Hydrogen Generation Market Trends, Growth Drivers, and Regional Insights (2025-2034)

Hydrogen Generation Market Overview

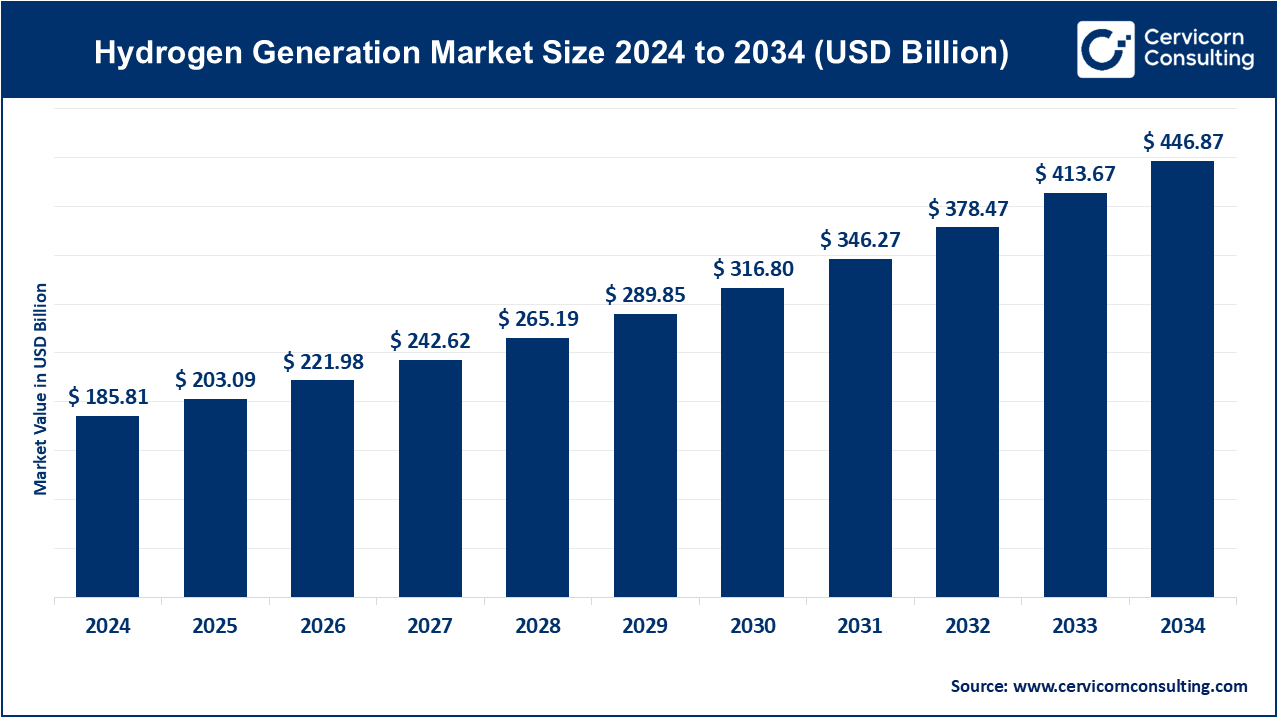

The global hydrogen generation market was worth USD 185.81 billion in 2024 and is anticipated to expand to around USD 446.87 billion by 2034, registering a compound annual growth rate (CAGR) of 9.3% between 2025 and 2034.

Key growth factors driving the hydrogen generation market include escalating energy demands from industrial and commercial sectors, stringent environmental regulations, government incentives for hydrogen production and adoption, and the development of innovative technologies such as green hydrogen through electrolysis powered by renewable energy sources. The rising popularity of hydrogen as a fuel for fuel-cell electric vehicles (FCEVs) and the global pivot toward decarbonization goals further accelerate market expansion.

Understanding the Hydrogen Generation Market

The hydrogen generation market refers to the global industry focused on producing hydrogen gas through various methods such as steam methane reforming (SMR), electrolysis of water, and gasification of coal or biomass. Hydrogen generation is a critical enabler of energy transition strategies, serving as a key feedstock for industrial processes and as a clean fuel for vehicles and power generation. This market is driven by the growing demand for cleaner energy solutions, government mandates for reducing greenhouse gas emissions, and advancements in hydrogen storage and distribution technologies.

Why the Hydrogen Generation Market is Important

Hydrogen holds immense potential as a versatile energy carrier capable of decarbonizing sectors that are challenging to electrify, such as heavy industry, long-haul transportation, and aviation. It supports the global push toward achieving net-zero carbon emissions by providing a sustainable alternative to fossil fuels. Hydrogen is also crucial for energy storage, enabling greater penetration of intermittent renewable energy sources like wind and solar. This makes the hydrogen generation market integral to building a more resilient and sustainable global energy ecosystem.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2344

Global Hydrogen Generation Market Top Companies

Air Liquide

- Specialization: Hydrogen production, storage, and distribution solutions

- Key Focus Areas: Large-scale hydrogen production plants, green hydrogen projects, hydrogen mobility initiatives

- Notable Features: Pioneering green hydrogen production through electrolysis

- 2024 Revenue (approx.): $26 billion

- Market Share (approx.): 15%

- Global Presence: Operations across 80 countries, with a strong presence in Europe, North America, and Asia-Pacific

Linde plc

- Specialization: Industrial gases, including hydrogen production and supply

- Key Focus Areas: Hydrogen liquefaction, distribution networks, and fuel cell applications

- Notable Features: Expertise in hydrogen liquefaction and large-scale SMR plants

- 2024 Revenue (approx.): $33 billion

- Market Share (approx.): 20%

- Global Presence: Operations in over 100 countries, leading in Europe and North America

Air Products and Chemicals, Inc.

