Beauty and Personal Care Products Market Growth Drivers, Key Players & Global Trends by 2034

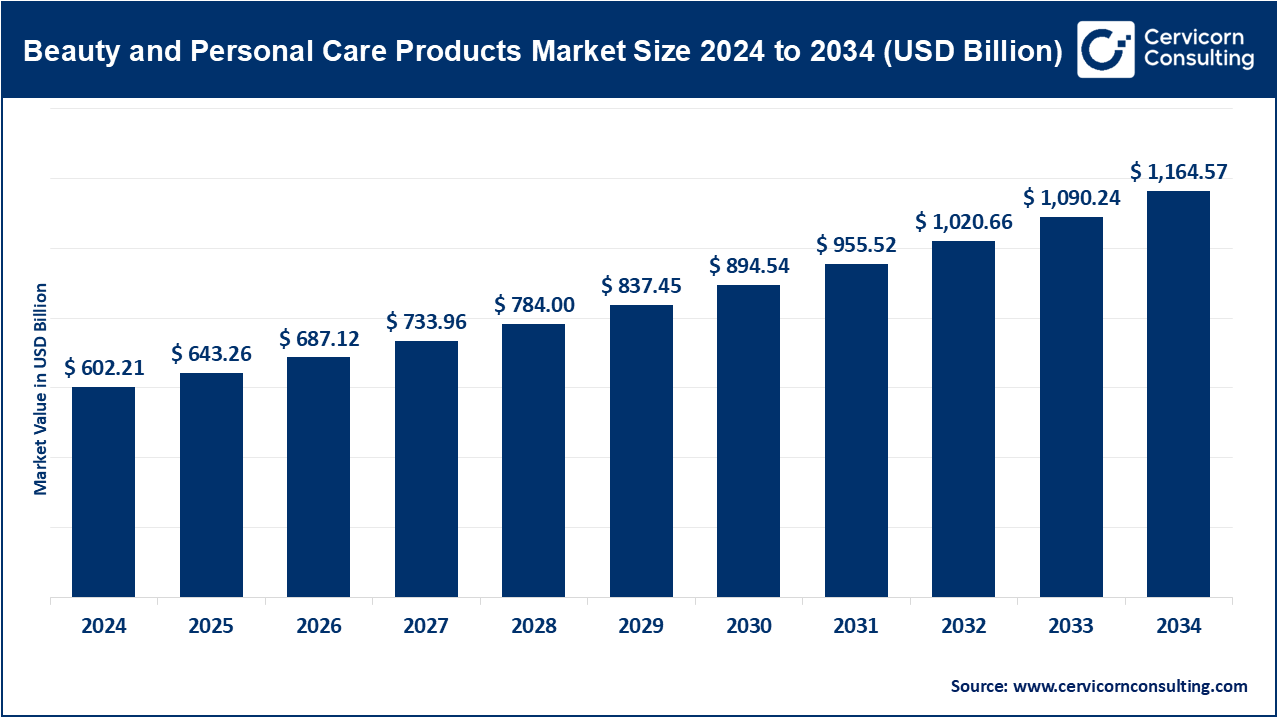

Beauty and Personal Care Products Market Size

The global beauty and personal care products market size was worth USD 602.21 billion in 2024 and is anticipated to expand to around USD 1,164.54 billion by 2034, registering a compound annual growth rate (CAGR) of 7.9% from 2025 to 2034.

The beauty and personal care products market is one of the most dynamic and rapidly evolving consumer segments globally. From skincare and haircare to cosmetics, fragrances, and personal hygiene, this industry has transformed itself from traditional grooming to holistic self-care and wellness. Driven by innovations in product formulations, digital engagement, sustainability demands, and the rise of clean and inclusive beauty, the global beauty and personal care market is projected to experience sustained growth in the coming years.

What is the Beauty and Personal Care Products Market?

The beauty and personal care products market encompasses a wide range of consumer goods aimed at enhancing personal hygiene, grooming, and appearance. These include skincare products (creams, serums, cleansers), haircare (shampoos, conditioners, hair treatments), cosmetics (makeup, color cosmetics), fragrances (perfumes, deodorants), oral care (toothpaste, mouthwash), bath and shower products, and men’s grooming solutions. The market caters to both mass and premium segments and covers offline and digital retail formats.

As the scope of personal care broadens beyond mere aesthetics to health and wellbeing, the market increasingly includes natural, organic, anti-aging, sun protection, gender-neutral, and dermatologically tested products. Innovations such as biotechnology-infused creams, vegan formulas, and AI-driven skin analysis apps are also gaining traction.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2675

Why Is the Beauty and Personal Care Market Important?

The significance of the beauty and personal care market goes far beyond vanity—it plays a central role in health, well-being, self-esteem, cultural identity, and social influence. In economic terms, it is a multi-billion-dollar industry that supports millions of jobs globally, from product development and manufacturing to retail and marketing. It acts as a barometer of consumer sentiment, societal values, and technological advancement. For governments and regulators, the industry is crucial from a public health, economic, and environmental standpoint.

