Robotic Process Automation in Chemical Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

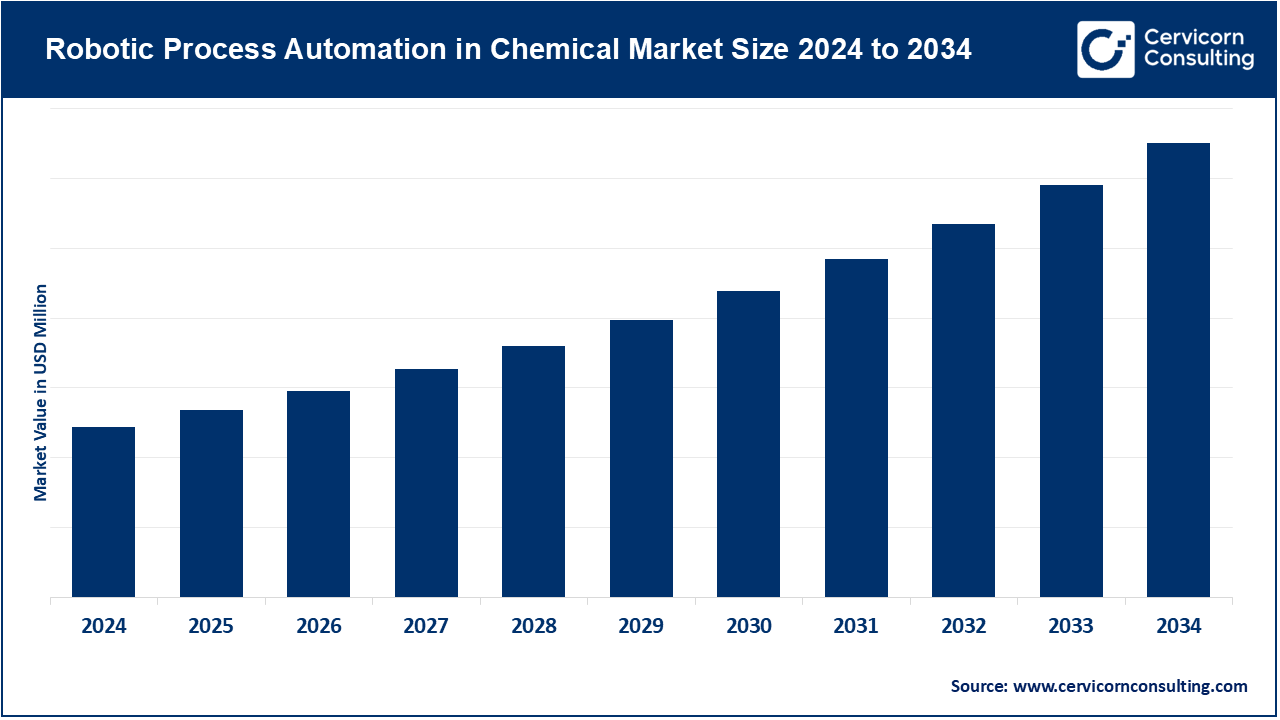

Robotic Process Automation in Chemical Market Size

The global robotic process automation in chemical market is registering a compound annual growth rate (CAGR) of 28.5% from 2025 to 2034.

Growth Factors

The robotic process automation (RPA) market in the chemical industry is expanding rapidly due to rising operational complexity, cost pressures, and the growing need for efficiency and compliance. Key growth factors include increasing adoption of digital transformation initiatives, volatility in feedstock and energy prices, and the push for productivity amid workforce shortages. RPA solutions help chemical companies automate repetitive and rule-based tasks, reducing manual errors, and improving regulatory adherence.

Additionally, the integration of RPA with artificial intelligence (AI), machine learning, and process mining enhances decision-making and enables automation of semi-structured processes such as safety data reporting and order management. The emphasis on environmental compliance, sustainability, and global supply chain resilience has also prompted chemical manufacturers to embrace RPA as a strategic tool to streamline operations and reduce costs across procurement, production planning, quality control, and logistics.

What is Robotic Process Automation in Chemical Market?

Robotic process automation in the chemical market refers to the deployment of software “robots” to automate repetitive digital tasks traditionally performed by humans. These bots mimic user interactions with systems, applications, and databases to complete processes faster and with higher accuracy. In the chemical industry, RPA is widely used in areas like regulatory reporting, order-to-cash processes, safety data management, inventory control, and procurement. RPA integrates seamlessly with enterprise resource planning (ERP) systems, laboratory information management systems (LIMS), and manufacturing execution systems (MES), enabling end-to-end automation of administrative and compliance-heavy workflows. It not only reduces the burden on human employees but also ensures consistent process execution, critical for maintaining safety and regulatory compliance in chemical manufacturing.

Why is RPA Important for Chemical Companies?

RPA plays a vital role in helping chemical companies maintain competitiveness in a highly regulated and cost-sensitive market. It allows organizations to focus on innovation while reducing manual intervention in transactional and compliance-based tasks.

