Autonomous Vehicle Market Growth Drivers, Top Companies & Global Insights 2025–2034

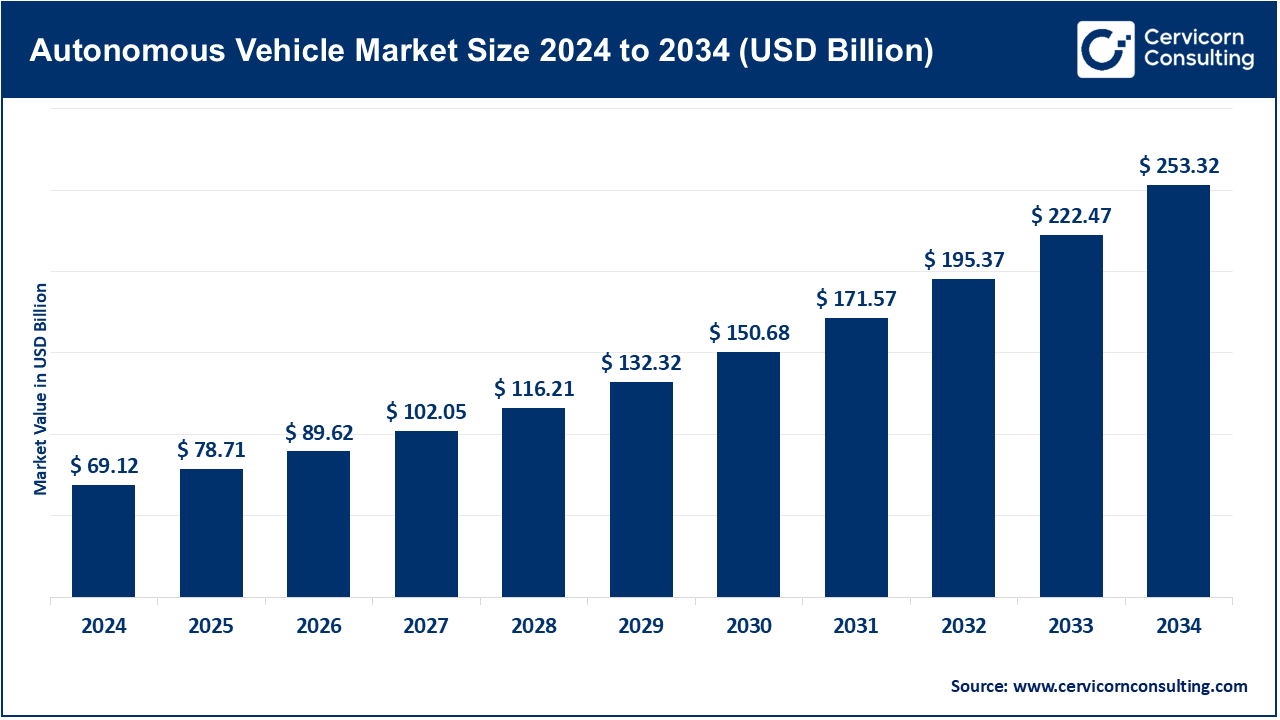

Autonomous Vehicle Market Size

The global autonomous vehicle market is set to surge from USD 69.12 billion in 2024 to over USD 253.32 billion by 2034, growing at an impressive CAGR of 18.12% during 2025–2034.

🚗 What Is the Autonomous Vehicle Market?

The autonomous vehicle (AV) market refers to the global ecosystem encompassing the development, production, deployment, and commercialization of self-driving vehicles and their supporting technologies. These vehicles are capable of sensing their environment and navigating without human intervention through advanced systems such as LiDAR, radar, GPS, computer vision, and artificial intelligence (AI). The market includes passenger vehicles, commercial transport, robotaxis, last-mile delivery bots, and autonomous shuttles, involving players from automotive manufacturing, semiconductor, software, and infrastructure industries.

Autonomous vehicles operate at various levels of autonomy, defined by the SAE (Society of Automotive Engineers) levels 0 to 5, where Level 0 indicates no automation, and Level 5 represents full autonomy under all conditions.

🌍 Why Is the Autonomous Vehicle Market Important?

The autonomous vehicle market holds transformative potential for urban mobility, safety, logistics, and sustainability. According to the World Health Organization, more than 1.3 million people die in road accidents annually, with 90% of cases attributed to human error. AVs offer the promise of drastically reducing fatalities, improving traffic flow, cutting fuel consumption, and enabling mobility access for the elderly and disabled.

