Electric Powertrain Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

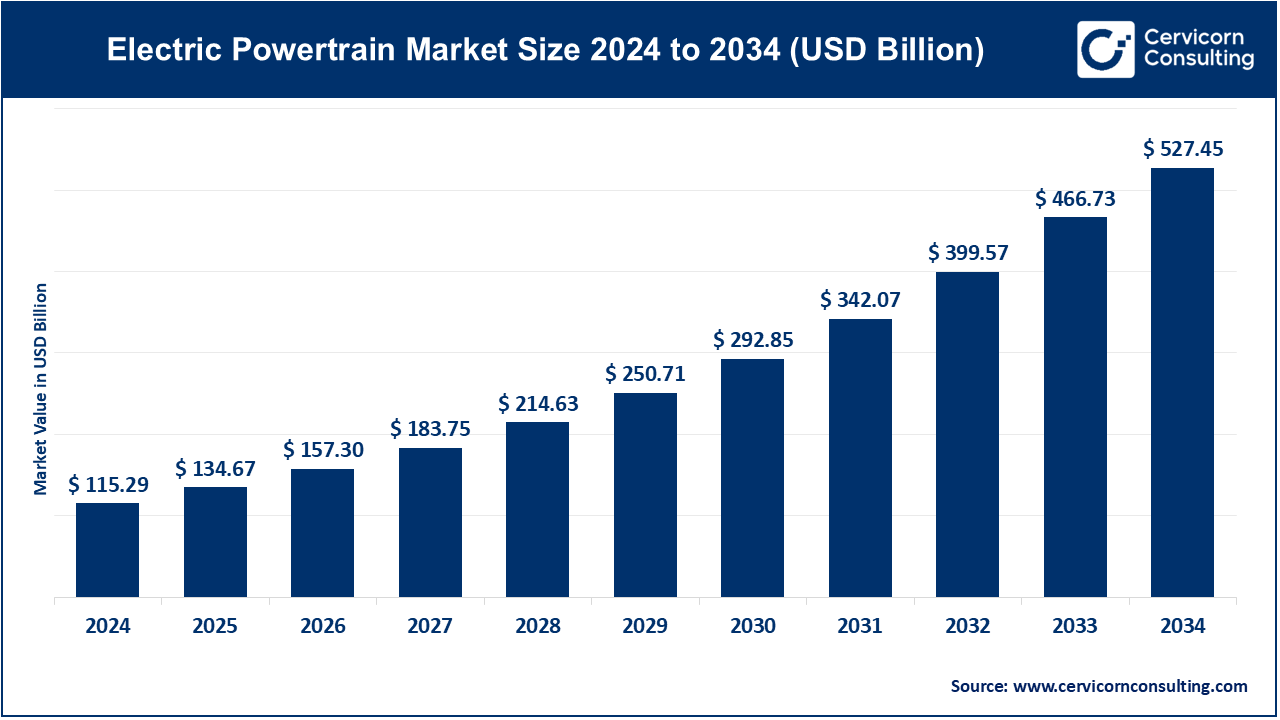

Electric Powertrain Market Size

The global electric powertrain market size was worth USD 115.29 billion in 2024 and is anticipated to expand to around USD 527.45 billion by 2034, registering a compound annual growth rate (CAGR) of 16.80% from 2025 to 2034.

What Is the Electric Powertrain Market?

The electric powertrain market encompasses all technologies and components used to convert electrical energy from batteries (or fuel cells) into mechanical force. This includes:

- Traction motors

- Inverters

- DC–DC converters

- Onboard chargers

- Battery management-related power units

- Gearboxes/reduction drives

- Integrated e-axles and electric drive modules

- Powertrain control software and ECUs

- Thermal management units

In 2024, the electric powertrain market was valued well above USD 100 billion (estimates vary by segmentation), driven by exponential BEV adoption and strong hybrid demand. Growth remains robust, supported by global investment in EV manufacturing, power electronics, and electrification infrastructure.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2423

Growth Factors of the Electric Powertrain Market

Electric powertrain market growth is driven by accelerating EV adoption worldwide, reinforced by stricter emissions regulations, government subsidies, fuel-economy standards, and national decarbonization policies; continuous reductions in battery costs; major advancements in silicon carbide (SiC) and gallium nitride (GaN) power electronics; increasing consumer interest in low-maintenance, energy-efficient vehicles; rapid expansion of charging infrastructure; OEM commitments to phase out internal combustion engines; heavy electrification of commercial fleets; and large-scale investments by suppliers and automakers in integrated e-axles and high-efficiency motor technologies. Together, these forces create unprecedented demand for scalable, lightweight, efficient, and software-defined electric powertrains globally.

