Containerised Electrolyzer Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

Containerised Electrolyzer Market Size

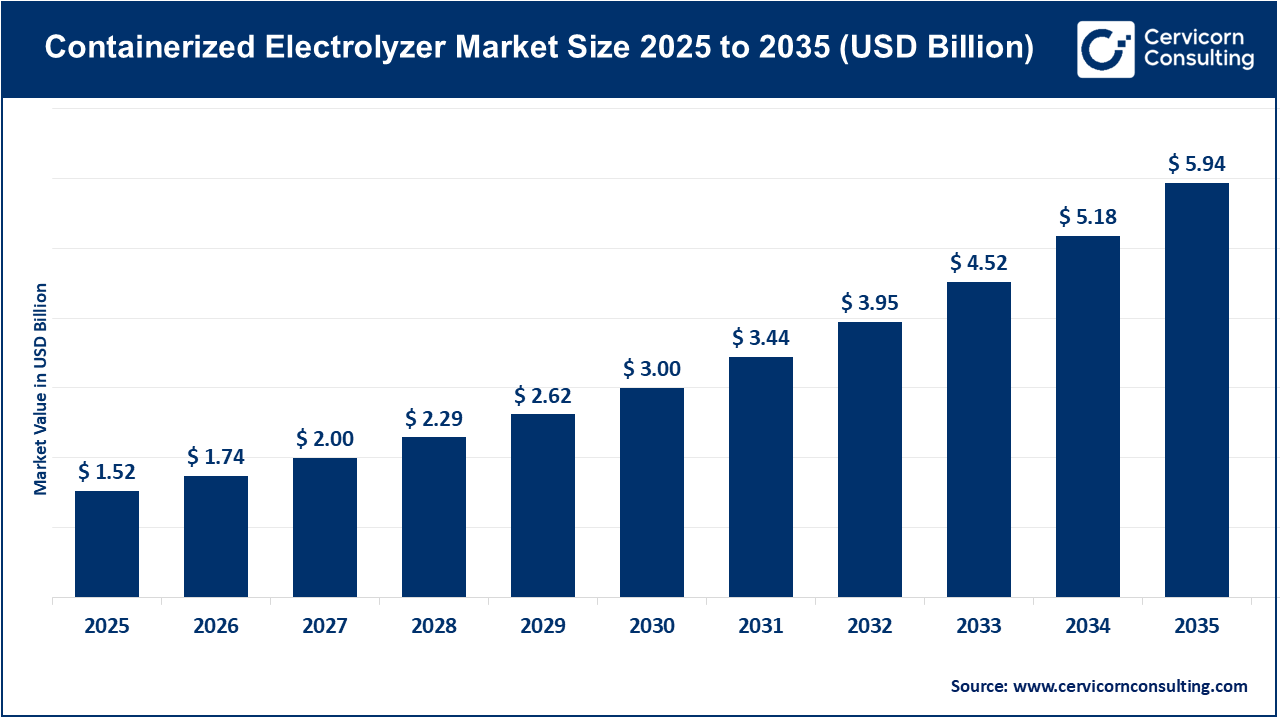

The global containerized electrolyzer market size was worth USD 1.52 billion in 2025 and is anticipated to expand to around USD 5.94 billion by 2035, registering a compound annual growth rate (CAGR) of 14.6% from 2025 to 2034.

What is the Containerised Electrolyzer Market?

The “containerised electrolyzer” market refers to the segment of the hydrogen‑electrolysis equipment industry in which water‑electrolysis systems (typically alkaline, PEM, or AEM types) are packaged into modular, self‑contained units (often housed in shipping‑container style enclosures) that can be transported, deployed, and integrated more flexibly than large bespoke installations. These containerised systems are pre‑assembled, skid‑mounted, or “plug & play” units that minimize on‑site civil works, allow rapid deployment, and support distributed hydrogen production, modular capacity expansion, or mobile/temporary installations.

In sum: the containerised electrolyzer market sits at the intersection of the broader electrolyzer market and the modularisation/truckable/plug‑in deployment theme in hydrogen production technologies.

