Obesity Treatment Market Growth to USD 98.26 Billion by 2034

Obesity Treatment Market Size and Growth

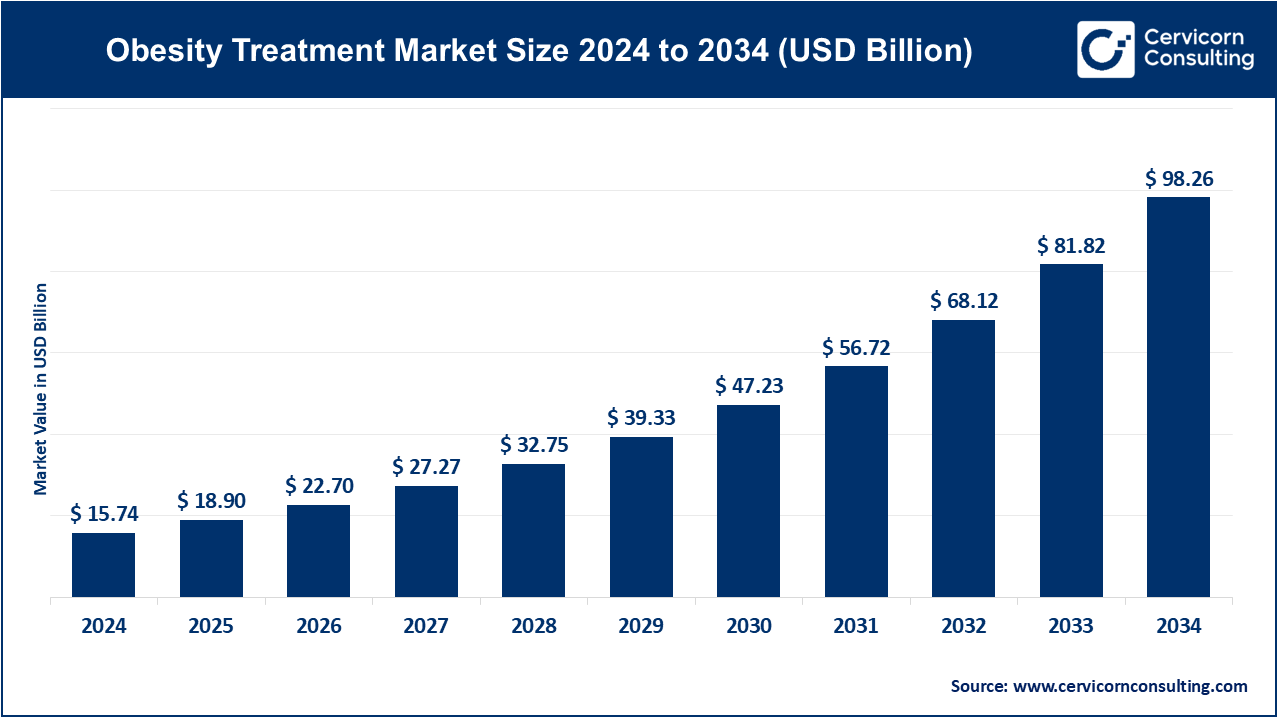

In 2024, the obesity treatment market was valued at approximately USD 15.74 billion and is projected to grow at a compound annual growth rate (CAGR) of 20.10% from 2025 to 2034, reaching an estimated USD 98.26 billion by 2034. The obesity treatment market is experiencing significant growth, driven by factors such as the rising global prevalence of obesity, increased awareness of obesity as a chronic condition requiring medical intervention, advancements in pharmacological treatments, and supportive government initiatives.

What is the Obesity Treatment Market?

The obesity treatment market encompasses a range of products and services aimed at managing and reducing obesity. This includes pharmacological treatments (such as anti-obesity drugs), surgical interventions (like bariatric surgery), medical devices, and lifestyle modification programs. The market addresses the growing demand for effective solutions to combat obesity, a condition associated with numerous health risks including diabetes, cardiovascular diseases, and certain cancers.

Why is it Important?

