Nitrogenous Fertilizer Market Growth Drivers, Trends, Key Players and Regional Insights by 2035

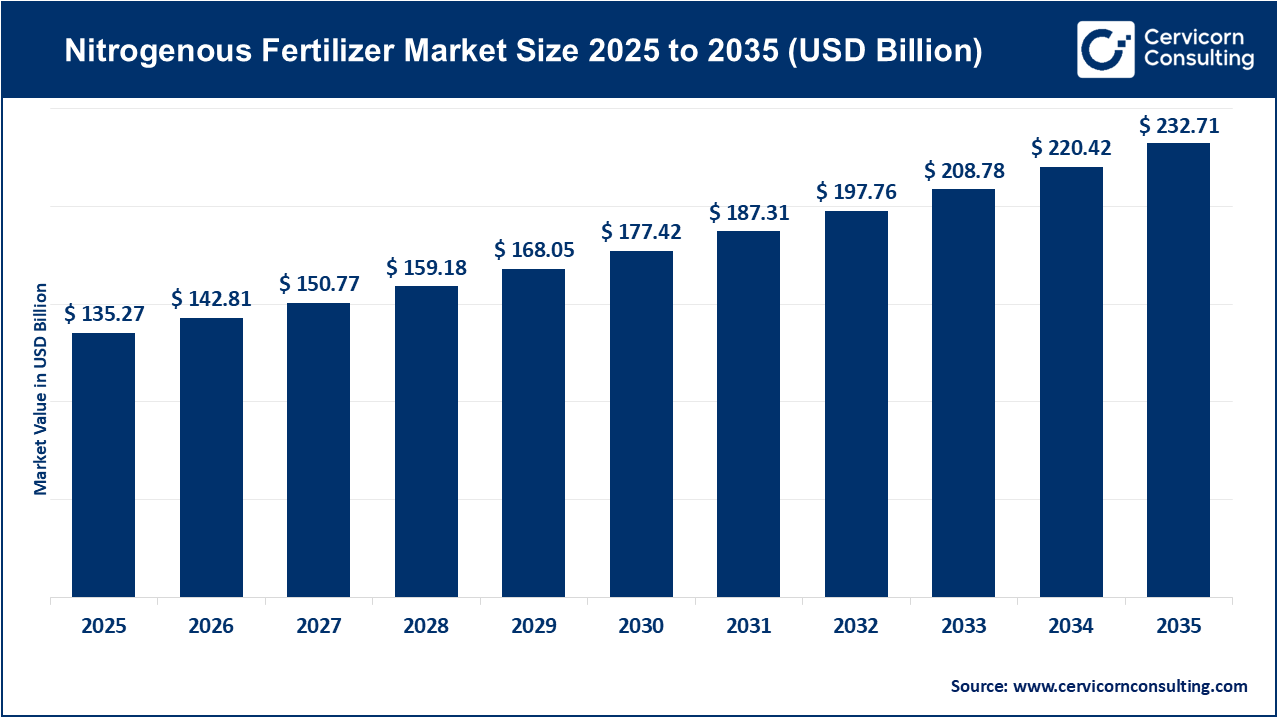

Nitrogenous Fertilizer Market Size

The global nitrogenous fertilizer market size was worth USD 135.27 billion in 2025 and is anticipated to expand to around USD 232.71 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% from 2026 to 2035.

What Is the Nitrogenous Fertilizer Market?

The nitrogenous fertilizer market comprises producers, distributors, and traders of nitrogen-rich fertilizers manufactured primarily from ammonia. Ammonia—generated through the Haber-Bosch process—is the building block for most nitrogen products including urea, ammonium nitrate, CAN, and UAN. The market covers every stage from feedstock procurement (mainly natural gas, though coal and renewable hydrogen are increasingly relevant) and chemical processing to storage, blending, distribution, and farm-level application.

Demand for nitrogen fertilizers is rooted in global agriculture’s need to maintain soil fertility, intensify cropping, and boost yields. Because nitrogen is the most yield-responsive nutrient in most crops, farmers across the world rely on nitrogenous fertilizers to maintain productivity, achieve higher protein content in cereals, and support sustainable food systems. Supply, meanwhile, is heavily influenced by global energy prices, international trade flows, production capacity expansions, export policies, and innovations in nitrogen efficiency.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2841

Why Is the Nitrogenous Fertilizer Market Important?

Nitrogenous fertilizers are the backbone of agricultural output. Without sufficient nitrogen, crop yields can drop by 30–50% or more, jeopardizing food security in regions dependent on staple grains. Nitrogen enables proper plant development, chlorophyll formation, and protein synthesis. Beyond agronomy, the nitrogenous fertilizer market is deeply intertwined with global energy markets, national trade balances, environmental policies, and rural livelihoods.

In many developing economies, governments subsidize fertilizers to maintain farmer incomes and ensure food availability. In advanced markets, environmental compliance, sustainability targets, and precision agriculture practices significantly influence nitrogen demand. As a result, the nitrogen fertilizer market is not only an agricultural segment—it is a system that shapes global food security, sustainability transitions, and macroeconomic stability.

