Europe Hydrogen Generation Market Growth Drivers, Key Players, Trends and Regional Insights by 2034

Europe Hydrogen Generation Market Size

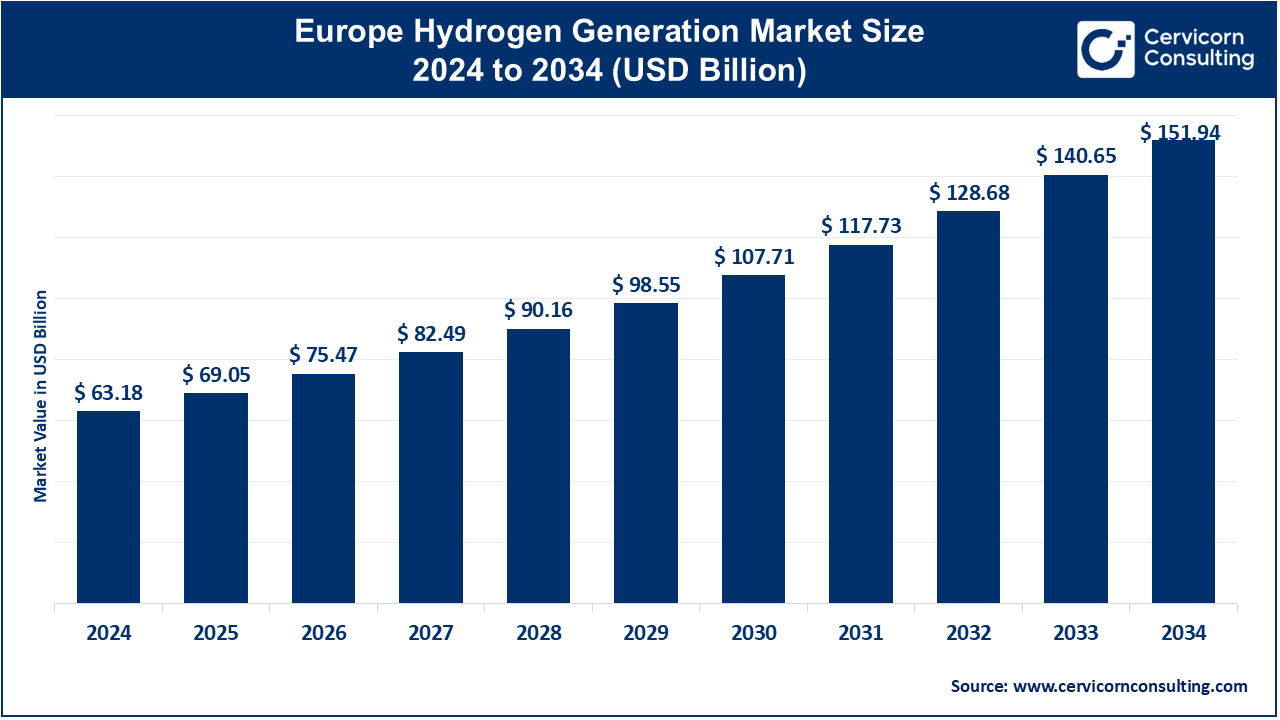

The Europe hydrogen generation market size was worth USD 63.18 billion in 2024 and is anticipated to expand to around USD 151.94 billion by 2034, registering a compound annual growth rate (CAGR) of 9.30% from 2025 to 2034.

Europe Hydrogen Generation Market — Growth Factors

Growth in the Europe hydrogen generation market is driven by several interconnected factors. Robust policy support from the EU and national governments, including multi-billion-euro investments and funding programs, is accelerating hydrogen deployment. Declining costs of renewable electricity enhance the economic viability of green hydrogen production via electrolysis.

