Human Augmentation Market Revenue, Trends, and Strategic Insights by 2035

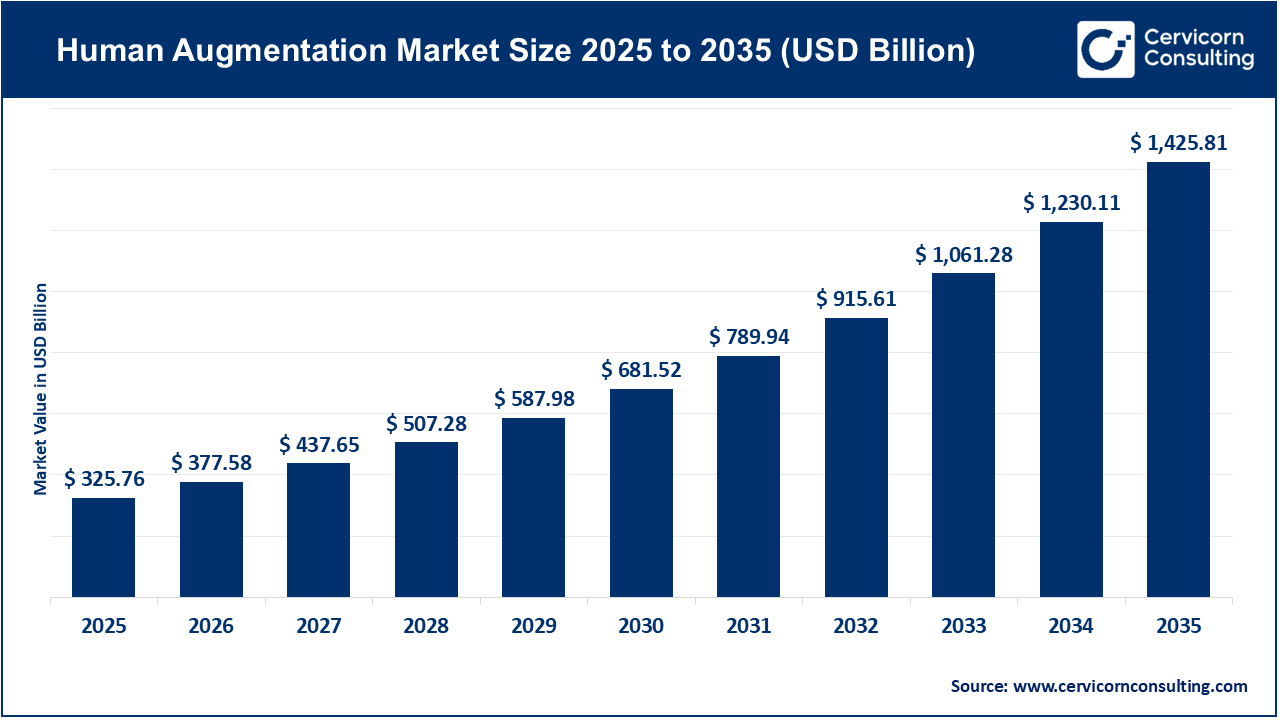

Human Augmentation Market Size

The global human augmentation market size was worth USD 325.76 billion in 2025 and is anticipated to expand to around USD 1,425.81 billion by 2035, registering a compound annual growth rate (CAGR) of 16.1% from 2026 to 2035.

What Is the Human Augmentation Market?

The Human Augmentation Market refers to the economic ecosystem emerging around technologies designed to extend, enhance, or supplement natural human physical, cognitive, and sensory capabilities. These technologies range from wearable robotics and exoskeletons that amplify strength or endurance to brain‑computer interfaces (BCIs) that connect human neural activity with digital systems, and immersive augmented/virtual reality (AR/VR) solutions that expand perception and communication. Augmentation solutions also include smart prosthetics and orthotics, neural implants, and AI-enabled cognitive augmentation platforms which collectively improve mobility, restore lost functions, boost productivity, and facilitate advanced interaction with machines and environments.

Why the Human Augmentation Market Is Important

The human augmentation market is significant because it represents a new frontier in human‑machine integration that directly impacts how people live, work, and overcome biological limitations. In healthcare, augmentation technologies restore lost abilities — for example, by enabling paralyzed patients to control devices through neural signals or helping stroke survivors regain movement with robotic exoskeletons. In defense and industrial settings, augmentation solutions enhance performance, reduce injury risks, and support soldiers or workers with fatigue‑reducing gear and strength amplifiers. Cognitive augmentation tools are evolving to support learning, memory, decision-making, and human-computer interaction in professional environments.

Furthermore, as populations age globally, demand for assistive technologies that preserve independence and quality of life is rising. Ethically and socially, human augmentation raises deep questions about identity, access, and equity, making it a critical nexus of technology, health, policy, and human potential.

