Pea Starch Market Revenue, Global Presence, and Strategic Insights by 2035

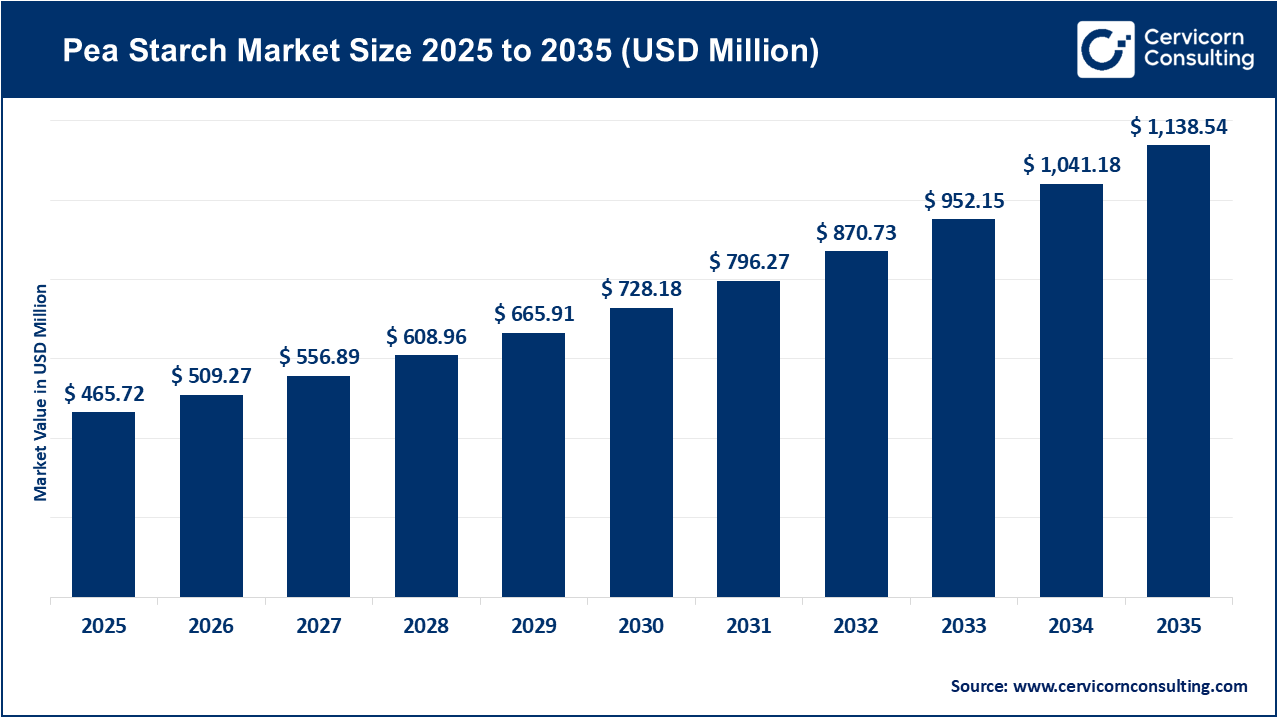

Pea Starch Market Size

The global pea starch market size was worth USD 465.72 million in 2025 and is anticipated to expand to around USD 1,138.54 million by 2035, registering a compound annual growth rate (CAGR) of 9.4% from 2026 to 2035.

Pea Starch Market Growth Factors

The growth of the pea starch market is propelled by rising consumer interest in plant-based and allergen-free food products, growing demand for clean-label and non-GMO ingredients, advancements in pea fractionation technologies that improve starch yield and purity, increased global pea cultivation driven by sustainable agricultural practices, and the expansion of pea starch applications across food, confectionery, pet food, paper, packaging, and industrial sectors. Additionally, supply-chain diversification, investments in local processing facilities, favorable government initiatives supporting pulse crops, and rising concerns over the environmental impact of traditional starch sources, all contribute to steady global market expansion.

What is the Pea Starch Market?

The pea starch market encompasses the global production, extraction, processing, distribution, and utilization of starch derived from yellow peas (Pisum sativum). Pea starch is rich in amylose, which gives it exceptional gelling, binding, and film-forming capabilities. The market includes agricultural production of peas, fractionation facilities that separate proteins, fibers, and starch, manufacturing plants that refine native and modified pea starches, and diverse end-use industries such as food & beverage, pet nutrition, pharmaceuticals, paper manufacturing, adhesives, and biodegradable materials. Market research estimates typically value the pea starch sector in the hundreds of millions of dollars, depending on whether the scope includes native, modified, or food-grade starch exclusively.

Why is Pea Starch Important?