At the same time, strong corporate commitments toward carbon neutrality are fostering steady demand in key sectors such as refining, chemicals, steelmaking, and heavy transport. Infrastructure development—including hydrogen pipelines, refueling stations, and storage facilities—is reducing logistical bottlenecks. Technological advancements in electrolyzers, fuel cells, and carbon capture systems are improving efficiency and scalability. Together, these dynamics are creating a favorable environment for both public and private investments, pushing hydrogen generation from pilot projects to large-scale commercial deployment across Europe.

What is the Europe Hydrogen Generation Market?

The Europe hydrogen generation market refers to the ecosystem of technologies, projects, and stakeholders involved in producing hydrogen gas for energy and industrial use within Europe. This includes a wide range of production methods:

- Electrolysis: The process of splitting water into hydrogen and oxygen using electricity. When powered by renewable energy sources such as wind or solar, this produces “green hydrogen.”

- Steam Methane Reforming (SMR): A conventional process using natural gas to produce hydrogen, often combined with carbon capture and storage (CCS) to create “blue hydrogen.”

- Autothermal Reforming (ATR): Similar to SMR but utilizes oxygen and steam in a single reactor for higher efficiency.

- Gasification and Pyrolysis: Emerging methods that use biomass or waste materials to produce hydrogen.

- By-product Hydrogen: Hydrogen recovered from industrial processes such as chlor-alkali production or steelmaking.

The market includes equipment manufacturers (electrolyzers, reformers, compressors, and purification systems), engineering and project development companies, industrial gas suppliers, and end-users in sectors such as transportation, energy, and chemicals. Scale ranges from small refueling station systems to gigawatt-scale electrolyzer plants integrated with renewable energy parks.

Why is the Europe Hydrogen Generation Market Important?

Hydrogen plays an essential role in Europe’s path toward achieving net-zero emissions. It serves multiple strategic functions:

- Decarbonization of Hard-to-Abate Sectors: Industries like steel, cement, chemicals, and heavy transport rely on high-temperature processes and fuels that are difficult to electrify. Hydrogen provides a clean substitute without sacrificing performance.

- Energy Storage and Grid Balancing: Hydrogen enables long-term energy storage by converting surplus renewable electricity into a storable, transportable fuel. It bridges seasonal mismatches between renewable generation and demand.

- Energy Security: By diversifying Europe’s energy mix and reducing dependence on imported fossil fuels, hydrogen enhances resilience and self-sufficiency.

- Economic Growth and Industrial Competitiveness: The hydrogen economy offers new opportunities for innovation, job creation, and industrial leadership, positioning Europe as a global hub for clean technologies.

In summary, hydrogen not only supports Europe’s climate ambitions but also strengthens its energy independence and industrial competitiveness in a rapidly evolving global energy landscape.

Europe Hydrogen Generation Market — Top Companies

Below are detailed profiles of major companies active in the European hydrogen generation market, highlighting their areas of specialization, focus, and global presence.

1. Air Products and Chemicals, Inc.

- Specialization: Industrial gases and large-scale hydrogen production.

- Key Focus Areas: Merchant hydrogen supply, SMR and electrolysis-based hydrogen generation, carbon capture, and hydrogen refueling infrastructure.

- Notable Features: Air Products is one of the world’s largest hydrogen producers, leading several landmark hydrogen projects across Europe. The company is investing heavily in low-carbon and renewable hydrogen facilities and provides integrated solutions covering production, liquefaction, and distribution.

- 2024 Revenue: Approximately USD 12.0 billion.

- Market Share: Among the top global players in industrial hydrogen, with a strong European footprint.

- Global Presence: Operations in over 50 countries across North America, Europe, the Middle East, and Asia-Pacific.

2. Ally Hi-Tech Co., Ltd.

- Specialization: Hydrogen generation, purification, and storage technologies.

- Key Focus Areas: On-site hydrogen production, hydrogen purification units, and small-to-medium-scale industrial hydrogen systems.

- Notable Features: Ally Hi-Tech has delivered over 600 hydrogen-related projects worldwide. It focuses on high-purity hydrogen systems, refueling station equipment, and integrated plant solutions for industrial clients.

