Injection Molding Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Injection Molding Market Size

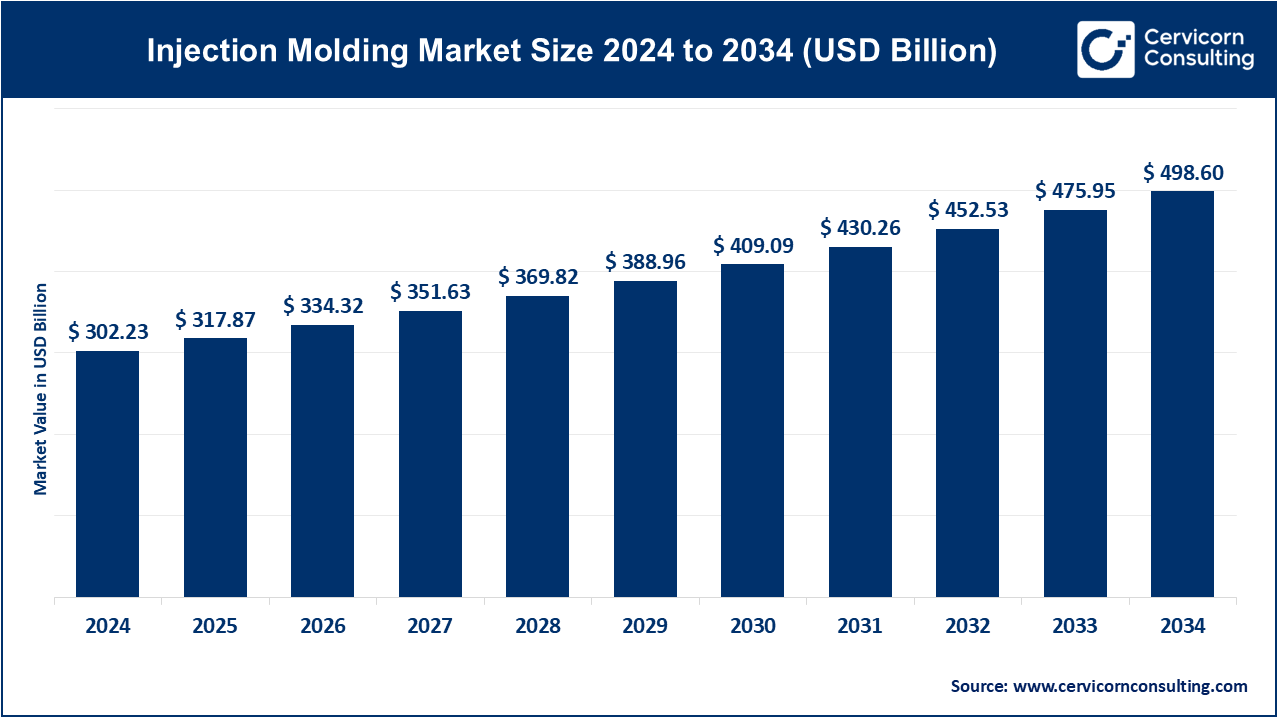

The global injection molding market size was worth USD 302.23 billion in 2024 and is anticipated to expand to around USD 498.60 billion by 2034, registering a compound annual growth rate (CAGR) of 5.17% from 2025 to 2034.

What is the Injection Molding Market?

The injection molding market comprises machine manufacturers, mold makers, automation system providers, materials suppliers, and contract manufacturers who produce injection-molded plastic parts. Injection molding is the process in which melted polymer is injected into a mold cavity, cooled and released as a finished part.

The market covers:

- Injection molding machines (hydraulic, hybrid, all-electric)

- Hot runner systems & mold technologies

- Automation & robotics

- Polymer materials and additives

- Contract molding services for high-volume or specialized manufacturing

Injection molding is central to the production of millions of plastic components—ranging from micro-medical parts to large automotive housings—and represents one of the largest segments of the plastics processing industry.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2397

Injection Molding Market Growth Factors

The injection molding market is growing due to rising demand for lightweight automotive components, increased production of consumer electronics, rapid expansion of medical device manufacturing, and the dominance of plastics in global packaging applications. Additional growth is driven by Industry 4.0 adoption, robotics, and energy-efficient all-electric machines that improve yield and reduce operating costs. Increasing investments in manufacturing automation, rising consumption of engineered plastics, and sustainability initiatives—such as lightweighting, recycled materials, and circular-economy mandates—are accelerating equipment upgrades and production expansion.