- Specialization: Hydrogen production and integrated supply chains

- Key Focus Areas: Blue hydrogen projects, carbon capture technologies, and hydrogen fueling stations

- Notable Features: Investment in blue hydrogen and carbon capture initiatives

- 2024 Revenue (approx.): $12 billion

- Market Share (approx.): 12%

- Global Presence: Dominance in North America, with expanding projects in Asia and the Middle East

Praxair, Inc.

- Specialization: Industrial gases and hydrogen solutions

- Key Focus Areas: On-site hydrogen generation, hydrogen pipelines, and green hydrogen

- Notable Features: Extensive pipeline networks for industrial hydrogen supply

- 2024 Revenue (approx.): $11 billion

- Market Share (approx.): 10%

- Global Presence: Major operations in North and South America, Asia, and Europe

Messer Group GmbH

- Specialization: Industrial and medical gases, including hydrogen

- Key Focus Areas: Green hydrogen, small-scale hydrogen plants, and industrial applications

- Notable Features: Focused investments in Europe’s green hydrogen projects

- 2024 Revenue (approx.): $4 billion

- Market Share (approx.): 5%

- Global Presence: Strong presence in Europe and growing operations in Asia and the Americas

Leading Trends and Their Impact

Green Hydrogen Expansion

The transition from grey and blue hydrogen to green hydrogen is a defining trend. Green hydrogen, produced via electrolysis using renewable energy, eliminates carbon emissions, making it a cornerstone for sustainable energy systems. Companies like Air Liquide and Linde are scaling green hydrogen production, significantly reducing the carbon footprint across industries.

Hydrogen Infrastructure Development

Investment in hydrogen pipelines, storage facilities, and refueling stations is increasing to facilitate hydrogen’s adoption in transportation and industry. For example, Air Products is spearheading hydrogen refueling station deployment worldwide, enabling the growth of hydrogen-fueled transportation.

Carbon Capture and Storage (CCS)

Blue hydrogen production—hydrogen derived from natural gas with carbon capture—is gaining traction as a transitional technology. Air Products’ large-scale CCS projects are setting benchmarks for integrating hydrogen production with emissions reduction.

Regional Collaborations and Alliances

International collaborations, such as the Hydrogen Council and European Clean Hydrogen Alliance, are accelerating technological advancements and policy alignment. Such initiatives foster cross-border investments and promote hydrogen’s global value chain.

Successful Examples of Hydrogen Generation Markets Around the World

Japan’s Hydrogen Economy

Japan leads in hydrogen innovation, with significant investments in hydrogen fuel cells, refueling stations, and hydrogen-powered public transport. The government’s Basic Hydrogen Strategy outlines plans for 800,000 hydrogen vehicles by 2030 and massive hydrogen import projects.

Germany’s Green Hydrogen Leadership

Germany’s National Hydrogen Strategy commits billions to green hydrogen production and infrastructure. Key projects include the H2Global initiative, fostering green hydrogen trade between Europe and partner regions like Africa.

Australia’s Export-Oriented Hydrogen Market

Australia is capitalizing on its renewable energy resources to produce green hydrogen for export. Projects like the Asian Renewable Energy Hub aim to supply hydrogen to Asian markets, solidifying Australia’s role as a global hydrogen powerhouse.

United States Hydrogen Hubs

The U.S. Department of Energy (DOE) is funding hydrogen hubs across the country to drive innovation and commercialization. Key initiatives include Texas’s Gulf Coast Hydrogen Hub and California’s focus on hydrogen mobility solutions.

South Korea’s Hydrogen Vision

South Korea’s hydrogen strategy integrates hydrogen into its energy mix, targeting 15 GW of fuel cells for power generation by 2040. Hyundai’s hydrogen-fueled heavy vehicles are already making waves in global markets.

Regional Analysis Including Government Initiatives and Policies Shaping the Market

North America

North America, particularly the United States and Canada, is advancing hydrogen adoption through policy frameworks and investments. The U.S. Infrastructure Investment and Jobs Act allocates $9.5 billion for clean hydrogen development, emphasizing production and infrastructure. Canada’s Hydrogen Strategy promotes green hydrogen production leveraging its vast renewable resources.

Europe

Europe is at the forefront of hydrogen adoption, with ambitious decarbonization goals under the European Green Deal. Germany, France, and the Netherlands are key players, investing heavily in green hydrogen production and distribution networks. The EU Hydrogen Strategy supports cross-border collaboration, funding projects like the Hydrogen Backbone, a trans-European pipeline initiative.

Asia-Pacific

Countries like Japan, South Korea, and China dominate the Asia-Pacific hydrogen market. Japan’s focus on fuel cell technology, South Korea’s hydrogen-powered heavy industries, and China’s large-scale hydrogen production projects underscore the region’s leadership. Government subsidies and public-private partnerships drive innovation and market growth.

Middle East and Africa

The Middle East, led by Saudi Arabia and the UAE, is leveraging abundant solar energy for green hydrogen production. Projects like NEOM’s green hydrogen plant position the region as a global hydrogen hub. African nations like South Africa are exploring green hydrogen opportunities to diversify energy portfolios and attract foreign investment.

Latin America

Latin America’s hydrogen potential is emerging, with Chile spearheading green hydrogen initiatives using its solar and wind energy resources. Brazil’s investments in hydrogen infrastructure aim to integrate hydrogen into its energy mix and enable export opportunities.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Nuclear Fusion Market Growth, Innovations, and Future Outlook (2024-2033)