Inulin Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Inulin Market Size

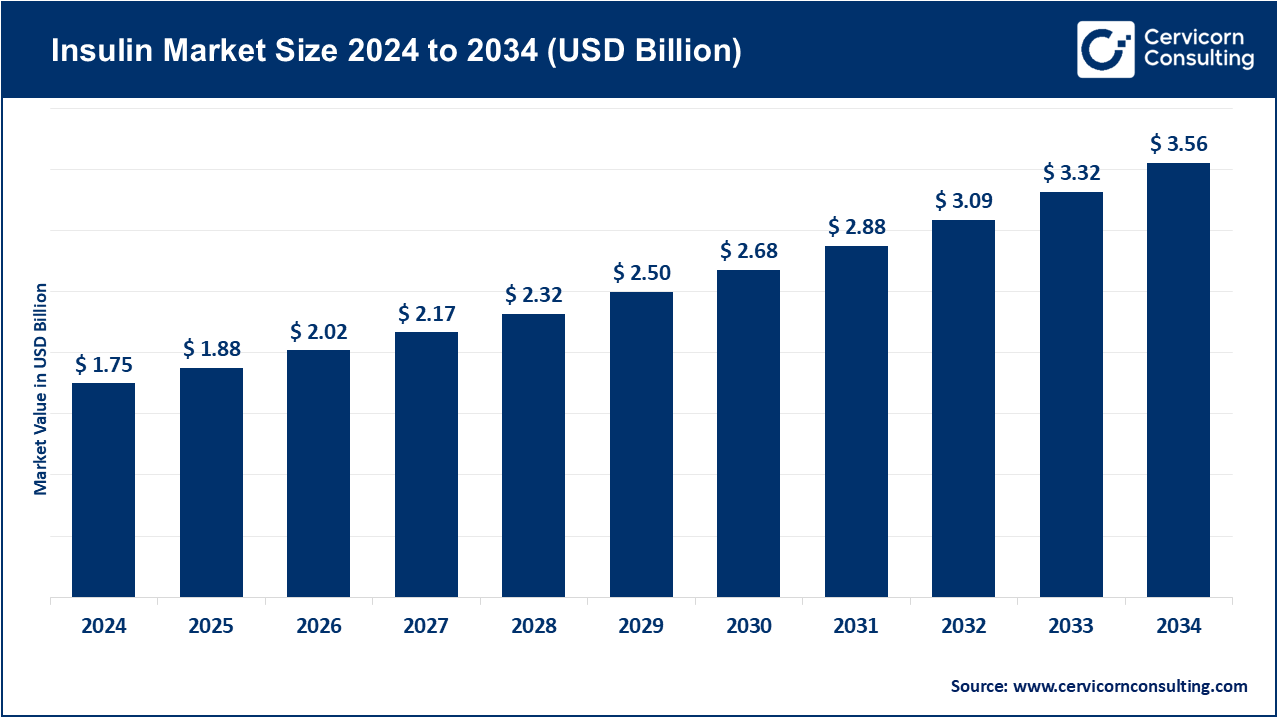

The global insulin market size was worth USD 1.75 billion in 2024 and is anticipated to expand to around USD 3.56 billion by 2034, registering a compound annual growth rate (CAGR) of 7.36% from 2025 to 2034.

What is the Inulin Market?

The inulin market focuses on the production, processing, and commercialization of inulin and oligofructose—soluble dietary fibers naturally found in plants such as chicory root, agave, and Jerusalem artichoke. These ingredients are used across a wide range of food, beverage, and nutraceutical applications due to their prebiotic benefits and ability to serve as natural sugar or fat replacers. Inulin promotes digestive health by stimulating beneficial gut bacteria and is frequently incorporated into products like yogurts, baked goods, cereals, infant formula, and dietary supplements. The market ecosystem includes raw material producers, ingredient processors, and suppliers, as well as downstream food manufacturers and retailers catering to consumer demand for health-conscious, clean-label, and functional foods.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2782

Inulin Market Growth Factors

The global inulin market is experiencing strong growth driven by rising consumer awareness about gut health and digestive wellness, growing demand for functional and prebiotic foods, and a global movement toward clean-label and low-calorie products. The rising prevalence of obesity, diabetes, and gastrointestinal disorders has encouraged consumers to seek natural ingredients that aid digestion and improve metabolic health. Inulin’s multifunctional properties—as a dietary fiber, sugar substitute, and texturizing agent—make it a preferred choice for manufacturers aiming to reformulate existing products into healthier versions without compromising taste or texture.

