Logistics Market Trends, Top Companies, and Key Insights by 2034

Logistics Market Overview

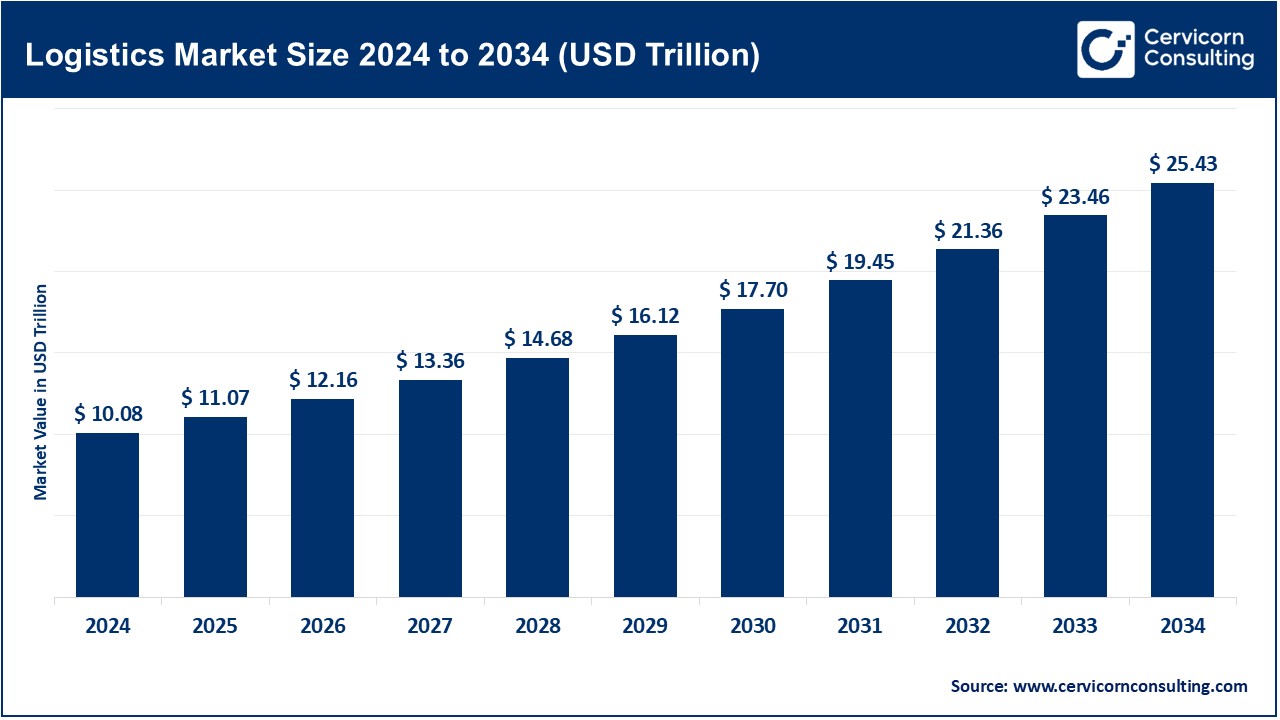

The global logistics market was valued at an estimated USD 10.08 trillion in 2024 and is expected to increase to USD 25.43 trillion by 2034, with a compound annual growth rate (CAGR) of 9.69%. The growth of the logistics market is driven by several key factors, including the rapid expansion of e-commerce, which demands efficient supply chain solutions and last-mile delivery services. Advancements in technology, such as artificial intelligence, big data analytics, and Internet of Things (IoT), are enhancing operational efficiency and enabling real-time tracking. Globalization has increased cross-border trade, necessitating robust international logistics networks.

Additionally, growing consumer expectations for faster and more reliable deliveries have spurred innovation in automation and sustainable practices. Government initiatives and investments in infrastructure development, coupled with the rise of 3PL (third-party logistics) services, are further fueling the market’s expansion across regions.

Why is the Logistics Market Important?

The logistics market is the engine of globalization, connecting producers to consumers and businesses to markets. Its importance lies in its ability to:

- Enhance Efficiency: By optimizing supply chain processes, logistics companies ensure timely delivery, reduce costs, and improve operational efficiencies.

- Drive Economic Growth: Efficient logistics systems boost trade by reducing the cost of goods movement, making markets more accessible.

- Support E-commerce Growth: Logistics is a critical enabler for the booming e-commerce sector, ensuring last-mile delivery and fast shipping.

