Nuclear Reactors Market Revenue, Global Presence, and Strategic Insights by 2035

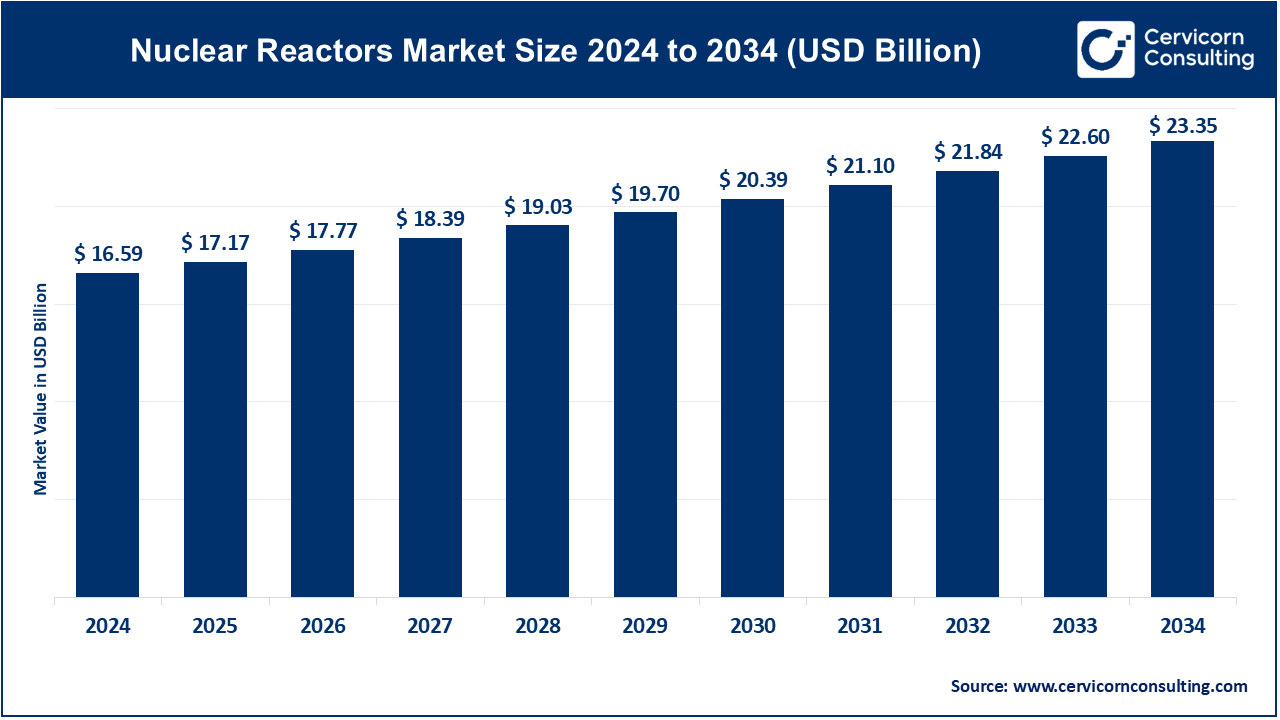

Nuclear Reactors Market Size

The global nuclear reactors market size was worth USD 16.59 billion in 2024 and is anticipated to expand to around USD 23.35 billion by 2034, registering a compound annual growth rate (CAGR) of 3.48% from 2025 to 2034.

What is the Nuclear Reactors Market?

The nuclear reactors market encompasses the design, engineering, manufacturing, construction, fuel supply, and servicing of nuclear power reactors, including both large-scale Gen-III/III+ reactors and emerging Gen-IV and SMR technologies. This market also includes downstream services: operations and maintenance (O&M), component upgrades, digital instrumentation and control systems, plant life-extension projects, fuel-cycle management, and decommissioning services.

Participants in this market include:

- Reactor technology vendors

- EPC (Engineering, Procurement & Construction) contractors

- Fuel manufacturers

- Instrumentation and control system providers

- Lifecycle service companies

- Government-backed nuclear energy corporations

Get a Free Sample: https://www.cervicornconsulting.com/nuclear-reactors-market

Why the Nuclear Reactors Market is Important

The significance of this market is rooted in three core factors:

1. Climate and decarbonization

Nuclear energy remains one of the few large-scale, low-carbon power sources capable of delivering firm, stable baseload energy. With countries setting net-zero targets, nuclear power is increasingly recognized as indispensable for grids relying heavily on intermittent renewables.

2. Energy security and geopolitical stability

The volatility of global natural gas and coal markets, combined with geopolitical tensions, has motivated many countries to re-evaluate nuclear energy as a means of achieving long-term energy independence.

3. Industrial, data center & hydrogen demand

The rise of data centers, AI workloads, hydrogen production, and high-temperature industrial processes requires clean, high-capacity, stable electricity — something nuclear delivers better than almost any other source.