Furthermore, the expansion of e-commerce and modern retail, the popularity of plant-based diets, and increased investment in R&D for novel inulin formulations have propelled market growth. Sustainability practices and improved chicory cultivation techniques have also enhanced supply-chain reliability, supporting consistent production and stable pricing.

Why is the Inulin Market Important?

The importance of the inulin market lies in its ability to bridge consumer wellness goals and food-industry innovation. As modern consumers increasingly seek preventive nutrition, inulin’s scientifically validated benefits—such as improved digestive function, enhanced calcium absorption, and regulation of blood glucose levels—have made it a core ingredient in functional nutrition. It allows manufacturers to enrich their product portfolios with natural fibers and reduce sugar and fat content while maintaining desirable sensory qualities. Moreover, global dietary guidelines emphasize higher fiber intake to combat chronic diseases, further reinforcing inulin’s market relevance. For the food industry, it offers formulation flexibility; for consumers, it contributes to long-term health benefits—making inulin a vital component of the evolving functional food landscape.

Top Companies in the Inulin Market

1. BENEO GmbH

Company Overview:

BENEO GmbH, part of the Südzucker Group, is a leading European manufacturer of functional food ingredients. The company is widely recognized for its chicory-based inulin and oligofructose products used in various food and beverage applications.

Specialization:

BENEO specializes in functional carbohydrates, plant-based proteins, and fibers derived from chicory roots, rice, and other sources.

Key Focus Areas:

- Sugar and fat reduction solutions

- Prebiotic and digestive health applications

- Baby food and clinical nutrition innovations

- Clean-label and sustainable ingredient sourcing

Notable Features:

BENEO operates globally with a strong focus on R&D, offering technical application support to clients. Its sustainability initiatives emphasize traceability from farm to factory and energy-efficient production methods.

2024 Revenue & Market Share:

While BENEO does not publicly disclose exact inulin revenue, it holds one of the largest market shares in the global inulin and oligofructose segment.

Global Presence:

Headquartered in Germany with manufacturing and sales operations across Europe, North America, and Asia.

2. Cosucra Groupe Warcoing SA

Company Overview:

Cosucra Groupe Warcoing SA, based in Belgium, is a family-owned company specializing in plant-based ingredients extracted from chicory and peas. It has been a key player in the European inulin market for decades.

Specialization:

Cosucra produces high-quality inulin and oligofructose from chicory, along with pea protein and starch ingredients for food and nutrition industries.

Key Focus Areas:

- Natural fiber enrichment

- Sugar-reduction product development

- Sustainable and locally sourced chicory cultivation

- Ingredient solutions for plant-based products

Notable Features:

The company’s integrated supply chain ensures quality control from raw material to final ingredient. It emphasizes circular agriculture and minimal environmental impact.

2024 Revenue & Market Share:

Cosucra’s total revenue is estimated around €120–130 million, with inulin representing a major portion of its business within the European market.

Global Presence:

Strong presence in Europe with expanding export operations across North America and Asia.

3. Sensus B.V.

Company Overview:

Sensus B.V., a subsidiary of the Royal Cosun Group, is one of the largest global producers of chicory-derived inulin. It has established itself as a pioneer in functional fibers and prebiotic ingredients.

Specialization:

Sensus develops Frutafit® inulin and Frutalose® oligofructose product lines used in beverages, dairy, bakery, and dietary supplements.

Key Focus Areas:

- Sugar and calorie reduction formulations

- Prebiotic fiber enrichment

- Infant and medical nutrition applications

- Sustainable agriculture partnerships

Notable Features:

Sensus supports its clients through formulation assistance and application testing. Its vertically integrated chicory cultivation network ensures quality, traceability, and environmental stewardship.

