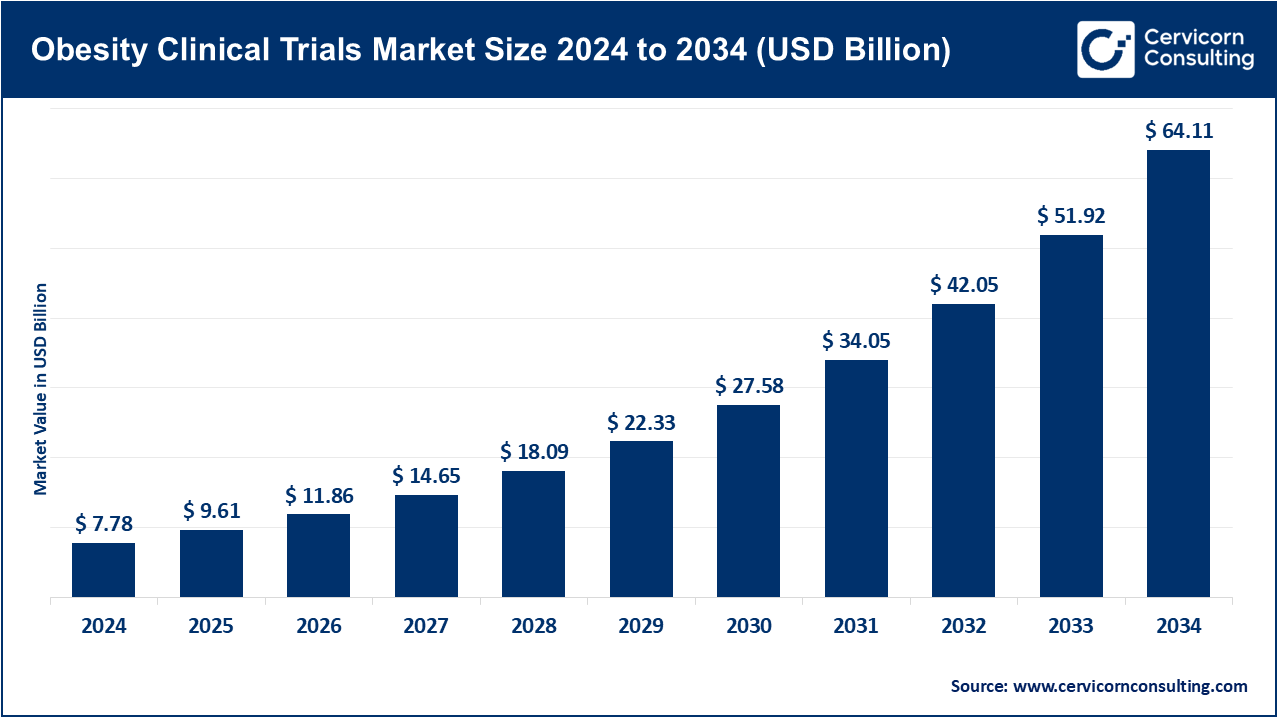

Obesity Clinical Trials Market Revenue, Global Presence, and Strategic Insights by 2034

Obesity Clinical Trials Market Size

Obesity Clinical Trials Market: Definition & Why It Matters

What is the obesity clinical trials market?

The obesity clinical trials market represents the ecosystem of pharmaceutical companies, biotechnology firms, contract research organizations (CROs), research institutions, and regulators working together to discover, test, and commercialize therapies that address overweight and obesity. This market includes early-phase safety and efficacy studies, large-scale Phase 3 pivotal trials, cardiovascular outcome studies, and long-term post-marketing surveillance. Trials are conducted for a wide variety of therapeutic modalities—injectable incretin therapies (GLP-1 agonists, GIP/GLP-1 dual agonists), oral small molecules, poly-hormonal agents, combination regimens, medical devices, and digital or behavioral interventions.

Why is it important?