- Regulatory Compliance: RPA ensures accurate and timely documentation for environmental, safety, and quality audits, meeting global standards such as REACH, OSHA, and GHS.

- Operational Efficiency: Automating order entry, invoice processing, and procurement approval workflows accelerates business processes and reduces turnaround times.

- Error Reduction: Consistency and precision of bots minimize human errors, especially in critical areas like safety reports and production records.

- Cost Optimization: Automating repetitive back-office tasks reduces labor costs and improves overall productivity.

- Scalability and Flexibility: RPA can scale across global operations, supporting multiple languages, currencies, and compliance frameworks.

- Data Accuracy and Integration: With RPA, chemical firms can synchronize data across systems, improving analytics, forecasting, and decision-making.

By freeing skilled professionals from repetitive duties, RPA allows them to concentrate on innovation, research, and production optimization—creating measurable value across the enterprise.

Robotic Process Automation in Chemical Market — Top Companies

UiPath

Specialization: UiPath provides one of the most comprehensive enterprise automation platforms, combining RPA, process mining, and AI-driven capabilities.

Key Focus Areas: Enterprise automation, attended and unattended bots, low-code development, and end-to-end orchestration.

Notable Features: Offers prebuilt industry templates, AI-integrated workflows, and strong analytics through the UiPath Automation Cloud.

2024 Revenue: Approximately USD 1.31 billion.

Market Share: UiPath remains a global market leader, with a strong foothold in manufacturing and chemical sectors.

Global Presence: Operates across more than 30 countries with a large partner ecosystem in North America, Europe, and Asia-Pacific.

Automation Anywhere

Specialization: Focused on cloud-native automation with robust AI and machine learning integration for large-scale enterprise environments.

Key Focus Areas: Intelligent automation, attended and unattended bots, process discovery, and analytics.

Notable Features: The Automation Success Platform offers seamless scalability, real-time insights, and cognitive automation capabilities.

2024 Revenue: Estimated between USD 600–800 million (privately held).

Market Share: Recognized as a top-tier global RPA vendor with wide adoption in industrial and process manufacturing.

Global Presence: Strong presence across North America, Europe, India, Japan, and other major markets, supported by extensive partnerships.

Blue Prism (SS&C)

Specialization: Enterprise-grade automation with a focus on governance, security, and scalability.

Key Focus Areas: Intelligent automation, process orchestration, and integration with AI and process mining tools.

Notable Features: High-security architecture, robust management console, and compatibility with hybrid IT environments.

2024 Revenue: Part of SS&C Technologies, which reported USD 5.88 billion in total 2024 revenue.

Market Share: Maintains a strong position among enterprise customers, particularly in highly regulated industries like chemicals and pharmaceuticals.

Global Presence: Operates in over 100 countries with clients across Europe, North America, and the Asia-Pacific region.

Pegasystems

Specialization: Pegasystems combines RPA with digital process automation (DPA) and AI decisioning for holistic process transformation.

Key Focus Areas: Case management, intelligent decisioning, process orchestration, and business rules automation.

Notable Features: Unified platform integrating RPA with customer engagement and analytics capabilities.

2024 Revenue: Around USD 1.50 billion.

Market Share: Recognized as a leader in end-to-end business automation and customer engagement solutions.

Global Presence: Extensive presence in North America and Europe, with growing penetration in Asia-Pacific for industrial automation.

NICE Systems

Specialization: A global leader in customer experience and process automation, NICE integrates RPA with analytics and AI.

Key Focus Areas: Workforce optimization, robotic automation, and digital customer service.

Notable Features: Real-time analytics, cloud-first automation, and integration with enterprise systems for back-office process efficiency.

2024 Revenue: Approximately USD 2.7 billion.

Market Share: Strong foothold in process automation and customer service sectors; expanding influence in manufacturing operations.

Global Presence: Operations in over 150 countries with major clients in North America, Europe, and Asia.

Leading Trends and Their Impact

1. AI and Cognitive Automation Integration:

The combination of AI, machine learning, and RPA is enabling bots to handle unstructured data, make intelligent decisions, and adapt to complex chemical workflows. This reduces the reliance on human supervision and speeds up decision-making in areas like quality control and compliance.

2. Cloud-Based Automation Platforms:

Cloud RPA allows faster deployment and centralized control of automation across geographically dispersed plants. It reduces infrastructure costs and simplifies governance for global chemical manufacturers.

3. Process Mining and Optimization:

Advanced process mining tools identify inefficiencies, enabling companies to target high-impact areas for automation. This data-driven approach ensures better ROI and faster scalability.

4. Integration with IoT and Industry 4.0:

Combining RPA with IoT sensors, MES, and ERP systems allows real-time process monitoring, predictive maintenance, and automatic report generation. This convergence drives operational agility and minimizes downtime.

5. Intelligent Document Processing (IDP):

Chemical companies deal with extensive documentation — from safety data sheets to regulatory forms. IDP combined with RPA automates data extraction, classification, and validation, reducing manual workloads and compliance risks.