2024 Revenue & Market Share:

As part of Royal Cosun, Sensus holds a significant market share globally in the inulin segment, although specific revenue figures are undisclosed.

Global Presence:

Headquartered in the Netherlands with manufacturing sites in Europe and sales offices in the Americas and Asia-Pacific.

4. The iidea Company (IIDEA)

Company Overview:

The iidea Company, commonly known as IIDEA, is a Mexico-based producer specializing in agave-derived ingredients, including agave inulin, syrup, and sweeteners.

Specialization:

Agave-based inulin, organic agave syrup, and specialty sweeteners catering to the health-conscious and organic markets.

Key Focus Areas:

- Organic and natural sweetening solutions

- Prebiotic agave fiber formulations

- Premium, clean-label functional food ingredients

Notable Features:

IIDEA’s agave inulin offers a mild flavor and high solubility, making it ideal for beverage and functional food applications. It is also certified organic, gluten-free, and suitable for vegan formulations.

2024 Revenue & Market Share:

Exact figures are not disclosed, but the company commands a niche position in the organic inulin subsegment, catering primarily to North American and European health-food manufacturers.

Global Presence:

Strong export presence in North America, Europe, and Latin America with growing distribution through global ingredient networks.

5. Jarrow Formulas, Inc.

Company Overview:

Jarrow Formulas, based in Los Angeles, USA, is a leading dietary supplement manufacturer and marketer known for science-backed formulations that include prebiotic ingredients like inulin.

Specialization:

Development and sale of nutritional supplements, probiotics, and prebiotic blends targeted at digestive and immune health.

Key Focus Areas:

- Prebiotic and probiotic combinations

- Dietary supplements for gut health

- Clinical and research-driven product development

Notable Features:

Jarrow emphasizes evidence-based product design and quality assurance. Its inulin-containing supplements are among the most recognized prebiotic products in the North American market.

2024 Revenue & Market Share:

Jarrow’s total company revenue is estimated at approximately USD 70–80 million annually, with inulin products comprising a smaller share within its broader supplement portfolio.

Global Presence:

Primary operations in North America with distribution through e-commerce and retail networks worldwide.

Leading Trends and Their Impact

1. Sugar Reduction and Clean-Label Reformulation

The global shift toward healthier, low-sugar diets is driving manufacturers to reformulate products using inulin as a natural sweetener and fat replacer. Inulin’s ability to mimic the texture of sugar and fat while maintaining a pleasant taste allows brands to reduce caloric content without affecting sensory appeal. This trend is particularly prominent in dairy, bakery, and beverage sectors.

2. Prebiotic and Gut-Health Awareness

Growing consumer understanding of the gut microbiome has elevated the demand for prebiotic ingredients. Inulin supports the growth of beneficial gut bacteria, enhancing digestive health and immunity. This scientific validation has spurred innovation in probiotic-prebiotic combinations, creating a strong synergy across the dietary supplement and functional food industries.

3. Sustainability and Agricultural Innovation

As sustainability becomes a key purchasing factor, manufacturers are investing in environmentally responsible chicory and agave cultivation. Companies are implementing regenerative agriculture, energy-efficient extraction processes, and transparent supply chains to align with global sustainability goals.

4. Expansion into Emerging Markets

Developing regions such as Asia-Pacific and Latin America are witnessing increased consumption of fiber-rich foods as urbanization and disposable incomes rise. Local production facilities and government support for health-centric foods are expected to create new growth avenues.

5. Technological Advancements and Customization

Advances in extraction and purification technologies have improved the quality and consistency of inulin products. Suppliers are now offering customized inulin grades to meet specific formulation needs, from instant solubility for beverages to high-fiber content for baked goods.

6. Regulatory Support and Labeling Clarity

Regulatory frameworks in the U.S., EU, and other major markets recognize inulin as a dietary fiber, allowing for health claims related to digestive wellness. Clear labeling standards help manufacturers market their products more effectively while ensuring consumer trust.

