Infectious Disease Diagnostics Market Revenue, Global Presence, and Strategic Insights by 2034

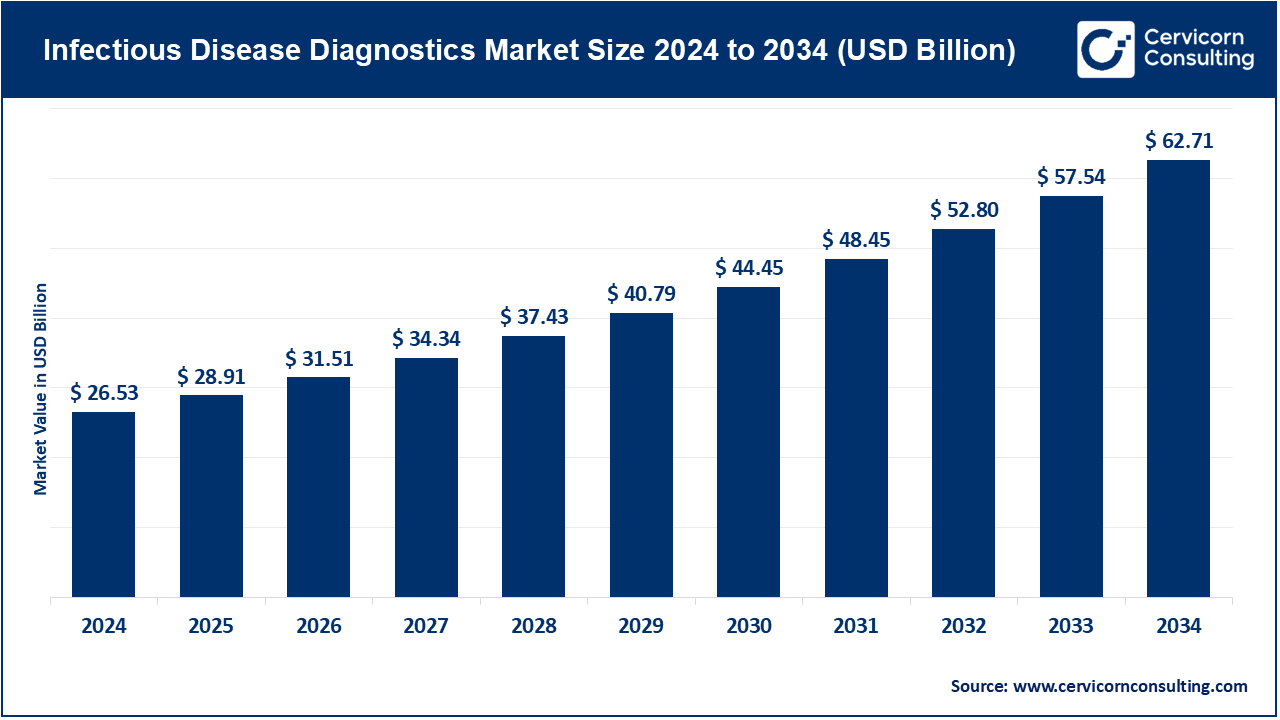

Infectious Disease Diagnostics Market Size

What is the Infectious Disease Diagnostics Market?

The infectious disease diagnostics market encompasses the technologies, products, and services used to detect, identify, and monitor pathogens that cause infectious diseases. It includes traditional microbiology tools (such as cultures and immunoassays), as well as advanced molecular diagnostics, next-generation sequencing (NGS), and point-of-care (POC) tests. These tools are used across hospitals, reference laboratories, clinics, and home settings to diagnose a wide range of infections, including viral, bacterial, parasitic, and fungal diseases.

This market is characterized by high innovation intensity, with constant technological advancements in PCR (polymerase chain reaction), antigen/antibody testing, and bioinformatics-driven pathogen identification. The growing emphasis on accuracy, speed, and decentralized testing has further diversified the market, introducing easy-to-use and portable testing devices. As a result, diagnostic manufacturers are now integrating AI, cloud data platforms, and automation to create comprehensive diagnostic ecosystems that support both clinical decision-making and public health surveillance.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2787

Why is it Important?

