Automotive Internet of Things (IoT) Market Revenue, Global Presence, and Strategic Insights by 2035

Automotive Internet of Things (IoT) Market Size

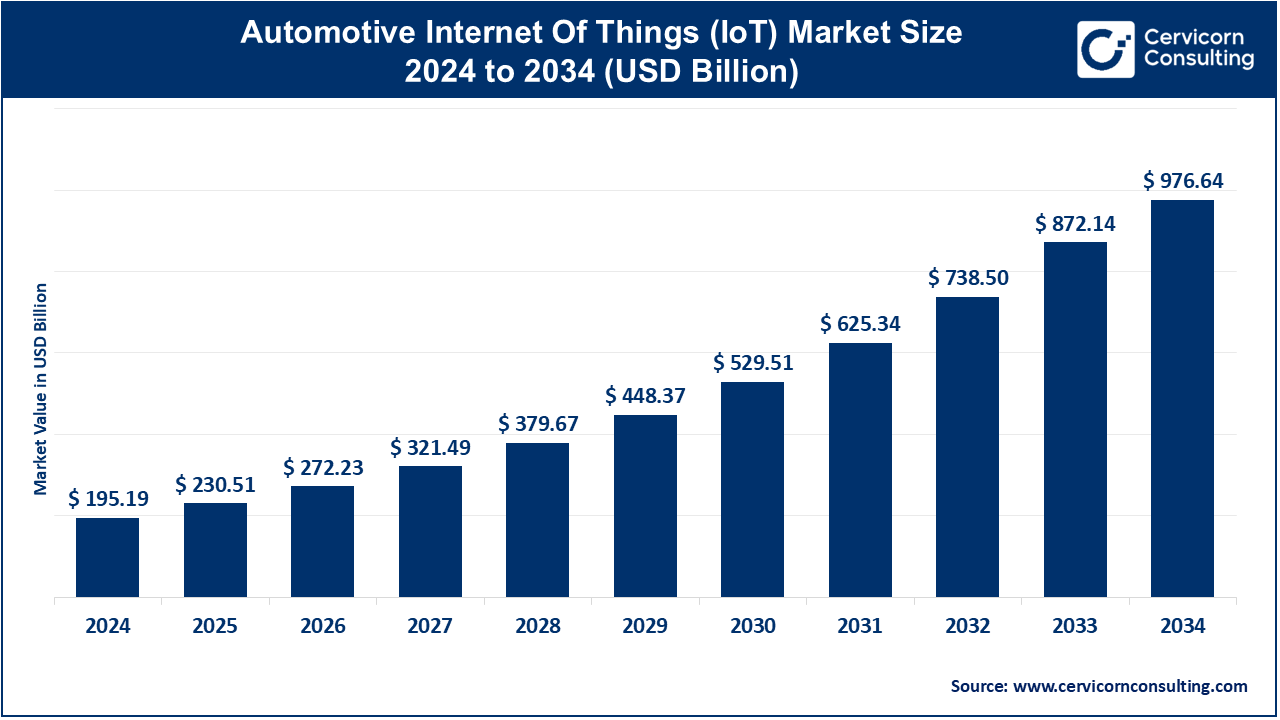

The global automotive internet of things (IoT) market size was worth USD 195.19 billion in 2024 and is anticipated to expand to around USD 976.64 billion by 2034, registering a compound annual growth rate (CAGR) of 17.47% from 2025 to 2034.

Automotive IoT Market Growth Factors

The automotive IoT market is growing rapidly due to increasingly affordable sensors, declining connectivity costs, expansion of 5G networks, and government regulations encouraging advanced driver-assistance, V2X technologies, and vehicle safety systems. Rising consumer expectations for connected experiences, remote services, and in-vehicle digital features fuel adoption. Automakers are also shifting from traditional hardware-focused business models to recurring-revenue streams powered by connectivity, software, and data-driven services. Electrification enhances the importance of IoT for battery monitoring, smart charging, and predictive maintenance, while advancements in cloud computing, AI, and edge analytics enable richer real-time vehicle insights. Coupled with smart city development, fleet digitization, and logistical optimization efforts, these factors combine to create robust long-term growth for the automotive IoT market.

What Is the Automotive Internet of Things (IoT) Market?

