IT Outsourcing Market Revenue, Global Presence, and Strategic Insights by 2035

IT Outsourcing Market Sizer

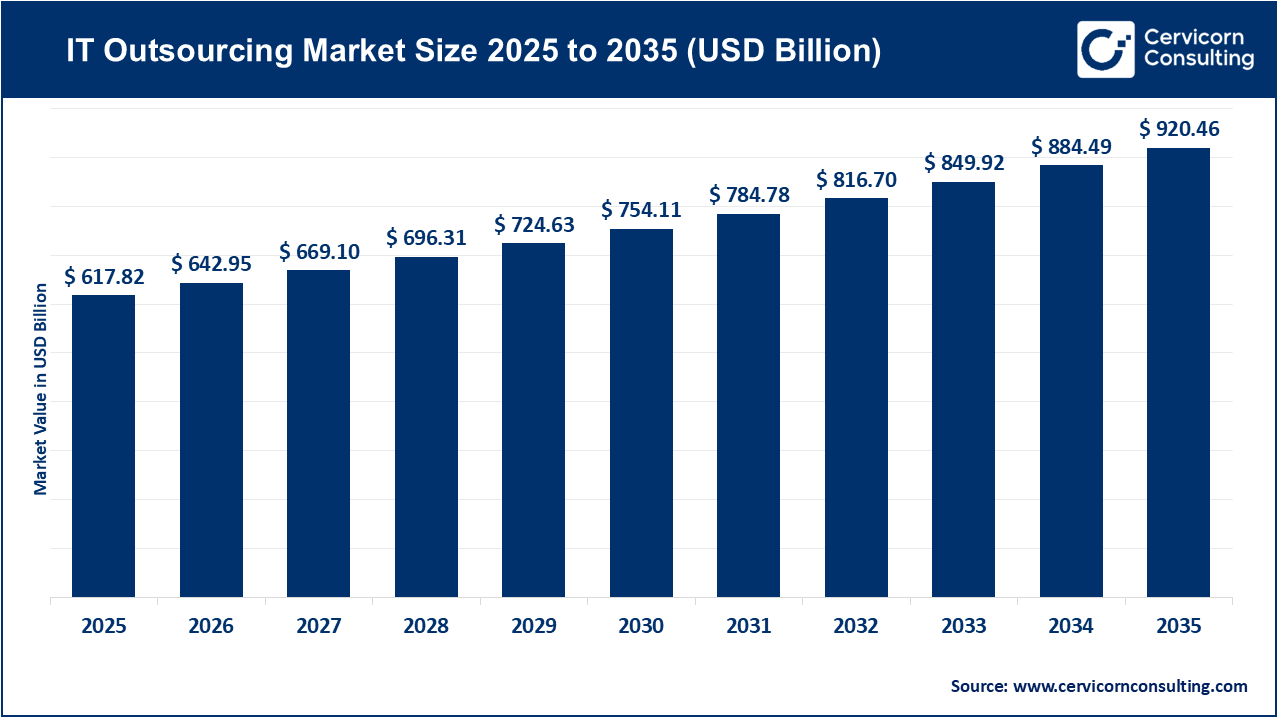

The global IT outsourcing market size was worth USD 617.82 billion in 2025 and is anticipated to expand to around USD 920.46 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% from 2026 to 2035.

What Is the IT Outsourcing Market?

The IT outsourcing market refers to the practice where organizations delegate their information technology functions — such as software development, infrastructure management, cybersecurity, cloud operations, technical support, and even business processes — to external service providers. These partnerships can be transactional (short-term, project-based) or strategic (long-term, end-to-end managed services). Outsourcing may be onshore, offshore, or nearshore, depending on cost, talent availability, and regulatory considerations. The market covers a wide range of services including application development, infrastructure and network management, digital transformation consulting, data analytics, AI engineering, process automation, platform modernization, and managed security services.

