Buy Now Pay Later Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

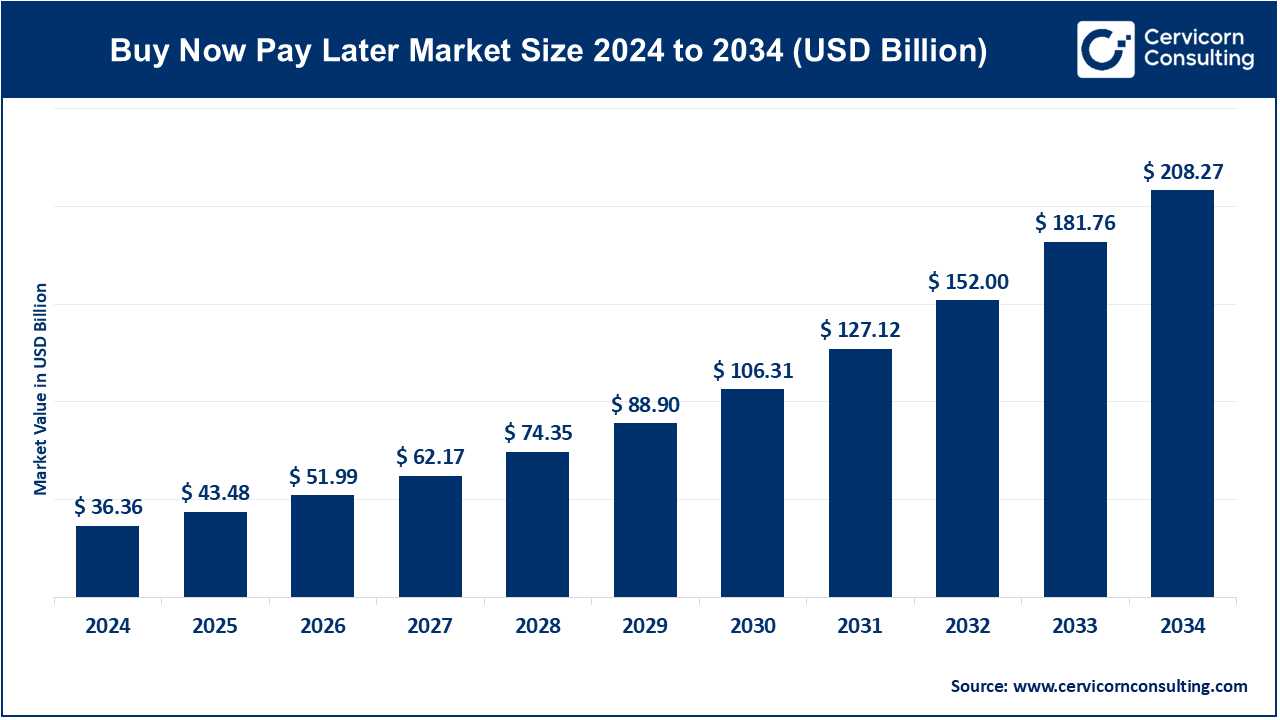

Buy Now Pay Later Market Size

The global buy now pay later market size was worth USD 36.36 billion in 2024 and is anticipated to expand to around USD 208.27 billion by 2034, registering a compound annual growth rate (CAGR) of 19.07% from 2025 to 2034.

What Is the Buy Now Pay Later Market?

The BNPL market consists of fintech platforms, banks, payment networks, and retailers that offer short-term installment payment options at the point of sale. Consumers can split their purchase—whether online or in-store—into smaller payments spread across weeks or months, often at zero interest.

BNPL providers earn revenue through merchant fees, interchange fees, late fees (in some models), subscription offerings, and in some cases, interest on extended installment products. BNPL has now become a foundational part of the broader embedded finance evolution, seamlessly integrated into shopping apps, e-commerce platforms, digital wallets, and physical merchant terminals.

It is a rapidly growing segment of digital payments, driven by consumers’ demand for flexible, predictable, and transparent credit options.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2413

Why Is Buy Now Pay Later Important?

BNPL occupies a unique intersection of credit, payments, and retail. Its importance stems from:

1. Consumer empowerment

BNPL allows consumers to budget more effectively and avoid the compound-interest structure of traditional credit cards. Younger consumers—especially Gen Z and Millennials—prefer cost transparency and short-term commitments.

