Health Insurance Market Growth, Trends, and Leading Players (2024-2034)

The Health Insurance Market Overview

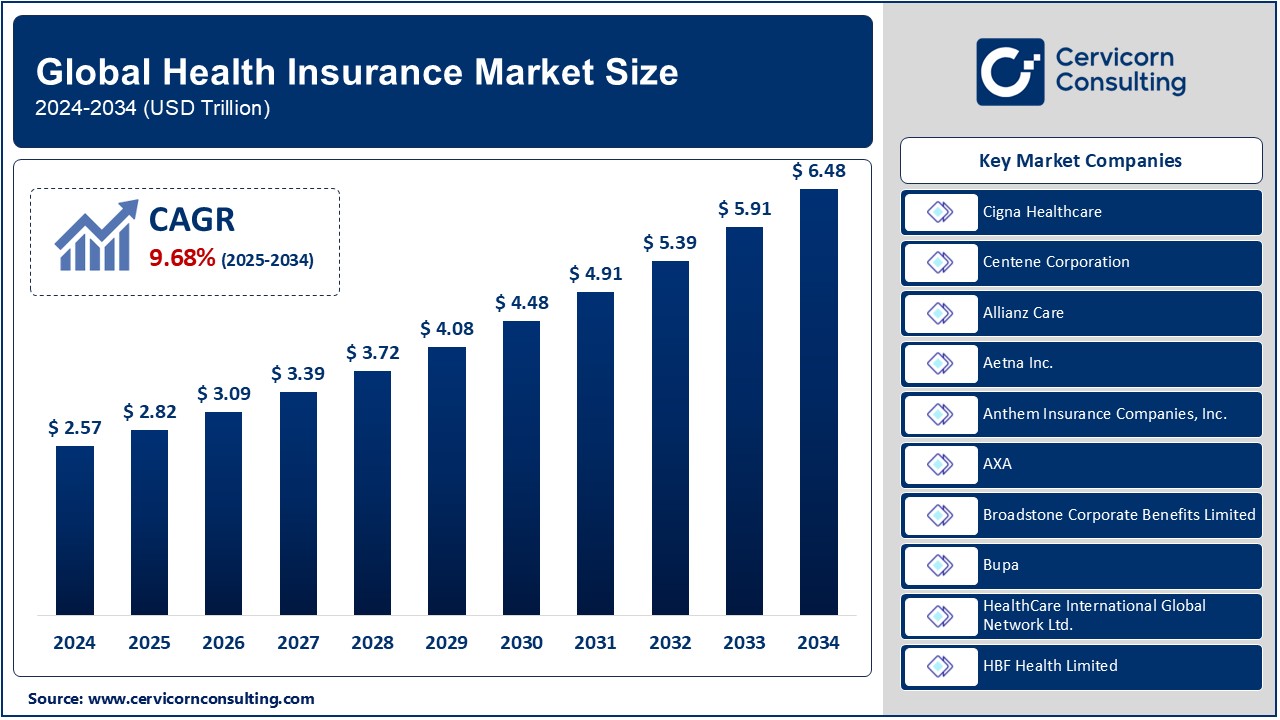

The global health insurance market was worth USD 2.57 trillion in 2024 and is anticipated to expand to around USD 6.48 trillion by 2034, registering a compound annual growth rate (CAGR) of 9.68% from 2025 to 2034.

The health insurance market is a vital component of the global healthcare system, providing financial protection and access to medical services for millions worldwide. With the rising prevalence of chronic diseases, increased healthcare costs, and growing awareness about the importance of preventive care, the health insurance market has witnessed significant growth. Key factors driving this growth include advancements in digital healthcare, innovative policy offerings, government mandates, and the expansion of private and public health insurance programs.

What is the Health Insurance Market?

The health insurance market encompasses the network of providers, insurers, and stakeholders involved in offering health insurance policies to individuals and groups. These policies cover various healthcare expenses such as hospitalization, outpatient care, prescription medications, preventive care, and sometimes dental and vision services. Health insurance can be categorized into public insurance (e.g., government-funded programs like Medicare and Medicaid in the U.S.) and private insurance provided by commercial entities. The market caters to diverse customer needs, including employer-sponsored plans, individual plans, and specialized coverage for critical illnesses or specific demographics.

Why is the Health Insurance Market Important?

Health insurance is critical for ensuring equitable access to healthcare services and reducing the financial burden of medical expenses on individuals and families. It promotes early diagnosis and treatment by encouraging preventive care and regular check-ups. Moreover, it supports healthcare infrastructure by pooling resources and funding medical innovations. In many countries, health insurance is a legal requirement, further emphasizing its role in shaping public health outcomes and economic stability. For individuals, it offers peace of mind and financial security during medical emergencies.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2477

Top Companies in the Health Insurance Market

Below are profiles of some leading companies in the health insurance market, highlighting their specialization, key focus areas, notable features, 2023 revenue estimates, market share, and global presence:

1. Cigna Healthcare

- Specialization: Comprehensive health and wellness solutions.

- Key Focus Areas: Individual and employer-sponsored plans, international health insurance, and wellness programs.