Organizations use outsourcing to reduce operational costs, improve service quality, accelerate digital transformation, access specialized talent, and scale technological capabilities without incurring full internal hiring or infrastructure expenses.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2839

IT Outsourcing Market — Growth Factors

The growth of the global IT outsourcing market is being fueled by rapid digital transformation across sectors, the urgent need to modernize legacy core systems, and the global shift toward cloud-first and AI-driven architectures; rising enterprise adoption of automation, advanced analytics, cybersecurity frameworks, and platform modernization is pushing companies to rely on specialized outsourcing providers; the worldwide shortage of skilled IT professionals, especially in cloud engineering, cybersecurity, AI/ML, and DevOps, is accelerating the outsourcing of high-value digital capabilities.

Continuous cost optimization pressures, the need for flexible operating models, and unpredictable economic cycles are further driving companies toward variable-cost outsourcing; additionally, regulatory complexity, industry-specific compliance requirements, and the shift from fixed contracts to outcome-based partnerships all contribute to the market’s expansion and the deepening of client–vendor strategic engagements.

Why Is IT Outsourcing Important?

IT outsourcing is crucial because it allows organizations to focus on their core strengths while leveraging specialized external expertise to accelerate innovation and digital transformation. Companies benefit from improved operational efficiency, reduced capital investment, and access to global talent pools that may not be available locally. Outsourcing partners offer advanced skills in AI, cloud, cybersecurity, and platform engineering, enabling rapid scaling and faster time-to-market for new technologies. It also enhances business agility, improves service reliability through well-defined SLAs, reduces cybersecurity risks through expert-managed security services, and helps enterprises manage regulatory and compliance demands more effectively. For many businesses, outsourcing is a strategic necessity to stay competitive in a rapidly evolving digital landscape.

Top IT Outsourcing Companies

1. Tata Consultancy Services (TCS)

Specialization: End-to-end IT services including application development, digital transformation, cloud services, enterprise platforms, and engineering.

Key Focus Areas: BFSI, retail, manufacturing, telecom, AI-driven transformation, enterprise modernization, and cloud-native development.

Notable Features: Massive global delivery footprint, strong domain expertise, industry-specific platforms, and long-standing Fortune 500 relationships.

2024 Revenue: Approximately US$29.1 billion.

Market Share: Consistently among the top global IT services and outsourcing firms by revenue.

Global Presence: Offices and delivery centers across the U.S., Europe, India, Latin America, APAC, and Middle East.

2. Infosys

Specialization: Digital consulting, product engineering, cloud migration, AI/automation, and cybersecurity.

Key Focus Areas: Financial services, retail, energy, telecom, and enterprise platform modernization.

Notable Features: Strong consulting-led model, globally recognized digital transformation frameworks, and industry-leading reskilling programs.

2024 Revenue: Approximately ₹153,670 crore.

Market Share: One of the world’s leading IT services providers with a strong position in North America and Europe.

Global Presence: Delivery centers across India, Europe, the U.S., Australia, and Southeast Asia.

3. IBM

Specialization: Hybrid cloud services, enterprise software, AI technologies, cybersecurity, and IT consulting.

Key Focus Areas: Cloud modernization, mainframe transformation, AI integration, analytics, and enterprise security solutions.

Notable Features: Strong IP portfolio, leadership in enterprise-grade AI, deep expertise in regulated industries, and hybrid cloud capabilities.

2024 Revenue: Around US$60–63 billion.

Market Share: Among the top global enterprise IT companies with significant outsourcing and consulting operations.

Global Presence: Extensive presence across the Americas, Europe, Asia, and government sectors worldwide.

4. Cognizant

Specialization: Digital engineering, cloud services, business process outsourcing, and consulting.

Key Focus Areas: Healthcare, BFSI, life sciences, consumer goods, and digital product engineering.

Notable Features: Strong North American client base, integrated digital + operations offerings, and advanced automation capabilities.

2024 Revenue: About US$19.7 billion.

Market Share: Positioned among the top 10 global IT and outsourcing companies.

Global Presence: North America, Europe, India, Philippines, LATAM, and expanding APAC presence.