Growth Factors of the Beauty and Personal Care Products Market

The beauty and personal care products market is witnessing robust growth, fueled by a combination of demographic, technological, and socio-cultural trends. Rising disposable incomes in emerging economies, growing awareness of personal grooming, the influence of social media and beauty influencers, and increasing demand for premium and clean-label products are pivotal. The rise of e-commerce platforms, subscription models, and customized beauty regimens enabled by AI and data analytics is expanding consumer access and personalization. Aging populations in developed nations are driving the anti-aging and skincare segments, while Gen Z’s preferences for inclusivity, sustainability, and ethical sourcing are reshaping product development. Additionally, increasing male grooming product adoption, urbanization, and government focus on hygiene (particularly post-COVID) continue to propel market expansion.

Top Companies in the Beauty and Personal Care Products Market

1. Unilever

- Specialization: Skincare, haircare, oral care, and hygiene

- Key Focus Areas: Sustainability, affordable luxury, inclusivity

- Notable Features: Brands like Dove, Pond’s, TRESemmé, Sunsilk, Vaseline, and Axe

- 2024 Revenue: Estimated $25.8 billion (Beauty & Personal Care segment)

- Market Share: ~7.3% of the global market

- Global Presence: 190+ countries

2. Estée Lauder Companies Inc.

- Specialization: Prestige skincare, makeup, and fragrance

- Key Focus Areas: Premium beauty, cruelty-free, personalization

- Notable Features: Brands like Estée Lauder, Clinique, MAC, La Mer, Bobbi Brown

- 2024 Revenue: ~$17.5 billion

- Market Share: ~4.8%

- Global Presence: 150+ countries

3. Shiseido Company, Limited

- Specialization: Skincare, makeup, haircare, and fragrances

- Key Focus Areas: J-beauty science, skin longevity, biotechnology

- Notable Features: Shiseido, NARS, Anessa, Elixir, Clé de Peau Beauté

- 2024 Revenue: Approx. $9.6 billion

- Market Share: ~2.5%

- Global Presence: Asia, North America, Europe

4. Revlon Inc.

- Specialization: Cosmetics, hair color, skincare, and fragrances

- Key Focus Areas: Mass-market beauty, legacy branding

- Notable Features: Revlon, Elizabeth Arden, Almay

- 2024 Revenue: ~$2.3 billion

- Market Share: ~0.6%

- Global Presence: 150 countries

5. Procter & Gamble (P&G)

- Specialization: Haircare, skincare, grooming, hygiene

- Key Focus Areas: Scalp health, male grooming, R&D-driven innovation

- Notable Features: Olay, Head & Shoulders, Pantene, SK-II, Gillette

- 2024 Revenue: ~$15.9 billion

- Market Share: ~4.5%

- Global Presence: 180+ countries

Leading Trends and Their Impact

- Clean and Sustainable Beauty: Biodegradable, cruelty-free, and zero-waste products

- Men’s Grooming Expansion: Rise in men’s skincare, beard care, and hair products

- Customization: AI-driven skincare analysis and DNA-based formulations

- Inclusive Beauty: Gender-neutral and multicultural products

- Digital-First Approach: TikTok, Instagram, YouTube driving beauty marketing

- Anti-Aging Innovation: Peptides, retinoids, and fermented ingredients

- Hybrid Products: Skincare-infused makeup (e.g., SPF foundations)

Successful Examples from Around the World

- Fenty Beauty: 50+ shades redefining inclusivity in makeup

- The Ordinary: Affordable, science-backed skincare disrupting pricing models

- SK-II Facial Treatment Essence: Aged skincare icon in Asia

- L’Oréal Perso: AI-powered beauty customization device

- Dove Campaign for Real Beauty: Celebrating diversity and boosting brand loyalty

Global Regional Analysis and Government Policies

North America

- Market Drivers: High-income, influencer culture, advanced R&D

- Policies: FDA oversight, state-level clean beauty laws (e.g., California)

Europe

- Market Drivers: Clean beauty, strong regulatory framework

- Policies: EU Cosmetic Regulation, Green Deal support for sustainable packaging

Asia-Pacific

- Market Drivers: Rising middle class, beauty culture (K/J-beauty)

- Policies: Relaxed animal testing laws in China, export initiatives in Korea and India

Latin America

- Market Drivers: Beauty-conscious youth, regional product preferences

- Policies: ANVISA in Brazil, export subsidies for local brands

Middle East & Africa

- Market Drivers: Urbanization, halal beauty demand, luxury imports

- Policies: Halal certifications, FDI promotion in UAE and Saudi Arabia

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Cosmetics Market Size USD 803.33 Billion by 2034, Stunning Growth