Why the Electric Powertrain Market Is Important

1. Decarbonization driver

Transportation is one of the largest contributors to global CO₂ emissions. Electric powertrains enable deep decarbonization by replacing combustion-based propulsion with zero-emission alternatives. As grids become greener, the climate impact of EVs improves further.

2. Transformation of automotive value chains

Electric powertrains shift industry value from mechanical engineering to electronics, software, semiconductors, and thermal management. They help create new industrial ecosystems around high-voltage technologies, motors, and battery integration.

3. Lower operating costs and customer value

Efficient electric powertrains reduce fuel and maintenance cost significantly. They also enable new driving characteristics — instant torque, high performance, smooth drivability, and advanced regenerative braking.

4. Foundation of intelligent and software-defined vehicles

EV propulsion is tightly integrated with software and vehicle intelligence systems. Over-the-air updates, predictive thermal control, and torque vectoring rely on electric drivelines.

Company Profiles

1. Mitsubishi Electric Corporation

Specialization:

Power electronics, traction motors, inverters, and integrated EV drive modules.

Key Focus Areas:

- Development of next-generation EV drive systems

- Motor-inverter integration

- Automotive power modules and semiconductor-based power control

- Collaborations with tier-1s and OEMs on e-axle technologies

Notable Features:

Strong industrial electronics expertise, advanced inverter technology, and partnerships with automotive suppliers. Mitsubishi Electric is known for high-efficiency power modules used in many global EV platforms.

2024 Revenue:

Approximately ¥5.25 trillion (group revenue).

Market Presence:

Strong footprint across Asia, Europe, and global OEM supply chains. Particularly influential in power electronics and traction components.

2. Magna International Inc.

Specialization:

Tier-1 supplier of driveline systems, electric motors, e-axles, transmissions, body structures, and manufacturing services.

Key Focus Areas:

- Electrified drivetrains (e-axles, motors, inverters)

- Complete EV systems engineering

- Contract vehicle manufacturing

- Lightweighting and efficiency optimization

Notable Features:

Magna is one of the world’s largest automotive suppliers with the ability to design, engineer, and manufacture entire EV powertrain modules. It also produces full vehicles for several OEMs.

2024 Revenue:

Around USD 42.8 billion.

Market Presence:

Strong in North America and Europe, with large-scale production facilities and long-term OEM relationships.

3. Nissan Motor Co., Ltd.

Specialization:

BEV and hybrid electric powertrains, including e-Power hybrid systems and in-house motor/inverter technology.

Key Focus Areas:

- Expansion of its EV lineup beyond the LEAF

- Development of high-efficiency motors and inverters

- Battery innovation and partnerships

- e-Power hybrid systems for global markets

Notable Features:

Nissan pioneered mass-market EV adoption with the LEAF, one of the earliest high-volume electric cars. It continues to expand its electrification strategy globally.

2024 Revenue:

Approximately ¥12.6 trillion.

Market Presence:

Strong global presence in Europe, Japan, the U.S., and emerging EV markets.

4. Tesla, Inc.

Specialization:

Highly integrated BEV powertrains including motors, inverters, thermal systems, and proprietary software.

Key Focus Areas:

- Vertical integration of motor, power electronics, and battery systems

- Software-defined torque vectoring and thermal management

- Multi-motor AWD performance architectures

- In-house development of SiC-based inverters

Notable Features:

Tesla is widely regarded as a leader in EV powertrain efficiency and performance. Its ability to scale the Model 3/Y platform has set industry benchmarks.

2024 Revenue:

Approximately USD 97–98 billion.

Market Presence:

Strong footprint in North America, China, and Europe with growing influence in emerging markets.

5. Cummins Inc.

Specialization:

Electric powertrains for commercial vehicles, including motors, inverters, battery packs, and fuel-cell systems.

Key Focus Areas:

- Electrification of buses, trucks, and off-highway vehicles

- Integration of high-voltage components for commercial mobility

- Development of hydrogen fuel-cell powertrains

- Partnerships with fleet operators

Notable Features:

Cummins leverages decades of expertise in heavy-duty powertrains and has transitioned aggressively into electric and hydrogen systems for commercial fleets.

2024 Revenue:

Approximately USD 34.1 billion.