Growth is also supported by nearshoring strategies, capacity additions across Asia and Latin America, and innovations in materials that enable more complex geometries and multi-material molding. Despite fluctuations in raw material prices, the long-term outlook remains robust due to technological advancements and global industrialization.

Why the Injection Molding Market Is Important

Injection molding is vital to global manufacturing because it enables consistent, high-precision, high-volume production of plastic components at a low per-unit cost. Without injection molding, industries like automotive, medical devices, packaging, and electronics would face higher production costs, slower speed-to-market and limited product design capabilities. As companies push for sustainability and efficiency, injection molding technologies—especially electric machines, advanced molds and data-driven controls—have become essential to delivering strong mechanical performance with reduced material use. The market also supports millions of jobs worldwide and contributes significantly to industrial output and global supply chain resilience.

Top Injection Molding Companies

Below are the top major manufacturers shaping the global injection molding machinery market.

1. Arburg GmbH + Co KG

Specialization:

All-electric, hydraulic and hybrid injection molding machines; turnkey solutions; automation systems; additive manufacturing platforms.

Key Focus Areas:

Energy-efficient machinery, modular production cells, digitalization, sustainability and precision manufacturing for medical, automotive, packaging and consumer goods.

Notable Features:

Family-owned European manufacturer known for high engineering standards, vertical integration, and strong automation capabilities.

2024 Revenue:

Estimated around €620 million (company guidance for 2024).

Market Share:

Strong share of the premium European market and a growing footprint in medical and precision molding solutions.

Global Presence:

Subsidiaries and technology centers across Europe, the Americas and Asia, with sales partners in over 100 countries.

2. Milacron Holdings Corp

Specialization:

Injection molding machines, hot runner systems, extrusion machinery, and industrial aftermarket services.

Key Focus Areas:

North American manufacturing, automation, integrated control systems, and service-based modernization.

Notable Features:

Major influence in North America; strong aftermarket network; advanced hot-runner solutions for packaging and complex molding.

2024 Revenue:

Reported revenue of approximately $526 million for 2024 (machine & systems segment).

Market Share:

Large share of the North American market and a solid global presence in hot-runner technologies.

Global Presence:

Manufacturing and service operations across the US, Europe, India and parts of Asia.

3. Husky Injection Molding Systems Ltd.

Specialization:

PET preform systems, beverage packaging solutions, hot runners, molds and integrated packaging production lines.

Key Focus Areas:

High-speed packaging, lightweighting, sustainability, recycling-friendly solutions and integrated manufacturing systems.

Notable Features:

Global leader in PET preform technology with advanced turnkey systems used by major beverage and packaging brands.

2024 Revenue:

Privately held; industry estimates place revenue in the $1.0–1.3 billion range.

Market Share:

Dominant market share in PET preform and beverage packaging injection molding systems.

Global Presence:

Manufacturing and service centers across the Americas, Europe, Middle East and Asia.

4. KraussMaffei Group GmbH

Specialization:

Injection molding machinery, extrusion equipment, reaction process machinery and integrated automation solutions.

Key Focus Areas:

Automotive, industrial, packaging and digital manufacturing; strong emphasis on energy-efficient machinery and global service capability.

Notable Features:

One of the oldest and most diversified machinery manufacturers, offering broad technology coverage.

2024 Revenue:

Reported revenue for 2024 is estimated in the low-to-mid CNY billions, based on parent entity reporting.

Market Share:

Strong European footprint and expanding presence in Asia due to strategic ownership realignment.

Global Presence:

Manufacturing hubs in Europe and China, with extensive sales/service networks worldwide.

5. Engel Austria GmbH

Specialization:

All-electric and hydraulic injection molding machines, robotics, digital solutions and turnkey automation.

Key Focus Areas:

Medical molding, packaging, automotive and technical molding; advanced digital monitoring and high-precision manufacturing.

Notable Features:

Known for highly integrated systems, strong robotics portfolio and leadership in European precision molding.

2024 Revenue:

Reported revenue approximately €1.5 billion for 2024/25 fiscal year.

Market Share:

One of the largest European OEMs by volume and revenue, strong in medical and technical applications.

Global Presence:

Manufacturing facilities in Europe and Asia, and service hubs across all major continents.

Leading Trends in the Injection Molding Market and Their Impact

1. Rise of All-Electric Machines

Demand for all-electric injection molding machines is accelerating due to their advantages:

- Lower energy consumption

- Higher precision

- Clean-room compatibility

- Reduced maintenance

This trend is especially strong in electronics, medical and high-precision automotive applications.