Obesity is a chronic disease that contributes significantly to cardiovascular disease, type 2 diabetes, certain cancers, musculoskeletal disorders, and overall higher healthcare costs. Clinical trials are critical because they generate the evidence required to demonstrate not only weight loss efficacy, but also durability, safety, impact on comorbidities, and overall patient quality of life. The results from these studies shape treatment guidelines, regulatory approvals, payer reimbursement, and patient access worldwide. With obesity rates continuing to rise globally, the market for obesity clinical trials has never been more essential in delivering solutions that address one of the most pressing public health challenges.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2714

Obesity Clinical Trials Market — Growth Factors

The growth of the obesity clinical trials market is driven by multiple interconnected factors: breakthrough efficacy from modern incretin therapies such as semaglutide and tirzepatide has fueled industry confidence in running larger and longer studies; regulatory agencies such as the FDA and EMA are offering clearer guidance on endpoints, trial duration, and maintenance requirements, reducing uncertainty and accelerating development; payer dynamics, particularly in the United States and Europe, are creating demand for cardiovascular outcomes and health-economic evidence to justify coverage.

The pipeline is expanding beyond injectables into oral agents and dual or triple-agonist combinations, prompting diverse trial designs; globalization of obesity R&D is accelerating, exemplified by China’s recent first-in-class approval of a GLP-1/glucagon dual agonist, which has spurred Asia-centric development programs; and finally, digital and decentralized trial technologies are improving recruitment, retention, and data quality by enabling remote monitoring, electronic patient-reported outcomes, and wearable device integration. Together, these factors are rapidly increasing the volume, size, and sophistication of obesity trials worldwide.

Market Structure & the 5 Leading Sponsors

Novo Nordisk A/S

- Specialization & Focus Areas: A global leader in GLP-1–based therapies for diabetes and obesity. Its flagship semaglutide products (Wegovy and Ozempic) have set the benchmark for efficacy in weight management. Novo runs extensive clinical programs in maintenance, cardiovascular outcomes, and long-term health impacts.

- Notable Features: The STEP program demonstrated unprecedented weight loss, while the SELECT trial showed cardiovascular risk reduction, strengthening payer coverage arguments.

- 2024 Revenue: About USD 33–35 billion (company total).

- Market Share: Approximately 70% global volume share in obesity care in 2024.

- Global Presence: Clinical trial networks across North America, Europe, Asia-Pacific, and Latin America, with ongoing real-world evidence studies.

Eli Lilly and Company

- Specialization & Focus Areas: Developer of tirzepatide (Zepbound/Mounjaro), a dual GIP/GLP-1 receptor agonist showing best-in-class efficacy. Lilly also leads development of oral incretins like orforglipron and explores obesity in comorbidity settings such as sleep apnea and fatty liver disease.

- Notable Features: SURMOUNT-1 redefined expectations for weight loss, and Lilly continues to scale manufacturing and expand access.

- 2024 Revenue: About USD 45.5 billion (company total).

- Market Share: Rapidly expanding in obesity therapeutics, narrowing the gap with Novo Nordisk.

- Global Presence: Extensive networks in the U.S., Europe, Japan, and expanding trials in Asia and emerging markets.

Pfizer Inc.

- Specialization & Focus Areas: Focused on developing oral small-molecule GLP-1 receptor agonists such as danuglipron. Though the twice-daily formulation was discontinued, Pfizer continues work on once-daily formulations to improve adherence.

- Notable Features: Strong potential to disrupt the market if oral therapies meet efficacy and tolerability benchmarks.

- 2024 Revenue: About USD 63.6 billion (company total).

- Market Share: Limited in obesity currently, but strategically positioned for expansion with a successful oral entrant.

- Global Presence: One of the broadest global R&D and clinical trial infrastructures across all therapeutic areas.

Amgen Inc.

- Specialization & Focus Areas: Focused on novel mechanisms beyond traditional incretins, such as AMG 133 (MariTide), a GLP-1/GIP agonist with unique pharmacology.

- Notable Features: Early clinical data show double-digit weight loss in relatively short treatment durations, with long-term durability studies ongoing.

- 2024 Revenue: About USD 33.4 billion (company total).