Growth Factors

The global containerised electrolyzer market is being driven by multiple converging factors: increasing demand for green hydrogen as a clean energy carrier and decarbonisation enabler; rapid roll‑out of renewable energy (wind, solar) that creates intermittent power sources that benefit from modular hydrogen production; the need for flexible and distributed hydrogen production rather than only centralised gigawatt‑scale plants; favourable government policies (incentives, funding, hydrogen strategies) around the world; declining costs of electrolyzers and greater manufacturing scale; shorter deployment timelines afforded by containerised modular solutions; and industrial end‑users (steel, chemicals, mobility/refuelling) seeking hydrogen production closer to the point of use.

Together, these drivers support strong growth in containerised electrolyzer deployments and the underlying market value. The containerised PEM electrolyzer market alone was valued at approximately USD 150.3 million in 2024 and is projected to grow to around USD 430.24 million by 2034 (CAGR ~11.09%). More broadly, the global containerized electrolyzer market size was estimated at USD 1.2 billion in 2023 and projected to reach USD 3.8 billion by 2032 (CAGR ~13.5 %). Thus, containerisation is increasingly seen as a growth‑lever in the hydrogen electrolyzer space.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2805

Why is the Containerised Electrolyzer Market Important?

Several reasons underline the importance of this market segment:

- Acceleration of green hydrogen uptake – Containerised electrolyzers lower time‑to‑install, reduce site risk, and permit incremental deployment, enabling quicker scaling of hydrogen production, especially for distributed or off‑grid applications.

- Flexibility and modularity – Industrial users can deploy smaller containerised units and scale up over time, or integrate them at remote/renewable sites where civil infrastructure is limited.

- Cost and standardisation benefits – Modular, factory‑built containerised units allow manufacturing learning curves, cost reduction, and more predictable installation and commissioning timelines.

- Enabling new business models – Mobile hydrogen production, containerised systems at refuelling stations, temporary installations, or plug‑in systems for remote energy systems become possible.

- Supporting decarbonisation goals – Many heavy‑industry, mobility or power‑system decarbonisation use‑cases require hydrogen, and the containerised model helps meet those needs with lower barrier to entry.

- Addressing grid/renewables integration – Containerised electrolyzers can serve as flexible load or dispatchable hydrogen‑production units, helping balance the grid or absorb excess renewable energy.

Thus, the containerised electrolyzer market is an important enabler of the broader hydrogen economy and helps unlock hydrogen production beyond just very large centralised plants.

Top Companies in the Containerised Electrolyzer Market

Here are five leading firms: Nel Hydrogen (Nel ASA), McPhy Energy (McPhy), Cummins Inc., Enapter AG (Enapter), and Siemens Energy.

Nel Hydrogen (Nel ASA)

- Specialization: Electrolyser technology (alkaline and PEM), modular hydrogen systems.

- Key Focus Areas: Large-scale electrolysers, PEM development, module packaging.

- Notable Features: Nearly a century of electrolyser experience, thousands of installations worldwide.

- 2024 Revenue / Market Data: Q4 2024 revenue from customer contracts was NOK 416 million.

- Market Share / Global Presence: Leading global electrolyser OEM with installations across Europe and North America, including contracts for 1 GW+ alkaline capacity.

McPhy Energy

- Specialization: Industrial hydrogen electrolysers, including containerised units.

- Key Focus Areas: Large capacity electrolysers, low‑carbon hydrogen for steel/industry.

- Notable Features: Focused exclusively on the electrolyser business; strong European industrial backlog.

- 2024 Revenue / Market Data: €15.8 million from electrolysers, ~92% of total revenue.

- Market Share / Global Presence: Active mainly in Europe; key industrial projects in Austria, Sweden, Germany.

Cummins Inc.

- Specialization: Power and hydrogen solutions, including modular electrolyzers.

- Key Focus Areas: Renewable hydrogen, modular electrolyzers, leveraging global industrial footprint.

- Notable Features: Large-scale, global operations, strong industrial base.