Pea starch is increasingly important due to its unique combination of functional performance, clean-label appeal, sustainability, and processing versatility. It offers excellent gelling, thickening, and stabilizing characteristics, making it a natural fit for soups, sauces, confectionery, gluten-free bakery products, noodles, plant-based meats, and snacks. Peas require fewer inputs compared to other crops and naturally enrich soils through nitrogen fixation, making pea starch a more environmentally sustainable choice. As consumers move away from allergens like gluten and seek non-GMO and minimally processed ingredients, pea starch provides food manufacturers with a future-ready alternative to corn, wheat, and potato starch. Additionally, emerging applications in biodegradable films, packaging, and industrial adhesives expand its importance beyond food and into sustainability-focused industrial sectors.

Get a Free Sample: https://www.cervicornconsulting.com/pea-starch-market

Top Companies in the Pea Starch Market

Below are detailed profiles of the leading companies involved in pea starch production, along with their specialization, key focus areas, notable features, 2024 revenues, market presence, and global reach.

1. Ingredion Incorporated

Specialization:

Global ingredient solutions provider specializing in starches, sweeteners, texturizers, fibers, and plant-based solutions.

Key Focus Areas:

Clean-label ingredients, native and modified starches, specialty texturizers, innovative plant-based alternatives.

Notable Features:

- Strong global R&D infrastructure

- Comprehensive formulation and co-creation capabilities

- Presence across both food and industrial applications

2024 Revenue:

Approx. USD 7.4 billion (company-wide revenue).

Market Share (Pea Starch):

Ingredion is a significant supplier of global starches, with pea starch included in its plant-based portfolio; exact pea-starch-specific market share is not publicly disclosed.

Global Presence:

Extensive operations across North America, Europe, Latin America, and Asia-Pacific with over 120 countries served.

2. Roquette Frères

Specialization:

Plant-based ingredients, starches, proteins, polyols, and pharmaceutical excipients.

Key Focus Areas:

Plant proteins, starch derivatives, clean-label specialty ingredients, food and pharma applications.

Notable Features:

- One of the largest pea protein and starch processors globally

- Heavy investments in sustainable plant-based technologies

- Strong commitment to R&D and innovation

2024 Revenue:

Approx. €4.5 billion.

Market Share (Pea Starch):

Roquette is among the largest players in the global pea starch and pea protein space, though exact market share is not disclosed.

Global Presence:

Operations in over 100 countries with 30+ manufacturing facilities across Europe, North America, India, and Asia.

3. Cosucra Groupe Warcoing

Specialization:

Specialized producer of pea ingredients, including pea starch, pea fiber, and pea protein.

Key Focus Areas:

High-amylose pea starch (NASTAR™), natural and functional food ingredients, traceable and sustainably sourced pea products.

Notable Features:

- Dedicated pulse-ingredient specialist

- Strong sustainability and environmental compliance program

- Known for advanced pea-processing technologies

2024 Revenue:

Estimated €140–141 million (company-level).

Market Share (Pea Starch):

A major European supplier of high-value pea starch for food and beverage applications.

Global Presence:

Major operations in Europe with exports to North America, Asia-Pacific, and the Middle East.

4. Emsland Group

Specialization:

Producer of potato and pea starches, fibers, flakes, and specialty food ingredients.

Key Focus Areas:

Pea starch for food, pet food, paper manufacturing, and specialty industrial applications.

Notable Features:

- Strong relationships with European farmers

- Expertise in specialty starch development

- Major processor of potatoes and peas

2024 Revenue:

Privately held; generally recognized as one of Europe’s largest starch producers, though exact revenue is not public.

Market Share (Pea Starch):

A key European supplier in the pea starch sector.

Global Presence:

Manufacturing and sales operations across Europe and exports to North America, Asia, and the Middle East.

5. PURIS Foods

Specialization:

U.S.-based producer of pea protein, pea starch, and plant-based ingredient systems.

Key Focus Areas:

Vertically integrated pea farming, domestic pea processing, clean-label food innovation.

Notable Features:

- Strong focus on U.S.-based supply chain resilience

- Known for innovation in plant protein and starch applications

- Active in shaping trade and policy frameworks for pea processing

2024 Revenue:

Privately held; official revenue not publicly disclosed, but the company is considered a major North American pea processing leader.

Market Share (Pea Starch):

Significant U.S. player; exact market share not disclosed.

Global Presence:

Primarily North American, with expanding partnerships in food and beverage industries globally.

Leading Trends and Their Market Impact

1. Growth of Plant-Based Foods

Increasing demand for vegan and flexitarian diets is driving manufacturers to adopt pea starch as a clean-label thickener and stabilizer. Plant-based meat and dairy alternatives rely heavily on pea starch for texture, binding, and gel strength.

Impact:

Accelerated adoption in mainstream food manufacturing.

2. Rise of Clean-Label Ingredients

Consumers increasingly want products free from artificial additives, allergens, and genetically modified ingredients. Pea starch’s natural, non-GMO profile positions it as an ideal replacement for modified starches.

Impact:

Premium pricing for native and minimally processed pea starch varieties.

3. Technological Advancements in Pea Fractionation

New dry-fractionation and wet-processing technologies improve extraction yields, lower processing cost, and enable new functional properties.

Impact:

Broader industrial applications and efficiency gains for producers.

