Regulatory Affairs Market Size, Trends, Forecasts and Competitive Landscape 2034

Regulatory Affairs Market Overview

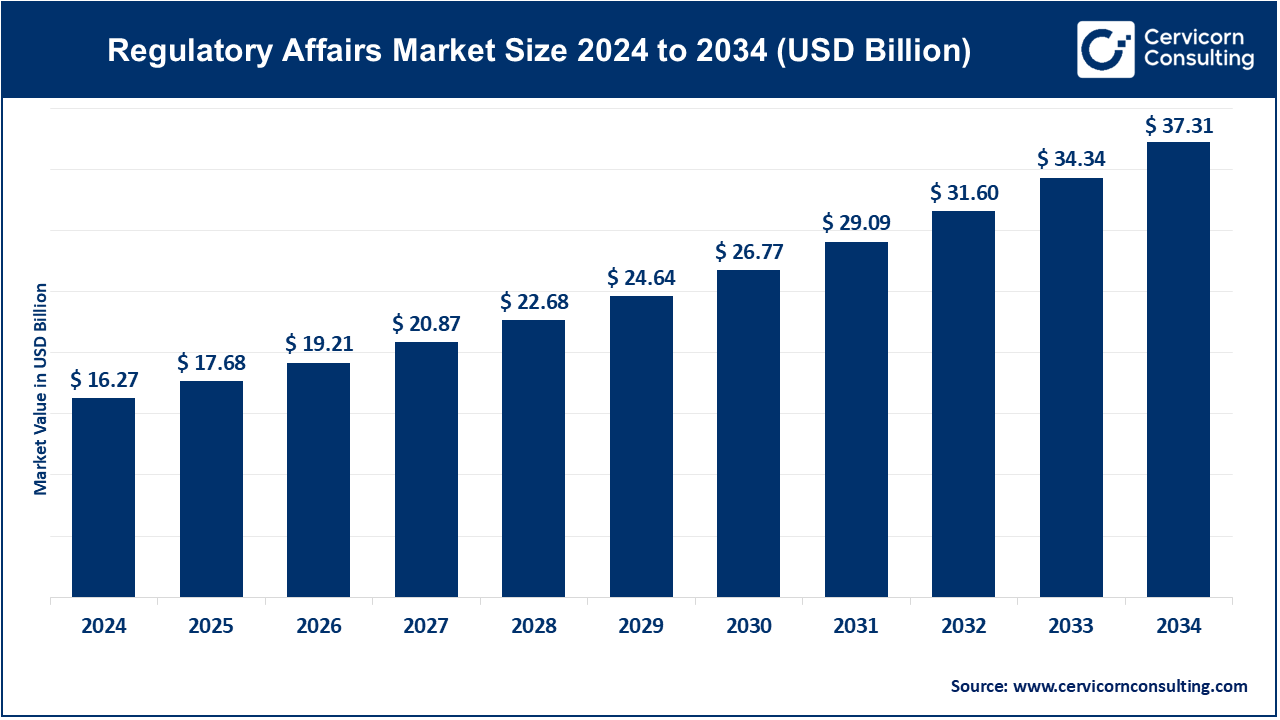

The global regulatory affairs market size was worth USD 16.27 billion in 2024 and is anticipated to expand to around USD 37.31 billion by 2034, registering a compound annual growth rate (CAGR) of 8.65% from 2025 to 2034. The global regulatory affairs market focuses on guiding companies—especially in healthcare, pharma, medical devices, chemicals, cosmetics, and energy—through stringent regulatory environments to ensure product compliance. It encompasses consulting, submissions, labeling, safety monitoring, legal representation, and post‑market surveillance, engaging deeply with bodies like the FDA, EMA, PMDA, and others.

Regulatory Affairs Market Growth Factors

The regulatory affairs market is primarily driven by the surge in R&D for specialty therapies like immunotherapies, orphan drugs, biologics, and personalized medicine, alongside escalating complexity of global regulatory landscapes, rising clinical trial activity, and growing outsourcing trends. Economic pressures encourage firms to focus on core competencies, turning to external experts. Meanwhile, rapid technological changes—such as AI-powered regulatory tech—and government policy shifts, especially in emerging economies, accelerate the demand for compliant and efficient regulatory solutions.

Why It’s Important

Regulatory affairs is essential for:

- Patient Safety – Minimizes risks linked to drug/device use.

- Market Access – Ensures timely approvals across international jurisdictions.

- Legal Compliance – Helps companies avoid costly delays, fines, or market withdrawals.

- Competitive Edge – Accelerates global launches through strategic regulatory planning.

- Post-Market Surveillance – Monitors ongoing safety, manages recalls and updating requirements.

This field saves lives, safeguards investments, and supports innovation in regulated industries.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2648

Top Companies in the Regulatory Affairs Market

Here’s a breakdown of key players shaping the market in 2024:

1. Genpact

A global professional services firm active in regulatory consulting and compliance, Genpact supports clients in pharma, devices, and across industries via compliance, digital and analytics solutions .

2. Accell Clinical Research, LLC

A U.S.-based CRO providing regulatory submissions, clinical development, and pharmacovigilance services, especially strong in oncology and complex indications.

3. Promedica International

Specialized in global regulatory affairs, life science strategy, and product development, offering end-to-end support from clinical trials to market entry .

4. Criterium, Inc.

A U.S. CRO and regulatory consulting firm supporting drug/device registration in North America and beyond .

