Data Center Lithium-ion Battery Market Revenue, Global Presence, and Strategic Insights by 2034

Data Center Lithium-ion Battery Market Size

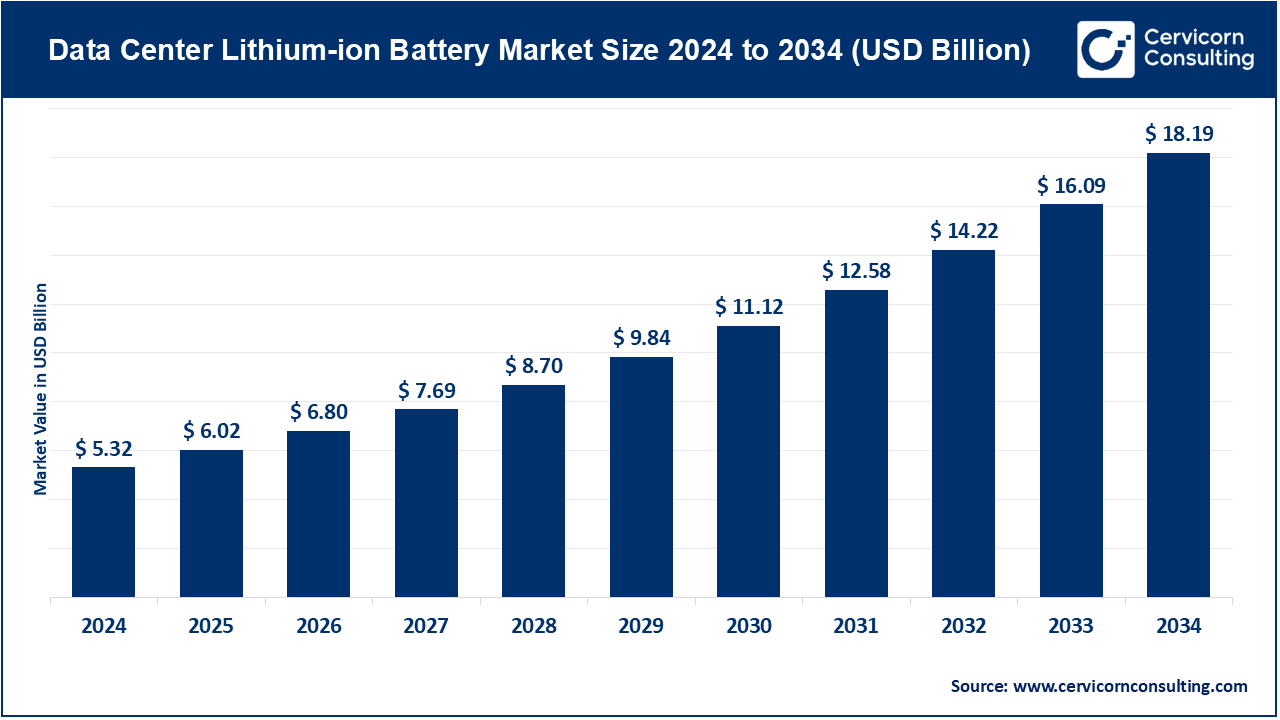

The global data center lithium-ion battery market size was worth USD 5.32 billion in 2024 and is anticipated to expand to around USD 18.19 billion by 2034, registering a compound annual growth rate (CAGR) of 13.8% from 2025 to 2034.

Growth Factors

The data center lithium-ion battery market is growing rapidly due to several interrelated factors: surging demand for data processing driven by AI, cloud computing, and digital transformation; the need for more efficient and compact UPS (uninterruptible power supply) systems; falling lithium-ion battery prices and improved lifecycle economics compared to traditional lead-acid batteries; and rising environmental and energy efficiency standards. The increasing focus on reducing carbon footprints, coupled with government incentives and policies promoting renewable integration and energy-efficient infrastructure, further accelerates adoption.

Additionally, lithium-ion’s superior energy density, shorter recharge times, lower total cost of ownership, and better temperature tolerance make it the ideal choice for modern data centers operating under tight space and performance constraints. Collectively, these growth factors are transforming lithium-ion batteries from an emerging option into a global data center standard.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2762

What is the Data Center Lithium-Ion Battery Market?