The automotive Internet of Things (IoT) market encompasses the ecosystem of connected hardware, software platforms, sensors, embedded communication modules, cloud computing architectures, telematics systems, V2X communication solutions, data analytics tools, and connected services that allow vehicles to sense, collect, transmit, analyze, and act on data. It includes in-vehicle embedded systems, GPS and telematics devices, infotainment platforms, advanced driver-assistance systems (ADAS), autonomous driving sensors, vehicle connectivity units, and aftermarket IoT solutions. The market further integrates ecosystem players such as cloud providers, cybersecurity companies, telecom operators, software developers, component manufacturers, and automotive OEMs. In essence, the market represents the backbone enabling connected, autonomous, shared, and electric (CASE) mobility.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2364

Why the Automotive IoT Market Is Important

- Safety Enhancement

IoT-enabled vehicles communicate with infrastructure, pedestrians, and other vehicles to prevent collisions, optimize traffic flow, and support emergency responses. - Software-Defined Mobility

Vehicles increasingly rely on software, and IoT allows updates, diagnostics, and feature rollouts to be delivered remotely—reducing downtime and improving long-term value. - Monetization and New Revenue Streams

Automakers now generate revenue from services such as real-time navigation upgrades, premium infotainment, driver-assist features, predictive maintenance, and fleet analytics. - Fleet Optimization

IoT solutions allow logistics companies to track vehicle health, fuel consumption, location, driver behavior, and maintenance needs, improving operational efficiency. - Foundation for EVs and Autonomous Vehicles

Electric vehicles require IoT for energy monitoring, charging management, and battery health analysis. Autonomous vehicles need sensor fusion, connectivity, and real-time data processing. - Smart City and Infrastructure Integration

IoT enables urban transportation systems to integrate intelligently with vehicles, supporting congestion management and sustainable mobility.

Top Companies in the Automotive IoT Market

Below are detailed profiles of the major automakers you requested—Tesla, Ford, GM, Toyota, and BMW—covering their specialization, key IoT focus areas, notable features, estimated 2024 revenues, global presence, and market influence. (Market share is discussed qualitatively because IoT-specific share is not publicly reported.)

1. Tesla, Inc.

Specialization

Tesla is a pioneer in software-defined vehicles, seamlessly integrating IoT across its EV lineup. The company specializes in autonomous driving systems, real-time connectivity, fleet data collection, vehicle diagnostics, and advanced over-the-air (OTA) software updates.

Key Focus Areas

- Full Self-Driving (FSD) and Autopilot systems

- OTA updates enabling new features post-purchase

- High-frequency fleet data collection for AI model training

- Connected energy systems (vehicle-to-grid experiments)

- Integrated infotainment and vehicle OS

Notable Features

- Industry-leading OTA software infrastructure

- Highly integrated electronics architecture

- Vehicle-as-a-platform business model

2024 Revenue

Approximately $97–100 billion globally (company-wide).

Market Influence

Although Tesla’s global sales volume is smaller than some legacy automakers, its IoT innovation influence is disproportionately high. Its connected fleet spans North America, Europe, and China.

Global Presence

Strong presence across the U.S., Europe, and China; expanding markets in APAC and the Middle East.

2. Ford Motor Company

Specialization

Ford is heavily investing in connected vehicle platforms and commercial fleet telematics through Ford Pro. It focuses on IoT-enabled logistics, EV connected technologies, and software-driven services.

Key Focus Areas

- FordPass and Ford Pro connected services

- Commercial fleet telematics

- Vehicle health monitoring & predictive maintenance

- Software-defined vehicles via the Model e division

Notable Features

- One of the strongest IoT portfolios for commercial fleets

- Subscription-based connected services

- Strategic partnerships with tech firms for cloud and AI

2024 Revenue

Approximately $180–190 billion (full-year company revenue).

Global Presence

Large footprint across North America, Europe, South America, and Asia with growing connected service penetration.

Market Influence

Ford plays a leading role in fleet IoT, logistics, and EV connectivity.

3. General Motors (GM)

Specialization

GM has one of the earliest and most mature connected vehicle ecosystems through OnStar. The company also integrates IoT deeply into its autonomous driving ambitions via Cruise.

Key Focus Areas

- OnStar connected & safety services

- Autonomous vehicle R&D

- EV connectivity

- OTA software updates and digital services

Notable Features

- Decades of experience with telematics

- Mature safety and emergency communication network

- Strategic investments in autonomous driving

2024 Revenue

Estimated $180–190 billion globally.

Global Presence

Strong presence in North America and China, with ongoing global expansion of EV and connected services.

Market Influence

GM is a pillar of automotive connectivity, especially in safety services and autonomous mobility.

4. Toyota Motor Corporation

Specialization

Toyota focuses on safe, reliable, and scalable connected vehicle technologies integrated with mobility services, robotics, and smart-city initiatives.

