Orthodontics Market Growth Trends, Leading Companies & Regional Insights by 2034

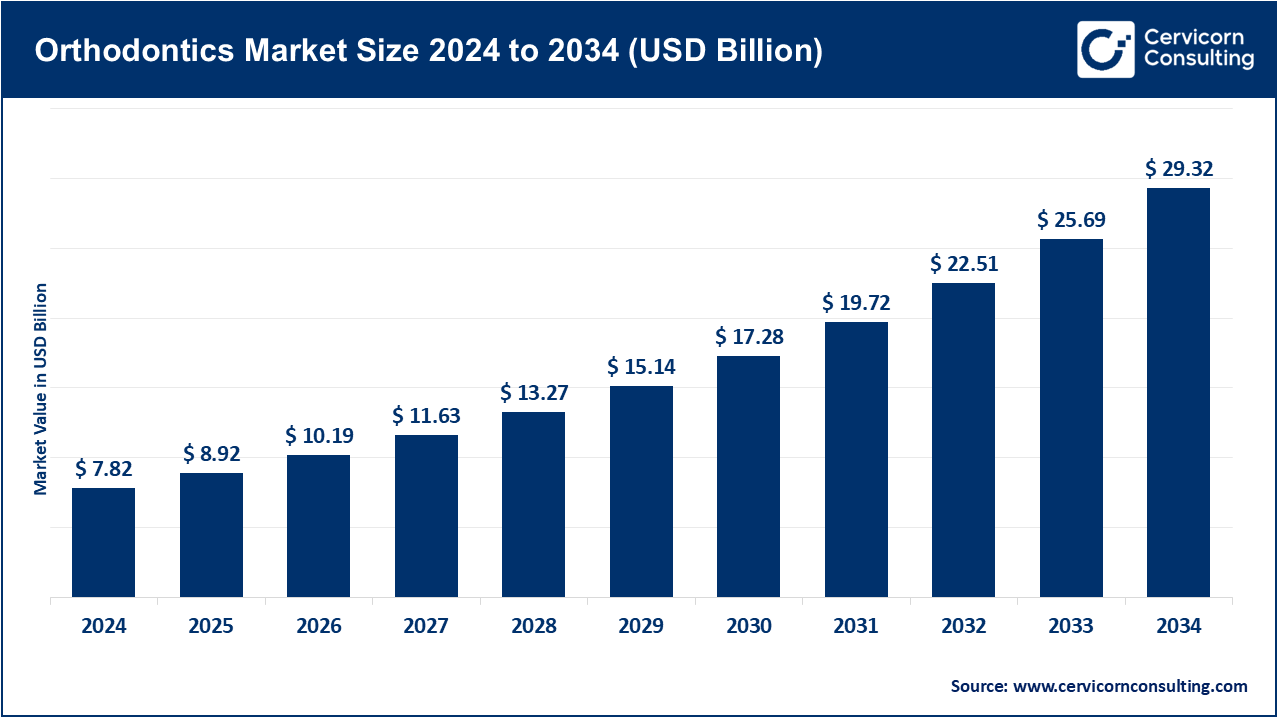

Global Orthodontics Market Size

The global orthodontics market is witnessing robust growth, projected to expand from USD 7.82 billion in 2024 to over USD 29.32 billion by 2034, at a CAGR of 14.12% during the forecast period (2025–2034).

What is the Orthodontics Market?

The orthodontics market refers to the global industry centered around the diagnosis, prevention, and correction of dental and facial irregularities. It includes a wide range of products and services such as braces, clear aligners, retainers, orthodontic headgear, 3D imaging systems, and specialized dental services. Orthodontics is a specialized branch of dentistry that focuses on improving oral function and aesthetics by aligning teeth and jaws. The market consists of device manufacturers, digital solution providers, and dental professionals, all contributing to the advancement and accessibility of orthodontic treatments.

The orthodontics market is increasingly blending traditional clinical expertise with cutting-edge technologies such as AI-driven treatment planning, digital scanners, 3D printing, and teledentistry platforms, significantly transforming how care is delivered and consumed globally.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2689

Why is the Orthodontics Market Important?

The significance of the orthodontics market lies in its impact on oral health, facial aesthetics, and quality of life. Malocclusion (misalignment of teeth), which affects over 60% of the global population, can lead to severe dental and health issues such as periodontal diseases, jaw disorders, speech impediments, and digestion problems.