6. Focus on Sustainability and Green Operations:

RPA helps automate environmental monitoring and sustainability reporting, ensuring accurate emission tracking and faster reporting aligned with ESG standards.

7. Hyperautomation:

Organizations are moving beyond simple task automation toward hyperautomation — the orchestration of RPA, AI, analytics, and process intelligence to create self-learning and adaptive digital ecosystems.

Successful Examples of Robotic Process Automation in Chemical Market

UBE Group (Thailand):

UBE Group implemented RPA to streamline administrative and operational workflows, resulting in over 60% reduction in manual working hours. The initiative improved accuracy in data entry and accelerated document processing, leading to enhanced productivity and operational consistency.

Global Petrochemical Companies:

Several global chemical and petrochemical giants have adopted RPA to automate invoice processing, order management, and safety audits. These initiatives reduced lead times, improved compliance documentation, and lowered the cost of regulatory reporting.

European Specialty Chemical Manufacturers:

In Europe, RPA solutions are being used to automate safety data sheet (SDS) management and environmental reporting. This ensures timely compliance with REACH and CLP regulations, reducing manual oversight and the risk of penalties.

Indian and Southeast Asian Chemical Firms:

Companies in India and Southeast Asia are increasingly implementing RPA for procurement and logistics management. By automating purchase order creation and vendor reconciliation, these firms have significantly improved supply chain transparency and efficiency.

North American Chemical Distributors:

RPA bots are being used to automate customer onboarding, credit checks, and order-to-cash cycles, leading to faster sales processing and better customer service without expanding workforce size.

Global and Regional Analysis

North America

The North American chemical industry is leading RPA adoption, supported by large-scale digital transformation projects. The U.S. and Canada have seen increased investment in automation due to strict regulatory frameworks like OSHA and EPA, which require precise record-keeping and reporting. Government initiatives such as the U.S. CHIPS and Science Act and manufacturing modernization programs are encouraging automation-driven productivity improvements. Chemical companies leverage RPA to ensure safety compliance, enhance supply chain agility, and reduce administrative costs.

Europe

Europe’s chemical sector is heavily regulated under frameworks such as REACH, CLP, and the European Green Deal. RPA helps automate regulatory data collection, environmental audits, and sustainability reporting. Governments across Germany, the Netherlands, and the UK are promoting Industry 4.0 initiatives, offering grants and tax incentives for companies investing in smart automation. The integration of RPA with sustainability tracking systems is also driving ESG reporting efficiency across the continent.

Asia-Pacific

Asia-Pacific represents one of the fastest-growing RPA markets in the chemical industry. China, India, Japan, and South Korea are investing heavily in digital transformation to improve manufacturing productivity. Government programs like “Make in India” and “Made in China 2025” encourage automation adoption. RPA is particularly effective in managing large volumes of transactions, logistics coordination, and regulatory submissions in export-oriented chemical firms. The presence of regional service providers and global RPA vendors ensures strong implementation support across diverse markets.

Latin America

In Latin America, countries like Brazil and Mexico are gradually embracing RPA in the chemical industry to enhance efficiency and compliance. Local governments are supporting automation projects through digitalization incentives. RPA adoption is mainly focused on finance, procurement, and supply chain functions to overcome operational inefficiencies and language barriers across multi-country operations.

Middle East and Africa

The Middle East and Africa are witnessing a gradual shift toward automation in petrochemical and specialty chemical sectors. Government initiatives aimed at industrial diversification, such as Saudi Arabia’s Vision 2030, are promoting technological modernization. RPA is being used to automate compliance documentation, financial reconciliation, and environmental monitoring. However, adoption levels vary by country depending on infrastructure readiness and digital maturity.

Government Initiatives and Policies Shaping the Market

Global policies supporting digital transformation, industrial automation, and sustainability are accelerating the adoption of RPA in the chemical industry.

- United States: Federal incentives for manufacturing modernization and workforce training programs indirectly promote RPA adoption. Compliance mandates from agencies such as OSHA and EPA further reinforce the need for automated, traceable reporting systems.

- European Union: The EU’s Industry 4.0 and Green Deal strategies encourage digitalization and sustainability, pushing chemical manufacturers toward RPA solutions that improve data accuracy in regulatory submissions.

- Asia-Pacific: Governments in India, China, and Japan are funding automation projects through national manufacturing and smart industry initiatives, facilitating partnerships between local firms and global RPA providers.

- Latin America and the Middle East: Emerging digital governance policies and incentives for industrial innovation are encouraging automation investments. Many local chemical companies are collaborating with technology providers to pilot RPA systems that enhance operational transparency.

Government-backed Industry 4.0 initiatives, combined with private-sector investment, are thus creating a conducive ecosystem for large-scale RPA deployment in the global chemical industry.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Reports:

Energy Transition Market Revenue, Global Presence, and Strategic Insights by 2034

Hyperscale Computing Market Size, Growth Trends & Forecast 2025–2034 | CAGR 23.14%

Applied AI Market Size, Trends & Forecast 2025–2034