General Delivery Transportation Market Revenue, Market Share & Innovations (2025 – 2034)

General Delivery Transportation Market Size

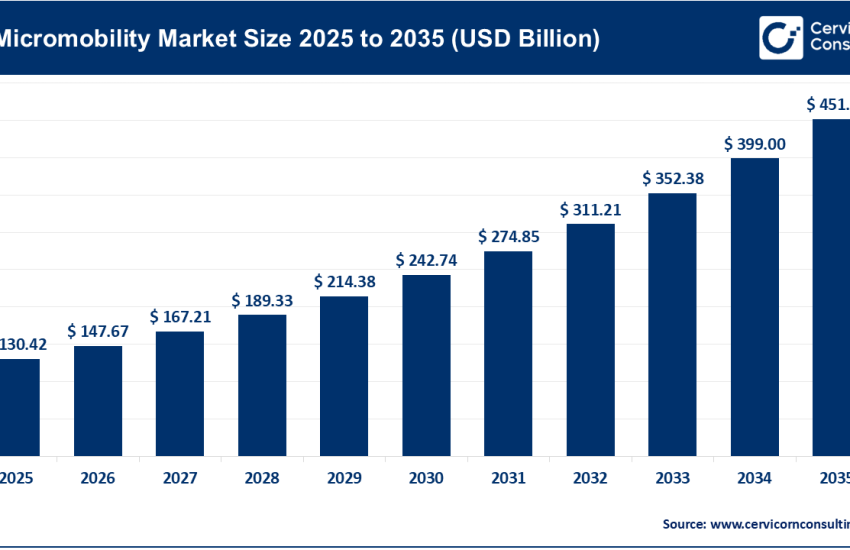

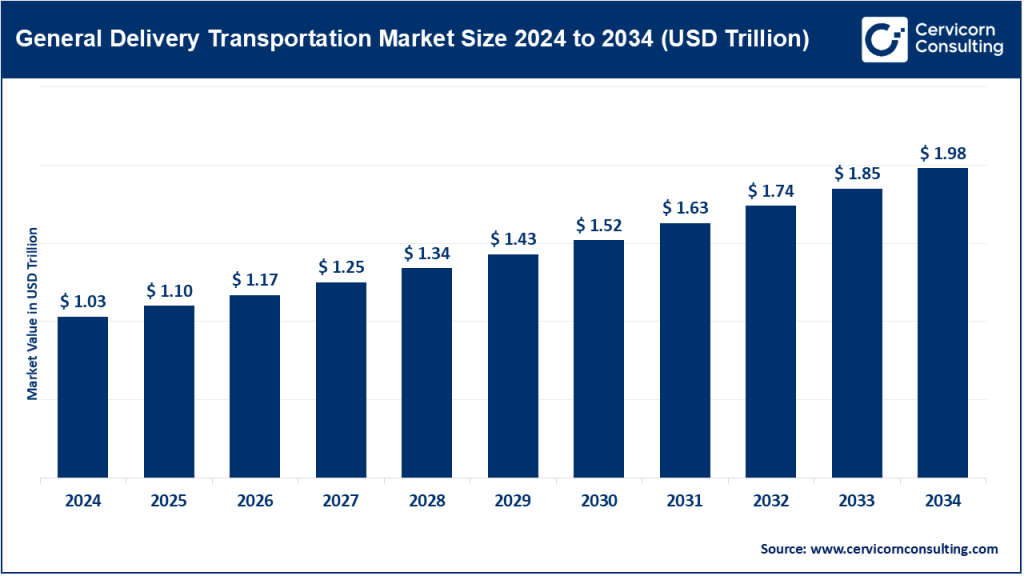

The global general delivery transportation market size was worth USD 1.03 trillion in 2024 and is anticipated to expand to around USD 1.98 trillion by 2034, registering a compound annual growth rate (CAGR) of 8.5% from 2025 to 2034.