Growth Factors in the Human Augmentation Market

The human augmentation market’s accelerated growth is driven by rapid advancements in AI, robotics, and neurotechnology, rising investments in brain‑computer interface and wearable augmentation solutions, an expanding healthcare and rehabilitation services sector responding to an aging population and chronic conditions, significant government and military funding for performance enhancement and soldier safety programs, and increasing applicability in industrial productivity and consumer technology realms. Additionally, miniaturization of electronics and sensors, improvements in battery and materials science, and supportive regulatory frameworks are breaking down barriers to commercialization and adoption. These elements combined, alongside growing public and private sector R&D, create a robust environment for broad commercialization and scaling of augmentation technologies worldwide, fueling strong projected compound annual growth rates.

Leading Companies in the Human Augmentation Market

1. Neuralink

Specialization & Key Focus Areas

Neuralink Corporation is a U.S. neurotechnology company focused on developing implantable brain‑computer interfaces (BCIs) that enable direct communication between the human brain and external devices. Its flagship product is designed to help users control computers, phones, and other machines through thought alone, potentially restoring capabilities for people with severe paralysis or motor impairments. Neuralink is also developing neural interface products targeting vision restoration and treatment of neurological conditions.

Notable Features

-

Ultra‑thin flexible electrode threads for high‑resolution neural recording

-

Robot‑assisted implantation procedures

-

Wireless connectivity for bi‑directional neural data exchange

-

Early human trial results showing control of computers via neural activity

2024 Revenue & Market Share

Neuralink is currently pre‑revenue as a commercial provider. However, investor documents and projected commercialization plans estimate revenue targets reaching USD 100 million by 2029, USD 500 million by 2030, and over USD 1 billion annually by 2031.

Global Presence

Headquartered in Fremont, California, Neuralink’s activities span clinical trial sites and research collaborations across the U.S., with early use of implants in patients in multiple regions including Europe.

2. Paradromics

Specialization & Key Focus Areas

Paradromics is an American neurotech startup developing high‑bandwidth brain‑computer interfaces aimed at high‑resolution neural data capture and translation. The company’s system is designed to help patients with severe motor impairment communicate and interact with devices by decoding neural signals at unprecedented scales, with the ultimate goal of restoring speech, movement, and digital command capability.

Notable Features

-

First human implant procedures completed in 2025

-

Focus on clinical usability and neural data fidelity

-

Potential future applications in communication, mobility, and therapeutic intervention

2024 Revenue & Market Share

Paradromics is an emerging company and has not yet reported publicly disclosed annual revenues. As it transitions from clinical milestones to commercial rollout, its market impact will grow in line with adoption of its BCI technology.

Global Presence

Primarily U.S.‑based with clinical trials at major research institutions. As regulatory approvals expand, Paradromics is positioned to expand into international clinical and commercial markets.

3. Ekso Bionics

Specialization & Key Focus Areas

Ekso Bionics is a key pioneer in wearable exoskeleton systems — powered suits and assistive robotic devices that support or amplify human mobility and strength. Its products serve medical rehabilitation, personal mobility, and industrial productivity applications, enabling people with spinal cord injuries to stand and walk and assisting workers with load‑bearing tasks.

Notable Features

-

EksoNR: Clinical exoskeleton for rehabilitation

-

Ekso Indego: Personal exoskeleton reimbursable under Medicare for eligible users

-

Focus on modular, ergonomic biomechanics

2024 Revenue & Market Share

Ekso Bionics recorded revenues of approximately USD 17.9 million in 2024. Its exact market share within the broader human augmentation market is relatively small given the scale of the global opportunity, but in the exoskeleton niche, it is a recognized leader.

Global Presence

Based in the U.S., Ekso Bionics sells products across North America, Europe, and Asia‑Pacific through partnerships with medical providers, distributors, and rehabilitation centers.

4. Samsung Electronics

Specialization & Key Focus Areas

Samsung participates in the human augmentation market through augmented reality wearables, biometric-enhanced devices, and health-monitoring technologies integrated with AI and sensors. Samsung’s work spans smart glasses concepts, advanced wearables, and collaborations on technologies that enhance human sensory and interaction capabilities.

Notable Features

-

AR/VR wearables integrated with smartphones and AI

-

Biometric sensing bands and health-tracking wearables

-

Edge computing and sensor fusion for real-time data insights

2024 Revenue & Market Share

Samsung Electronics reported KRW 71.92 trillion (~USD 55–60 billion) in consolidated revenue in Q1 2024, with human augmentation technologies representing a smaller component of total revenue, estimated around 10–14 % of the specific augmentation technology market.

Global Presence

Samsung has a global footprint spanning Asia, Europe, the Americas, and beyond, with augmentation-related products accessible in many regions.