The data center lithium-ion battery market encompasses the ecosystem of manufacturers, integrators, and service providers involved in designing, producing, and maintaining Li-ion-based power backup and energy storage solutions for data centers. These batteries are typically used in UPS systems to provide seamless power continuity during outages or grid fluctuations. Unlike traditional lead-acid batteries, lithium-ion systems are lighter, recharge faster, and can endure thousands of charge cycles with minimal degradation.

The market includes key product categories such as battery cells, packs, battery management systems (BMS), integrated UPS systems, and large-scale battery energy storage systems (BESS). End users include hyperscale data centers (operated by major cloud providers), colocation facilities, enterprise data centers, and edge computing sites. The growing adoption of modular designs and software-driven energy management solutions is enhancing performance, monitoring, and predictive maintenance capabilities across the industry.

Why It Is Important

Data centers are the digital backbone of the global economy, hosting the infrastructure that powers everything from streaming platforms and e-commerce to AI-driven analytics and cloud applications. Ensuring continuous uptime is therefore critical. Lithium-ion batteries play an indispensable role by providing reliable short-term backup power during grid failures or transitions to generators, preventing costly downtime and data loss.

Their significance extends beyond reliability. Li-ion systems enable higher power density per rack, reducing space requirements and improving scalability — essential as hyperscale and edge data centers expand. They also support sustainability goals through improved energy efficiency, longer lifespan, and compatibility with renewable energy sources. Many operators use lithium-ion battery systems not only for emergency backup but also for grid services, peak shaving, and load balancing. The combination of operational resilience, efficiency, and environmental responsibility positions lithium-ion technology as a cornerstone of next-generation data center infrastructure.

Top Companies in the Data Center Lithium-Ion Battery Market

Below are detailed company profiles of five leading players driving innovation and adoption in this market:

1. Vertiv Group Corp.

Specialization:

Vertiv focuses on critical digital infrastructure, including UPS systems, racks, cooling, and integrated power solutions for data centers.

Key Focus Areas:

- Modular and scalable UPS systems compatible with Li-ion batteries.

- Infrastructure optimization for hyperscale and edge data centers.

- Integrated monitoring and lifecycle support services.

Notable Features:

Vertiv is known for its close partnerships with hyperscalers, its end-to-end data center solutions, and its robust service network that supports rapid deployment and maintenance.

2024 Revenue: Approximately USD 8 billion.

Market Share/Positioning: One of the top UPS suppliers globally, particularly strong in North America and Europe.

Global Presence: Operates across the Americas, EMEA, and APAC, with global manufacturing and service capabilities.

2. Eaton Corporation

Specialization:

Eaton provides power management solutions, including advanced UPS systems, electrical distribution, and power quality equipment for industrial and IT applications.

Key Focus Areas:

- Energy-efficient Li-ion UPS systems.

- Intelligent power distribution and management.

- Smart grid connectivity and energy optimization.

Notable Features:

Eaton’s strength lies in its large installed base, technical expertise in electrical systems, and long-standing relationships with enterprise and hyperscale clients.

2024 Revenue: Around USD 25 billion.

Market Share/Positioning: A leading player in the power management and UPS markets with growing emphasis on Li-ion integration.

Global Presence: Operations in over 160 countries worldwide.

3. Schneider Electric SE

Specialization:

Schneider Electric specializes in energy management, automation, and data center infrastructure through brands like APC.

Key Focus Areas:

- Integrated power and cooling systems for data centers.

- Sustainable and digital energy management solutions.

- Cloud-based monitoring (EcoStruxure platform).

Notable Features:

Schneider is a pioneer in sustainable power management, offering lifecycle services and modular data center solutions. Its EcoStruxure platform provides real-time visibility and control, improving energy efficiency and uptime.

2024 Revenue: Over USD 35 billion (company-wide).

Market Share/Positioning: A global leader in UPS systems and energy automation.

Global Presence: Operates in more than 100 countries with a strong footprint in Europe, APAC, and the Americas.