General Delivery Transportation Market Growth Factors

The general delivery transportation market is driven by a combination of macroeconomic, technological, and consumer behavior factors. The exponential growth of e-commerce and business-to-business logistics is resulting in higher parcel and freight volumes globally. Sustainability mandates and corporate ESG goals are accelerating the shift toward electric and alternative-fuel fleets. Digital platforms—leveraging AI for route optimization, predictive maintenance, IoT-based tracking, and blockchain for supply chain visibility—are revolutionizing operations. Infrastructure investments in urban logistics hubs, intermodal corridors, and port modernization are reducing delivery bottlenecks. The rise of on-demand and gig-economy delivery services adds flexibility and cost-efficiency.

Additionally, globalization and the expansion of cross-border trade increase the complexity and scale of delivery networks, prompting public and private investment in intelligent logistics systems and EV infrastructure, collectively pushing the market toward unprecedented growth.

What Is the General Delivery Transportation Market?

The general delivery transportation market encompasses services that facilitate the movement of parcels, packages, and general freight, excluding niche or specialized logistics such as hazardous materials or perishable goods. This broad market includes courier, express, and parcel (CEP) delivery, road and rail freight, air cargo, maritime shipping, and last-mile services. It is the backbone of retail, e-commerce, industrial supply chains, and global trade. The market handles both B2B and B2C delivery requirements, often operating across complex multimodal networks and digital ecosystems that enable timely and cost-effective transport from origin to destination.

Why Is It Important?

This market is fundamental to the functioning of modern commerce and daily life. It supports global supply chains, connects producers to consumers, and powers industries such as retail, manufacturing, healthcare, and agriculture. With the rapid growth of e-commerce, particularly in the wake of the COVID-19 pandemic, the importance of last-mile and home delivery services has surged. Logistics costs often represent a significant portion of the total cost of goods sold, especially for consumer-facing businesses. Furthermore, the sector is critical to economic development, urban mobility, employment generation, and even sustainability efforts, as it transitions to cleaner transportation solutions to reduce emissions and environmental impact.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2679

General Delivery Transportation Market – Top Companies

Amazon (Amazon Logistics / Amazon Shipping)

- Specialization: In-house parcel delivery network for Amazon’s e-commerce ecosystem, expanding to third-party logistics.

- Key Focus Areas: Dense last-mile networks, two-day and same-day shipping, robotics in warehousing, EV delivery fleets, AI-driven logistics.

- Notable Features: Vertically integrated logistics infrastructure from fulfillment centers to doorstep delivery; proprietary routing algorithms and real-time tracking.

- 2024 Revenue (Estimate): Estimated tens of billions in logistics revenue. Overall North America sales in 2023 exceeded $360 billion, with logistics contributing significantly.

- Market Share: Among the top parcel delivery service providers globally by volume.

- Global Presence: Strong in North America, Europe, and expanding in Asia-Pacific.

FedEx Corporation

- Specialization: Global courier and logistics provider with services in air freight, ground shipping, and freight forwarding.

- Key Focus Areas: AI-based route planning, predictive analytics, automation, sustainability, and international trade logistics.

- Notable Features: BrightDrop electric delivery vans, a vast air cargo network, and advanced digital tracking systems.

- 2024 Revenue: Approximately $94 billion.

- Market Share: One of the top three global CEP providers.

- Global Presence: Operations in over 220 countries and territories.

United Parcel Service (UPS)

- Specialization: Package delivery and supply chain management services.

- Key Focus Areas: Fleet electrification, drone delivery, route optimization, and sustainability.

- Notable Features: Owns UPS Airlines; innovative drone delivery service (UPS Flight Forward); robust global infrastructure.

- 2024 Revenue: Estimated over $100 billion.

- Market Share: Approximately 15% of global parcel delivery market.

- Global Presence: Delivering to over 200 countries and territories.