5. Google (Alphabet Inc.)

Specialization & Key Focus Areas

Google contributes to human augmentation through AI-driven wearable technologies, smart interfaces, and prototype neural or immersive interface systems. Its investments in AR, AI, cloud-assisted wearables, and machine learning platforms underpin many augmentation use cases in both consumer and enterprise sectors.

Notable Features

-

AI integration for enhanced user experiences

-

AR wearables (exploratory projects)

-

Scalable cloud-AI backend for augmentative analytics

2024 Revenue & Market Share

Alphabet Inc. posted revenues of over USD 200 billion annually, with its share of the human augmentation segment estimated between 12–16 %, reflecting strength in software, AI, and platform capabilities rather than hardware sales alone.

Global Presence

Google has a truly global presence, with products and R&D facilities across North America, Europe, Asia, and other regions, enabling cross-border deployment of AR, AI, and augmentation tools.

Leading Trends in the Human Augmentation Market and Their Impact

Human augmentation is rapidly evolving due to several major trends shaping innovation, adoption, and market value across sectors:

1. Brain-Computer Interfaces (BCIs)

BCIs are one of the fastest-growing segments, enabling users to control devices with thoughts, restore abilities to individuals with paralysis, and open up new paradigms in human-machine interaction. Improvements in electrode technology, signal processing, and wireless systems are accelerating BCI development.

2. AI-Enhanced Exoskeletons and Wearables

Augmentative exoskeletons combined with AI are transforming physical augmentation. Lightweight, adaptive exosuits can reduce worker fatigue, improve ergonomic support, and provide rehabilitation assistance. Soft robotics and machine-learning control algorithms are increasing comfort and usability.

3. Sensory Augmentation via AR/VR

AR and VR devices offer methods of sensory enhancement, blending digital information with physical perception. Applications include training, remote collaboration, surgical planning, and cognitive enhancement.

4. Wearables and Biometric Sensing

Wearable devices monitor physiological signals and provide feedback, enhancing health tracking, adaptive feedback, and real-time decision support, integrating with broader ecosystems like smartphones and cloud services.

5. Modular, AI-Driven Software Platforms

Augmentation increasingly relies on AI-driven software to interpret sensor data, adapt responses to individual users, and deliver customized augmentative functions. This extends augmentation into cognitive assistance, prosthetic control, and health monitoring.

Successful Examples of Human Augmentation Around the World

1. Clinical BCI Implants: Patients with paralysis have used neural implants to control computers and robotic devices through thought alone, restoring digital and motor functions.

2. Exoskeleton Use in Rehabilitation: Exoskeleton systems have enabled individuals with spinal cord injuries to stand, walk, and participate more fully in rehabilitation programs.

3. Industrial Augmentation Solutions: Exoskeletons are deployed in manufacturing and logistics to reduce injury rates, enhance productivity, and support aging workforces with physically demanding tasks.

4. AR-Enabled Training and Workflows: AR systems are used in complex assembly, maintenance, and remote assistance, enabling workers to view digital overlays on physical environments for enhanced precision and safety.

Global Regional Analysis Including Government Initiatives & Policies

North America

North America dominates the human augmentation market, capturing around 30–40 % of global revenue due to strong R&D investments, supportive regulatory frameworks, and the presence of major technology innovators. U.S. agencies like DARPA, NIH, and the Department of Defense fund prosthetics, BCIs, and augmentation research. FDA breakthrough device designations accelerate clinical adoption, while Medicare reimbursement for personal exoskeletons increases patient access.

Europe

Europe maintains a significant market share with advanced healthcare infrastructure and regulatory clarity emphasizing safety and efficacy. EU research programs foster innovation in assistive technologies, with countries like Germany and France leading clinical deployments of exoskeletons and AR systems.

Asia-Pacific

Asia-Pacific is one of the fastest-growing regions due to rapid industrialization, increasing disposable income, and government support for technology and innovation. Countries such as China, Japan, and South Korea invest heavily in robotics, AI, and wearable systems, while programs to improve elderly care and automation drive augmentation adoption in healthcare and manufacturing sectors.

Latin America, Middle East & Africa

These regions are developing markets for human augmentation, with growing awareness and investment in healthcare augmentation, defense modernization, and industrial automation. Although adoption rates are lower, targeted government initiatives and partnerships are expanding access to augmentation solutions in emerging economies.

Government Policies Shaping the Market

Government policies and funding models are critical in shaping market growth. Regulatory designations accelerate clinical approvals, reimbursement policies translate innovation into commercial uptake, defense research agencies allocate funding to soldier augmentation, European frameworks balance innovation with ethical safeguards, and Asia-Pacific governments promote R&D incentives and technology grants to bolster industrial and healthcare augmentation ecosystems.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Polyamide Market Revenue, Trends, and Strategic Insights by 2035