Class C and D Medical Devices Market Size and Growth Forecast by 2034

Class C and D Medical Devices Market Size

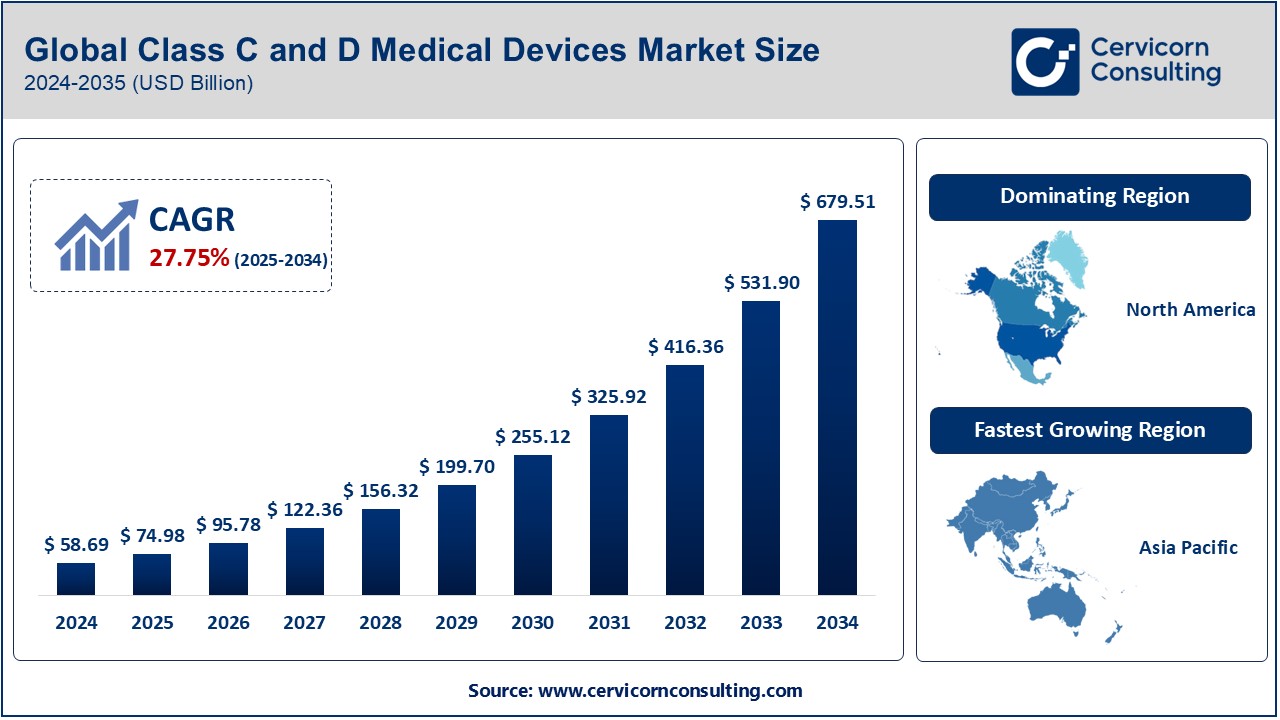

The global class C and D medical devices market was worth USD 58.69 billion in 2024 and is anticipated to expand to around USD 679.51 billion by 2034, registering a compound annual growth rate (CAGR) of 27.75% from 2025 to 2034.

Understanding the Class C and D Medical Devices Market

Class C and D medical devices represent some of the most critical and high-risk categories in the medical device industry. These devices include those used to sustain life, prevent major health impairments, or perform highly complex and sensitive functions. Examples include pacemakers, implantable defibrillators, advanced imaging systems, and in vitro diagnostic (IVD) devices. They require stringent regulatory scrutiny to ensure safety and efficacy before they can be deployed in clinical settings.

Importance of Class C and D Medical Devices

The significance of Class C and D medical devices lies in their ability to save lives, improve patient outcomes, and advance healthcare practices globally. These devices cater to a wide range of medical applications, from diagnosing and monitoring life-threatening conditions to delivering therapeutic solutions that can enhance the quality of life for millions of patients worldwide. Their precision, reliability, and innovation make them indispensable in modern healthcare systems.

Growth Factors Driving the Class C and D Medical Devices Market

The growth of the Class C and D medical devices market is driven by advancements in technology, a rising prevalence of chronic diseases, aging populations, increasing healthcare expenditure, and the growing adoption of minimally invasive surgical procedures. Additionally, government policies promoting healthcare infrastructure development and faster regulatory approvals are fostering market expansion.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2503

Top Companies in the Class C and D Medical Devices Market

1. Medtronic plc

- Specialization: Cardiovascular devices, neuromodulation, diabetes management systems, and surgical technologies.

- Key Focus Areas: Innovation in cardiac rhythm management, advanced surgical navigation systems, and robotic-assisted surgery.

- Notable Features: High investment in R&D, robust product portfolio, and a strong focus on value-based healthcare solutions.

- 2023 Revenue (approx.): $32 billion.

- Market Share (approx.): 25%.

- Global Presence: Operations in over 150 countries, with significant market penetration in North America, Europe, and Asia-Pacific.

2. Johnson & Johnson (Including DePuy Synthes and Ethicon)

- Specialization: Orthopedic devices, surgical instruments, and wound management solutions.

- Key Focus Areas: Advanced wound closure products, innovative joint reconstruction technologies, and digital surgery platforms.