In addition to clinical importance, the growing global demand for aesthetic appeal and facial harmony—especially among millennials and Gen Z—has expanded the consumer base beyond adolescents to include adults and older populations. Furthermore, early orthodontic interventions can reduce future healthcare costs by preventing complications. As such, orthodontics is no longer a luxury but a preventive and restorative necessity, making it a critical component of public health infrastructure in both developed and developing countries.

Growth Factors Driving the Orthodontics Market

Growth is primarily driven by:

- Rising prevalence of malocclusion and jaw irregularities

- Increasing consumer awareness and aesthetic demand

- Expanding base of orthodontic professionals and clinics

- Advancements in 3D printing, intraoral scanning, and AI

- Growth in adult orthodontic procedures

- Adoption of teleorthodontics and digital workflows

- Increased government investments in oral healthcare

- Market expansion in emerging economies

Top Companies in the Orthodontics Market

1. 3M Company

- Specialization: Orthodontic adhesives, brackets, digital solutions

- Key Focus Areas: Innovation, clinical efficiency

- Notable Products: Clarity™ Aligners, APC™ Flash-Free Adhesive

- 2024 Revenue: USD 1.4 billion (oral care segment)

- Market Share: 8–10%

- Presence: 60+ countries, strong in North America and Europe

2. Align Technology, Inc.

- Specialization: Clear aligners (Invisalign), iTero scanners

- Key Focus Areas: AI, consumer marketing, clinician support

- Notable Products: Invisalign SmartTrack™, iTero Element™

- 2024 Revenue: USD 4.1 billion

- Market Share: 40%+ in aligners

- Presence: 100+ countries

3. American Orthodontics

- Specialization: Brackets, tubes, wires, bands

- Key Focus Areas: Customization and affordability

- Notable Products: Empower® Brackets, Dynamic Archwires

- 2024 Revenue: USD 400–500 million

- Market Share: 6–8%

- Presence: 100+ countries

4. Danaher Corporation (Envista)

- Specialization: Ormco, Damon™, Insignia™, Spark Aligners

- Key Focus Areas: Full-system solutions, digital adoption

- Notable Products: Spark™ Clear Aligners, Damon Ultima™

- 2024 Revenue: USD 2.6 billion (Envista)

- Market Share: 12–14%

- Presence: Strong APAC and North America

5. Dentaurum GmbH & Co. KG

- Specialization: Orthodontic brackets, implants, casting products

- Key Focus Areas: Sustainability and precision

- Notable Products: Discovery® Smart, Orthocryl®

- 2024 Revenue: USD 150–200 million

- Market Share: 2–4%

- Presence: 80+ countries, especially Europe

Leading Trends and Their Market Impact

- Clear Aligners: Rising adult demand; 15%+ CAGR

- Teledentistry: Remote monitoring, virtual consults, AI-powered diagnostics

- 3D Printing: Custom brackets and appliances, faster production

- AI in Treatment: Real-time modeling and simulation, shortened cycles

- Adult Orthodontics: 25%+ patient base now adults

- Eco-Innovation: Focus on recyclable/biodegradable materials

Successful Orthodontics Examples Around the World

- USA: Invisalign’s global leadership, teledentistry regulations

- Germany: Dentaurum’s product engineering excellence

- China: Angelalign’s rising adoption among urban youth

- Brazil: Cosmetic dentistry growth; orthodontist density highest

- India: Expanding access and public-private oral health partnerships

Regional Analysis and Policy Frameworks

North America

- Size: USD 2.6 billion (2024)

- Drivers: High insurance coverage, innovation hubs

- Policies: ACA pediatric mandates, HIPAA teledentistry compliance

Europe

- Size: USD 1.8 billion

- Drivers: NHS orthodontics, adult treatment adoption

- Policies: EU MDR, government-subsidized pediatric care

Asia-Pacific

- Size: USD 1.1 billion

- Drivers: Dental tourism, urbanization, mobile care

- Policies: China’s Healthy 2030, India’s NOHP

Latin America

- Size: USD 450 million

- Drivers: Low cost, rising demand

- Policies: Brazil’s SUS support, cross-border care programs

Middle East & Africa

- Size: USD 250 million

- Drivers: Dental tourism, private clinics growth

- Policies: UAE Vision 2031, South Africa’s clinic incentives

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Next-Generation Sequencing in Drug Discovery Market Top Companies, Trends & Global Outlook by 2034