4. Legrand SA

Specialization:

Legrand is a global specialist in electrical and digital building infrastructure, offering components that support efficient data center power distribution.

Key Focus Areas:

- Modular busways and electrical distribution systems.

- Racks, enclosures, and connectivity for data centers.

- Integration of intelligent power management with battery systems.

Notable Features:

Legrand combines energy efficiency and digital control to enhance operational sustainability. It has diversified through acquisitions to strengthen its data center product portfolio.

2024 Revenue: Approximately €8.6 billion.

Market Share/Positioning: Recognized for complementary infrastructure products that integrate with UPS systems.

Global Presence: Strong presence across Europe and North America, with growing expansion in emerging markets.

5. Delta Electronics Inc.

Specialization:

Delta Electronics provides high-efficiency power and thermal management solutions for industries, including telecommunications and data centers.

Key Focus Areas:

- High-performance UPS systems and Li-ion battery integration.

- Renewable energy-based power solutions.

- Modular and scalable energy infrastructure.

Notable Features:

Delta is known for its engineering depth and manufacturing scale, particularly in the APAC region. It is investing heavily in R&D for energy-efficient and low-carbon technologies.

2024 Revenue: Approximately NT$421 billion (USD 13 billion).

Market Share/Positioning: Prominent in APAC, supplying major OEMs and data center integrators.

Global Presence: Headquarters in Taiwan with operations across Asia, Europe, and the Americas.

Leading Trends and Their Impact

1. Hyperscaler Adoption

Cloud giants like Google, Microsoft, and Amazon are leading the transition from lead-acid to lithium-ion. These hyperscalers are deploying millions of Li-ion cells to support their massive global data centers. This large-scale adoption is driving economies of scale, increasing standardization, and encouraging global suppliers to innovate and scale production.

Impact: Accelerated technological maturity, improved safety standards, and broader availability of certified Li-ion UPS systems.

2. Short-Run UPS Architectures

Modern data centers increasingly rely on short-run (3–15 minute) UPS systems for rapid power transfer between the grid and generators. Lithium-ion batteries excel in such applications due to high discharge rates and faster recharge cycles.

Impact: Reduced floor space, optimized cooling, and higher overall energy efficiency with less maintenance downtime.

3. Sustainability and Circular Economy

With global emphasis on net-zero emissions, lithium-ion systems align perfectly with sustainability goals. They enable recycling, second-life applications (e.g., repurposed EV batteries), and lower carbon footprints.

Impact: Companies are forming recycling partnerships and adopting circular battery supply chains to comply with environmental regulations and ESG commitments.

4. Advanced Battery Management Systems (BMS)

Intelligent monitoring is now a must. Advanced BMS integrated into DCIM (Data Center Infrastructure Management) systems provide predictive maintenance, optimize charge cycles, and prevent thermal runaway.

Impact: Higher reliability, reduced operational risk, and longer usable life for Li-ion systems.

5. Supply Chain Localization

Global supply chain risks and dependence on specific geographies for lithium-ion cells are pushing governments and corporations to invest in local battery manufacturing and recycling infrastructure.

Impact: Enhanced supply security, cost control, and compliance with domestic energy policies.

Successful Examples Around the World

- Google: Deployed more than 100 million lithium-ion cells across its global data centers, drastically reducing maintenance and improving reliability.

- Microsoft (Dublin): Implemented Li-ion battery systems integrated with renewable energy sources to test grid services and backup efficiency.

- Amazon Web Services (AWS): Introduced lithium-ion UPS systems in its hyperscale facilities to enhance energy efficiency and reduce operational carbon emissions.

- Redwood Materials & Crusoe Energy: Partnered to create second-life battery systems repurposed from EV batteries to power GPU-intensive data centers.

- Vertiv & Schneider Electric Partnerships: Collaborated with cloud and colocation providers to deliver modular, Li-ion-enabled UPS systems with intelligent monitoring capabilities.

These success stories showcase how lithium-ion batteries have become integral to modernizing data center energy infrastructure while aligning with decarbonization goals.

Regional Analysis: Government Initiatives and Market Dynamics

North America

Government Initiatives:

The U.S. Department of Energy has implemented the National Blueprint for Lithium Batteries, promoting domestic manufacturing, recycling, and R&D. Federal tax incentives and grants for energy storage projects under the Inflation Reduction Act (IRA) have further strengthened the market.

