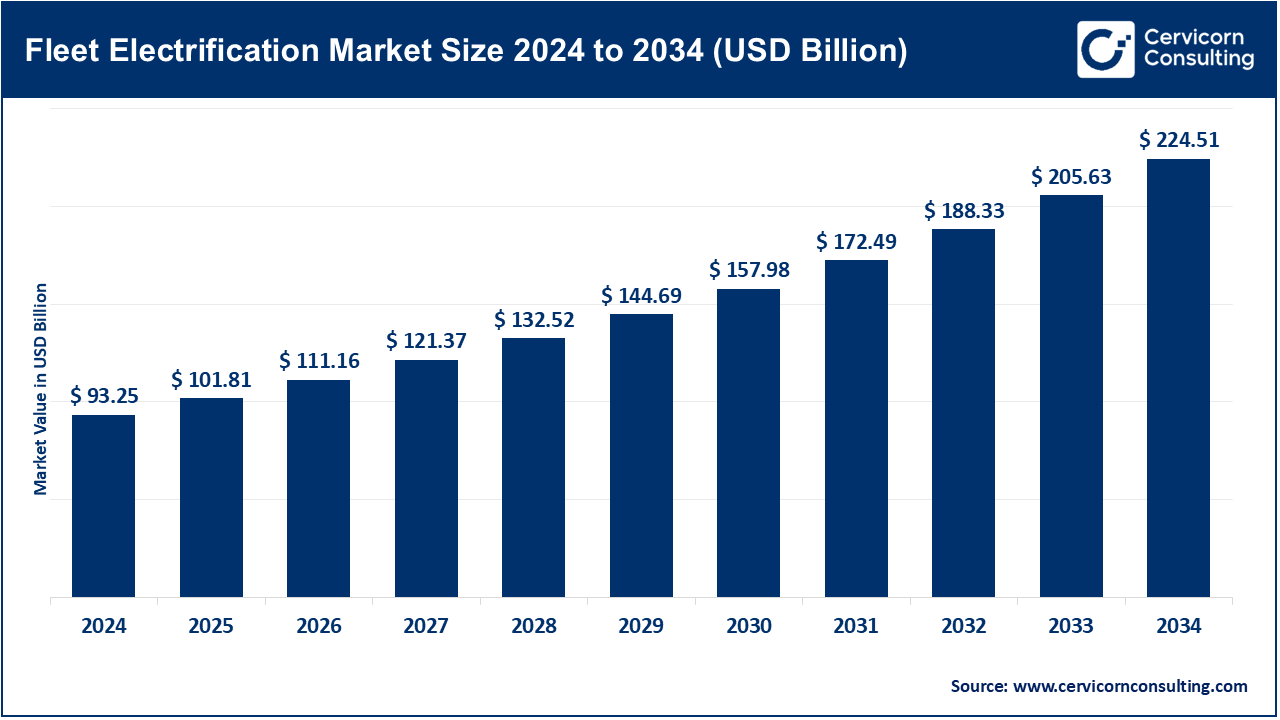

Fleet Electrification Market to Grow at a CAGR of 9.20% to Drive USD 224.5 Billion by 2034

Fleet Electrification Market Size

The global fleet electrification market size was worth USD 93.25 billion in 2024 and is anticipated to expand to around USD 224.51 billion by 2034, registering a compound annual growth rate (CAGR) of 9.20% from 2025 to 2034.

What is the Fleet Electrification Market?

The fleet electrification market encompasses the conversion or replacement of internal combustion engine (ICE) fleet vehicles with electric vehicles (EVs) across various sectors such as commercial transportation, logistics, public transit, utilities, government, and corporate services. This market involves a broad range of components, including electric powertrains, batteries, electric drivetrains, EV-specific telematics, and supporting infrastructure such as fleet-level charging stations and energy management systems. Fleet electrification is not limited to passenger cars—it also includes electric trucks, vans, buses, and specialized vehicles like refuse trucks and utility vehicles.

Why is Fleet Electrification Important?