2. Merchant conversion & revenue lift

Merchants experience higher conversion rates, reduced cart abandonment, and increased average order values (AOV). BNPL partnerships act as performance marketing channels rather than just payment methods.

3. Access to credit

Traditional credit systems exclude many consumers without established credit scores. BNPL fills this gap through real-time underwriting and alternative data.

4. Embedded finance transformation

BNPL is deeply woven into online checkout flows, mobile shopping apps, digital wallets, and retail ecosystems.

5. Global regulatory development

BNPL is prompting governments to rethink consumer credit rules, transparency standards, and digital lending frameworks.

Buy Now Pay Later Market Growth Factors

The BNPL market is expanding rapidly due to surging global e-commerce penetration, rising consumer demand for flexible and transparent payment options, strong merchant adoption fueled by clear gains in conversion rate and basket size, and technological advancements in real-time risk scoring and API-based payment integrations. Younger demographics are increasingly rejecting traditional high-interest credit models in favor of short-term, interest-free BNPL options, while merchants and brands are using BNPL partnerships to differentiate customer experience and drive loyalty.

Additionally, the availability of investment capital, partnerships with major retail and fintech ecosystems, and continuous product innovations such as longer-term financing, subscription features, and loyalty tools further accelerate market expansion. Despite heightened regulatory scrutiny and shifting macroeconomic conditions, BNPL continues to grow as it reshapes digital payments and consumer credit infrastructure worldwide.

Top Buy Now Pay Later Market Companies — Profiles, Focus Areas, Notable Features & 2024 Metrics

1. Afterpay (Part of Block, Inc.)

Specialization

Pay-in-4 short-term, interest-free installments; strong merchant-first model.

Key Focus Areas

- Retail sector dominance (fashion, lifestyle, beauty)

- Integration into Block’s broader ecosystem (Cash App, merchant services)

- Deepening U.S., Canada, U.K., and ANZ market penetration

Notable Features

- High repayment rates

- Large global merchant network

- Strong cross-platform commerce integrations via Cash App

2024 Performance

- Millions of active customers globally

- Billions in gross merchandise volume (GMV) processed across markets

- Significant contribution to Block’s commerce revenue streams

Market Presence

Strongest in Australia (origin), but major footprint in the U.S., U.K., and Canada. Plays a key role in fashion/lifestyle e-commerce.

2. Klarna

Specialization

Multi-product BNPL including pay-in-4, pay later in 30 days, longer-term financing, shopping app, rewards, and savings.

Key Focus Areas

- Expansion across the U.S. and Europe

- AI-driven consumer shopping experiences

- Building a global “shopping super app”

Notable Features

- One of the world’s largest BNPL customer bases

- Rapid user adoption driven by integrated shopping + payments model

- Strong partnerships with global retail brands

2024 Performance

- Revenue above USD 2.8 billion

- Over 90 million active users globally

- Returned to profitability after years of heavy expansion investment

Market Presence

Clear BNPL leader in Europe; major and growing presence in the U.S., U.K., and key global markets.

3. Affirm

Specialization

Flexible installment loans for small and large ticket purchases, including both interest-free and interest-bearing products.

Key Focus Areas

- Major U.S. retail partnerships (electronics, furniture, travel)

- Strengthening underwriting and unit economics

- Expanding consumer app footprint and card-linked BNPL

Notable Features

- Transparent, non-compounding interest model

- Predictable, consumer-friendly terms

- High-margin long-term installment financing products

2024 Performance

- Revenue around USD 2.3 billion

- Large increases in GMV across U.S. retail categories

- Continued expansion with major retail chains

Market Presence

One of the most dominant BNPL players in the U.S.; selective expansion internationally via partnerships.

4. Zip (formerly Quadpay)

Specialization

BNPL products in Australia, New Zealand, and the U.S.; consumer and merchant solutions.

Key Focus Areas

- Strengthening ANZ leadership

- U.S. expansion through major online retailers

- Improving profitability and unit economics

Notable Features

- Cross-border BNPL capabilities

- Strong app engagement in ANZ

- Merchant analytics and conversion tools

2024 Performance

- Revenue around AUD 450 million

- Significant growth in customer usage and transaction volume

Market Presence

Market leader in Australia/New Zealand with a growing user base in the United States.