- Notable Features: Comprehensive portfolio in surgical and orthopedic devices, strong brand equity, and patient-centric innovation.

- 2023 Revenue (approx.): $28 billion.

- Market Share (approx.): 22%.

- Global Presence: Operations in over 100 countries, with a strong focus on North America, Europe, and emerging markets.

3. Siemens Healthineers AG

- Specialization: Diagnostic imaging systems, laboratory diagnostics, and advanced therapy solutions.

- Key Focus Areas: Artificial intelligence in imaging, precision diagnostics, and value-based healthcare models.

- Notable Features: Cutting-edge MRI and CT scanners, innovative laboratory automation systems, and AI-driven diagnostic platforms.

- 2023 Revenue (approx.): $22 billion.

- Market Share (approx.): 18%.

- Global Presence: Active in more than 75 countries, with a dominant presence in Europe and North America.

4. Philips Healthcare

- Specialization: Patient monitoring, diagnostic imaging, and connected care solutions.

- Key Focus Areas: Remote patient monitoring, advanced ultrasound systems, and telehealth solutions.

- Notable Features: Integration of AI in imaging, focus on connected healthcare ecosystems, and energy-efficient products.

- 2023 Revenue (approx.): $19 billion.

- Market Share (approx.): 15%.

- Global Presence: Operations in over 100 countries, with a strong foothold in Asia-Pacific and Europe.

5. GE HealthCare Technologies Inc.

- Specialization: Diagnostic imaging, biomanufacturing, and patient monitoring solutions.

- Key Focus Areas: AI-powered imaging technologies, molecular diagnostics, and innovative healthcare IT solutions.

- Notable Features: Robust AI ecosystem, strong partnerships with hospitals and clinics, and emphasis on personalized medicine.

- 2023 Revenue (approx.): $21 billion.

- Market Share (approx.): 20%.

- Global Presence: Active in more than 100 countries, with significant operations in North America, Europe, and emerging markets.

Leading Trends and Their Impact

1. Artificial Intelligence and Machine Learning Integration

AI and machine learning are transforming the Class C and D medical devices market by enhancing diagnostic accuracy, enabling predictive analytics, and improving operational efficiency. For instance, AI-powered imaging systems can detect abnormalities with higher precision, reducing diagnostic errors.

2. Miniaturization and Wearable Technologies

The development of smaller, portable, and wearable devices has expanded the applications of Class C and D medical devices. Examples include wearable insulin pumps and portable ECG monitors, which offer greater convenience and real-time monitoring for patients.

3. Telehealth and Remote Monitoring

The growing adoption of telehealth solutions and remote monitoring devices has reshaped patient care, enabling healthcare providers to manage chronic conditions more effectively and reduce hospital readmissions.

4. Regenerative Medicine and 3D Printing

Advancements in regenerative medicine and 3D printing have enabled the development of customized implants and prosthetics, enhancing the efficacy of treatments and improving patient outcomes.

5. Sustainability and Eco-Friendly Practices

With increasing environmental awareness, companies are adopting sustainable manufacturing practices and developing energy-efficient devices to reduce their carbon footprint.

Successful Examples of Class C and D Medical Devices

1. Medtronic’s Micra® Transcatheter Pacing System

This leadless pacemaker is a groundbreaking innovation in cardiac care. Its minimally invasive implantation process and small size make it a highly effective solution for patients requiring pacing.

2. GE HealthCare’s Revolution CT Scanner

This advanced imaging system delivers high-quality images with reduced radiation exposure, significantly improving diagnostic accuracy and patient safety.

3. Philips’ Lumify Portable Ultrasound

This portable ultrasound system enables point-of-care imaging, offering convenience and accuracy for healthcare providers in remote and emergency settings.

4. Siemens Healthineers’ Atellica® Solution

This laboratory diagnostics system offers high-speed sample handling and precise results, optimizing laboratory operations and enhancing patient care.

5. Johnson & Johnson’s VELYS™ Robotic-Assisted Solution

This robotic-assisted platform for knee replacement surgery provides greater precision and improved surgical outcomes, reducing recovery time for patients.

Regional Analysis and Government Initiatives

1. North America

- Overview: North America dominates the Class C and D medical devices market, driven by advanced healthcare infrastructure, high healthcare expenditure, and robust R&D activities.

- Government Initiatives: Policies like the FDA’s breakthrough device designation program accelerate the approval of innovative devices.

2. Europe

- Overview: Europe holds a significant market share due to its well-established medical device regulations and a strong emphasis on innovation.

- Government Initiatives: The implementation of the Medical Device Regulation (MDR) enhances device safety and efficacy, fostering market growth.

3. Asia-Pacific

- Overview: The region is experiencing rapid growth due to increasing healthcare investments, a rising burden of chronic diseases, and expanding healthcare access.

- Government Initiatives: Governments in countries like China and India are promoting local manufacturing and fast-tracking device approvals to meet growing demand.

4. Latin America

- Overview: Latin America offers significant growth potential due to improving healthcare infrastructure and increasing awareness of advanced medical devices.

- Government Initiatives: Efforts to expand healthcare coverage and improve regulatory frameworks are driving market development.

5. Middle East and Africa

- Overview: The market in this region is growing steadily, supported by rising healthcare investments and increasing demand for advanced medical technologies.

- Government Initiatives: Programs aimed at strengthening healthcare infrastructure and facilitating technology transfer are fostering market expansion.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Viral Vectors and Plasmid DNA Manufacturing Market Leaders & Insights by 2034