Fleet electrification plays a pivotal role in reducing greenhouse gas emissions, decreasing fleet operation and maintenance costs, and supporting regulatory compliance amid tightening emissions and fuel economy standards. Electrified fleets are often central to corporate sustainability agendas, government decarbonization roadmaps, and energy independence goals. Additionally, as fleets typically represent a large portion of vehicle miles traveled (VMT), transitioning them to electric power can result in outsized environmental and economic benefits. The market also holds strategic importance for power grid modernization and vehicle-to-grid (V2G) initiatives, turning fleet assets into potential energy storage and balancing tools.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2661

Fleet Electrification Market Growth Factors

The fleet electrification market is growing rapidly due to a convergence of factors such as stricter emissions regulations, rising fuel costs, declining battery prices, and growing pressure on corporations to meet environmental, social, and governance (ESG) targets. Government subsidies and tax incentives, particularly in North America, Europe, and China, have significantly accelerated EV adoption in fleets, while advances in charging infrastructure and fleet management platforms have made deployment more practical and cost-effective.

Furthermore, innovations in battery technology have improved range, reliability, and charging speed, making electric fleets increasingly viable for long-haul and high-duty applications. Corporate commitments from logistics giants like Amazon, UPS, and FedEx to electrify large portions of their delivery fleets have also boosted demand, while urban congestion and clean air zones are incentivizing transit agencies and municipalities to shift toward e-buses and shared electric mobility. The integration of AI-driven fleet optimization and real-time telematics data has further bolstered the ROI proposition for fleet electrification across industries.

Top Companies in the Fleet Electrification Market

1. Robert Bosch GmbH

- Specialization: Powertrain systems, e-mobility components, battery management systems

- Key Focus Areas: Integrated electric drives, e-axles, advanced battery tech

- Notable Features: Supplier of complete e-drive modules, active in vehicle-to-grid integration

- 2024 Revenue: Estimated $6.8 billion from electrification-related technologies

- Market Share: ~7.2% of the global fleet electrification components segment

- Global Presence: Extensive manufacturing and R&D facilities in Europe, Asia-Pacific, and North America

2. Continental AG

- Specialization: Electric powertrains, control units, energy management systems

- Key Focus Areas: Modular electric drive platforms, thermal management for EVs

- Notable Features: Continental’s high-voltage drive system is used in numerous commercial fleet applications

- 2024 Revenue: ~$5.3 billion from EV and hybrid solutions

- Market Share: ~6.1% in the electric commercial fleet components market

- Global Presence: Strong footprint in Europe, the U.S., and China

3. DENSO CORPORATION

- Specialization: Electric motors, inverters, battery cooling systems

- Key Focus Areas: Electrification components for heavy-duty fleets, advanced thermal management

- Notable Features: Works closely with Toyota and other OEMs for commercial EV integration

- 2024 Revenue: ~$4.7 billion from EV systems

- Market Share: ~5.4% in electrified fleet systems

- Global Presence: Strong in Japan, North America, and growing in Southeast Asia

4. Aptiv

- Specialization: Advanced safety and electrification architecture

- Key Focus Areas: High-voltage distribution, smart vehicle platforms

- Notable Features: Offers end-to-end EV fleet solutions including software, sensors, and power systems

- 2024 Revenue: ~$3.9 billion from electrified platforms

- Market Share: ~4.8% in connected and electric fleet ecosystems

- Global Presence: Active in the U.S., Europe, India, and expanding in Latin America

5. Johnson Electric Holdings Limited

- Specialization: Motion subsystems, actuators for EV powertrains

- Key Focus Areas: Compact motors for commercial EV applications

- Notable Features: Supplies major OEMs and fleet conversion specialists

- 2024 Revenue: ~$1.6 billion from e-mobility components

- Market Share: ~2.3% in global EV fleet electrification parts

- Global Presence: Manufacturing and engineering hubs in Asia, Europe, and the U.S.

Leading Trends and Their Impact on the Fleet Electrification Market

1. Rise of Vehicle-to-Grid (V2G) Technology: V2G allows EVs to return electricity to the grid, turning fleet vehicles into mobile energy storage units. This helps in peak demand management and grid stabilization, especially as renewable energy use increases.

2. Total Cost of Ownership (TCO) Optimization: Fleet managers are increasingly focused on TCO rather than just upfront costs. Lower fuel and maintenance costs of EVs are making them attractive despite higher initial investments.

3. Digital Fleet Management Integration: Real-time telematics, AI-based routing, predictive maintenance, and charging analytics are becoming integral to fleet operations, enhancing the efficiency and scalability of electrified fleets.