Obesity is a global health crisis, with the World Health Organization estimating that over one billion people worldwide are obese. The condition significantly increases the risk of various non-communicable diseases, leading to increased healthcare costs and reduced quality of life. Effective obesity treatment is crucial for improving individual health outcomes, reducing the burden on healthcare systems, and enhancing overall public health.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2634

Top Companies in the Obesity Treatment Market

GlaxoSmithKline plc (GSK)

- Specialization: Pharmaceuticals and healthcare products.

- Key Focus Areas: Development of medications targeting metabolic disorders.

- Notable Features: Emphasis on research and development for innovative treatments.

- Global Presence: Operations in over 100 countries.

Novo Nordisk A/S

- Specialization: Diabetes care and hormone replacement therapies.

- Key Focus Areas: GLP-1 receptor agonists for obesity and diabetes management.

- Notable Features: Products like Ozempic and Wegovy have shown significant efficacy in weight loss.

- 2024 Revenue: Ozempic and Wegovy generated $7.2 billion in Q1 2025.

- Market Share: Leading position in the GLP-1 segment.

- Global Presence: Strong presence in North America, Europe, and Asia.

VIVUS LLC

- Specialization: Biopharmaceutical company focused on treatments for obesity and related conditions.

- Key Focus Areas: Development of novel therapies for weight management.

- Notable Features: Emphasis on personalized medicine approaches.

- Global Presence: Primarily operating within the United States.

AstraZeneca

- Specialization: Global biopharmaceutical company.

- Key Focus Areas: Research and development in various therapeutic areas, including metabolic diseases.

- Notable Features: Investment in innovative treatment options for obesity-related conditions.

- 2024 Revenue: Reported an 18% increase in revenue in 2024.

- Global Presence: Operations in over 100 countries.

Rhythm Pharmaceuticals, Inc.

- Specialization: Biopharmaceutical company focused on rare genetic disorders of obesity.

- Key Focus Areas: Development of therapies for rare genetic obesity disorders.

- Notable Features: Precision medicine approach targeting specific genetic mutations.

- Global Presence: Primarily focused on the U.S. market, with plans for international expansion.

Leading Trends and Their Impact

The obesity treatment market is witnessing several key trends:

- Advancements in Pharmacotherapy: The development of GLP-1 receptor agonists, such as semaglutide (Wegovy) and tirzepatide (Zepbound), has revolutionized obesity treatment, offering significant weight loss outcomes.

- Increased Investment in R&D: Companies are investing heavily in research to develop more effective and safer obesity treatments, including oral formulations and combination therapies.

- Digital Health Integration: The incorporation of digital tools and telemedicine is enhancing patient engagement and adherence to treatment plans.

- Policy Support: Government initiatives and endorsements, such as the WHO’s potential inclusion of weight-loss drugs on its essential medicines list, are facilitating broader access to treatments.

Successful Examples Around the World

- United States: The U.S. has seen widespread adoption of GLP-1 receptor agonists, with companies like Eli Lilly reporting significant sales from products like Mounjaro and Zepbound.

- Europe: Countries in Europe are integrating obesity treatments into public health strategies, with a focus on preventive care and access to pharmacological interventions.

- Asia-Pacific: Rapid urbanization and lifestyle changes have led to increased obesity rates, prompting governments to implement awareness campaigns and support access to treatments.

Global Regional Analysis and Government Initiatives

- North America: Leading the market due to high obesity prevalence, supportive healthcare infrastructure, and rapid adoption of new treatments.

- Europe: Strong regulatory frameworks and public health initiatives are promoting the integration of obesity treatments into standard care.

- Asia-Pacific: Experiencing the fastest growth, driven by increasing awareness, economic development, and government-led health campaigns.

- India: The Food Safety and Standards Authority of India (FSSAI) has urged states to intensify efforts against obesity, including reducing oil consumption and promoting healthier lifestyles through initiatives like the Eat Right India movement.

- World Health Organization (WHO): Set to endorse the use of weight-loss drugs globally, aiming to include them on the essential medicines list to improve accessibility, especially in low- and middle-income countries.

These concerted efforts across regions and organizations underscore the global commitment to addressing the obesity epidemic through comprehensive treatment strategies and supportive policies.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Inhaled Insulin Market to Hit USD 2.6 Billion by 2034