- Market Share: No marketed obesity products yet, but strong potential pipeline.

- Global Presence: Expanding into global obesity trials as its programs progress to later stages.

Altimmune, Inc.

- Specialization & Focus Areas: Developing pemvidutide, a GLP-1/glucagon dual agonist designed to deliver high efficacy with favorable tolerability.

- Notable Features: The Phase 2 MOMENTUM trial showed significant weight loss (~15% at 48 weeks) with encouraging safety data.

- 2024 Revenue: Development-stage; no significant commercial revenue.

- Market Share: Pipeline-only but closely watched as a promising dual-agonist candidate.

- Global Presence: Primarily U.S.-based trials, with global expansion expected as late-stage development advances.

Leading Trends & Their Impact

- From Weight Loss to Outcomes: Regulators and payers now emphasize cardiovascular outcomes, durability of weight loss, and quality of weight reduction (lean mass preservation). This is changing the design of Phase 3 trials and outcome studies.

- Poly-agonists and Oral Next-Gens: Dual and triple agonists, as well as oral incretins, are diversifying the pipeline. Sponsors are running dose-optimization studies to balance efficacy and tolerability.

- Asia’s Emergence: China approved a GLP-1/glucagon dual agonist, leading to an influx of local and multinational trials in the region.

- Access & Reimbursement: U.S. Medicare and employer coverage expansions are steering sponsors to focus on cardiovascular and economic outcomes.

- Digital Integration: Wearables, ePROs, and decentralized methods are becoming standard in obesity trials, improving patient experience and data quality.

Successful Examples of Obesity Clinical Trials

- STEP-1 (semaglutide): Demonstrated nearly 15% mean weight loss in 68 weeks, setting a new efficacy standard.

- SURMOUNT-1 (tirzepatide): Showed approximately 20% mean weight loss at 72 weeks, making it one of the most effective anti-obesity treatments to date.

- SELECT (semaglutide): Proved cardiovascular benefit by reducing major adverse events, unlocking broader reimbursement pathways.

- Pemvidutide MOMENTUM (Altimmune): Delivered ~15% mean weight loss at 48 weeks with favorable safety.

- Amgen AMG 133 (MariTide): Early studies showed double-digit weight loss in a short timeframe, sparking strong market interest.

Global Regional Analysis with Government Initiatives & Policies

North America

The United States leads the market due to FDA’s updated guidance clarifying trial endpoints, maintenance phases, and cardiovascular risk assessments. Medicare Part D now covers Wegovy for cardiovascular risk reduction, driving demand for outcome-focused evidence. Employer coverage for GLP-1 drugs expanded in 2024, though utilization management measures persist. Canada aligns closely with EMA and FDA, requiring inclusion in global trial designs.

Europe

The European Medicines Agency emphasizes long-term maintenance, pediatric trials, and patient-reported outcomes. The UK’s National Institute for Health and Care Excellence (NICE) has recommended Wegovy and tirzepatide under defined patient pathways, with implementation challenges due to capacity constraints in obesity clinics. European payers require strong cost-effectiveness evidence, shaping trial endpoints.

Asia-Pacific

China’s approval of mazdutide, a GLP-1/glucagon dual agonist, marked the first of its kind globally and accelerated China-centric trial designs. Japan, South Korea, and Australia are increasing their role in bridging studies and regional Phase 3 cohorts. APAC provides diverse patient populations and accelerated enrollment opportunities.

Latin America

Countries such as Brazil and Mexico are becoming important trial hubs due to rising obesity prevalence and cost-efficient recruitment. Regulatory agencies like ANVISA and COFEPRIS are modernizing frameworks, but payer budgets remain constrained, making cost-effectiveness data crucial for adoption.

Middle East & Africa

Gulf countries are rapidly adopting advanced therapies through private healthcare systems, while African markets face challenges in infrastructure. Nevertheless, obesity prevalence is rising, and trial sponsors are starting to expand capacity-building efforts in the region.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Blade Battery Market Growth Trends, Top Companies, Global Insights and Adoption