

- Integration into solar glass and EV-related materials

- R&D for specialty chemistries

- Expanding global supply chains for chemicals

Notable Features

- Strong manufacturing presence in India, with past operations in Europe and North America

- Vertically integrated into consumer products

- Stable demand from domestic glass and detergent industries

2024 Revenue (Company-Level)

- Approximately ₹15,421 crore for FY2023–24

Market Share & Global Presence

Tata Chemicals is one of India’s largest soda ash producers, with a notable presence in Asia-Pacific and exports to global customers through long-term contracts.

3. Ciner Group (Including Ciner Resources / Related WE Soda Capacity)

Specialization

A leading global producer of natural soda ash, extracted from rich trona deposits in Turkey and the United States.

Key Focus Areas

- Large-scale trona mining

- Low-cost natural soda ash production

- Global export expansion

- Investment in new natural-soda capacity

Notable Features

- Among the lowest-cost producers globally

- Expansive export footprint

- Beneficiary of the global shift to low-carbon, natural soda ash

- Known for large-scale, high-efficiency mining and processing techniques

2024 Revenue & Market Share

Although exact 2024 revenues vary by entity, the group — including the components associated with WE Soda — is one of the largest natural soda producers globally, holding a significant share of the global market (especially in natural soda ash).

Global Presence

Exports to Europe, North America, Middle East, Africa, and Asia, and operates large assets in Turkey and the U.S.

4. FMC Corporation

Specialization

A global agro-sciences and chemicals company. Its inclusion reflects legacy connections to soda ash and participation in industrial chemicals.

Key Focus Areas

- Crop protection technologies

- Specialty chemical innovations

- Strengthening global agricultural value chains

Notable Features

- Diversified industrial and agricultural product line

- Strong presence in R&D-intensive chemical sectors

2024 Revenue

- Approximately $4.25 billion in FY2024

Market Presence

While FMC is not a major soda ash manufacturer today, its historical chemical footprint and industrial scale make it a recognized name in multiple global chemical markets.

5. Nirma Limited

Specialization

An Indian conglomerate specializing in detergents, soda ash, chemicals, and consumer products.

Key Focus Areas

- Strengthening domestic soda ash production

- Cost-efficient manufacturing

- Expansion into chemicals and building materials

- Integration with consumer product lines

Notable Features

- Deep integration in the Indian detergent market

- One of the lowest-cost producers in India

- Strong regional footprint in Western India

2024 Revenue

- Approximately ₹10,403 crore in FY2024

Market Share & Global Presence

Nirma holds a large share of India’s soda ash market with expanding exports into Asia and Africa.

Leading Trends in the Sodium Carbonate Market & Their Impact

1. Strong Growth in the Global Glass Industry

Demand for flat and container glass continues to grow, especially in:

- Construction

- Automotive

- Packaging

- Solar PV

Impact: Significant increase in dense soda ash consumption, driving long-term market growth.

2. Expansion of Solar PV Manufacturing

Solar PV requires high-purity glass. As countries expand renewable energy targets, demand for soda ash increases.

Impact: Structural demand growth; stronger pricing power for natural soda producers.

3. Rising Popularity of Natural Soda Ash

Natural soda ash production emits less CO₂ and costs less.

Impact: Shift in competitiveness from synthetic producers to natural producers (e.g., U.S. and Turkey).

4. Consolidation & Capacity Expansion

Recent acquisitions and expansions in trona-mining assets have reshaped global market dominance.

Impact:

- Greater supply stability

- Economies of scale

- Increased global trade flows

5. Sustainability and Decarbonization

Customers such as glass manufacturers increasingly demand low-carbon inputs.

Impact:

- Investments in cleaner technologies

- Increased transparency via sustainability reporting

- Competitive advantage for natural-soda producers

Successful Examples of Sodium Carbonate Market Leadership Around the World

1. Large-Scale Trona Mining Clusters in the U.S. and Turkey

These operations produce millions of tonnes of low-cost, low-carbon natural soda ash.

Why Successful:

- Strong cost competitiveness

- High export volumes

- Reliable long-term supply

2. Tata Chemicals’ Integrated Operations (India)

By linking soda ash to specialty chemicals, consumer products, and sustainable materials, Tata has built a resilient, diversified chemical ecosystem.

Why Successful:

- Vertical integration

- Strong domestic demand

- Ability to supply specialty-grade soda ash and bicarbonate

3. Nirma’s Cost-Leadership Model

Nirma has become a highly competitive soda ash provider through efficient manufacturing and strong domestic distribution.

Why Successful:

- Low operational costs

- Integrated detergent market

- Strong regional presence

4. Solvay’s Specialty Bicarbonate Businesses

Solvay has successfully moved into high-margin segments such as pharmaceutical bicarbonates and environmental-grade bicarbonates.

Why Successful:

- Product innovation

- Strong R&D

- Diversified, high-value markets

Global Regional Analysis & Government Policies Shaping the Market

Below is a region-wise breakdown of market dynamics and the role of policy.

1. China

Market Dynamics

- Largest producer and consumer of soda ash

- Massive glass, construction, and chemical sectors

- Continuous capacity adjustments based on demand cycles

Policies Shaping the Market

- Environmental regulations influencing synthetic soda ash production

- Industrial planning to support infrastructure and manufacturing

- Export policies impacting global pricing

2. North America (U.S.)

Market Dynamics

- World’s largest natural-soda ash producer

- Major exporter to Latin America, Asia, and Europe

- Strong demand from glass and detergents

Policies Shaping the Market

- Permitting and land-use rules for mining

- Support for low-carbon manufacturing

- Trade regulations affecting export competitiveness

3. Europe

Market Dynamics

- Strong consumption in glass, detergents, and chemicals

- Presence of key producers (Solvay, others)

Policies Shaping the Market

- Strict EU emissions rules

- Green transition policies

- Incentives for circular economy and sustainable raw materials

4. India

Market Dynamics

- Fast-growing demand from glass, chemicals, and detergents

- Significant production from Tata Chemicals and Nirma

Policies Shaping the Market

- Make-in-India industrial initiatives

- Support for renewable energy (increasing solar-glass demand)

- Tariff protections for domestic chemical producers

5. Middle East and Turkey

Market Dynamics

- Major natural-soda producing hub (Turkey)

- Increasing global influence through exports

Policies Shaping the Market

- Investment incentives for mining operations

- Export-oriented industrial strategy

- Energy and mineral resource policies supporting production

6. Africa & Latin America

Market Dynamics

- Growing end-use industries (construction, detergents, packaging)

- Reliance on imports from U.S., Turkey, and Asia

Policies Shaping the Market

- Trade agreements that influence soda ash flow

- Industrialization policies to stimulate local glass and chemicals manufacturing

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: ESG Investing Market Growth Drivers, Trends, Key Players and Regional Insights by 2034