- Notable Features: Tailored solutions for expatriates, robust telemedicine services, and an emphasis on preventive care.

- 2023 Revenue (approx.): $180 billion.

- Market Share (approx.): 5%.

- Global Presence: Operations in over 30 countries, with a strong presence in North America, Europe, and Asia.

2. Centene Corporation

- Specialization: Managed care services for government-sponsored programs.

- Key Focus Areas: Medicaid, Medicare Advantage, and Affordable Care Act (ACA) marketplace plans.

- Notable Features: Focus on underserved communities and integration of behavioral health services.

- 2023 Revenue (approx.): $144 billion.

- Market Share (approx.): 6%.

- Global Presence: Predominantly in the United States, with growing international partnerships.

3. Allianz Care

- Specialization: International health insurance for expatriates and global citizens.

- Key Focus Areas: Global mobility solutions, corporate plans, and tailored individual coverage.

- Notable Features: Worldwide network of medical providers, multilingual support, and digital health tools.

- 2023 Revenue (approx.): $120 billion.

- Market Share (approx.): 4%.

- Global Presence: Coverage in over 70 countries, with a focus on Europe and Asia-Pacific.

4. Aetna Inc.

- Specialization: Managed care and traditional health insurance.

- Key Focus Areas: Employer-sponsored plans, Medicare, and pharmacy benefit management.

- Notable Features: Integration with CVS Health, consumer-friendly digital platforms, and wellness incentives.

- 2023 Revenue (approx.): $90 billion.

- Market Share (approx.): 3%.

- Global Presence: Strong foothold in the United States, with expanding international operations.

5. Anthem Insurance Companies, Inc.

- Specialization: Blue Cross Blue Shield plans and government-sponsored programs.

- Key Focus Areas: Medicaid, Medicare Advantage, and individual ACA marketplace plans.

- Notable Features: Data-driven health insights, value-based care initiatives, and mobile health solutions.

- 2023 Revenue (approx.): $157 billion.

- Market Share (approx.): 7%.

- Global Presence: Operations primarily in the United States, with limited international exposure.

Leading Trends and Their Impact

- Telemedicine Integration: The adoption of telemedicine has surged, enabling insurers to provide remote consultations and reducing costs for routine care. Companies like Cigna and Aetna are leading in integrating telehealth into their offerings, improving accessibility and patient engagement.

- Value-Based Care: A shift from fee-for-service to value-based care is transforming the industry. Insurers are collaborating with healthcare providers to focus on patient outcomes, emphasizing preventive measures and chronic disease management.

- AI and Data Analytics: Advanced analytics tools are helping insurers predict healthcare trends, optimize claims processing, and customize policies. This has led to increased efficiency and better customer experiences.

- Personalized Plans: With diverse customer needs, insurers are offering tailored plans that include wellness programs, mental health coverage, and options for alternative treatments.

- Global Mobility Solutions: As globalization increases, demand for international health insurance for expatriates and travelers is growing. Allianz Care and Cigna have strengthened their global mobility offerings to cater to this segment.

Successful Examples in the Health Insurance Market

- Germany’s Public-Private Model: Germany’s health insurance system combines public and private options, ensuring universal coverage while maintaining market competition. This model has achieved high satisfaction rates and superior health outcomes.

- Singapore’s MediShield Life: Singapore’s universal health insurance scheme provides affordable coverage while encouraging personal responsibility through co-payment mechanisms.

- United States’ Medicare Advantage: The Medicare Advantage program has seen tremendous growth, offering seniors a wide range of benefits, including dental and vision care, beyond traditional Medicare.

- Sweden’s Egalitarian System: Sweden’s government-funded health insurance ensures access to high-quality care for all residents, reducing disparities in healthcare outcomes.

Regional Analysis

North America

- Key Features: High penetration of private insurance, robust employer-sponsored plans, and significant government programs like Medicare and Medicaid.

- Government Initiatives: The Affordable Care Act (ACA) expanded coverage for millions, emphasizing preventative care and consumer protections.

Europe

- Key Features: A mix of public and private insurance, with strong regulatory oversight and universal coverage in most countries.

- Government Initiatives: Programs like Germany’s statutory health insurance (SHI) and the UK’s National Health Service (NHS) focus on inclusivity and affordability.

Asia-Pacific

- Key Features: Rapidly growing market driven by economic growth, urbanization, and rising healthcare awareness.

- Government Initiatives: India’s Ayushman Bharat and China’s Basic Medical Insurance are notable programs aiming to expand coverage for low-income populations.

Latin America

- Key Features: Developing health insurance infrastructure, with public insurance dominating the market.

- Government Initiatives: Brazil’s Unified Health System (SUS) and Mexico’s Seguro Popular focus on expanding access to essential health services.

Middle East and Africa

- Key Features: Emerging market with increasing private sector participation and government efforts to expand universal coverage.

- Government Initiatives: The UAE’s mandatory health insurance policies and South Africa’s National Health Insurance (NHI) plan are shaping the market landscape.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Ambulatory Surgery Centers Market Growth, Trends, Key Players, and Future Projections (2024-2033)