Deutsche Post DHL Group

- Specialization: Parcel, express, freight forwarding, and integrated logistics services under the DHL brand.

- Key Focus Areas: Green logistics, automation, global trade facilitation, and digital transformation.

- Notable Features: Comprehensive multimodal network; strong presence in Europe and emerging markets.

- 2024 Revenue: Estimated at around €94 billion.

- Market Share: Holds a leading position in the global CEP market.

- Global Presence: Active in more than 220 countries and territories.

Maersk

- Specialization: Integrated container logistics and shipping, combining sea, air, and land freight.

- Key Focus Areas: Multimodal transport, digital platforms, end-to-end logistics, and port terminal management.

- Notable Features: Strong maritime backbone; digital logistics platform for end-to-end supply chain visibility.

- 2024 Revenue: Approximately $81 billion.

- Market Share: A top global player in sea freight; expanding in general delivery logistics.

- Global Presence: Operations in more than 130 countries.

Leading Trends and Their Impact

- Electrification of Delivery Fleets: Major firms are deploying EVs to cut emissions and meet sustainability targets.

- Digital Transformation: AI, analytics, and big data improve route planning, customer service, and cost efficiency.

- Autonomous and Drone Deliveries: Pilots and early deployments show potential for high-efficiency last-mile logistics.

- Real-Time Tracking and Visibility: IoT and GPS provide greater supply chain transparency and reliability.

- On-Demand and Gig Economy Logistics: Flexible delivery networks offer rapid service in urban environments.

- Green and Smart Logistics Hubs: Warehouses and distribution centers integrate clean energy and automation.

- Intermodal Integration: Blending sea, air, road, and rail optimizes delivery time and cost.

Successful Examples Around the World

- UPS Flight Forward (USA): FAA-certified drone delivery operations for medical and campus deliveries.

- Amazon Prime Air (UK/USA): Pilot drone deliveries executed in under 30 minutes.

- Maersk Integrated Platform: Seamless multimodal operations reduce transit delays and improve visibility.

- Belt and Road Initiative (China): Mega infrastructure investment linking Asia to Europe and Africa for faster trade routes.

- Smart City Logistics (Europe): Urban policies promoting green deliveries and reducing congestion.

Global and Regional Analysis

Asia-Pacific

Rapid e-commerce expansion, infrastructure investment, and favorable government policies position Asia-Pacific as the fastest-growing region in the delivery transportation space. Countries like China and India are heavily funding logistics hubs, smart freight corridors, and EV adoption programs.

North America

Home to global leaders like Amazon, UPS, and FedEx, North America focuses on last-mile innovations, warehouse automation, and regulatory incentives for fleet electrification. Government support for infrastructure and EV deployment is strong.

Europe

Europe leads in green logistics. With emission control zones, EU Green Deal mandates, and a strong public-private partnership model, the region is aggressively shifting to electric vehicles and low-impact urban delivery methods.

Middle East and Africa

Governments in the Gulf region are building logistics infrastructure and special economic zones. Africa is increasingly benefiting from foreign investment in transportation corridors and trade facilitation programs.

Latin America

Challenges include underdeveloped logistics networks, but countries like Brazil and Mexico are investing in digital platforms, smart infrastructure, and airport expansions to support growing e-commerce demand.

Government Initiatives and Policies Shaping the Market

- Emission Reduction Mandates: Governments are enforcing fleet electrification and introducing green vehicle incentives.

- Infrastructure Investment: Public spending in intermodal corridors, urban freight hubs, and port modernization is accelerating.

- Digital Freight Corridors: Policy-driven innovation supports digitized, secure freight transport systems.

- Public-Private Partnerships: Collaboration models help scale EV infrastructure, warehouse ecosystems, and logistics innovation.

- Drone and AV Regulations: Legal frameworks are emerging to support commercial drone and autonomous delivery services.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Unmanned Aerial Vehicle (UAV) Market Trends, Leaders, and Global Impact by 2034