4. Battery-as-a-Service (BaaS) and Leasing Models: Innovative business models such as battery leasing, pay-per-mile, and performance-based financing are removing CAPEX barriers for fleet operators.

5. Fleet-Specific Charging Infrastructure: Companies are building depot-centric and en-route charging networks tailored to fleet schedules, often with on-site energy storage and renewable integration.

6. Urban Clean Air Zones and Regulatory Push: Low-emission zones in cities like London, Amsterdam, and Los Angeles are accelerating fleet electrification mandates.

7. OEM Commitments and Electrification Roadmaps: Automakers like Daimler, Volvo, and Ford are rapidly expanding their electric commercial vehicle offerings tailored for fleet deployment.

Successful Examples of Fleet Electrification Around the World

- Amazon (United States): Amazon has committed to deploying 100,000 Rivian electric delivery vans by 2030. Thousands are already in operation, supported by Amazon’s proprietary fleet management and charging infrastructure.

- UPS and Arrival (United Kingdom): UPS has partnered with Arrival to roll out custom-built electric vans optimized for urban logistics, with integrated route planning and real-time fleet data analytics.

- DHL (Germany): DHL’s StreetScooter program electrified its postal delivery fleet with purpose-built EVs, reducing emissions and achieving substantial operational savings.

- BYD and Shenzhen Transport Bureau (China): Shenzhen became the first major city globally to fully electrify its public bus fleet (~16,000 buses) using BYD vehicles, with infrastructure powered by renewable energy.

- Transport for London (United Kingdom): TfL introduced electric double-decker buses and required all new black cabs to be electric or hybrid, contributing to improved air quality in the capital.

- Bangalore Metropolitan Transport Corporation (India): Partnered with Tata Motors to deploy hundreds of electric buses, supported by India’s FAME II scheme.

Global Regional Analysis and Government Initiatives Shaping the Fleet Electrification Market

North America

- Market Size (2024): ~$22.8 billion

- Key Drivers: Corporate fleet sustainability goals, state-level zero-emission mandates, federal tax incentives (e.g., IRA)

- Government Policies: U.S. Inflation Reduction Act (IRA) offers extensive credits for commercial EVs; Canada’s iMHZEV Program supports medium- and heavy-duty fleet electrification

- Regional Trends: Rapid depot electrification, school bus electrification initiatives, V2G pilots in California and New York

Europe

- Market Size (2024): ~$19.5 billion

- Key Drivers: EU Green Deal, high fuel prices, stringent CO2 standards, low-emission zone proliferation

- Government Initiatives: Germany’s electric commercial vehicle subsidy scheme; France’s ZE urban logistics zones; UK’s Plug-in Van Grant

- Regional Trends: Electrification of municipal fleets, last-mile logistics fleets transitioning to EVs, widespread adoption of fleet telematics and smart charging

Asia-Pacific

- Market Size (2024): ~$18.3 billion

- Key Drivers: Urban air quality goals, rising energy security concerns, strong domestic EV production in China, India

- Government Policies: China’s NEV subsidies and fleet electrification mandates; India’s FAME II for commercial EVs and bus electrification

- Regional Trends: E-bus dominance in China, light electric trucks gaining traction in Japan and South Korea, ride-sharing EV fleet expansion in Southeast Asia

Latin America

- Market Size (2024): ~$4.7 billion

- Key Drivers: Air pollution in urban areas, rising fuel costs, international climate finance

- Government Initiatives: Chile’s electric bus program; Colombia’s green public transport initiatives; tax exemptions for EV fleets in Brazil

- Regional Trends: Growing use of EVs in public transport, local assembly of electric vans and micro-EVs, foreign direct investments from China

Middle East & Africa

- Market Size (2024): ~$2.1 billion

- Key Drivers: High oil prices creating EV interest, sustainability targets in Gulf countries, donor-funded pilot projects

- Government Actions: UAE’s Green Mobility Strategy, Egypt’s e-bus deployment plans, South Africa’s electric taxi feasibility studies

- Regional Trends: EV deployment in logistics and hospitality fleets, infrastructure development lagging but improving, solar-powered charging emerging as a solution

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Passenger Cars Market Set for 16.10% CAGR Growth