Infectious disease diagnostics are a cornerstone of modern healthcare. They provide clinicians and public health officials with vital information to identify infections, guide treatment, prevent outbreaks, and monitor disease progression. Early and accurate diagnosis is essential for effective treatment and for preventing the spread of contagious diseases.

The COVID-19 pandemic illustrated the indispensable role of diagnostics in managing global health crises. Quick testing enabled early isolation, contact tracing, and large-scale surveillance, ultimately saving millions of lives. Beyond pandemics, diagnostics also help reduce the misuse of antibiotics by ensuring accurate pathogen identification, which is crucial in combating antimicrobial resistance (AMR). Moreover, diagnostic innovations have expanded access to testing in remote areas, helping low- and middle-income countries manage endemic diseases such as tuberculosis, malaria, and HIV more effectively.

In short, infectious disease diagnostics not only improve individual patient outcomes but also strengthen global preparedness and response systems.

Growth Factors

The infectious disease diagnostics market is expanding rapidly, fueled by multiple interconnected forces. Rising prevalence and awareness of infectious diseases — including influenza, HIV, hepatitis, tuberculosis, and emerging zoonotic infections — are major drivers. The growing threat of antimicrobial resistance (AMR) has increased demand for advanced diagnostics that can rapidly identify resistant strains. Technological progress in molecular biology, such as next-generation sequencing, digital PCR, and CRISPR-based detection systems, is enabling faster and more accurate results. The increased adoption of decentralized testing, telehealth integration, and home-based diagnostic kits has opened new market segments.

In addition, governments and international organizations have launched significant initiatives to strengthen pandemic preparedness and laboratory capacity. Regulatory updates in major markets (like the EU’s IVDR) are also influencing innovation, standardization, and product quality. Together, these factors are propelling sustained global growth and reshaping the competitive landscape of infectious disease diagnostics.

Top Companies in the Infectious Disease Diagnostics Market

Below is an overview of leading companies that play a pivotal role in the global infectious disease diagnostics market. These companies are recognized for their technological capabilities, global reach, and contributions to innovation.

| Company | Specialization | Key Focus Areas | Notable Features | 2024 Revenue (Approx.) | Market Share (Est.) | Global Presence |

|---|---|---|---|---|---|---|

| Thermo Fisher Scientific | Life sciences, molecular diagnostics, and lab automation | Molecular diagnostics, PCR reagents, NGS, pathogen genomics, consumables | Comprehensive product ecosystem, integrated software and automation platforms | USD 42.88 billion | Major share in molecular diagnostics and lab instruments | Strong global presence in North America, Europe, and Asia |

| Becton, Dickinson and Company (BD) | Diagnostic solutions, laboratory systems, and specimen collection | Molecular and immunoassay instruments, automation, microbiology systems | Global leader in laboratory automation and collection systems; extensive installed base | USD 20.2 billion | Significant share in specimen collection and microbiology testing | Operations in over 50 countries |

| 3M | Healthcare products, filtration, and diagnostic consumables | Diagnostic sample handling, sterilization, infection control | Known for manufacturing quality and process innovation; diversified healthcare operations | USD 24.6 billion | Moderate, mainly through consumables and testing accessories | Global manufacturing and supply network |

| Medline Industries | Medical and lab supplies, logistics, and distribution | Specimen collection, POC accessories, hospital and lab consumables | Strong logistics and supply capabilities; expanding diagnostic supplies | USD 25.5 billion | Indirect market influence through supply and distribution | Predominantly North American, expanding globally |

| Smith & Nephew | Wound management and infection prevention | Infection control and wound-care diagnostics | Focused on infection prevention and wound management | USD 5.81 billion | Small indirect share in infection-related diagnostics | Global presence across Europe, North America, and Asia |

Leading Trends and Their Impact

1. Growth of Molecular Testing

Molecular diagnostics — particularly PCR and NGS — have become the gold standard in infectious disease detection. Multiplex PCR panels can detect multiple pathogens from a single sample, improving efficiency and accuracy. This trend enhances hospital workflow and supports real-time surveillance during outbreaks.