Nitrogenous Fertilizer Market Growth Factors

Growth of the nitrogenous fertilizer market is driven by rising global food demand, increased per-capita caloric consumption, expansion of commercial agriculture in Asia, Africa, and Latin America, and the need to replenish nutrients in intensively farmed soils. The adoption of precision agriculture, fertigation, and controlled-release fertilizers is increasing nitrogen efficiency and reshaping product mixes. Government subsidies and rural support programs help maintain farmer demand even amid price volatility.

At the same time, investments in low-carbon nitrogen production—such as green ammonia from renewable hydrogen—are accelerating as companies pursue sustainability goals. While supply remains sensitive to feedstock prices, geopolitical shifts, and export restrictions, the combined agricultural, environmental, and technological drivers are pushing global demand upward, even as markets transition toward smarter and more efficient nitrogen use.

Company Profiles

1) Bunge Ltd.

- Company: Bunge Limited

- Specialization: Global agribusiness, grain merchandising, oilseed processing, and agricultural input distribution.

Key Focus Areas: Supply chain integration, trading, grain origination, oilseed processing, value-added food ingredients, and agri-input distribution. - Notable Features: Bunge operates one of the world’s most extensive agricultural logistics networks, enabling distribution of fertilizers alongside grains and oilseeds. Its large storage, port, and transportation footprint strengthens its role as a key supply-chain partner. In 2024, the company continued major M&A restructuring to expand global reach.

- 2024 Revenue: Approximately $53.1 billion in net sales.

- Market Share: While not a pure nitrogen fertilizer manufacturer, Bunge holds a strong position in fertilizer trading and distribution across the Americas, Europe, and Asia.

- Global Presence: North America, South America, Europe, and Asia, with deep logistics integration and partnerships worldwide.

2) Sorfert (Sorfert Algérie SPA)

- Company: Sorfert Algérie

- Specialization: Large-scale nitrogen fertilizer production—primarily ammonia and granular urea.

- Key Focus Areas: Industrial ammonia and urea production, domestic supply support, and large-volume exports through integrated port facilities.

- Notable Features: Sorfert operates one of North Africa’s most advanced ammonia–urea complexes located in Arzew, Algeria. Its integration with local natural gas supply and its proximity to export terminals gives it significant competitive advantages in the Mediterranean and European markets.

- 2024 Revenue: Specific 2024 revenue is not publicly disclosed in a consolidated annual report, though the company is known to generate substantial export earnings and dividend flows through its parent and JV structures.

- Market Share: One of the largest nitrogen fertilizer producers in North Africa, with over a million tonnes of combined ammonia and urea production capacity.

- Global Presence: Strong regional presence with exports to Europe, Latin America, and other global markets via the Arzew port.

3) OCI Nitrogen (OCI Global / OCI N.V.)

- Company: OCI Global (OCI N.V.)

- Specialization: Ammonia, urea, UAN, and a portfolio of nitrogen-based industrial and agricultural products.

- Key Focus Areas: Nitrogen optimization, portfolio restructuring, efficiency enhancement, and expansion of low-carbon ammonia initiatives.

- Notable Features: OCI is recognized for its large-scale nitrogen production assets across Europe and the Middle East, along with recent divestments in methanol to refocus on nitrogen. Its supply chain, logistics capabilities, and energy integration support its competitive position.

- 2024 Revenue: Around $975 million from continuing operations (European Nitrogen + Corporate).

- Market Share: Considered a major global player in nitrogen production; exact share varies by region and product category.

- Global Presence: Active in Europe, the Middle East, North Africa, and global merchant ammonia markets.

4) EuroChem Group

- Company: EuroChem Group AG

- Specialization: Fully integrated fertilizer manufacturing—nitrogen, phosphate, potash, and NPK complexes.

- Key Focus Areas: Vertical integration, mining expansion, nitrogen product development, sustainability improvements, and global distribution.

- Notable Features: One of the few companies globally with full N-P-K integration. Strong investments in Brazil, Europe, and CIS markets have strengthened its logistics and manufacturing capabilities. Offers one of the broadest nutrient product portfolios worldwide.

- 2024 Revenue: EuroChem’s detailed 2024 consolidated revenue is published in its annual financial report; however, due to currency fluctuations and geographic reporting variations, the exact USD figure is not universally listed in summaries.

- Market Share: Among the world’s top-tier fertilizer producers, holding major shares across nitrogen, phosphate, potash, and specialty products.

- Global Presence: Operations in Europe, Russia, Brazil, the United States, and Asia.

5) Kynoch Fertilizer

- Company: Kynoch Fertilizer

- Specialization: Granular fertilizers, liquid fertilizers, custom blends, and micronutrient-coated specialty products for Southern African agriculture.

- Key Focus Areas: Crop-specific formulation, blending innovation, precision nutrient solutions, and farmer advisory services.

- Notable Features: One of the most established fertilizer producers in Southern Africa, known for blending facilities, localized agricultural expertise, and specialty starter fertilizers.

