Digital Transformation in Healthcare Market Revenue, Global Presence, and Strategic Insights by 2034

Digital Transformation in Healthcare Market Size

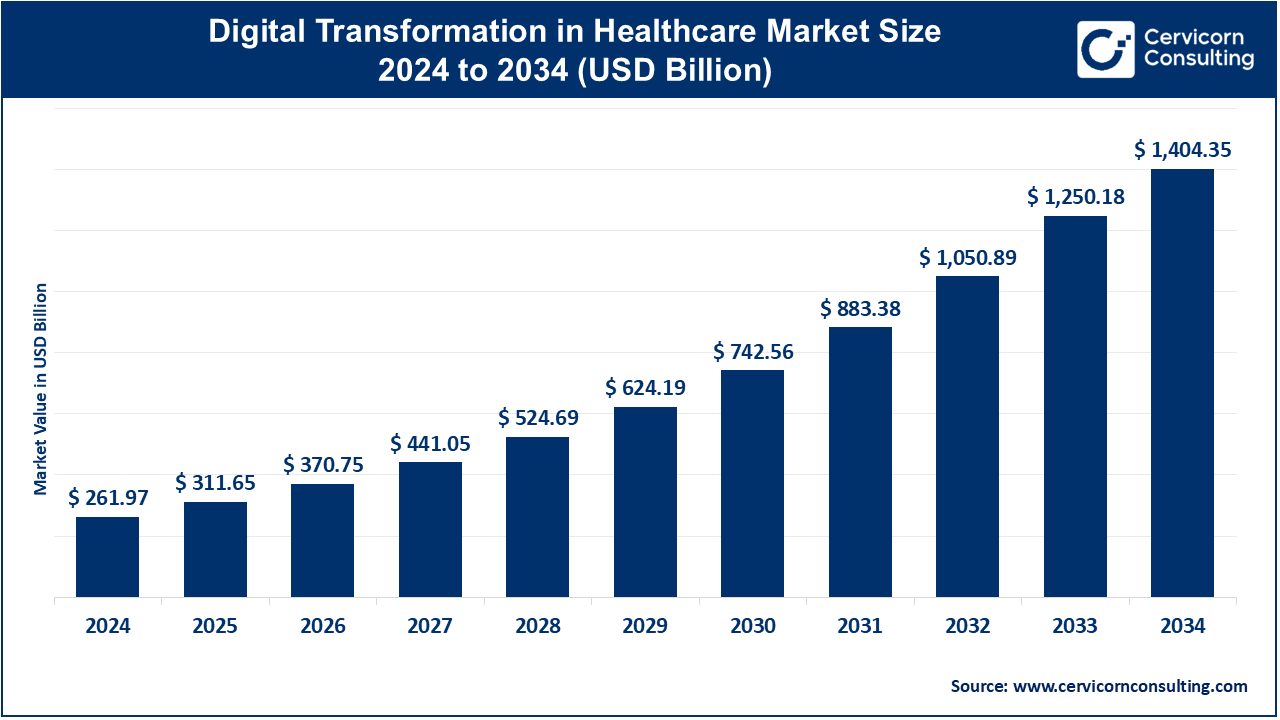

The global digital transformation in healthcare market size was worth USD 261.97 billion in 2024 and is anticipated to expand to around USD 1,404.35 billion by 2034, registering a compound annual growth rate (CAGR) of 30.20% from 2025 to 2034.

Digital Transformation in Healthcare Market Growth Factors

The growth of the digital transformation in healthcare market is driven by increasing adoption of electronic health records (EHRs), expansion of telemedicine and remote monitoring, rising demand for AI-based diagnostics, a growing need to automate administrative processes, and significant cost pressures that push hospitals to optimize workflows. Additionally, aging populations and chronic disease burdens amplify demand for digital care models, while government mandates promoting interoperability and data portability accelerate technology adoption. Cloud migration, value-based care initiatives, and payer-provider collaborations are further propelling investment as both public and private stakeholders modernize their healthcare infrastructure.

What Is the Digital Transformation in Healthcare Market?

Digital transformation in healthcare refers to the integration of digital technologies into various healthcare operations — clinical, administrative, and patient-facing — to enhance efficiency, accessibility, accuracy, and value. It includes transitioning from paper-based systems to EHRs, implementing telehealth solutions, using AI for diagnostic support, integrating wearable device data into patient care, deploying cloud-based data systems, automating billing and claims, and improving interoperability across hospitals, clinics, payers, labs, and pharmacies. Ultimately, it represents a holistic re-engineering of healthcare delivery models using technology.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2421

Why It Is Important

Digital transformation is essential for addressing today’s most pressing healthcare challenges:

- Improving quality of care: Real-time data access, decision-support tools, and predictive analytics help clinicians reduce errors and enhance outcomes.

- Expanding access: Telehealth, virtual care, and remote monitoring enable patients to receive care regardless of location.

- Lowering operational costs: Automation reduces manual paperwork, waste, and administrative overhead, improving financial performance.

- Enhancing patient engagement: Mobile apps, patient portals, and connected devices allow patients to track and manage their health more actively.