- Ensure Resilience: Amid disruptions such as pandemics or geopolitical tensions, advanced logistics systems maintain supply chain continuity.

- Sustainability: Innovations in logistics are driving sustainable practices, including reduced carbon emissions and energy efficiency.

Top Companies in the Logistics Market

DHL Supply Chain & Global Forwarding

- Specialization: Freight transportation, warehousing, and supply chain management.

- Key Focus Areas: Digital transformation, sustainability, and global connectivity.

- Notable Features: Extensive network spanning over 220 countries and territories, cutting-edge digital platforms, and carbon-neutral logistics solutions.

- 2023 Revenue (Approx.): $42 billion.

- Market Share (Approx.): 14% of the global logistics market.

- Global Presence: Dominant in Europe, Asia-Pacific, and North America, with strong capabilities in emerging markets.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2316

FedEx Corporation

- Specialization: Express delivery, e-commerce solutions, and freight forwarding.

- Key Focus Areas: Technology-driven logistics, last-mile delivery, and customer experience.

- Notable Features: Extensive overnight shipping services, advanced tracking systems, and robust e-commerce logistics.

- 2023 Revenue (Approx.): $93 billion.

- Market Share (Approx.): 12% globally.

- Global Presence: Strong presence in North America and Europe, with expanding networks in Asia-Pacific.

United Parcel Service, Inc. (UPS)

- Specialization: Parcel delivery, freight transportation, and supply chain consulting.

- Key Focus Areas: Speed, reliability, and integrated solutions.

- Notable Features: Industry-leading delivery times, robust infrastructure, and innovative sustainable packaging solutions.

- 2023 Revenue (Approx.): $102 billion.

- Market Share (Approx.): 15% of the global logistics market.

- Global Presence: Comprehensive global network with dominance in North America and Europe.

C.H. Robinson Worldwide, Inc.

- Specialization: Freight brokerage, supply chain management, and logistics technology.

- Key Focus Areas: Digital freight matching and real-time visibility.

- Notable Features: Advanced TMS platforms, extensive carrier network, and custom logistics solutions.

- 2023 Revenue (Approx.): $24 billion.

- Market Share (Approx.): 6% globally.

- Global Presence: Significant operations in North America, Europe, and Asia.

Kuehne + Nagel International AG

- Specialization: Ocean freight, air freight, and contract logistics.

- Key Focus Areas: Data-driven decision-making, sustainability, and customer-centric solutions.

- Notable Features: Leading market position in sea freight, digital platforms for visibility, and expertise in pharmaceutical logistics.

- 2023 Revenue (Approx.): $39 billion.

- Market Share (Approx.): 10% globally.

- Global Presence: Broad presence in Europe, Asia, and the Americas, with a strong foothold in emerging markets.

Leading Trends in the Logistics Market and Their Impact

Digital Transformation

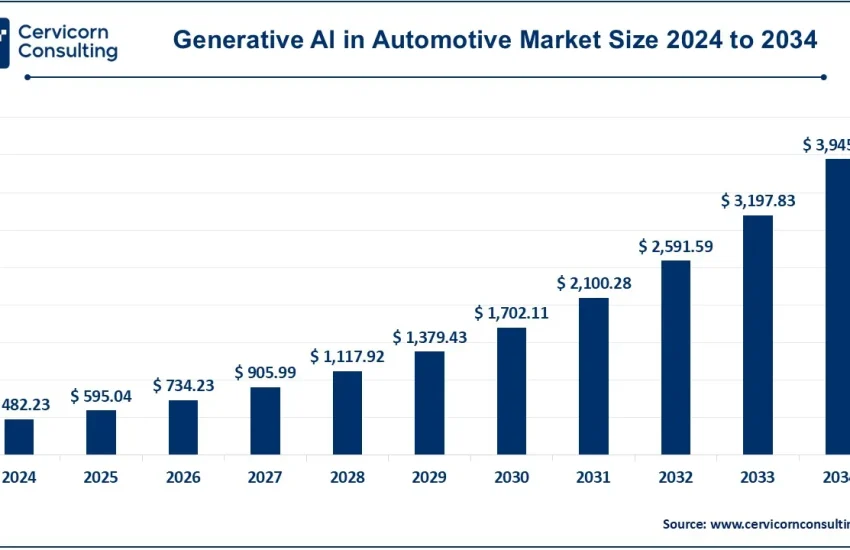

- Impact: The adoption of technologies like Artificial Intelligence (AI), Internet of Things (IoT), and Blockchain is revolutionizing logistics operations. These technologies enhance transparency, improve efficiency, and reduce costs.