Successful Examples of the Inulin Market Worldwide

- European Dairy Innovations:

Major European dairy companies have successfully launched low-sugar, high-fiber yogurts and drinks fortified with chicory inulin. These products cater to health-conscious consumers seeking functional benefits and better digestive balance. - Plant-Based Dairy Alternatives:

Inulin plays a critical role in improving the creaminess and mouthfeel of plant-based milks and yogurts. It also adds fiber, compensating for the nutritional gaps often present in plant-based diets. - Functional Beverages and Snack Bars:

In North America, a surge in prebiotic drinks and snack bars using inulin as a fiber source has revolutionized the functional beverage segment. These products often combine inulin with probiotics to enhance gut health claims. - Infant and Medical Nutrition:

Inulin is used in specialized infant formulas and medical nutrition products to promote healthy digestion and nutrient absorption, particularly calcium. This application area continues to expand as healthcare professionals advocate for preventive nutrition. - Agave Inulin in Organic Products:

Agave-derived inulin from companies like The iidea Company has been adopted by organic and natural food brands for use in premium health foods, aligning with clean-label and vegan trends.

Global Regional Analysis

Europe

Europe dominates the global inulin market due to its long-standing tradition of chicory cultivation and strong regulatory framework supporting dietary fibers. Countries like Belgium, the Netherlands, and France are home to key players such as BENEO, Cosucra, and Sensus. The European Food Safety Authority (EFSA) supports claims related to inulin’s health benefits, giving manufacturers an edge in marketing. Government emphasis on sustainability and reduced-sugar diets further drives demand for inulin-enriched products.

North America

North America represents a rapidly expanding market fueled by rising health awareness, higher prevalence of digestive disorders, and a growing preference for natural ingredients. The U.S. Food and Drug Administration (FDA) classifies inulin as a recognized dietary fiber, enabling clear labeling on packaged foods. The market has also been boosted by consumer interest in gut-health products and the widespread availability of inulin-based supplements from brands like Jarrow Formulas.

Asia-Pacific

Asia-Pacific is projected to exhibit the fastest growth rate in the inulin market. Increasing urbanization, westernized dietary patterns, and government-led nutrition programs in countries like India, China, and Japan have encouraged the inclusion of functional fibers in everyday diets. Rising disposable incomes and the proliferation of modern retail channels have also accelerated market penetration. Local food and beverage companies are incorporating inulin to appeal to consumers prioritizing digestive wellness.

Latin America

Latin America, particularly Mexico and Brazil, is emerging as a significant production and consumption hub. Mexico’s agave industry provides a sustainable alternative to chicory-based inulin, helping the region carve a unique niche in organic and natural ingredients. The IIDEA Company’s agave inulin has seen growing export demand from Europe and North America.

Middle East and Africa

Although still in the nascent stage, increasing consumer education on gut health and the expansion of international food brands are gradually introducing inulin-based products into these regions. Government nutrition campaigns focusing on reducing sugar intake are expected to create new opportunities over the coming years.

Government Initiatives and Policies Shaping the Market

- Nutritional Labeling and Fiber Fortification Policies:

Governments across the EU, U.S., and Asia are encouraging food manufacturers to fortify products with dietary fibers like inulin to combat rising rates of obesity and digestive disorders. These initiatives align with WHO recommendations for increased daily fiber intake. - Sustainability and Agricultural Support:

Subsidies and grants for sustainable chicory cultivation and agave farming help stabilize raw material supplies. European agricultural policies emphasize crop diversification and eco-friendly farming, benefiting inulin producers. - Public Health Programs and Awareness Campaigns:

National campaigns promoting digestive health and preventive nutrition are directly boosting demand for prebiotic-enriched foods. Public-private partnerships between governments and food companies have accelerated R&D in functional ingredients. - Trade and Export Incentives:

Emerging economies are implementing export incentives and tariff reductions to enhance their position in the global ingredients trade. This has led to the expansion of production facilities and increased international collaboration between ingredient suppliers. - Investment in R&D and Innovation Hubs:

Several countries are establishing innovation clusters and food-tech hubs to foster research on prebiotics and functional fibers. This environment promotes continuous innovation and strengthens regional competitiveness.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Implantable Medical Devices Market Growth Drivers, Trends, Key Players and Regional Insights by 2034