Nuclear Reactors Market Growth Factors

Growth in the global nuclear reactors market is driven by accelerating decarbonization commitments, rising electricity demand from digitalization and industrial expansion, strong government incentives such as tax credits and federal loan guarantees, the need for greater energy security amid geopolitical uncertainties, advancements in SMR and Gen-III+ reactor technologies that reduce construction risks, the expansion of public–private partnerships, increased public acceptance of nuclear energy, and significant investments in life-extension, modernization and uprating of existing nuclear fleets. Combined, these factors are fueling a resurgence in nuclear investment, strengthening supply chains, expanding project pipelines, and driving consistent growth across established and emerging nuclear markets worldwide.

Top Companies in the Nuclear Reactors Market

Below is a detailed breakdown of the five major companies driving the global nuclear reactors industry, including their specialization, areas of focus, notable features, 2024 revenue (where available), market share context, and global presence.

1. General Electric (GE) / GE Vernova / GE Hitachi Nuclear Energy

Specialization

- Boiling Water Reactors (BWRs)

- Advanced reactor technologies including the SMR BWRX-300

- Grid integration and nuclear engineering services

Key Focus Areas

- Small Modular Reactors (SMRs)

- Advanced nuclear fuels and digital monitoring systems

- Nuclear services, modernization, and long-term maintenance

Notable Features

- Decades of BWR leadership

- Joint venture with Hitachi to supply advanced nuclear technologies

- Strong influence in the U.S., Japan, and global SMR programs

2024 Revenue

- GE Vernova reported approximately USD 35 billion in 2024 across its energy divisions (nuclear is a portion of that total).

Market Share & Global Presence

- Strong presence in North America, Europe, and Asia

- Increasing influence in global SMR projects

2. Westinghouse Electric Company

Specialization

- Pressurized Water Reactors (PWRs)

- AP1000 reactor design and turnkey nuclear plant solutions

- Nuclear fuel, digital control systems, and O&M services

Key Focus Areas

- Deployment of AP1000 in new markets

- Fuel supply diversification

- Modernization and life-extension services for existing plants

Notable Features

- AP1000’s passive safety systems

- Long-term engineering and fuel-cycle capabilities

- Known as a global leader in nuclear servicing

2024 Revenue

- As a privately owned company, detailed 2024 revenue numbers are not publicly disclosed.

Market Share & Global Presence

- Strong presence in the U.S., Europe, and Asia

- Key contracts for fuel supply in countries diversifying away from Russian fuel

- Serves a large share of the world’s operating nuclear reactors

3. Framatome

Specialization

- Nuclear reactor components, control systems, and comprehensive services

- Fuel assembly design and manufacturing

- Engineering support for PWR and EPR plants

Key Focus Areas

- EPR (European Pressurized Reactor) projects in Europe and Asia

- Fuel cycle solutions

- Modernization, digitalization, and long-term O&M

Notable Features

- Core supplier for French and European nuclear programs

- Major player in global nuclear fuel production

2024 Revenue

- Reported €4.68 billion in 2024, reflecting strong global service demand.

Market Share & Global Presence

- Strong footprint in Europe and the U.S.

- Technical support across global EPR projects

- Widely recognized for reliability and engineering excellence

4. Rosatom (Russia)

Specialization

- Full-scope nuclear delivery: design, construction, fuel supply, and decommissioning

- Advanced VVER reactor technology

- State-backed financing for nuclear exports

Key Focus Areas

- Turnkey international reactor projects (BOO and EPC+F models)

- Long-term fuel supply and operational services

- Development of fast reactors and closed fuel cycle technologies

Notable Features

- Large foreign order book

- Ability to provide comprehensive financing packages, making it highly competitive in emerging markets

2024 Revenue

- Consolidated revenue publicly reported in the tens of billions of USD, with international projects contributing significantly.

Market Share & Global Presence

- One of the world’s most active nuclear exporters

- Strong presence in Turkey, India, Bangladesh, Africa, and Eastern Europe

- Supplies and services multiple reactors under construction globally

5. Mitsubishi Heavy Industries (MHI)

Specialization

- Nuclear reactor components and heavy engineering

- Joint reactor development in Japan

- Turbines, steam generators, and critical equipment for nuclear plants

Key Focus Areas

- Advanced reactor components

- Japan domestic restart support

- Global supply partnerships and SMR-related development

Notable Features

- Deep heritage in heavy industry and precision engineering

- Significant contributor to Japan’s nuclear manufacturing base

2024 Revenue

- MHI reported multi-trillion-yen consolidated revenue for FY2024; nuclear forms a portion within its Energy & Infrastructure segment.

