PEM Electrolyzer Market Size, Leading Companies & Government Policies 2025–2034

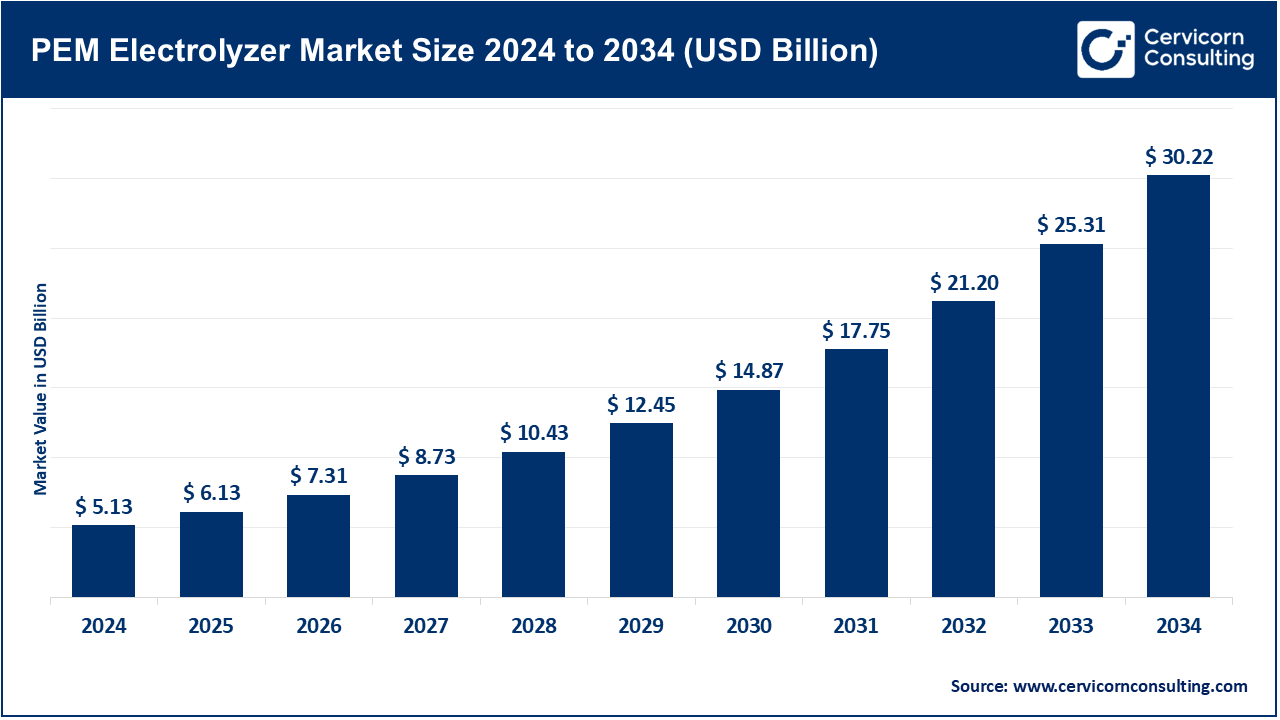

PEM Electrolyzer Market Size

The global PEM electrolyzer market size was worth USD 5.13 billion in 2024 and is anticipated to expand to around USD 30.22 billion by 2034, registering a compound annual growth rate (CAGR) of 19.40% from 2025 to 2034.

What is the PEM Electrolyzer Market?

The Proton Exchange Membrane (PEM) electrolyzer market refers to the global industry surrounding the production, distribution, and implementation of PEM electrolyzers, which are devices that utilize electricity to split water into hydrogen and oxygen using a solid polymer electrolyte membrane. Unlike traditional alkaline electrolyzers, PEM systems are compact, operate at high current densities, offer fast response times, and can function efficiently under varying load conditions—making them particularly suitable for integration with renewable energy sources such as wind and solar power. The market encompasses equipment manufacturers, service providers, component suppliers, and end-use industries seeking to decarbonize their operations by leveraging green hydrogen as a clean fuel alternative.

Why is the PEM Electrolyzer Market Important?