2. Expansion of Point-of-Care (POC) Testing

There is a strong shift toward decentralized and patient-centric testing. Portable diagnostic tools, such as cartridge-based PCR machines and rapid antigen tests, allow clinicians to obtain results in minutes. This reduces hospital burden and increases access to testing in rural or low-resource areas.

3. Adoption of Next-Generation Sequencing (NGS)

NGS is revolutionizing how pathogens are monitored and tracked. Countries are integrating sequencing into their national disease surveillance systems to detect new variants and monitor antimicrobial resistance. Companies like Thermo Fisher have capitalized on this shift through comprehensive sequencing platforms.

4. Digital Integration and Connectivity

Diagnostics are becoming smarter and more connected. Cloud-based systems now link laboratory instruments with data analytics platforms, enabling real-time data sharing with health authorities. Digital diagnostics are enhancing surveillance accuracy and improving pandemic preparedness.

5. Regulatory Evolution

Stricter regulations, such as the European Union’s IVDR, have raised product quality standards. Although compliance has added cost pressures, these frameworks improve safety and encourage the development of validated, evidence-based diagnostic tests.

6. Antimicrobial Resistance (AMR) and Stewardship

AMR has emerged as a critical global threat. Governments are prioritizing rapid diagnostic solutions that can identify resistant pathogens and guide targeted antibiotic use. This is pushing research toward molecular assays capable of detecting resistance genes quickly.

7. Supply Chain and Localization

Post-pandemic, supply chain resilience has become a strategic priority. Countries are encouraging local manufacturing of diagnostic reagents and kits to reduce dependency on imports. This shift is fostering regional partnerships and capacity building.

Successful Examples of Market Implementation Worldwide

1. U.S. Public-Private Partnership in Pandemic Response

During the COVID-19 crisis, collaboration between government agencies, diagnostic companies, and laboratories enabled rapid scale-up of testing capacity. Public funding, combined with private innovation, created a blueprint for future pandemic responses.

2. India’s Antimicrobial Resistance (AMR) Surveillance Network

The Indian Council of Medical Research (ICMR) established a national AMR surveillance network across tertiary hospitals. This program improved pathogen tracking and supported infection control policies, setting a model for developing economies to build diagnostic infrastructure.

3. Europe’s Regulatory Advancement

The EU’s IVDR transformed the diagnostics landscape by enforcing stricter validation and safety requirements. Although implementation has been challenging, it has elevated product quality and transparency across European markets.

4. Genomic Surveillance Programs

Countries such as the U.K., U.S., and Japan have integrated genomic sequencing into their national infectious disease strategies. These programs allow real-time variant tracking and have become essential for understanding pathogen evolution.

Global Regional Analysis

North America

North America dominates the market due to high healthcare spending, advanced laboratories, and rapid adoption of new diagnostic technologies. The U.S. Centers for Disease Control and Prevention (CDC) and National Institutes of Health (NIH) fund numerous surveillance and preparedness programs. Private labs, such as LabCorp and Quest Diagnostics, also contribute significantly to the region’s testing capacity. Strong reimbursement policies and strategic collaborations between public agencies and private companies further drive innovation.

Europe

Europe’s infectious disease diagnostics market benefits from robust healthcare infrastructure and a strong emphasis on quality control. The introduction of the In Vitro Diagnostic Regulation (IVDR) has reshaped market entry requirements, pushing manufacturers to invest in data-backed clinical evidence. Public health initiatives such as the European Centre for Disease Prevention and Control (ECDC) strengthen cross-border collaboration in disease monitoring and outbreak response.