- Increasing interoperability and data fluidity: Seamless data exchange among providers leads to coordinated, efficient care.

Digital transformation also supports the shift toward value-based care, making healthcare more sustainable and outcomes-driven.

Major Companies in the Digital Transformation in Healthcare Market

1. Epic Systems Corporation

Specialization:

Epic is a leading developer of enterprise electronic health record (EHR) systems for hospitals and large health networks.

Key Focus Areas:

- Integrated inpatient and outpatient EHRs

- Interoperability and information exchange

- Patient engagement platforms like MyChart

- Analytics and population health management

- Clinical decision support

Notable Features:

Epic is known for its deep clinical functionality, customizable workflows, and robust interoperability networks connecting thousands of hospitals and clinics. The company also hosts a strong user community with regular updates and innovations.

2024 Revenue:

Approximately $5.7 billion (industry-reported estimates).

Market Share:

Epic holds the largest share of U.S. acute-care hospitals, estimated around 40%+, making it the dominant EHR vendor.

Global Presence:

Epic has an extensive footprint in the U.S. and is expanding globally across Europe, the Middle East, Canada, and parts of Asia.

2. Cerner Corporation (Oracle Health)

Specialization:

Cerner (now integrated into Oracle Health) provides EHR platforms, population health solutions, revenue cycle management, and government healthcare system support.

Key Focus Areas:

- Cloud-based EHR modernization under Oracle

- Population health and analytics

- Interoperability and public health system integrations

- Large government and VA implementations

- Data-driven healthcare management

Notable Features:

Cerner is known for its large customer base, deep expertise in government and public health systems, and evolving cloud-transition strategies as part of Oracle’s ecosystem.

2024 Revenue:

Now reported under Oracle; Cerner’s standalone 2024 revenue is consolidated into Oracle’s Health segment.

Market Share:

Cerner remains the second-largest EHR vendor in the U.S., with an estimated ~22–23% share of the acute-care hospital market.

Global Presence:

The company serves hospitals in North America, Europe, the Middle East, and the Asia-Pacific region, with major ongoing cloud-migration efforts worldwide.

3. Allscripts Healthcare Solutions (Veradigm)

Specialization:

Allscripts, now rebranded and operating primarily under Veradigm, specializes in ambulatory EHRs, analytics solutions, and interoperable platforms for clinics and provider networks.

Key Focus Areas:

- Ambulatory care EHRs

- Practice management solutions

- Analytics and data services

- Care coordination and population health

- Revenue cycle management

Notable Features:

The company is recognized for strong data-driven tools and its presence among independent physician groups. Veradigm also partners with life sciences companies to support real-world data analytics.

2024 Revenue:

Estimated around $583–$588 million.

Market Share:

Allscripts/Veradigm holds a smaller share compared to Epic and Cerner, with low single-digit percentages in the U.S. ambulatory market.

Global Presence:

Primarily U.S.-focused with select international implementations and strategic partnerships.

4. McKesson Corporation

Specialization:

McKesson is one of the world’s largest medical distributors and healthcare logistics companies.

Key Focus Areas:

- Pharmaceutical and medical-surgical distribution

- Specialty pharmacy services

- Pharmacy automation systems

- Supply-chain technology and digital logistics

- Provider-facing software for inventory management

Notable Features:

McKesson plays a foundational role in the healthcare supply chain, supporting hospitals, pharmacies, clinics, and manufacturers with high-volume distribution and advanced logistics technologies.

2024 Revenue:

Approximately $309 billion (consolidated fiscal 2024 revenue).

Market Share:

Ranks among the world’s top healthcare distributors alongside AmerisourceBergen and Cardinal Health.

Global Presence:

Extensive presence across North America, with operations in Europe and Asia-Pacific through supply chain and pharmaceutical services.

5. Philips Healthcare (Royal Philips)

Specialization:

Philips operates across imaging, patient monitoring, healthcare informatics, and connected care technologies.

Key Focus Areas:

- Medical imaging (MRI, CT, ultrasound)

- Patient monitoring systems

- Hospital informatics and integrated care platforms

- Telehealth and virtual care ecosystems

- AI-driven diagnostic tools

Notable Features:

Philips is distinguished by its strong combination of hardware and software, offering integrated solutions from imaging equipment to data analytics and cloud-connected patient monitoring.

2024 Revenue:

Around €18 billion in global sales.

Market Share:

A major player in global imaging and connected care, with strong positions in multiple diagnostic categories.

Global Presence:

Operations span North America, Europe, Asia, Latin America, and the Middle East, with manufacturing and R&D centers worldwide.

Leading Trends and Their Impact

1. Cloud Migration & SaaS Healthcare Platforms

Hospitals are increasingly shifting from on-premise systems to cloud-based infrastructures to improve scalability, reduce maintenance costs, and access modern AI tools. Cloud models enable faster updates and expand interoperability, but require robust cybersecurity and change management.

2. AI-Powered Diagnostics and Clinical Decision Support

AI models are now used in radiology, pathology, cardiology, and administrative tasks like coding and documentation. These tools improve diagnostic accuracy, reduce wait times, and alleviate clinician workload, though they also introduce regulatory challenges around safety and transparency.