5. WuXi AppTec, Inc.

A major Chinese CRO/CDMO, provides drug/device testing, toxicology, chemistry, clinical trial support, and full regulatory lifecycle management globally .

Company Profiles: Specialization, Focus, Features, 2024 Revenue, Market Share & Global Presence

| Company | Specialization | Key Focus | Notable Features | 2024 Revenue & Market Share | Global Presence |

|---|---|---|---|---|---|

| Genpact | Regulatory consulting & outsourcing | Pharma, devices, financial compliance | Robust digital/regulatory tech, analytics, global scale | Not disclosed individually; part of ~$4.5B+ revenue | North America, Europe, Asia-Pacific, LATAM |

| Accell Clinical Rsrch | Clinical trial regulatory support | Oncology, global clinical registrations | Strong NVigilance, regulatory dossier expertise | Private; notable global CROs market share | U.S., Europe, Asia-Pacific |

| Promedica Intl. | Regulatory strategy & lifecycle management | Global product registration & compliance | Integrated approach spanning submissions to post-approval | Private; in top-tier global CROs cluster | North America, Europe, emerging markets |

| Criterium, Inc. | Drug/device regulatory filings | U.S./EU submissions, labeling, PMCF | Mid-sized CRO focused on personalized service | Private; recognized key player | U.S., Europe |

| WuXi AppTec | CRO/CDMO, labs, clinical and device support | Integrated R&D to regulatory services | End-to-end: chemistry, biology, toxicology, clinical, regulatory submissions | Public; part of ~$4–5B+ CRO services | China, U.S., Europe, Asia-Pacific |

Leading Trends and Their Impact

- Outsourcing Surge – Over 56% of regulatory services are now outsourced, led by clinical trial applications and product registration. Companies seek specialized providers to manage global compliance.

- AI and RegTech Integration – AI/LLMs and regulatory technology (RegTech) automate monitoring, submissions, and data extraction, reducing manual work and raising accuracy. This accelerates submissions and enhances scalability.

- Rise of Biologics/Biosimilars – Regulatory frameworks around complex biotech products are expanding. CROs with biologics expertise are capturing more share .

- Global Trial Expansion – Clinical trials in Asia, Latin America, and MEA are increasing, necessitating region-specific regulatory pathways.

- Stringent Regulatory Environments – Evolving regulations from agencies like FDA, EMA, PMDA, and national bodies (e.g., MHRA reforms) demand up-to-date submissions and local representation .

Successful Examples Around the World

- Asia-Pacific leadership: In 2024, APAC commanded ~38–39% of market share, driven by Singapore’s robust CAGR and countries like India, China, Japan investing in regulatory frameworks and trials.

- Saudi Vision 2030: MEA region growth, particularly Saudi Arabia, due to regulatory infrastructure enhancements under Vision 2030.

- UK MHRA Revamp: Post-Brexit, UK’s Medicines and Healthcare products Regulatory Agency is being overhauled—with new Regulatory Innovation Office—to improve predictability and investment.

- China’s Biologics Surge: China’s CRO industry, notably providers like WuXi AppTec, is expanding, with facilities for biologics, toxicology, and global GMP compliance.

Regional Analysis & Policy Influence

North America

- Market: ~29–30% global share (~USD 4.82B in 2024).

- Drivers: FDA guidelines, 21st Century Cures Act, complex biotech landscape, high clinical trial volumes.

- Government: FDA modernization policies streamline digital submissions and reinforce clinical trial oversight.

Europe

- Share: ~25–26% (~USD 4.10B in 2024).

- Drivers: EMA centralised approvals, stringent quality regulations, harmonisation via EU directives.

- Policies: UK MHRA reforms and establishment of Regulatory Innovation Office .

Asia-Pacific

- Dominance: ~38–39% market share (~USD 6.12B in 2024), fastest CAGR ~8.9%.

- Drivers: Cost advantage, clinical trial boom, government regulations (India, China, Japan).

- Policies: India and China expanding regulatory agencies; Singapore achieving highest regional CAGR.

Latin America, Middle East & Africa (LAMEA)

- Share: ~7–8% (~USD 1.2 B) with Saudi, Brazil, South Africa emerging .

- Drivers: Infrastructure investment, disease burden (chronic/oncology), strengthening regulatory bodies.

- Policies: Saudi Vision 2030; ANVISA (Brazil) and COFEPRIS (Mexico) enhancing drug/device registration processes.

2024 Market Size, Forecast & Outsourcing Insights

- Global market: ~USD 16.4B–17.3B in 2024 .

- CAGR: 8–8.8% through 2025–2030, with forecasts up to USD 27–37 B by 2033–2034.

- Outsourcing segment: Dominates ~56% of services, especially in clinical trial applications and regulatory writing.

- 2024 Revenue estimate: USD 16.43B (2024) with projected USD 27.18B by 2030.

Government Initiatives & Policies Shaping the Market

- FDA: 21st Century Cures Act enabling expedited review; digital submission push.

- EMA: Harmonization via centralized approvals under EU frameworks .

- MHRA (UK): Capacity-building, Regulatory Innovation Office, post-Brexit regulation overhaul.

- Asia-Pacific Governments: India–CDSCO streamlining e‑submissions; China’s NMPA reforms for biologics and device approvals .

- Saudi Arabia: Vision 2030 drives regulatory body investments toward international standards .

- Latin America: ANVISA and COFEPRIS reforms enhance regional openness to global trial sponsors .

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: India Health Insurance Market Size, Trends & Forecast (2024–2034)