Moreover, self-driving technology is expected to redefine public transportation, eliminate idle vehicle time, reduce emissions in urban centers, and lower logistics costs in sectors such as e-commerce, food delivery, and freight. In short, AVs are not just about convenience—they’re a cornerstone of future smart cities and the next frontier in sustainable and efficient mobility ecosystems.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2690

📈 Growth Factors Driving the Autonomous Vehicle Market

The market’s growth is driven by a convergence of technical, economic, social, and regulatory factors:

- Rising demand for safer, accident-free transportation

- Government support in the form of R&D funding, regulatory sandboxes, and smart road infrastructure

- Surge in electric vehicle (EV) adoption, accelerating AV integration

- Increasing investments from technology giants and venture capital firms

- Breakthroughs in AI and machine learning algorithms

- Proliferation of connected vehicle infrastructure (V2X, 5G, and cloud computing)

- Growing demand for last-mile delivery automation

- Urbanization trends pushing the need for traffic optimization and reduced congestion

🚘 Top Companies in the Autonomous Vehicle Market

1. AB Volvo

- Specialization: Commercial autonomous trucks, buses, and construction equipment

- Key Focus Areas: Safety-first automation, autonomous freight corridors, industrial logistics

- Notable Features: Vera autonomous truck, Autonomous Transport Solutions (ATS)

- 2024 Revenue: USD 48.3 billion

- Market Share: 5–6% (autonomous trucking segment)

- Global Presence: Operations in 190+ markets; strong in Europe, North America, and Asia-Pacific

2. AUDI Aktiengesellschaft (Volkswagen Group)

- Specialization: Level 3–4 passenger vehicles, AI-based driver assistance systems

- Key Focus Areas: Urban premium mobility, driverless parking, infotainment integration

- Notable Features: Audi A8 with Traffic Jam Pilot, Artemis Project, zFAS processor

- 2024 Revenue (Audi brand): USD 68.9 billion

- Market Share: ~3% of the AV passenger segment

- Global Presence: Manufacturing in 13 countries; expanding AV R&D in Germany, China, and the US

3. Bayerische Motoren Werke AG (BMW Group)

- Specialization: Level 2+ and Level 3 automation, intelligent connectivity systems

- Key Focus Areas: Safe autonomy, driver-centric software, premium user experience

- Notable Features: BMW Personal CoPilot, Remote-Control Parking, Open Mobility Cloud

- 2024 Revenue: USD 157.5 billion

- Market Share: 4–5% in luxury AV segment

- Global Presence: Strong footprint in Europe, China, and US; key alliances with Intel, Mobileye

4. Daimler AG (Mercedes-Benz Group AG)

- Specialization: Level 3 autonomous luxury sedans and commercial vans

- Key Focus Areas: Regulatory leadership, luxury autonomy, AV-as-a-service

- Notable Features: Mercedes-Benz DRIVE PILOT (Level 3), AV commercial van pilot programs

- 2024 Revenue: USD 153.6 billion

- Market Share: 6–7% in premium and logistics AV segments

- Global Presence: Worldwide, with test programs in Germany, Nevada, and Japan

5. Ford Motor Company

- Specialization: Autonomous commercial fleets, ride-hailing vehicles, L4 robotaxis

- Key Focus Areas: Scalable AV systems, fleet deployment, urban mobility partnerships

- Notable Features: Ford AV LLC, Argo AI (until 2022), autonomous delivery pilot with Walmart

- 2024 Revenue: USD 174.2 billion

- Market Share: ~8–9% in commercial AV deployment

- Global Presence: AV trials in Miami, Austin, Washington D.C., and future scale-ups planned globally

🚀 Leading Trends and Their Impact

1. Sensor Fusion & Advanced Perception Systems

LiDAR, radar, ultrasonic sensors, and computer vision are increasingly fused using AI algorithms to create high-definition environmental maps, enabling vehicles to navigate complex conditions safely.

2. Connected Autonomous Vehicles (CAVs)

Integration with 5G networks and Vehicle-to-Everything (V2X) communication allows AVs to talk to infrastructure, pedestrians, and each other, reducing latency in decision-making and improving safety.

3. AI and Deep Learning

Neural networks trained on millions of miles of driving data are powering object detection, path prediction, and dynamic decision-making, especially in urban driving environments.