4. Supply-Chain Localization

Trade disruptions and tariff changes are leading countries to invest in domestic pea processing capacities.

Impact:

More regional mills, increased farmer contracts, improved traceability.

5. Industrial Applications Beyond Food

Pea starch is being explored for biodegradable films, sustainable packaging, adhesives, and paper coatings.

Impact:

Significant future diversification of demand beyond food industries.

Successful Real-World Examples in the Pea Starch Market

1. Cosucra’s NASTAR™ High-Amylose Starch

Cosucra has successfully commercialized high-amylose pea starch for gluten-free bakery, noodles, and clean-label processed foods. Their product is widely used across Europe and increasingly in Asia.

2. PURIS’ Domestic Fractionation Innovation

PURIS expanded U.S.-based pea processing capacity, enabling major food brands to rely on traceable domestic supplies. This has strengthened the U.S. plant-based ecosystem.

3. Roquette’s Integrated Plant-Based Platform

Roquette’s investments in large-scale pea starch and protein facilities have created one of the world’s most comprehensive plant-based ingredient portfolios.

4. Emsland Group’s European Agricultural Integration

By integrating contract farming and advanced starch-processing capabilities, Emsland has ensured consistent supply of high-quality pea starch for food, pet food, and industrial markets.

Global Regional Analysis

1. Europe

Market Drivers:

Strong push toward plant-based diets, sustainable agriculture, and locally sourced protein crops.

Government Initiatives:

- EU protein strategy encouraging domestic protein crop production

- R&D support for pulse-based ingredients

- Environmental policies under the EU Green Deal promoting sustainable crop rotation

Market Dynamics:

Europe remains one of the largest markets for pea starch, with France, Belgium, Germany, and the Netherlands leading production and consumption.

2. North America (USA & Canada)

Market Drivers:

- Massive rise in plant-based food startups

- Growing need for clean-label, allergen-free ingredients

- Investment in domestic pea fractionation to reduce reliance on imports

Government Initiatives:

- USDA Pulse Crop Research programs

- Funding for agricultural innovation and sustainable farming

- Policies influencing trade, tariffs, and local processing incentives

Market Dynamics:

The U.S. has seen significant growth in pea processing facilities, while Canada remains a major producer of yellow peas used globally.

3. Asia-Pacific

Market Drivers:

- Rapid urbanization and dietary shifts

- Growing demand for clean-label ingredients in packaged foods

- Expansion of industrial starch applications

Government Initiatives:

Policies vary but include subsidies for pulse cultivation, support for food processing industries, and incentives for bioplastic development.

Market Dynamics:

China and India are emerging as major consumers and potential processing hubs, while Japan and South Korea drive demand for high-quality specialty starches.

4. Latin America

Market Drivers:

Increasing interest in pulse cultivation due to climate suitability and soil benefits.

Government Initiatives:

Programs promoting sustainable agriculture, crop diversification, and rural development.

Market Dynamics:

Latin America is an emerging exporter of peas and is beginning to attract investment in local processing.

5. Middle East & Africa

Market Drivers:

Growing import demand for plant-based ingredients and food-processing inputs.

Government Initiatives:

Policies encouraging food security, agricultural innovation, and water-efficient crops.

Market Dynamics:

MEA is currently a net importer but represents strong growth potential for clean-label food ingredients.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

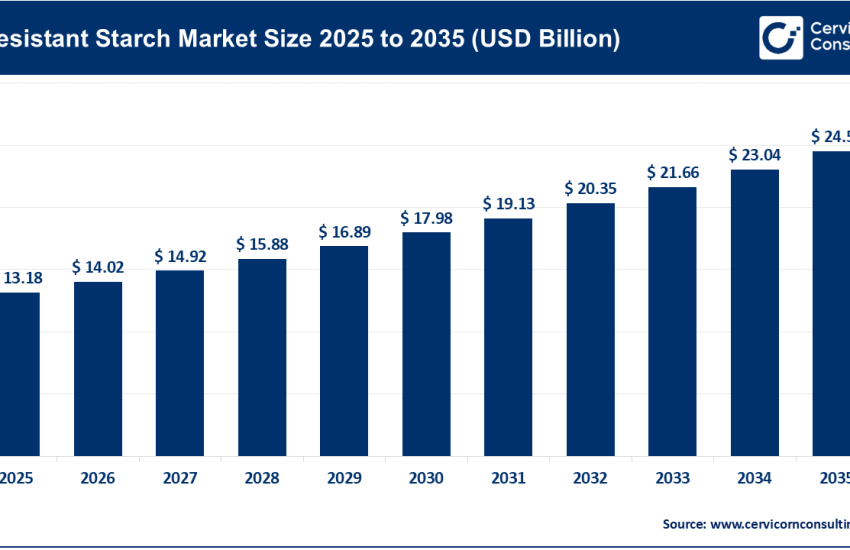

Read Report:Starch Derivatives Market Revenue, Global Presence, and Strategic Insights by 2035