The PEM electrolyzer market is crucial for the global shift towards a low-carbon economy. Hydrogen, especially green hydrogen produced via PEM electrolyzers, is viewed as a key enabler for decarbonizing hard-to-abate sectors such as steel, cement, shipping, and aviation. PEM technology offers several advantages, including high purity hydrogen production, compact footprint, and better adaptability to intermittent renewable energy sources. As countries and corporations align their climate goals with net-zero emission targets, PEM electrolyzers are gaining prominence as scalable and reliable solutions for hydrogen production. Their deployment not only supports energy diversification but also strengthens energy security, reduces greenhouse gas emissions, and fosters new industrial value chains.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2656

PEM Electrolyzer Market Growth Factors

The growth of the PEM electrolyzer market is primarily driven by increasing global investments in green hydrogen infrastructure, favorable government policies and incentives, rapid cost declines in renewable electricity, rising demand for hydrogen in transportation and industrial sectors, and an urgent need to decarbonize high-emission industries. Additional factors such as advancements in PEM technology, public-private collaborations, hydrogen strategies by major economies (EU, US, China, India), and efforts to ensure energy independence are accelerating market expansion. Strategic partnerships among equipment manufacturers and energy providers, along with venture capital influx into hydrogen startups, also play a critical role in fueling growth. The anticipated commercialization of hydrogen fuel cell vehicles and power-to-gas projects further augments demand for PEM electrolyzers globally.

PEM Electrolyzer Market Top Companies

1. Air Liquide

- Specialization: Industrial gases and hydrogen infrastructure.

- Key Focus Areas: Deployment of large-scale electrolyzer plants, green hydrogen production for mobility and industry.

- Notable Features: Operates Europe’s largest PEM electrolyzer (20 MW) in Canada; extensive experience in gas handling and purification.

- 2024 Revenue (Est.): $30.5 billion (total), hydrogen segment estimated at $1.5–2 billion.

- Market Share: ~8–10% of global PEM electrolyzer projects.

- Global Presence: Over 80 countries; key operations in France, Germany, Canada, and the UAE.

2. Air Products and Chemicals, Inc.

- Specialization: Hydrogen production, gasification, and hydrogen infrastructure.

- Key Focus Areas: Turnkey hydrogen solutions, clean energy projects, green hydrogen export hubs.

- Notable Features: Partner in NEOM’s $5 billion green hydrogen project in Saudi Arabia (650 tons/day).

- 2024 Revenue (Est.): $13 billion; hydrogen business estimated at $2.1 billion.

- Market Share: 5–8% of global market, with major projects under development.

- Global Presence: 50+ countries; flagship hydrogen projects in Saudi Arabia, the US, and the Netherlands.

3. Cummins Inc.

- Specialization: Hydrogen fuel cells, electrolyzers, engines.

- Key Focus Areas: Integration of PEM electrolyzers with mobility, stationary power, and infrastructure.

- Notable Features: Acquired Hydrogenics; developing 5–20 MW electrolyzer systems.

- 2024 Revenue (Est.): $34 billion (total); electrolyzer segment ~$500 million.

- Market Share: 6–9%; strong penetration in North America and Europe.

- Global Presence: Global operations with a focus on the US, Germany, and India.

4. Erre Due S.p.A.

- Specialization: On-site gas generation systems, PEM electrolyzers.

- Key Focus Areas: Customized hydrogen production solutions for laboratories and industrial plants.

- Notable Features: Compact modular systems; over 3 decades of electrolysis expertise.

- 2024 Revenue (Est.): $100–150 million (estimated).

- Market Share: ~1–2%, mainly focused on niche and industrial applications in Europe.

- Global Presence: Primarily Europe with expanding exports to the Middle East and Asia.

5. Elogen (Groupe GTT)

- Specialization: High-efficiency PEM electrolyzers, stack design and manufacturing.

- Key Focus Areas: Decentralized hydrogen production, integration with renewable energy.

- Notable Features: Backed by Groupe GTT; focuses on innovation and modular PEM systems.

- 2024 Revenue (Est.): ~$70–100 million (rapid growth expected).

- Market Share: 1–2% but expanding rapidly with projects in France and Germany.

- Global Presence: Mainly France and Europe, entering North American and Asian markets.

Leading Trends and Their Impact

1. Gigawatt-Scale Hydrogen Projects

The rise of mega green hydrogen projects—such as NEOM (Saudi Arabia), HyDeal Ambition (Spain), and Hy2Gen (Norway)—is pushing demand for multi-MW PEM electrolyzers. These projects are fostering supply chain expansion and promoting economies of scale that are expected to reduce electrolyzer costs by 50% over the next 5–7 years.