Asia-Pacific

Asia-Pacific is witnessing the fastest growth due to increasing awareness, population density, and infectious disease prevalence. Governments in China, India, Japan, and South Korea are investing heavily in diagnostic infrastructure. India’s Virology Research and Diagnostic Laboratories (VRDL) network, for instance, has significantly expanded the country’s testing capacity. Rapid urbanization, rising disposable income, and local production capabilities are accelerating adoption of advanced diagnostic technologies.

Latin America

The Latin American market is growing steadily, driven by the region’s battle against endemic diseases such as dengue, Zika, and chikungunya. Governments are collaborating with international agencies like the Pan American Health Organization (PAHO) to strengthen disease surveillance. Brazil and Mexico lead in implementing molecular and rapid testing technologies in both public and private sectors.

Middle East and Africa

Africa remains one of the most underdeveloped yet promising markets. International partnerships are helping build diagnostic infrastructure for diseases like HIV, malaria, and tuberculosis. Organizations such as the World Health Organization (WHO) and the Global Fund support capacity-building projects. The Middle East, especially the Gulf Cooperation Council (GCC) countries, is investing in laboratory automation and digital connectivity to modernize healthcare delivery.

Government Initiatives and Policies Shaping the Market

1. Global Health Security Agenda (GHSA)

Many countries are members of the GHSA, a global partnership aimed at improving capacity to prevent, detect, and respond to infectious disease threats. Diagnostic capability is one of its core components.

2. National Action Plans on Antimicrobial Resistance

Countries including India, the United Kingdom, and the United States have adopted AMR action plans emphasizing rapid diagnostics. These programs are fostering collaborations between government bodies, diagnostic manufacturers, and research institutions.

3. Public Health Laboratory Networks

Governments worldwide are investing in integrated laboratory networks to support early detection and response. These include the CDC’s Laboratory Response Network in the U.S. and the WHO’s Global Influenza Surveillance Network.

4. Pandemic Preparedness Funding

Post-COVID, several governments have allocated long-term funds for diagnostics research, manufacturing, and stockpiling. This funding ensures rapid scale-up in case of future outbreaks.

5. Digital Health and Data Sharing Policies

Many regions are establishing frameworks for digital data sharing between laboratories, healthcare providers, and health ministries. These systems enable faster outbreak tracking and better allocation of healthcare resources.

How Company Strategies Align with Market Needs

- Thermo Fisher Scientific is leveraging its global reach and technological depth in molecular and genomic diagnostics to serve both hospital and public health segments. Its integrated approach — from sample collection to data analytics — makes it a market leader in surveillance and outbreak detection.

- Becton Dickinson (BD) continues to expand its automated systems and laboratory solutions, focusing on improving diagnostic workflow efficiency. Its specimen collection systems and lab automation platforms make it indispensable in large-scale testing operations.

- 3M and Medline Industries play vital supporting roles through manufacturing, distribution, and logistics of diagnostic consumables and infection control products. Their ability to maintain robust supply chains ensures continuity during surges in global demand.

- Smith & Nephew, though not primarily an IVD company, contributes to infection prevention through wound care technologies and infection management solutions that complement diagnostic systems in clinical settings.

Future Outlook and Analytical Observations

- Market Consolidation: Regulatory tightening and high R&D costs are encouraging mergers and acquisitions. Large firms are likely to acquire innovative startups specializing in rapid molecular or CRISPR-based tests.

- Decentralized Diagnostics: Growth of home-based and POC testing will expand patient accessibility and redefine traditional diagnostic models.

- Artificial Intelligence Integration: AI and machine learning will increasingly be used to interpret complex diagnostic data, predict outbreaks, and optimize treatment decisions.

- Affordable Access in Emerging Markets: The next phase of growth will focus on affordability and accessibility, supported by local manufacturing and technology transfer agreements.

- Data-Driven Health Systems: Integration of diagnostic data into national and global surveillance networks will continue to strengthen health security and outbreak management.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Smart Meter Market Trends, Growth Drivers and Leading Companies 2024