- Examples: UPS’s Orion route optimization tool and DHL’s smart warehouse solutions.

E-commerce Integration

- Impact: The rise of e-commerce demands faster delivery and efficient reverse logistics. Companies are investing in last-mile delivery innovations and automated fulfillment centers.

- Examples: FedEx’s partnership with Shopify for e-commerce logistics.

Sustainability Initiatives

- Impact: With increasing environmental concerns, logistics companies are focusing on green technologies, such as electric vehicles and carbon-neutral shipping.

- Examples: DHL’s GoGreen program and Kuehne + Nagel’s Net Zero Carbon initiative.

Automation and Robotics

- Impact: Automated warehousing and robotics are streamlining operations, reducing errors, and improving efficiency.

- Examples: Amazon’s automated warehouses and DHL’s use of autonomous delivery robots.

Resilience in Supply Chains

- Impact: Post-pandemic, companies are building resilient supply chains by diversifying suppliers and leveraging real-time data analytics.

- Examples: C.H. Robinson’s real-time freight visibility tools.

Some Successful Examples of the Logistics Market Around the World

Amazon’s Logistics Ecosystem (Global)

Why It’s Successful:

Amazon’s in-house logistics network is a benchmark for efficiency and innovation. The company has built a global delivery ecosystem comprising warehouses, sorting centers, and last-mile delivery services.

- Notable Features:

- Use of robotics in warehouses to enhance operational efficiency.

- Real-time tracking and predictive analytics for inventory management.

- Amazon Prime’s two-day and same-day delivery options.

- Drone delivery initiatives like Amazon Prime Air.

Impact:

Amazon’s logistics system has set a high standard for e-commerce logistics, compelling other companies to adopt similar innovations.

DHL Supply Chain & Global Forwarding (Europe and Global)

Why It’s Successful:

DHL has established itself as a leader in global logistics through its vast network and commitment to sustainability.

- Notable Features:

- Extensive coverage across 220+ countries and territories.

- Deployment of digital platforms for real-time shipment tracking.

- The GoGreen initiative for carbon-neutral shipping solutions.

- Specialized services for sectors like healthcare, automotive, and retail.

Impact:

DHL’s focus on technology and sustainability has reinforced its position as a reliable logistics partner, especially in emerging markets.

Alibaba’s Cainiao Network (China)

Why It’s Successful:

Cainiao, Alibaba’s logistics arm, has revolutionized e-commerce logistics in China and beyond by integrating advanced technology and partnerships.

- Notable Features:

- Smart logistics hubs leveraging IoT and big data for real-time operations.

- Automated sorting centers and drone delivery trials.

- Seamless integration with Alibaba’s e-commerce platforms.

- Global logistics alliances to enhance cross-border trade.

Impact:

Cainiao has enabled rapid e-commerce growth in China and positioned Alibaba as a global logistics powerhouse.

Regional Analysis and Government Initiatives

North America

- Key Features: A mature logistics market characterized by advanced infrastructure, high technology adoption, and a strong e-commerce sector.

- Government Initiatives: Investments in smart infrastructure and transportation networks, such as the Bipartisan Infrastructure Deal in the U.S.

- Market Impact: Accelerated digital transformation and growing demand for last-mile delivery solutions.

Europe

- Key Features: A robust logistics network with a strong emphasis on sustainability and innovation.

- Government Initiatives: European Union’s Green Deal targeting carbon-neutral logistics by 2050 and support for rail freight.

- Market Impact: Growth in sustainable logistics and intermodal transportation.

Asia-Pacific

- Key Features: A rapidly growing market driven by e-commerce, urbanization, and economic development.

- Government Initiatives: India’s National Logistics Policy aiming to reduce costs and improve infrastructure, and China’s Belt and Road Initiative boosting regional connectivity.

- Market Impact: Expansion of logistics networks and increased investments in technology.

Latin America

- Key Features: Emerging market with growing e-commerce demand and challenges in infrastructure.

- Government Initiatives: Regional trade agreements and investments in transport infrastructure.

- Market Impact: Opportunities for logistics providers to establish a stronger foothold.

Middle East and Africa

- Key Features: Strategic location for global trade and significant investments in logistics hubs.

- Government Initiatives: Development of free trade zones and investments in port infrastructure, such as the UAE’s Khalifa Port expansion.

- Market Impact: Increased importance as a global logistics hub.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report:

Materials Informatics Market Trends, Top Companies, and Insights 2024 – 2033