2. Industry 4.0 and Smart Factories

Machine builders are integrating digital controls, AI-enabled monitoring, and cloud-based analytics to:

- Improve cycle consistency

- Reduce downtime

- Enable predictive maintenance

- Enhance quality control

Smart factories are becoming a key differentiator for molders.

3. Sustainability & Circular Economy Requirements

Packaging, consumer goods and automotive industries are demanding:

- Recyclable materials

- PCR (post-consumer recycled) resin compatibility

- Lightweighting

- Reduced waste and scrap

Machine OEMs are responding with enhanced melt control, multi-material handling systems and energy-efficient drives.

4. Multi-Material and Complex Molding

Demand for overmolding, insert molding and multi-component molding (2K/3K) is increasing due to advancements in electric and hybrid machines. This enables higher performance components for electronics, medical and automotive markets.

5. Automation and Robotics Integration

Labor shortages and quality requirements drive investments in:

- Robotic part removal

- Vision systems

- In-mold labeling

- Automated packaging

- Lights-out manufacturing

Turnkey integrated manufacturing cells are becoming standard.

6. Nearshoring and Regionalization

Manufacturers are diversifying supply chains by shifting production closer to end markets. This creates demand for localized manufacturing hubs and service centers, boosting machinery sales in North America, Eastern Europe, India and Latin America.

Successful Real-World Examples of Injection Molding Applications

1. Automotive Lightweighting Programs (Europe)

European OEMs have replaced traditional metal parts with high-strength plastic components manufactured through injection molding. These lighter components improve fuel efficiency and contribute to EV performance goals.

2. Global PET Preform Projects (Asia & North America)

Beverage companies use high-speed injection molding systems to produce lightweight PET preforms at scale. Husky and other OEMs have supported major bottling operations to reduce material usage while increasing output.

3. Micro-Medical Component Manufacturing (Japan, Germany, Singapore)

Medical suppliers use all-electric injection molding machines in clean-room environments to produce precise, small-scale components for syringes, inhalers, diagnostic devices and implants.

4. Consumer Electronics Casings (China & Southeast Asia)

Major electronics brands rely heavily on injection molding for thin-wall device housings, buttons, internal structural components and connectors.

5. Localized Tooling and Molding Hubs (India & Eastern Europe)

Automotive Tier-1 suppliers have established regional tooling and molding hubs to support just-in-time manufacturing and reduce import dependence.

Global Regional Analysis & Government Policies Shaping the Market

Asia-Pacific

Market Dynamics

Asia-Pacific is the world’s largest injection molding market, led by China, Japan, South Korea, India and Southeast Asia. Factors driving growth include:

- Expanding electronics manufacturing

- Rising automotive production

- Large packaging consumption

- Increased medical manufacturing

- Technology investments by regional OEMs

Government Initiatives

- China’s policies supporting advanced manufacturing equipment and industrial automation

- India’s “Make in India” and PLI schemes promoting local plastics and tooling production

- Southeast Asian governments offering incentives for electronics and automotive clusters

- Regional mandates encouraging recycling and circular plastics industries

North America

Market Dynamics

North America benefits from strong automotive, aerospace, packaging and medical markets. High labor costs have accelerated automation and nearshoring, creating demand for high-precision machines.

Government Initiatives

- Tax incentives for domestic manufacturing

- Federal/state funding for advanced manufacturing technologies

- Recycling mandates shaping packaging materials demand

- Grants supporting innovation in clean energy and sustainability

Europe

Market Dynamics

Europe maintains a strong leadership position in injection molding machine engineering and technical applications such as medical molding, precision parts and automotive components.

Government Initiatives

- EU circular economy and recycled content policies

- Energy-efficiency mandates encouraging upgrades to electric machines

- Investments in industrial digitalization and smart factories

- Regulations promoting reduction of single-use plastics

Latin America

Market Dynamics

Growing consumer goods, automotive and packaging sectors make Latin America a developing market for injection molding machinery.

Government Initiatives

- Import substitution policies

- Manufacturing development programs in Brazil, Mexico and Colombia

- Evolving plastic waste management regulations

Middle East & Africa

Market Dynamics

Demand comes mainly from packaging, construction products, agriculture and FMCG sectors. Growth is steady but slower due to lower industrial base.

Government Initiatives

- Industrial diversification programs such as Saudi Vision 2030

- Incentives for local plastics conversion industries

- Early-stage sustainability policies influencing material choices

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Construction Chemicals Market Growth Drivers, Trends, Key Players and Regional Insights by 2034