Fertility Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Fertility Market Size & Outlook

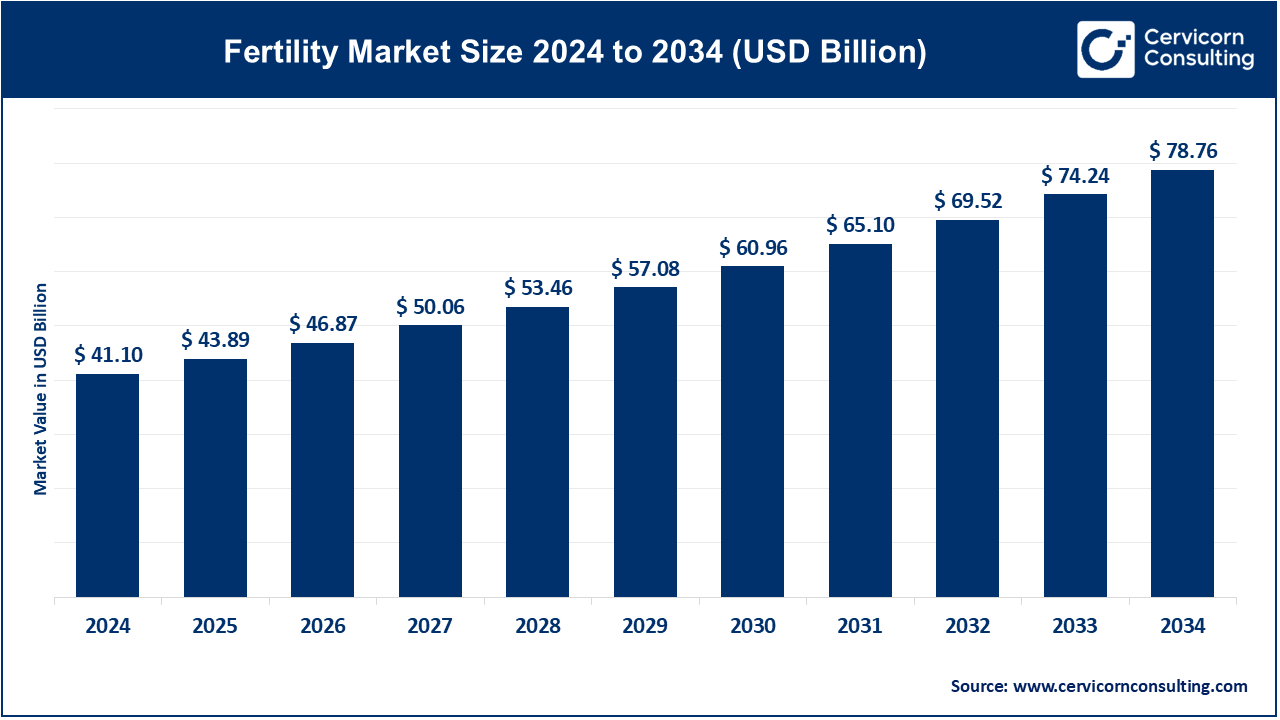

The global fertility market size was worth USD 41.10 billion in 2024 and is anticipated to expand to around USD 78.76 billion by 2034, registering a compound annual growth rate (CAGR) of 6.72% from 2025 to 2034, driven by:

- Increasing ART accessibility

- Greater insurance coverage and government support

- Improved IVF success rates

- Adoption of automation, AI and genetic technologies

- Growing fertility preservation demand

APAC, Europe and North America show the strongest growth momentum, with emerging markets rapidly increasing ART penetration.

Fertility Market Growth Factors

The fertility market is expanding rapidly due to rising infertility rates caused by delayed parenthood, lifestyle factors, and underlying medical conditions; increasing awareness and acceptance of ART; growth in elective fertility preservation such as egg freezing; higher female workforce participation; improved IVF success rates driven by AI, automation, time-lapse imaging, and advanced genetic testing; increased employer-sponsored fertility benefits; regulatory clarity in several regions; cross-border reproductive care and medical tourism; venture capital and private equity investment into fertility chains; and supportive government initiatives aimed at addressing demographic challenges such as declining birth rates. Together, these forces create stronger patient demand, improved clinic capabilities and a more vibrant global market.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2427

What Is the Fertility Market?