3. Interoperability and Data Standards Adoption

Health systems are adopting FHIR APIs, unified records, and cross-provider data sharing strategies. Interoperability enables better care coordination, reduces duplicate tests, and supports national health information networks — strengthening continuity of care.

4. Telehealth & Remote Patient Monitoring (RPM)

Virtual care has become a permanent part of healthcare delivery. RPM technologies assist chronic disease management, enabling earlier intervention and reducing hospitalizations. Telehealth also supports rural and underserved populations.

5. Automation and RPA in Administrative Workflows

Automation in billing, claims processing, prior authorizations, scheduling, and inventory management saves time and reduces operational costs. Hospitals are increasingly turning to intelligent automation to offset workforce shortages.

6. Digital Supply Chain Transformation

Digitized logistics systems track pharmaceuticals, enhance cold chain management, and automate reordering. This reduces shortages, minimizes waste, and strengthens resilience in global supply chains.

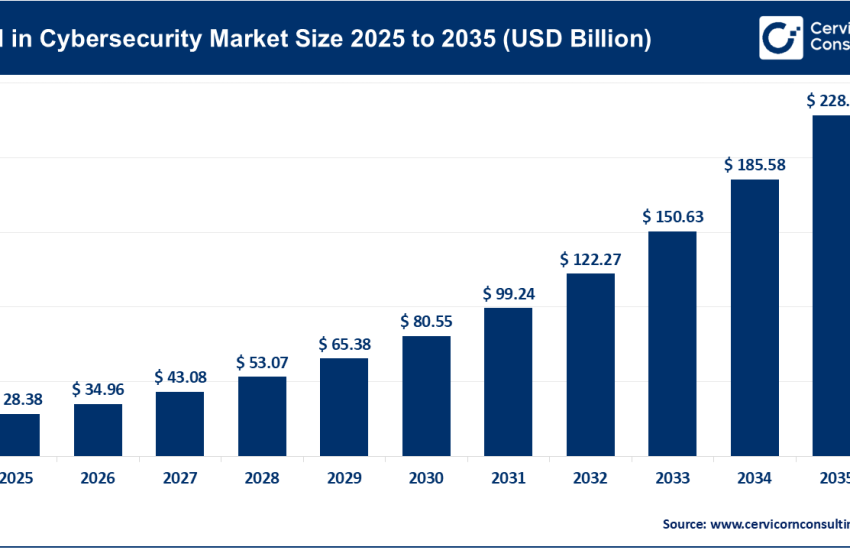

7. Cybersecurity and Data Governance

With rising cyberattacks, organizations are investing heavily in identity access management, encryption, and secure cloud infrastructure. Data governance frameworks now play a central role in digital transformation strategies.

Successful Global Examples of Digital Transformation in Healthcare

1. Kaiser Permanente (USA)

A fully integrated digital ecosystem that includes advanced EHRs, comprehensive telehealth services, remote monitoring, and predictive analytics for population health.

2. NHS England (UK)

Nationwide digital health systems such as electronic prescribing, shared care records, and digital referral pathways have improved system-wide coordination.

3. Sheba Medical Center (Israel)

Known for its “hospital of the future,” Sheba incorporates AI imaging tools, telemedicine, digital twins, and advanced clinical decision support solutions.

4. Rwanda’s National Digital Health Platform (Africa)

Rwanda uses mobile health (mHealth) tools, digital registries, and telemedicine networks to extend care to remote communities.

5. Apollo Hospitals (India)

Digital pathology, teleconsultation hubs, and remote ICUs are implemented to improve care accessibility and diagnostic accuracy for millions of patients.

6. Singapore Health Services (SingHealth)

Advanced analytics, AI triage tools, integrated EHRs, and smart hospital systems enhance clinical efficiency and patient outcomes.

Global Regional Analysis — Government Initiatives & Policies

North America

United States

- Federal policies promoting interoperability and patient access to health data

- Reimbursement expansion for telehealth and RPM services

- Investments in AI and cybersecurity across public health infrastructure

Canada

- Provincial digital health programs focused on shared EHRs

- National initiatives supporting virtual care and cross-province data exchange

Europe

- EU’s European Health Data Space encouraging cross-border data sharing

- Strong privacy and security standards under GDPR

- Government-led EHR modernization in the UK, Germany, France, and Nordics

- Public health systems adopting telehealth and remote monitoring at scale

Asia-Pacific

- China investing heavily in AI diagnostics, smart hospitals, and digital insurance systems

- India promoting telemedicine through national platforms and digital health ID programs

- Japan and South Korea advancing robotics, home-care technologies, and integrated EHR systems

Latin America

- Brazil and Mexico expanding digital health initiatives in public hospitals

- Growing mobile health (mHealth) adoption to reach remote populations

- Emerging government incentives for telemedicine providers

Middle East & Africa

- Gulf countries investing in smart hospitals, AI diagnostics, and national health information systems

- African nations adopting mobile-based care models and donor-supported digital health platforms

- Emphasis on electronic registries for maternal health, immunization, and chronic care

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Mental Health Market Revenue, Global Presence, and Strategic Insights by 2035