- 2024 Revenue: Not publicly disclosed; Kynoch is a regional private entity without global financial filings.

- Market Share: Strong presence within South Africa and neighboring markets; not categorized as a global nitrogen market shareholder.

- Global Presence: Primarily South Africa and select Southern African markets.

Leading Trends and Their Impact

1. Green Ammonia and Decarbonization

The shift toward renewable hydrogen and low-carbon ammonia is one of the most transformative industry trends. Producers are investing in electrolysis, carbon capture, and hybrid production systems to reduce carbon intensity. This affects long-term production costs, trade routes, and regulatory positioning, especially in markets with carbon taxes or emissions restrictions.

2. Feedstock Price Volatility

Natural gas remains the dominant feedstock for ammonia production. Fluctuating energy prices in Europe and LNG-dependent markets have driven margin swings. Regions with low-cost gas—such as the Middle East and North Africa—retain structural cost advantages and continue expanding export capacity.

3. Precision Agriculture and Enhanced-Efficiency Fertilizers

Adoption of stabilizers, inhibitors, coated urea, and slow-release formulations has accelerated. These products improve nitrogen-use efficiency, reduce emissions, and help meet environmental regulations. They are also increasingly integrated with digital tools such as satellite monitoring and sensor-based applications.

4. Government Subsidies and Pricing Policies

Subsidy schemes in India, China, and sub-Saharan Africa significantly influence fertilizer affordability and demand. Export bans, price ceilings, and nutrient-based subsidy updates help stabilize farmer incomes but can disrupt global prices and supply availability.

5. Vertical Integration and Consolidation

Major companies are acquiring blending units, logistics assets, and downstream retail channels. Vertical integration improves resilience against supply-chain disruptions and provides farmers with bundled nutrient + advisory services.

6. Environmental and Regulatory Pressures

Stricter nitrate contamination rules, emission reporting requirements, and global sustainability commitments are pushing the industry toward controlled-release products, lower application rates, and integrated soil fertility programs.

Successful Examples of Nitrogenous Fertilizer Market Development Around the World

1. Gulf Cooperation Council (GCC) Export Platforms

Producers in the UAE, Saudi Arabia, and Qatar have built some of the world’s most efficient ammonia and urea production systems. Low-cost gas feedstock, large-scale plants, and port infrastructure enable high export volumes. These facilities often maintain strong profitability even during global downturns.

2. North African Integrated Complexes

Facilities such as Algeria’s Sorfert demonstrate how joint ventures supported by stable energy supply and export terminals can create globally competitive production sites.

3. European Value-Added Nitrogen Segments

EU fertilizer companies have excelled by combining blending expertise with agronomic advisory services, enabling premium pricing for stabilized nitrogen products that align with the region’s strict environmental regulations.

4. North American Agronomy-Integrated Retail Systems

Large retail networks offering nitrogen fertilizers bundled with precision agriculture tools, soil testing, and variable-rate application have improved fertilizer efficiency and strengthened customer loyalty.

5. Brazil’s Rapid Growth in NPK and Nitrogen Blending

Brazil’s agricultural expansion, particularly in soy and corn, has led to major investments in local blending, logistics upgrades, and import terminals, creating one of the fastest-growing fertilizer markets.

Global Regional Analysis and Government Policies Shaping the Market

Asia-Pacific

The largest consumer of nitrogen fertilizers globally.

- India: Strongly subsidy-driven market; government policies shape annual demand, prevent extreme price volatility, and promote balanced nutrient use.

- China: A major producer with policies focused on reducing emissions, optimizing production efficiency, and ensuring domestic supply security.

Europe

Europe’s nitrogen market is heavily influenced by environmental regulations, carbon pricing, and decarbonization strategies. High natural gas costs have led to temporary shutdowns and operational adjustments in several countries. The EU’s hydrogen and decarbonization policies are accelerating investments in green ammonia pilots.

North America

A technologically advanced market with high adoption of enhanced-efficiency fertilizers. U.S. and Canadian producers benefit from relatively stable natural gas prices and well-integrated transport networks. Sustainability, emissions reduction, and precision agriculture are major market drivers.

Latin America

Demand continues to grow rapidly, driven by crop expansion in Brazil and Argentina. Government efforts to reduce import dependency, combined with investments in ports and inland storage, are improving supply chain reliability. These developments encourage more stable nitrogen fertilizer availability.

Middle East & North Africa

A global powerhouse for ammonia and urea exports. Abundant natural gas, strategic port networks, and supportive government policies create highly competitive production environments. Countries across MENA are also emerging as major investors in green hydrogen and green ammonia projects.

Sub-Saharan Africa

A mix of domestic production (e.g., South Africa) and significant import dependence. Governments, regional blocs, and development partners support fertilizer subsidy programs, blending plant expansions, and logistics improvements. Market growth is tied to improving access, affordability, and farmer education.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Chemical Intermediates Market Growth Drivers, Trends, Key Players and Regional Insights by 2035