The fertility market consists of all medical services, technologies and products that help individuals and couples conceive. This includes:

-

Fertility clinics offering IVF, ICSI, IUI, donor programs and surrogacy coordination

-

Diagnostic services such as hormone tests, ovarian reserve assessments and genetic screening

-

Fertility drugs, including ovulation-inducing medications and hormonal therapies

-

Laboratory equipment such as incubators, cryopreservation tools and culture media

-

Cryobanking (egg, sperm and embryo freezing)

-

Advanced technologies such as AI-enabled embryo selection, reproductive genomics and personalized medicine tools

Some market reports define the market narrowly around IVF cycles, while others include adjacent sectors such as pharmaceuticals, biotech and lab manufacturing.

Why the Fertility Market Is Important

The fertility market is crucial for several reasons:

Medical importance: Millions of individuals worldwide face infertility, and ART helps provide safe, effective solutions.

Social importance: The market supports diverse family structures—single parents by choice, older parents, LGBTQ+ families and cancer survivors preserving fertility.

Economic importance: Fertility services support clinicians, embryologists, biotech firms, lab manufacturers, and diagnostic companies while attracting private investment and generating significant healthcare revenue.

Demographic importance: With many nations facing declining birth rates, ART has become a part of long-term demographic and public policy planning.

Ethical and policy relevance: The sector intersects with debates on surrogacy, donor rights, embryo storage, and access to reproductive care.

Company Profiles

1. Boston IVF Fertility Clinic

Specialization:

Comprehensive reproductive medicine including IVF, IUI, egg freezing, male infertility, fertility preservation, PGT genetic testing, and donor programs.

Key Focus Areas:

High-volume IVF, excellence in embryology labs, outcomes transparency, research collaborations, and patient-centered treatment.

Notable Features:

One of the most recognized fertility clinic networks in the United States with multiple centers; known for high clinical standards and strong success-rate reporting.

2024 Revenue / Market Share:

As a privately held fertility network, Boston IVF does not publicly publish 2024 revenue. Industry databases estimate multi-million-dollar revenue based on clinic size and cycle volume, but exact figures are not disclosed.

Global Presence:

Primarily operates across the United States, serving both domestic and international patients who travel for treatment.

2. INVO Bioscience (INVO)

Specialization:

Developer of the INVOcell system, an intravaginal incubation device that offers a lower-cost alternative to traditional IVF laboratory incubation.

Key Focus Areas:

Affordable and simplified ART solutions, fertility clinic operations, device development, and international distribution partnerships.

Notable Features:

Publicly traded company offering the only FDA-cleared intravaginal culture system for ART. Positioned as an accessibility-focused fertility innovator.

2024 Revenue / Market Share:

INVO reported notable year-over-year revenue growth in 2024 driven by expansion of their U.S. fertility clinics and increased adoption of INVOcell. Revenue remained modest relative to large global players due to the company’s early-stage scale.

Global Presence:

Present primarily in the U.S., with global aspirations through device distribution programs and partnerships.

3. San Diego Fertility Center

Specialization:

Full-service fertility clinic offering IVF, egg donation, surrogacy support, male infertility services, embryo freezing and comprehensive diagnostics.

Key Focus Areas:

Advanced IVF treatments, international patient programs, donor services, and fertility preservation.

Notable Features:

Renowned fertility center in Southern California with a long track record, well-established medical team and strong patient satisfaction.

2024 Revenue / Market Share:

As a private clinic, revenue is not disclosed publicly. Business intelligence sources estimate multi-million-dollar annual revenue typical for a large U.S. fertility center.

Global Presence:

Primarily serves domestic U.S. patients, with a notable flow of international patients seeking IVF and surrogacy services.

4. Celmatix

Specialization:

A biotechnology company focused on women’s reproductive health, reproductive genomics and drug discovery.

Key Focus Areas:

Genomic markers for ovarian aging, diagnostics innovation, data-driven drug development, and partnerships with pharmaceutical companies.

Notable Features:

Holds extensive proprietary datasets on women’s reproductive health; among the pioneers in applying big data to fertility research.

2024 Revenue / Market Share:

As a private biotech organization, Celmatix does not generate significant commercial revenue and focuses primarily on R&D grants, partnerships and preclinical development.

Global Presence:

Based in the U.S. with collaborations across academic and pharmaceutical ecosystems worldwide.

