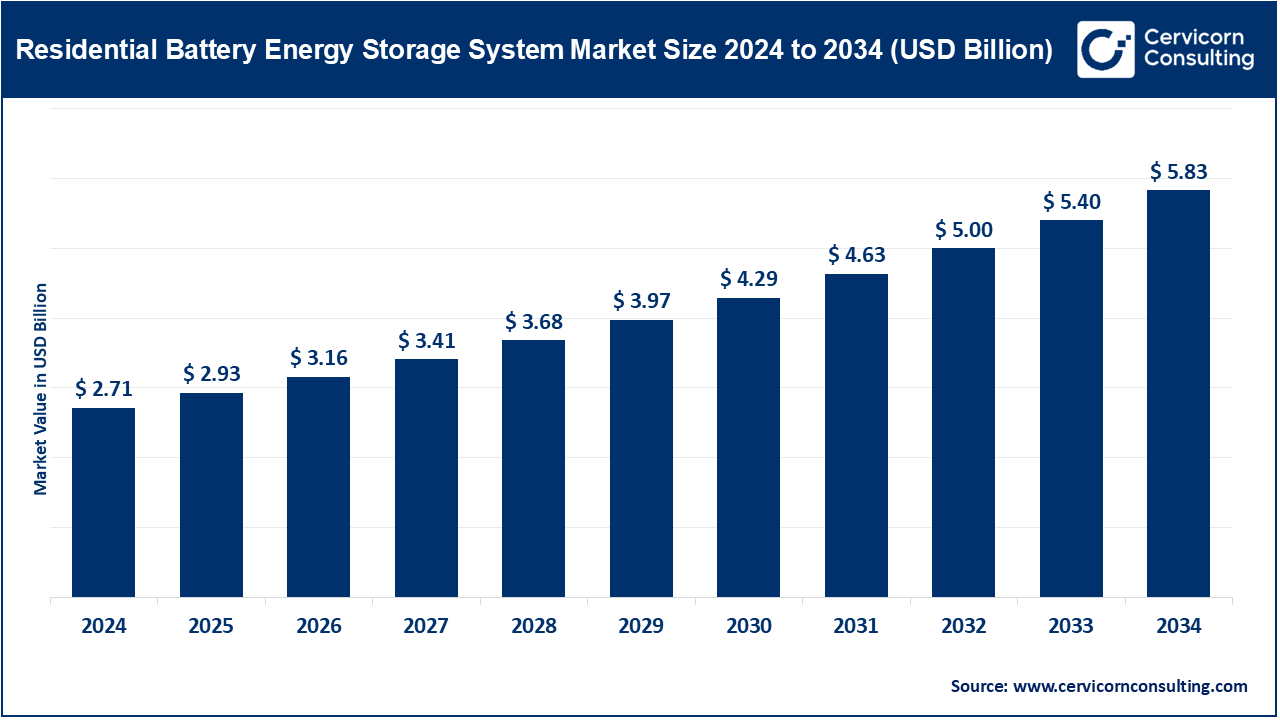

Residential Battery Energy Storage System Market Trends, Growth Drivers and Leading Companies 2024

Residential Battery Energy Storage System Market Size

What is the Residential Battery Energy Storage System Market?

The RBESS market covers the hardware, software, installation, and service ecosystem around home energy storage. Key components include:

- Battery modules and packs: usually lithium-ion but expanding into LFP and sodium-ion.

- Battery Management Systems (BMS) and inverters/charge controllers: AC-coupled or DC-coupled systems that regulate charging and discharging.

- Integrated systems: often bundled with solar inverters, or retrofit systems designed for standalone use.

- Services: installation, warranties, remote monitoring, energy management software, aggregation platforms, and financing solutions.

Demand is measured by installed capacity (kWh), units shipped, and revenues from both hardware sales and recurring services. This market sits at the convergence of residential solar power, distributed energy resources, and smart grid services.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2750

Why is RBESS Important?

Residential battery systems are essential because they deliver benefits on three levels: household, grid, and society.

- For households, they provide resilience against power outages, lower electricity bills by storing cheap or self-generated power, and optimize time-of-use tariffs.

- For grids, aggregated home batteries provide frequency regulation, peak shaving, and defer costly upgrades to distribution networks.

- For society, RBESS helps integrate variable renewable energy, reduces dependence on fossil fuel peaker plants, and lowers carbon emissions.

Beyond economics, they are enabling a transition toward decentralized, consumer-driven energy models and support the global energy transition toward decarbonization.

Residential Battery Energy Storage System Market — Top Companies

Here are the five leading companies shaping the RBESS market: Tesla Energy, Panasonic Holdings Corporation, BYD Company Ltd., Enphase Energy, Inc., and Sonnen GmbH.

Tesla Energy

- Specialization: Integrated home energy systems (Powerwall + Solar + software), grid-scale storage, and energy services.

- Key focus areas: Residential Powerwall deployments, energy management software, and VPP participation.

- Notable features: Sleek, high-density batteries, strong ecosystem integration, and one of the widest installer networks worldwide.

- 2024 Revenue Snapshot: Tesla’s Energy Generation and Storage segment generated more than USD 10 billion, with record deployments in 2024.

- Global Presence: Strong in North America, Europe, Australia, and expanding across Asia.