5. Capgemini

Specialization: Technology consulting, digital transformation, cloud integration, systems integration, and engineering services.

Key Focus Areas: Cloud transformation, green IT, sustainability, business consulting, and industry-specific digitization.

Notable Features: Strong European footprint, deep consulting heritage, and global engineering capabilities via Capgemini Engineering.

2024 Revenue: Approximately €22.1 billion.

Market Share: One of Europe’s largest IT and outsourcing providers with significant global market influence.

Global Presence: Europe, North America, APAC, Middle East, and Africa.

6. Atos

Specialization: Managed infrastructure services, cloud, cybersecurity, and high-performance computing.

Key Focus Areas: Public sector, defense, healthcare, cybersecurity operations, and digital infrastructure services.

Notable Features: Strong specialization in secure and sovereign cloud solutions, HPC systems, and critical public-sector digital operations.

2024 Revenue: Nearly €9.6 billion.

Market Share: One of Europe’s major outsourced IT service providers.

Global Presence: Strong European base, with additional operations in North America, APAC, and the Middle East.

Leading Trends in the IT Outsourcing Market and Their Impact

1. AI-Driven Outsourcing Partnerships

AI is reshaping outsourcing by automating repetitive tasks, enabling predictive operations, and enhancing decision-making. Vendors now embed AI in contracts to ensure continuous optimization.

Impact: Lower operational cost for clients, higher-value responsibilities for vendors, and outcome-based pricing models.

2. Multi-Cloud & Hybrid Cloud Managed Services

Enterprises are adopting distributed cloud architectures across AWS, Azure, Google Cloud, and private clouds.

Impact: High demand for cloud-native skills, platform engineers, SRE teams, and 24/7 managed cloud operations.

3. Outcome-Based and Value-Linked Contracts

Traditional time-and-materials models are declining. Enterprises now prefer KPIs like uptime, cost efficiency, or revenue impact.

Impact: Vendors assume greater risk but gain stronger long-term partnerships.

4. Nearshoring and Regional Delivery Expansion

The need for faster delivery, lower latency, and compliance alignment is pushing companies to build delivery centers closer to clients.

Impact: Growing outsourcing hubs in Eastern Europe, Mexico, Brazil, Vietnam, and the Middle East.

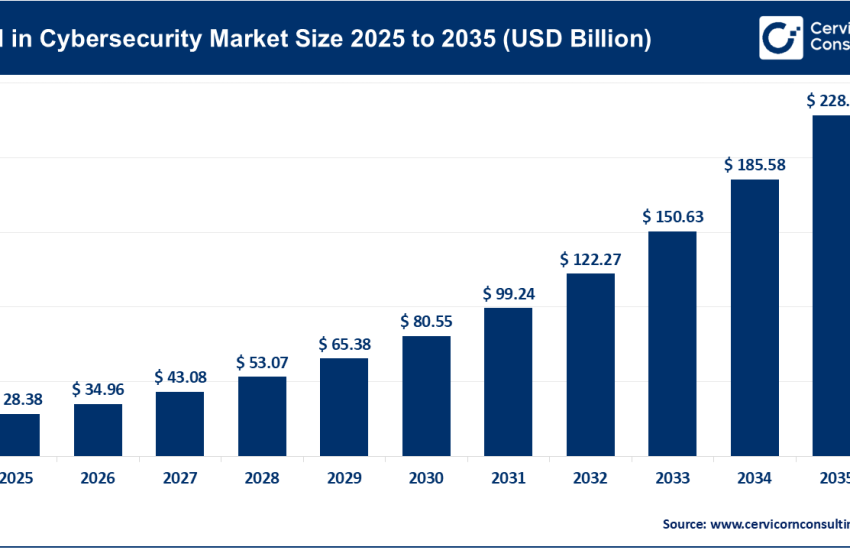

5. Cybersecurity-Integrated Managed Services

With rising cyber threats, cybersecurity is no longer a standalone service but a core layer of every outsourcing contract.