2. Integration with Renewables

PEM electrolyzers are increasingly co-located with wind and solar farms. Their fast response time makes them ideal for managing variable energy input, creating efficient Power-to-X applications and grid-balancing systems.

3. Policy-Driven Market Acceleration

Governments are launching hydrogen roadmaps (e.g., U.S. Hydrogen Hubs, EU Hydrogen Strategy, India’s National Green Hydrogen Mission), which include financial incentives, R&D grants, and mandatory green hydrogen quotas for industry. These policies are accelerating market adoption and enabling long-term contracts for electrolyzer deployment.

4. Technological Innovation and Stack Efficiency

New stack designs, enhanced membrane materials, and automation in manufacturing are increasing the efficiency and reliability of PEM electrolyzers. This trend improves project bankability and shortens payback periods for investors.

5. Localization of Supply Chains

To mitigate geopolitical risks and ensure supply chain resilience, several countries are promoting domestic electrolyzer manufacturing—leading to regional manufacturing hubs in Europe (France, Germany), the U.S., India, and Australia.

Successful Examples of PEM Electrolyzer Projects

Bécancour, Quebec, Canada (Air Liquide)

- World’s largest PEM electrolyzer (20 MW) producing 3,000 tons of green hydrogen per year.

- Integrated with hydropower, feeding industrial clients and transport fleets.

H2FUTURE, Linz, Austria (Voestalpine + Siemens Energy)

- A 6 MW PEM electrolyzer project used in the steel industry.

- Demonstrates integration with industrial decarbonization pathways.

Refhyne, Germany (Shell + ITM Power)

- 10 MW PEM electrolyzer at the Rheinland refinery.

- First large-scale hydrogen integration into a European refinery system.

NEOM, Saudi Arabia (Air Products + ACWA Power)

- Under construction: 650 tons/day green hydrogen from solar/wind using PEM technology.

- Projected to become the world’s largest hydrogen plant by 2026.

Haru Oni, Chile (Siemens Energy + Porsche)

- 3.4 MW PEM electrolyzer generating green hydrogen for synthetic fuels.

- Powers decarbonization of aviation and automotive sectors.

Global Regional Analysis and Government Initiatives

North America

- U.S.: The Inflation Reduction Act (IRA) offers $3/kg production tax credits for green hydrogen. Department of Energy has announced $8 billion for regional hydrogen hubs.

- Canada: Federal clean fuel regulations, and provinces like Quebec and Alberta are launching electrolyzer-based hydrogen projects with favorable tariffs and low-cost hydropower.

- Key Focus: Heavy-duty transport, industrial decarbonization, export infrastructure.

Europe

- European Union: Aims to install 40 GW of electrolyzer capacity by 2030. The EU Hydrogen Bank and REPowerEU provide subsidies for electrolyzer manufacturing and green hydrogen use.

- Germany: €9 billion national hydrogen strategy; PEM electrolyzer projects integrated into energy-intensive sectors.

- France and Spain: Aggressively scaling domestic electrolyzer production with national tenders.

- Key Focus: Steel, ammonia, energy security, domestic production.

Asia-Pacific

- China: World’s largest electrolyzer manufacturing base; emphasis on scaling domestic capacity for energy independence. Targets 100,000 tons of green hydrogen production by 2025.

- Japan: Focus on hydrogen fuel cell vehicles (FCEVs), import of green hydrogen via ammonia.

- India: National Green Hydrogen Mission with $2.5 billion investment; domestic electrolyzer capacity incentives.

- Key Focus: Manufacturing scale-up, transport sector, grid balancing.

Latin America

- Chile and Brazil: Harnessing abundant solar/wind for hydrogen exports. Chile targets 25 GW electrolyzer capacity by 2030.

- Government Support: Streamlined permitting, land access, international partnerships (e.g., Germany, EU).

Middle East & Africa

- Saudi Arabia: NEOM project—a global hydrogen export hub powered by PEM electrolyzers.

- UAE and Oman: Investment-friendly policies and free trade zones attracting green hydrogen investment.

- South Africa: National Hydrogen Strategy targeting PEM electrolyzer production using platinum-group metals.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Lithium-Ion Battery Market Size to Reach USD 417.5 Billion by 2034