5. Sezzle

Specialization

Short-term BNPL (commonly pay-in-4), with a focus on ethical lending, financial education, and subscription offerings.

Key Focus Areas

- Expansion in U.S. and Canada

- Subscription-based premium offerings (Sezzle Premium, Sezzle Anywhere)

- Underwriting improvements aimed at reducing default risk

Notable Features

- BNPL acceptance at nearly any Visa-accepting merchant via premium tiers

- Strong appeal among younger consumers

- Emphasis on transparent, ethical lending practices

2024 Performance

- Revenue around USD 271 million

- Significant year-over-year GMV growth

Market Presence

Primarily strong in the U.S. and Canada; rapidly building merchant network and consumer engagement.

Leading Buy Now Pay Later Trends and Their Market Impact

1. Regulatory Tightening

Governments are establishing frameworks for:

- Affordability checks

- Data transparency

- Consumer protections

This is driving operational discipline and improved underwriting across the industry.

2. Expansion Beyond Pay-in-4

BNPL providers are offering:

- Longer-term installments (3–36 months)

- Interest-bearing loans

- Subscription products

- Loyalty and rewards

This diversification improves monetization and consumer stickiness.

3. Embedded Finance & Merchant Ecosystem Integration

BNPL is increasingly embedded in:

- Checkout flows

- Shopping apps

- Digital wallets

- Retail POS terminals

This integration boosts adoption and competitive defensibility.

4. AI-Powered Credit Assessment

Providers now use:

- Real-time data

- Machine learning models

- Open banking data

This reduces default rates and enhances financial inclusion.

5. Rising Competition from Banks & Big Tech

Major financial institutions and tech companies are launching their own BNPL products, pushing market consolidation and new partnership models.

Successful Buy Now Pay Later Examples Around the World

1. Afterpay’s Retail Transformation in Australia

Afterpay boosted merchant revenue by increasing conversion rates and average order values. Its success in Australia laid the foundation for expansion into the U.S. and U.K.

2. Klarna’s European Dominance

Klarna’s shopping app ecosystem became a central hub for product discovery, price comparison, and financing, creating one of the world’s most engaged BNPL user communities.

3. Affirm’s Big-Ticket Success in the U.S.

Affirm’s partnerships with electronics brands, furniture retailers, and travel companies have made BNPL viable for larger transactions, not just small purchases.

4. Zip’s ANZ Expansion Strategy

Zip’s dual approach—deep ANZ penetration and aggressive U.S. expansion—has allowed the company to scale rapidly across consumer and merchant networks.

5. Sezzle’s “Pay Anywhere” Innovation

By extending installment options to almost any Visa-accepting merchant through a subscription model, Sezzle expanded BNPL utility beyond traditional in-app merchants.

Global and Regional Buy Now Pay Later Analysis — Policy & Government Initiatives

1. Europe

Europe has some of the most advanced BNPL regulatory frameworks. Governments emphasize:

- Clear disclosures

- Creditworthiness assessments

- Consumer rights

BNPL providers must adjust business models to comply with unified EU credit rules.

2. North America (U.S. & Canada)

Regulators are focusing on:

- Consumer data rights

- Transparency standards

- Reporting BNPL usage to credit bureaus

Multiple states are moving toward formal BNPL licensing to ensure responsible lending.

3. Australia & New Zealand

Australia is one of the earliest regulators to examine BNPL risks. The region prioritizes:

- Responsible lending obligations

- Merchant transparency

- Hardship support

BNPL players often collaborate with regulators to refine standards.

4. Asia (India, Southeast Asia, China, Japan)

Asia’s BNPL growth comes from:

- Rising digital payments adoption

- Low credit card penetration

Governments are rapidly introducing digital lending regulations, especially around: - Interest caps

- Licensing requirements

- Data privacy

5. Latin America & Africa

BNPL adoption is rising due to:

- Growing smartphone penetration

- Digital wallets

- Underbanked populations

Regulators are developing new rules to govern digital installment products and protect customers from over-indebtedness.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: U.S. Renewable Diesel Market Revenue, Global Presence, and Strategic Insights by 2034