Impact: Vendors expand SOC operations, zero-trust frameworks, MDR services, and compliance monitoring.

6. Sustainability and Green IT Outsourcing

Organizations are demanding eco-friendly data centers, energy-efficient cloud architectures, and sustainability reporting.

Impact: Outsourcing vendors integrate green practices into SLAs and form sustainability-based service models.

7. Rise of Build-Operate-Transfer (BOT) Models & Global Talent Centers

Companies increasingly rely on BOT centers for long-term capability building.

Impact: Hybrid insourcing-outsourcing models drive talent development in India, Poland, Mexico, and the Philippines.

Successful Examples of IT Outsourcing Around the World

1. Large Bank Core System Modernization

A top-tier global bank partnered with a major IT outsourcing provider to modernize its legacy core banking platform.

Outcome: Faster product launches, reduced infrastructure costs, and improved customer experience.

2. Government Digital Transformation Initiatives

Several governments have outsourced e-governance systems, cloud infrastructure, identity management, and digital public services.

Outcome: Enhanced citizen service delivery, improved resilience, and scalable digital platforms.

3. Healthcare Payer Claims Modernization

A leading healthcare insurer outsourced claims management, analytics, and process automation to transform service delivery.

Outcome: Faster claims processing, improved accuracy, and reduced administrative overhead.

4. Retail E-commerce Digital Platform Modernization

Retailers are outsourcing omnichannel platforms, cloud-native applications, and customer analytics to global IT service firms.

Outcome: Higher conversion rates, better customer insights, and scalable digital engagement.

These success stories show that effective governance, strong vendor relationships, optimized SLAs, and robust data security are the cornerstones of successful IT outsourcing.

Global Regional Analysis, Government Initiatives & Policies

North America (U.S. & Canada)

Market Drivers:

- Rapid digital modernization of enterprises

- Strong demand for cloud, AI, analytics, and cybersecurity

- Highly competitive business landscape requiring faster innovation

Government Influence:

- Strict cybersecurity compliance standards (FedRAMP, CMMC)

- Data privacy laws at federal and state levels

- Incentives for domestic tech capability building

Impact:

Firms with strong regulatory expertise and local delivery presence gain preference.

Europe (UK, Germany, France, Nordics, etc.)

Market Drivers:

- High emphasis on data privacy, regulatory compliance, and green IT

- Increasing digital public services and industry-specific modernization

Government Influence:

- GDPR and stringent data protection mandates

- Cybersecurity directives (e.g., the NIS framework)

- Public-sector procurement favoring regional providers

Impact:

Vendors must adhere to stringent compliance requirements, encouraging growth of EU-based service hubs.

Asia-Pacific (India, China, Japan, SE Asia, Australia)

Market Drivers:

- Fast-growing digital economies

- Significant cost advantages in software development & IT operations

- Expanding cloud and AI adoption

Government Influence:

- India’s Digital India and technology export incentives

- China’s localized technology development policies

- Regional investments in smart cities and digital infrastructure

Impact:

APAC remains a global outsourcing powerhouse with a strong technical talent base.

Latin America (Brazil, Mexico, Colombia, Chile)

Market Drivers:

- Strategic nearshore advantage for U.S. organizations

- Growth in fintech, telecom, and digital services

- Bilingual tech workforce with competitive labor costs

Government Influence:

- Digital transformation policies

- Technology-focused investment incentives

- Expansion of regional data centers

Impact:

Latin America continues to rise as a preferred nearshore destination.

Middle East & Africa (UAE, Saudi Arabia, South Africa, Egypt)

Market Drivers:

- National transformation agendas (Vision 2030, smart cities)

- Rapid cloud adoption and digital public service modernization

- Growing cybersecurity requirements

Government Influence:

- Sovereign cloud initiatives

- Cybersecurity frameworks and compliance standards

- Investments in national digital infrastructure

Impact:

Strong demand for cloud, cybersecurity, and managed services, especially from government and large enterprises.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Display Market Revenue, Global Presence, and Strategic Insights by 2035