Market Dynamics:

Hyperscalers dominate adoption, and domestic manufacturing capacity is expanding rapidly. The U.S. and Canada are emerging as innovation hubs for grid-connected data centers integrating Li-ion battery systems.

Europe

Government Initiatives:

The European Union’s Battery Regulation enforces sustainable sourcing, battery passports, and end-of-life recycling requirements. EU energy policies supporting renewable integration further incentivize data center operators to use sustainable energy storage solutions.

Market Dynamics:

Europe leads in regulatory-driven adoption. Data centers in Germany, the Netherlands, and the Nordics are pioneering carbon-neutral operations powered by Li-ion-based energy systems.

Asia-Pacific

Government Initiatives:

China, Japan, and South Korea dominate global battery manufacturing, supported by government-backed R&D and incentives. China’s initiatives to expand computing capacity and digital infrastructure have spurred rapid data center growth, driving local demand for Li-ion solutions.

Market Dynamics:

APAC hosts the majority of Li-ion production and is the fastest-growing regional market. Tier 1 cities in China, Singapore, and India are seeing exponential data center expansion, supported by domestic battery suppliers.

Middle East and Africa

Government Initiatives:

Countries like the UAE and Saudi Arabia are diversifying into digital economies and renewable energy integration. Vision 2030 programs include investments in data centers and sustainable infrastructure.

Market Dynamics:

Regional markets are still developing but offer high potential. New hyperscale facilities are being built with Li-ion UPS systems due to extreme temperature resilience and reliability requirements.

Latin America

Government Initiatives:

While policy frameworks are still evolving, Brazil, Chile, and Mexico are witnessing growth in data center infrastructure and renewable energy deployment.

Market Dynamics:

Data centers in Latin America favor Li-ion solutions due to power reliability concerns and the need for efficient, low-maintenance systems in challenging environments.

Policy and Regulatory Drivers to Watch

- EU Battery Regulation: Promotes traceability, sustainability, and recycling, setting a global precedent for responsible battery manufacturing.

- U.S. Energy Storage Incentives: Federal and state programs encouraging adoption of grid-connected and backup battery systems in critical infrastructure.

- China’s Battery Industrial Policy: Expanding local capacity for lithium-ion production, reducing dependency on imports.

- Fire Safety and Installation Standards: Updated global safety codes and testing procedures are ensuring the secure use of Li-ion batteries in data centers.

- Recycling Mandates: Governments are pushing for closed-loop battery ecosystems to manage end-of-life waste effectively.

Procurement and Operational Considerations

- Lifecycle Cost Analysis: While initial investment in Li-ion systems is higher, they offer lower total cost of ownership due to reduced maintenance, fewer replacements, and energy savings.

- Vendor Qualification: Data center operators must choose suppliers with proven safety certifications, BMS reliability, and lifecycle guarantees.

- Sustainability Compliance: Procurement teams should ensure battery traceability, recycling options, and compliance with environmental regulations.

- Integration with Renewable Energy: Combining Li-ion systems with solar and wind energy storage enhances both reliability and sustainability.

Challenges in the Market

- Supply Chain Constraints: Concentration of lithium-ion production in limited geographies exposes the market to potential material shortages.

- Safety Concerns: Thermal management remains a critical aspect, requiring advanced BMS and fire-suppression systems.

- High Initial Cost: Although decreasing, upfront capital expenditure remains a barrier for small and medium-sized operators.

- Regulatory Compliance: Meeting evolving standards for recycling, traceability, and emissions requires continuous adaptation.

Future Outlook

The data center lithium-ion battery market is transitioning from an innovation phase to mainstream deployment. As digital infrastructure grows, Li-ion batteries will play an increasingly strategic role — not only as backup systems but as integral components of sustainable energy ecosystems. The convergence of policy support, technological advancement, and environmental responsibility ensures that lithium-ion batteries will define the future of power resilience in data centers worldwide.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Construction Equipment Market Growth Drivers, Key Players, Trends and Regional Insights by 2034