- 2024 Revenue: Not publicly disclosed.

- Market Share: A leading hydrogen solutions provider in Asia, with increasing engagement in the European and North American markets.

- Global Presence: Headquarters in China with project exports to multiple continents, including Europe and the Middle East.

3. CALORIC Anlagenbau GmbH

- Specialization: Custom hydrogen and syngas plant engineering for industrial customers.

- Key Focus Areas: On-site hydrogen generation plants based on natural gas, LPG, and methanol reforming.

- Notable Features: Over six decades of experience in designing and commissioning hydrogen generation systems worldwide. CALORIC is recognized for its modular, tailor-made solutions and strong engineering expertise.

- 2024 Revenue: Not publicly available.

- Market Share: Established European specialist for customized hydrogen plant solutions.

- Global Presence: Primarily active in Europe with installations and collaborations in Asia, the Middle East, and North America.

4. Cummins Inc.

- Specialization: Power technology and hydrogen electrolyzer manufacturing.

- Key Focus Areas: PEM and alkaline electrolyzers, hydrogen fuel cells, and integrated hydrogen energy systems.

- Notable Features: Cummins’ hydrogen division, operating under its Accelera brand, is scaling up manufacturing to support large projects in Europe and North America. The company combines decades of engineering experience with modern hydrogen innovations.

- 2024 Revenue: Approximately USD 34.1 billion.

- Market Share: Rapidly growing market share in electrolyzer manufacturing and hydrogen solutions.

- Global Presence: Extensive global footprint with facilities and R&D centers across North America, Europe, and Asia.

5. Hexagon Composites ASA

- Specialization: High-pressure composite storage systems for hydrogen and other gases.

- Key Focus Areas: Hydrogen storage, transport, and refueling applications.

- Notable Features: One of the leading manufacturers of composite pressure vessels used for hydrogen transport and fueling. Its technology plays a crucial role in ensuring safe, lightweight, and efficient hydrogen logistics.

- 2024 Revenue: NOK 4,877 million (approx. USD 450 million).

- Market Share: Major player in hydrogen and natural gas storage solutions globally.

- Global Presence: Headquartered in Norway, with operations in Europe, North America, and Asia.

Leading Trends and Their Impact

-

Rapid Scale-Up of Electrolyzer Manufacturing:

Companies are expanding electrolyzer production capacity across Europe, reducing costs and accelerating deployment. Gigafactories for electrolyzers are being established to meet rising demand, enhancing Europe’s manufacturing independence. -

Policy-Driven Expansion:

Strong policy frameworks, such as the EU Hydrogen Strategy and REPowerEU Plan, are creating predictable demand. Subsidies, carbon pricing mechanisms, and public-private partnerships are driving large-scale investment in hydrogen generation. -

Infrastructure Development:

Massive infrastructure projects are underway, including hydrogen pipelines, storage caverns, and refueling corridors. These developments will enable cross-border trade and the creation of integrated hydrogen valleys. -

Cost Decline and Technological Innovation:

Innovations in electrolyzer technology, such as PEM and solid oxide systems, are lowering the levelized cost of hydrogen (LCOH). Economies of scale, automation, and improved materials are making green hydrogen more competitive. -

Industrial Decarbonization and Mobility Applications:

Steel, cement, and chemical industries are investing in hydrogen to replace fossil fuels. In parallel, the transport sector is witnessing the rollout of hydrogen buses, trucks, and trains across Europe. -

International Collaborations and Hydrogen Imports:

Europe is forming partnerships with resource-rich nations in the Middle East, Africa, and Australia to secure future hydrogen imports. These collaborations ensure supply diversification and long-term price stability.

Impact:

Collectively, these trends are reducing production costs, stimulating demand, and transforming hydrogen from a niche industrial gas into a mainstream clean energy vector. The resulting ecosystem is set to reshape Europe’s energy, industrial, and transport sectors over the next decade.