Market Share & Global Presence

- Strong presence in Japan and Asia

- Supplier of high-value components to global reactor projects

- Key player in next-generation technology partnerships

Leading Trends Reshaping the Nuclear Reactors Market

1. Rise of Small Modular Reactors (SMRs)

SMRs represent the most transformative shift in nuclear power in decades. Designed for factory production and easier financing, they promise lower capital risk, faster deployment, and better scalability.

Impact:

- New industrial players entering the market

- Larger addressable market including remote regions, industrial hubs, and hydrogen production

- Strong government-backed demonstration programs

2. Strong Government Incentives & Pro-Nuclear Policies

Countries are rolling out tax credits, loan guarantees, and direct project financing to promote nuclear energy development.

Impact:

- Higher investor confidence

- Faster approvals for new builds and restarts

- Long-term commitments for nuclear fleet modernization

3. State-Backed Export Models

Countries like Russia, China, and increasingly Korea offer attractive financing, enabling emerging economies to procure nuclear power plants.

Impact:

- Competitive pressure on Western suppliers

- Expanded nuclear adoption in developing regions

- Long-term fuel and service contracts secured by vendor nations

4. Supply Chain Expansion & Localization

Due to geopolitical constraints, many nations are diversifying away from single-vendor supply chains.

Impact:

- New domestic manufacturing and assembly centers

- Reduced reliance on foreign nuclear fuel

- Stronger global competition

5. Digitalization of Nuclear Operations

Artificial intelligence, digital twins, predictive maintenance, and remote monitoring are becoming integral to nuclear operation.

Impact:

- Improved performance and efficiency

- Lower O&M costs

- Enhanced safety and predictive oversight

6. Life-Extension and Uprate Projects

Many reactors are being upgraded to operate for 60–80 years, delaying expensive replacements.

Impact:

- Significant revenue streams for service providers

- Stable, long-term low-carbon power supply

- Cost-effective expansion of national nuclear portfolios

Successful Nuclear Reactor Projects Around the World

1. Barakah Nuclear Energy Plant (UAE)

- Built by South Korea’s KEPCO

- One of the most successful nuclear megaprojects in modern history

- All four APR-1400 units now in commercial operation

- Demonstrated on-time and well-managed nuclear deployment in a newcomer nation

2. Olkiluoto 3 (Finland)

- Europe’s first EPR reactor

- Successfully entered commercial operation, delivering one of the highest outputs of any European plant

- Significantly improved grid stability and reduced reliance on imports

3. France’s PWR Fleet

- One of the world’s most reliable nuclear fleets

- Delivers a major share of France’s low-carbon electricity

- Longstanding proof of nuclear power’s ability to sustain national-level energy independence

4. Rosatom’s Akkuyu (Turkey) & Rooppur (Bangladesh)

- Large-scale turnkey projects

- Designed, financed, and supported by Rosatom

- Showcase how developing countries can adopt nuclear through comprehensive vendor partnerships

5. South Korea’s APR-1400 Exports

- Proven high-quality engineering and efficient project delivery

- Barakah success is boosting demand for the APR-1400 model globally

Global Regional Analysis — Policies, Initiatives & Market Dynamics

North America

United States

- Renewed interest due to clean energy laws, nuclear production tax credits, and federal loan guarantees

- Federal support for SMRs and advanced reactors

- Utilities increasingly exploring nuclear for long-term decarbonization

Canada

- Major SMR initiatives in Ontario and Saskatchewan

- Advanced reactors planned for remote mines and industrial hydrogen production

- Strong provincial and federal policy alignment

Europe

Western Europe

- France leading a resurgence with plans for multiple new EPR2 reactors

- UK investing in both large reactors and SMRs

- Several countries restoring or expanding nuclear support after the energy crisis

EU Policies

- Inclusion of nuclear in the EU taxonomy under strict conditions

- Opens channels for institutional funding

- Continued debates among member states, but increasingly favorable environment

Asia-Pacific

China

- World’s largest builder of nuclear reactors

- Rapid deployment of both indigenous and imported designs

- Strong push for domestic SMR development and exports

Japan

- Gradual restart of reactors under stringent new safety rules

- Domestic companies like MHI and Hitachi advancing reactor innovation

South Korea

- Strong export ambitions following Barakah success

- Growing pipeline of international partnerships

Emerging Markets (Middle East, Africa, South Asia)

Middle East

- UAE’s Barakah plant sets a benchmark for nuclear newcomers

- Saudi Arabia exploring large-scale nuclear programs

- Regional interest driven by industrial loads and desalination needs

Africa

- Countries like Egypt and South Africa evaluating new builds

- Vendor financing critical to project realization

South Asia

- Bangladesh building its first reactors

- India expanding its domestic reactor program and exploring SMRs

- Strong state-backed financing impacting adoption trends

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Flexible Packaging Market Revenue, Global Presence, and Strategic Insights by 2035