4. Mobility-as-a-Service (MaaS)

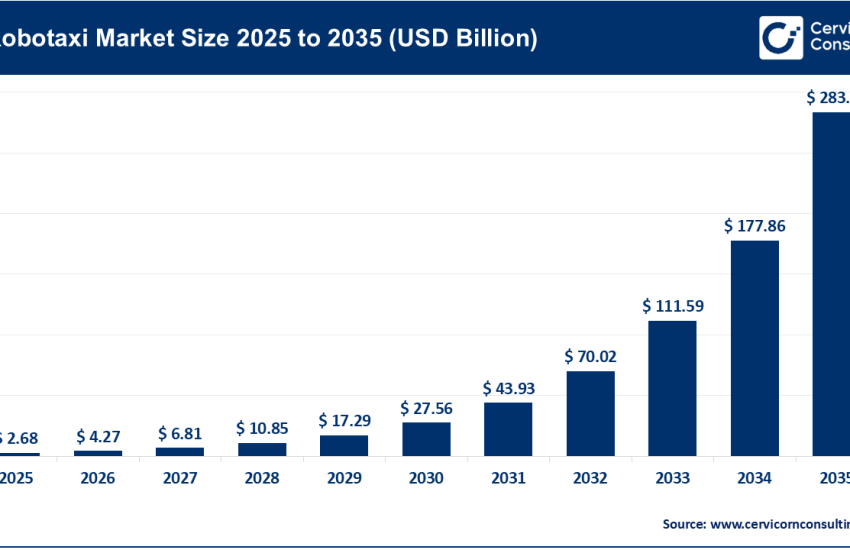

AVs are central to the rise of subscription-based ride-hailing and ride-sharing services, with companies testing robotaxi fleets and on-demand shuttles.

5. EV-AV Convergence

Most AVs are being developed on electric powertrains, reinforcing the global shift toward zero-emission transport and simplifying design due to fewer moving parts.

6. Cloud-Based Simulation & Digital Twins

AV developers increasingly rely on cloud simulations to test scenarios at scale. Digital twins of cities help AVs train in a variety of environmental conditions.

🌎 Successful Examples of AV Deployment Around the World

🇺🇸 United States

Waymo (Alphabet) operates one of the world’s most advanced Level 4 robotaxi services in Phoenix, Arizona. Cruise (GM) and Aurora Innovation are piloting autonomous rides and freight corridors in multiple states.

🇨🇳 China

Baidu’s Apollo Go and Pony.ai are running commercial autonomous taxi operations in cities like Beijing and Guangzhou. The Chinese government supports AV development via national-level pilot zones.

🇩🇪 Germany

Daimler’s Mercedes-Benz DRIVE PILOT is the first internationally approved Level 3 system operating on German highways. The country is actively modifying road traffic laws to accommodate higher levels of autonomy.

🇸🇬 Singapore

The country has established a model AV regulatory framework and launched autonomous buses through partnerships with ST Engineering and MIT spin-offs. AVs are seen as part of Singapore’s Smart Nation agenda.

🇯🇵 Japan

Nissan, Honda, and Toyota are testing driverless shuttles in aging rural towns, addressing labor shortages. Japan is a leader in AV regulation with government grants and 2025 deployment goals.

🌐 Global Regional Analysis: Policies & Government Initiatives

🟦 North America

- Key Markets: U.S., Canada

- Initiatives: U.S. DOT’s AV 4.0 policy framework; NHTSA guidance on AV safety; AV START Act pending

- Focus Areas: Private-public R&D partnerships, smart infrastructure, autonomous freight corridors

🟨 Europe

- Key Markets: Germany, France, UK, Sweden

- Initiatives: EU Strategy on C-ITS (Cooperative Intelligent Transport Systems), UNECE WP.29 AV standards

- Focus Areas: Legal frameworks for Level 3/4 deployment, consumer safety, cross-border testing

🟩 Asia-Pacific

- Key Markets: China, Japan, South Korea, Singapore, India

- Initiatives:

- China’s AV test zones in over 16 provinces

- Japan’s Road Traffic Act amendments for Level 3 AVs

- South Korea’s “Smart Mobility City” pilot program

- Focus Areas: Infrastructure readiness, AI chip development, urban traffic decongestion

🟥 Latin America

- Key Markets: Brazil, Mexico, Chile

- Initiatives: Early-stage trials and investments in smart transport corridors

- Focus Areas: Connected vehicle pilots, AV testbeds in urban zones, infrastructure co-development with EVs

⬛ Middle East & Africa

- Key Markets: UAE, Israel, South Africa

- Initiatives:

- UAE’s Dubai Autonomous Transportation Strategy (25% trips via AVs by 2030)

- Israel’s AV innovation hub near Tel Aviv

- Focus Areas: Tech park investments, driverless shuttle pilots, public-private AV R&D partnerships

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: General Delivery Transportation Market Revenue, Market Share & Innovations (2025 – 2034)