Panasonic Holdings Corporation

- Specialization: Battery manufacturing for EVs and stationary storage, with OEM partnerships.

- Key focus areas: Lithium-ion cell production, supply to storage integrators, and research in next-generation chemistries.

- Notable features: Strong vertical integration, extensive R&D, and long-term partnerships with automakers and storage developers.

- 2024 Revenue Snapshot: Panasonic’s consolidated revenue remains in the multi-trillion yen range, with batteries a core growth segment.

- Global Presence: Japan, North America, and Asia with global manufacturing facilities.

BYD Company Ltd.

- Specialization: EVs, batteries, and integrated energy storage products.

- Key focus areas: Leveraging massive automotive battery capacity for stationary storage solutions.

- Notable features: Industry-leading manufacturing scale, competitive pricing, and rapid global expansion.

- 2024 Revenue Snapshot: BYD reported consolidated revenue of more than USD 100 billion, with a growing portion tied to energy storage products.

- Global Presence: China, Southeast Asia, Europe, and Latin America.

Enphase Energy, Inc.

- Specialization: Microinverters, modular residential batteries, and cloud-based energy management.

- Key focus areas: Pairing storage with its microinverter ecosystem for seamless integration.

- Notable features: Easy installation, modularity, and strong cloud monitoring platform.

- 2024 Revenue Snapshot: Revenue in the low-to-mid billions, with storage contributing meaningfully despite some annual decline compared to 2023.

- Global Presence: North America, Europe, Australia, and growing in Latin America and Asia-Pacific.

Sonnen GmbH

- Specialization: Home batteries with advanced energy management and VPP aggregation.

- Key focus areas: Smart home storage, community energy platforms, and virtual power plants.

- Notable features: Pioneer in community energy services, strong software layer, and owned by Shell’s New Energies division.

- 2024 Deployment Snapshot: Tens of thousands of systems installed globally, with strong market share in Europe.

- Global Presence: Germany, wider Europe, and growing reach under Shell’s global energy networks.

Leading Trends and Their Impact

- Virtual Power Plants (VPPs): Aggregated residential batteries are being integrated into grid operations, creating new revenue streams and improving grid stability.

- Battery Chemistry Diversification: Beyond lithium-ion, sodium-ion and flow batteries are emerging as cost-effective and safer alternatives.

- New Financing Models: Subscription services and leasing reduce the barrier of high upfront costs, expanding access to mass markets.

- Government Incentives: Tax credits, rebates, and feed-in tariffs improve return on investment and speed adoption.

- Resilience Demand: Natural disasters, heat waves, and wildfires drive demand in areas prone to grid instability.

- Automotive Scale Manufacturing: EV-driven battery scale is lowering costs for home batteries, making them more affordable and widely available.

These trends are shortening payback periods, increasing customer value, and positioning RBESS as a mainstream energy solution.

Successful Examples Around the World

- Australia: High solar adoption and strong state incentives have made Australia one of the top per-capita adopters of home batteries. Programs like South Australia’s Home Battery Scheme and Victoria’s Solar Homes Program have spurred rapid installations.

- Germany: One of the earliest leaders, driven by the KfW subsidy scheme and pioneering companies like Sonnen, which created community-based energy sharing models.

- United States (California, Hawaii): Adoption driven by high retail tariffs, wildfire-related power shutoffs, and state-level rebates. California’s Self-Generation Incentive Program (SGIP) significantly boosted installations.

- China: Backed by massive local manufacturing scale and provincial subsidy programs, residential storage deployments are rising quickly.

- Japan: Focused on resilience after natural disasters, Japan has seen consistent uptake of home batteries to provide emergency backup power.

Global Regional Analysis: Government Initiatives and Policies Shaping the Market

North America

In the U.S., the Inflation Reduction Act extended the 30% tax credit for residential clean energy systems through the early 2030s, making combined solar and storage far more attractive. State-level programs such as California’s SGIP further accelerate adoption. Canada is gradually developing similar initiatives with provincial incentives.

Europe

Germany has long led with subsidies for home batteries, with policies supporting grid integration and VPP participation. The European Union is pushing member states to expand DER participation in energy markets, creating clear frameworks for aggregated storage to earn revenue.

Asia Pacific

China dominates manufacturing and increasingly domestic installations, supported by subsidies and municipal rebates. Australia, with high solar penetration, strong retail rates, and state-level incentives, has one of the highest household battery attachment rates worldwide. Japan continues to emphasize backup power and energy security in policy support.

Latin America and Middle East / Africa

Early adoption is emerging in regions with unreliable grids and high fuel costs for backup generators. Governments in Chile, South Africa, and the Middle East are beginning to explore incentives and pilot programs.

Policy Levers Driving Growth

-

Financial incentives: Rebates and tax credits lower upfront cost.

-

Interconnection rules: Streamlined policies encourage installations.

-

Grid market access: Allowing aggregated residential batteries to participate in capacity and ancillary markets boosts ROI.

-

Financing models: Consumer protections and loan programs make installations more accessible.

Markets that combine high electricity prices, strong solar penetration, resilience needs, and supportive policy frameworks are seeing the fastest adoption.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Applied AI Market Trends, Growth Drivers and Leading Companies 2024