- 2024 Revenue / Market Data: Full-year revenue $34.1 billion; hydrogen segment is part of broader portfolio.

- Market Share / Global Presence: Global presence across 190+ countries; hydrogen segment growing.

Enapter AG

- Specialization: AEM electrolyser technology, modular and containerised solutions.

- Key Focus Areas: Small to medium size electrolysers, multicore/plug-in scaling.

- Notable Features: Significant deployment of containerised units; ~1,200 small AEM units shipped by 2022.

- 2024 Revenue / Market Data: FY 2023 turnover EUR 31.5 million.

- Market Share / Global Presence: Active in Europe and Canada; containerised units are a key focus.

Siemens Energy

- Specialization: Large-scale hydrogen/electrolyser systems, modular transportable units.

- Key Focus Areas: Industrial and utility-grade electrolysers, gigawatt-scale manufacturing.

- Notable Features: Berlin gigafactory producing electrolyser stacks for modular solutions.

- 2024 Revenue / Market Data: Q4 FY 2024 revenue €9.7 billion; electrolyser segment part of total.

- Market Share / Global Presence: Global operations across Europe, Americas, and Asia.

Leading Trends and Their Impact

- Modular containerised deployment: Accelerates uptake in smaller-scale or distributed applications.

- Standardisation and factory manufacturing scale-up: Reduces costs and improves deployment timelines.

- Growth of “plug & play” hydrogen solutions: Supports mobile hydrogen, leased containers, and remote installations.

- Hybrid renewable plus storage plus hydrogen solutions: Absorbs variable renewable energy and balances the grid.

- Industrial decarbonisation & hard-to-abate sectors: Meets localized hydrogen demand for steel, chemicals, and refuelling infrastructure.

- Government policies and hydrogen hubs: Subsidies, grants, and funding spur modular projects.

- Technology advancement: Cost reduction and efficiency gains in PEM/AEM/alkaline electrolysers improve containerised unit competitiveness.

Successful Examples of Containerised Electrolyser Deployments

- Enapter deployed a 500 kW containerised AEM electrolyser at the Karlsruhe Institute of Technology (KIT) in Germany.

- Enapter shipped a 500 kW containerised unit to a Canadian Clean Hydrogen Hub.

- Siemens Energy’s Berlin gigafactory produces modular electrolyser skids and container-compatible modules.

- Nel Hydrogen supplied over 1 GW of alkaline electrolyser capacity for the Mississippi Clean Hydrogen Hub in the US.

- McPhy Energy delivered 4 MW electrolysers to industrial projects in Austria and Sweden.

Global Regional Analysis Including Government Initiatives and Policies

Europe

Europe leads in hydrogen policy and containerised electrolyser deployment. The EU’s REPowerEU Plan aims for 10 Mt domestic renewable hydrogen production by 2030. National strategies (Germany, France, Netherlands) support modular and containerised solutions with funding, subsidies, and IPCEI programs. Containerised units are attractive for industrial decarbonisation and faster project deployment.

North America

US and Canada are expanding hydrogen policies through funding programs and hydrogen hubs. Containerised electrolyzers are deployed at renewable sites, industrial clusters, and remote locations, benefiting from modular, rapid-installation capabilities.

Asia-Pacific

Rapid growth is expected due to abundant renewables, industrial hydrogen demand, and national hydrogen strategies (Japan, South Korea, Australia, China). Containerised systems suit remote sites, renewable integration, and industrial clusters.

Middle East & Africa / Latin America

Emerging markets with high solar/wind potential, industrial applications, and hydrogen export ambitions. Containerised units offer modularity for remote/off-grid projects.

Government Initiatives & Policies

- Public funding and subsidies for hydrogen production and modular units.

- Permitting frameworks favoring modular deployment.

- Renewable integration policies for Power-to-X projects.

- Industrial decarbonisation mandates requiring on-site hydrogen production.

- Standardisation and certification to ease containerised unit deployment.

- Manufacturing incentives supporting gigafactories and modular production.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Biofertilizer Market Growth Drivers, Trends, Key Players and Regional Insights by 2034