5. FUJIFILM Irvine Scientific

Specialization:

Global manufacturer of IVF laboratory culture media, cryopreservation products, cell culture solutions and equipment.

Key Focus Areas:

High-quality lab consumables for ART clinics, cell and tissue culture innovations, media optimization, and scientific support.

Notable Features:

Part of FUJIFILM’s extensive healthcare and life sciences ecosystem; widely used by IVF laboratories worldwide.

2024 Revenue / Market Share:

FUJIFILM Holdings reported multi-billion-dollar revenues in 2024 across all businesses. Irvine Scientific is part of the broader medical systems and life-sciences segment; standalone revenue is not publicly separated.

Global Presence:

Strong worldwide presence with distribution channels covering North America, Europe, Asia Pacific, and emerging markets.

Leading Trends and Their Impact on the Fertility Market

1. AI-Driven Reproductive Technologies

AI algorithms are being used for embryo selection, predicting IVF success, improving lab workflows and enhancing diagnostic accuracy. This increases success rates and reduces the number of cycles required.

2. Elective Egg Freezing Surge

Due to family planning shifts, career priorities and later motherhood, elective egg freezing is one of the fastest-growing services. It drives demand for cryobanking infrastructure and long-term storage.

3. Growth of Cryopreservation

Egg, sperm and embryo banking are integral to oncology, donor programs, and “social freezing,” expanding revenue streams for clinics and suppliers.

4. Personalized Reproductive Medicine

Advanced genetic testing (PGT-A, carrier screening, mitochondrial DNA analysis) enables tailored treatment plans and enhances IVF outcomes.

5. Expansion of Fertility Benefits

Corporations increasingly offer fertility benefits covering IVF, ICSI, egg freezing and diagnostics, significantly improving ART adoption in North America and Europe.

6. Private Equity and Consolidation

Clinic networks are merging into larger regional or national groups, improving operational efficiency, standardizing care and attracting investment—but sometimes raising cost concerns.

7. Cross-Border Reproductive Care

Patients seek fertility treatment abroad for cost, legal or time advantages. Countries with supportive regulations are becoming ART tourism hubs.

Successful Examples of Fertility Market Models Worldwide

Spain (IVI-RMA Global)

Spain is a global leader due to supportive donor laws, high-quality clinics, and strong research integration. IVI has created one of the world’s largest fertility networks through consolidation and international expansion.

Israel

Israel’s national health system subsidizes multiple IVF cycles for eligible women, giving it one of the highest IVF usage rates globally.

Nordic Countries

Scandinavian countries offer generous public funding for ART with well-regulated clinics and strong patient outcomes.

United States (Private Clinic Networks)

Large private groups and PE-backed networks set standards for advanced lab technology and patient services, driving innovation and competition.

India and Thailand (Medical Tourism)

Affordable IVF pricing, skilled clinical talent and more flexible legal environments for donor programs make these countries major destinations for reproductive tourism.

Global Regional Analysis & Government Policies Influencing the Market

North America

- Multiple U.S. states have mandated insurance coverage for infertility treatments.

- Employer-sponsored fertility benefits have expanded significantly, increasing IVF access.

- Regulatory bodies emphasize outcomes reporting, lab quality and patient safety.

Europe

- Wide variation in ART regulations, donor anonymity laws and funding.

- Countries like France, Denmark and the UK offer partial or full funding for IVF cycles.

- Strong ethical oversight and national registries ensure quality control.

Asia Pacific

China

- Declining birth rates have pushed the government to introduce supportive pronatalist measures.

- Expanding access to ART and loosening childbirth restrictions contribute indirectly to market growth.

India

- The Assisted Reproductive Technology (Regulation) Act formalized licensing, reporting, and compliance standards for clinics and ART banks.

- Regulation of surrogacy and donor programs has improved transparency and patient safety.

Southeast Asia

- Thailand, Malaysia, and Singapore have strong private fertility sectors supported by medical tourism.

Middle East

- Several countries have invested heavily in fertility clinics to reduce infertility stigma and offer high-tech treatments.

- Regulations vary significantly by country, particularly regarding donor use.

Latin America

- Brazil, Argentina, Colombia and Mexico have growing ART markets driven by private investment and rising infertility rates.

- Some countries subsidize or partially cover fertility treatments.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Digital Therapeutics Market Growth Drivers, Trends, Key Players and Regional Insights by 2034