Successful Examples of Hydrogen Generation Projects

1. Spain’s Green Hydrogen Projects

Spain has emerged as one of Europe’s hydrogen frontrunners, launching large-scale electrolyzer installations supported by government subsidies worth nearly €800 million. Projects led by energy giants such as Iberdrola and Repsol are integrating hydrogen with renewable power plants to decarbonize refineries and industrial clusters.

2. Germany’s Hydrogen Clusters

Germany’s industrial heartlands, particularly in the Ruhr region, are building hydrogen valleys that link producers, industrial consumers, and refueling stations through dedicated infrastructure. Projects like H2Global are fostering a structured market with long-term contracts for green hydrogen supply.

3. Netherlands and Belgium — Port Hydrogen Hubs

Major European ports such as Rotterdam and Antwerp-Bruges are being transformed into hydrogen import and distribution hubs. These locations are integrating offshore wind resources with electrolyzer projects and establishing large storage and transport capacities.

4. Scandinavia’s Renewable Hydrogen Initiatives

Norway, Sweden, and Denmark are leveraging abundant renewable resources for large-scale hydrogen production. Scandinavian projects focus on integrating green hydrogen with maritime transport, ammonia production, and clean steel initiatives.

5. Private Sector Leadership

Industrial gas companies like Air Products and Air Liquide, along with equipment manufacturers such as Cummins, are partnering with governments and utilities to build gigawatt-scale hydrogen plants. Their financial strength and technological expertise are instrumental in moving projects from concept to operation.

Europe Regional Analysis

Europe remains at the forefront of the global hydrogen economy. The European Commission’s Hydrogen Strategy and the REPowerEU Plan aim to deploy at least 40 GW of electrolyzer capacity by 2030. Member states such as Germany, France, Spain, and the Netherlands have launched national hydrogen programs supporting both domestic production and cross-border infrastructure. The development of “hydrogen valleys” is connecting local production sites with industrial and mobility applications, while certification frameworks ensure the sustainability of hydrogen supply.

Government Initiatives and Policies Shaping the Market

- European Hydrogen Strategy:

The European Commission’s 2020 strategy outlines a roadmap for scaling hydrogen production, with clear targets for renewable hydrogen and infrastructure expansion by 2030 and 2050. - REPowerEU Plan:

Introduced to reduce Europe’s dependency on fossil fuels, REPowerEU emphasizes accelerating renewable hydrogen production and establishing international import corridors. - National Hydrogen Strategies:

- Germany: Focus on green hydrogen for industrial use and international partnerships.

- France: Investment in electrolyzer manufacturing and clean mobility.

- Spain: Support for large-scale renewable hydrogen plants.

- Netherlands: Development of hydrogen import and distribution hubs through major ports.

- EU Hydrogen Bank:

A financing mechanism to support hydrogen project deployment by reducing investment risk and enabling long-term offtake agreements. - Cross-Border Infrastructure Projects:

Initiatives such as the H2Med pipeline connect Iberia to Northern Europe, facilitating large-scale hydrogen transport across borders. - Certification and Guarantees of Origin:

The EU is establishing a unified certification scheme to ensure hydrogen produced and traded within its borders meets sustainability standards. - Hydrogen Valleys and Industrial Clusters:

Regional projects that integrate production, storage, and consumption across industries, demonstrating hydrogen’s role in circular, local economies.

Summary

The Europe hydrogen generation market stands at the center of the continent’s transition to a sustainable energy future. Supported by strong policy frameworks, growing private investment, and technological innovation, hydrogen is transforming from a niche energy carrier into a mainstream industrial and transport fuel. Key players—ranging from global industrial gas giants to specialized engineering firms—are driving innovation and scalability. Meanwhile, regional initiatives and international collaborations are strengthening Europe’s position as a leader in the global hydrogen economy. As hydrogen generation capacity expands, Europe is poised to achieve both climate goals and economic competitiveness in the decades to come.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Injectable Drug Delivery Market Trends, Growth Drivers and Leading Companies 2024