Market Presence:

Strong in North America, Europe, India, and global commercial-vehicle clusters.

Leading Trends and Their Impact

1. Integrated e-Axles and Modular Powertrains

Manufacturers are shifting toward compact motor–inverter–gearbox units known as e-axles.

Impact:

- Reduced manufacturing complexity

- Better vehicle packaging

- Lower system cost

- Higher energy efficiency

2. Silicon Carbide (SiC) Power Electronics

SiC MOSFETs dramatically improve inverter efficiency and thermal performance.

Impact:

- Longer driving range

- Smaller cooling systems

- Higher power density

- Faster charging compatibility

3. Software-Driven Powertrains

Modern EVs optimize torque, regen braking, and thermal behavior through software.

Impact:

- Better real-world range

- Enhanced performance via OTA updates

- Vehicle-level energy optimization

4. Commercial Vehicle Electrification

Light, medium, and heavy-duty trucks are rapidly adopting electric drivetrains.

Impact:

- New market opportunities for suppliers

- Fleet decarbonization

- Dedicated high-torque, high-voltage powertrains

5. Supply Chain Localization

Countries are incentivizing domestic production of motors, inverters, and semiconductors.

Impact:

- Reduced dependency on imports

- Regional competitiveness

- Growth of new EV manufacturing clusters

6. Consolidation of Suppliers

Electrification is increasing M&A deals among Tier-1s, semiconductor companies, and OEMs.

Impact:

- Economies of scale

- Stronger R&D pipelines

- Integrated solution portfolios

Successful Examples of Electric Powertrain Adoption Worldwide

Tesla Model 3 / Model Y

These vehicles set global efficiency benchmarks. Their integrated drive units, SiC inverters, and advanced software deliver superior range and performance.

Nissan LEAF

One of the world’s first mainstream BEVs, the LEAF proved electric powertrains could be durable, affordable, and mass-produced. It accelerated industry-wide EV programs.

BYD’s Integrated EV Powertrains

BYD’s “Blade battery + in-house motor + inverter” strategy in China enables high-volume, cost-effective powertrain production. The company has become a global EV powerhouse.

Electric Buses and Trucks Using Cummins Systems

Cities across the U.S., Europe, and India have adopted Cummins-powered electric buses. These deployments demonstrate the maturity of electric commercial powertrains.

European OEM–Tier-1 Partnerships

Magna, Mitsubishi Electric, Bosch, and others collaborate with European OEMs for e-axle integration, accelerating EV production timelines.

Global Regional Analysis — Government Policies and Market Drivers

North America

United States

- Strong incentives through the Inflation Reduction Act (IRA)

- Tax credits for domestically produced EV components

- Rapid expansion of battery and inverter manufacturing

- Electrification of federal and state fleets

Market Impact:

Driving large-scale localization of motors, power electronics, and e-axle production.

Canada

- Incentives for EV manufacturing and clean-technology investments

- Strong supplier base (Magna, Linamar) supporting OEMs

Market Impact:

Growth of EV component manufacturing clusters in Ontario.

Europe

EU 2035 Zero-Emission Vehicle Mandate

Strict CO₂ emissions rules require OEMs to scale BEV production rapidly.

National Incentives

Germany, France, Norway, the Netherlands, and the UK offer purchase subsidies, tax benefits, and fleet incentives.

Industrial Strategy

The EU supports local battery and semiconductor production through grants and partnerships.

Market Impact:

Europe is a global hub for high-efficiency motors, SiC inverters, and integrated e-drive R&D.

China

New Energy Vehicle (NEV) Policy

China remains the world’s largest EV market, shaped by:

- National subsidies

- Massive charging infrastructure

- Local production incentives

- Strong domestic suppliers

Market Impact:

China dominates global supply chains for motors, inverters, and high-voltage components.

India & South Asia

FAME II and PM E-DRIVE Schemes

India’s policies support:

- EV manufacturing incentives

- E-bus fleet deployment

- Battery and motor localization

- Charging infrastructure growth

Market Impact:

Rapid growth in e-2W, e-3W, and e-bus segments, creating demand for localized electric powertrains.

Latin America, Middle East & Emerging Markets

- Early-stage EV adoption

- Governments adopting electrified public buses

- OEMs expanding CKD/SKD assembly plants

Market Impact:

Commercial EVs such as buses and delivery fleets are driving early demand for electric powertrains.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Digital Health Market Growth Drivers, Trends, Key Players and Regional Insights by 2034