Key Focus Areas

- Safety systems and driver assistance

- Hybrid and EV connectivity

- Connected mobility-as-a-service

- Smart city infrastructure integration

Notable Features

- Woven City initiative (future mobility ecosystem)

- Strong global leadership in reliability-focused IoT systems

- Collaborative ecosystem approach

2024 Revenue

Toyota’s 2024 fiscal-year revenue stands at multi-trillion yen scale (one of the highest in the world).

Global Presence

Strongest global network among automakers, with deep penetration across Asia, North America, Europe, and developing markets.

Market Influence

Toyota maintains dominant influence in scalable, safety-centric IoT technologies.

5. BMW AG

Specialization

BMW integrates IoT into its premium vehicles through ConnectedDrive, focusing on digital luxury, advanced infotainment, and driver-assistance services.

Key Focus Areas

- ConnectedDrive digital ecosystem

- OTA-enabled feature upgrades

- Premium navigation, infotainment, and digital services

- Electrification via the BMW i ecosystem

Notable Features

- High-end user experience with digital personalization

- Strong R&D investment in connected mobility

- Early adopter of subscription-based features

2024 Revenue

BMW’s 2024 revenue (in euros) remains among the highest in global premium automotive manufacturing.

Global Presence

Strong presence in Europe, the U.S., and China, with premium IoT services widely adopted.

Market Influence

A leader in premium connected car services and experience-driven IoT design.

Leading Trends in the Automotive IoT Market and Their Impact

1. V2X Communication (Vehicle-to-Everything)

Impact:

- Improves safety by reducing accidents

- Enables autonomous coordination

- Supports smart-city infrastructure

2. Edge Computing + In-Vehicle AI

Impact:

- Reduces latency

- Makes autonomy safer

- Enables real-time analytics

3. OTA Updates & Software-Defined Vehicles

Impact:

- Reduces physical recalls

- Allows new feature monetization

- Creates long-term customer engagement

4. Vehicle Cybersecurity

Impact:

- Protects connected systems

- Prevents hacking of safety-critical functions

- Required to meet global standards

5. Data Monetization & Connected Services

Impact:

- Generates recurring revenue

- Supports usage-based insurance

- Enables predictive maintenance

6. EV Connexctivity & Grid Integration

Impact:

- Enables smart charging and V2G

- Optimizes fleet charging

- Improves battery lifecycle management

Successful Automotive IoT Examples Worldwide

Tesla OTA Platform

Tesla’s software-first approach is the industry benchmark, enabling frequent updates, new features, and performance improvements without dealership visits.

GM OnStar

One of the earliest global telematics platforms, now expanded to safety, concierge, diagnostics, and connectivity services.

Ford Pro Telematics

A comprehensive fleet solution offering routing optimization, driver behavior analysis, energy management for EV fleets, and business analytics.

European V2X Smart Corridors

EU nations have deployed smart intersections, connected highways, and cooperative mobility corridors integrating IoT systems with real-time traffic systems.

China’s Connected EV Ecosystems

China leads in EV telematics, integrated charging infrastructure, and large-scale smart mobility initiatives supported by both the private sector and government policy.

Global Regional Analysis With Government Policies and Initiatives

North America

United States

- Strong federal emphasis on connected vehicle safety

- Emerging regulatory frameworks for autonomous vehicles

- Investment in V2X corridor development

- Increasing cybersecurity and data privacy standards

- 5G network expansions enabling high-bandwidth applications

Canada

- Focus on smart mobility pilots

- Investments in EV IoT integration

- Growing adoption of fleet telematics for logistics

Europe

European Union

- Coordinated policies for Connected and Automated Mobility (CAM)

- Strong data privacy laws (GDPR) shaping vehicle data usage

- Smart transportation and zero-emission initiatives

- Interoperable V2X communication standards

Germany, France, UK

- Significant national investments in autonomous mobility

- High penetration of premium connected services

- IoT-integrated EV incentives and charging infrastructure expansion

Asia-Pacific

China

- One of the world’s strongest smart mobility ecosystems

- Mandatory EV connectivity requirements

- Investments in AI, IoT infrastructure, and smart cities

- Integration of telematics with national transportation systems

Japan

- Leadership in safety and reliability-focused IoT

- Strong collaboration between automakers and robotics research

- Government incentives for connected EV technologies

India

- National programs supporting EV adoption and local automotive innovation

- Growing fleet telematics market

- Smart-city initiatives incorporating IoT traffic systems

Latin America

- IoT growth driven by logistics optimization

- Broad adoption of telematics in commercial fleets

- Expanding interest in connected car services despite infrastructure challenges

Middle East & Africa

- Early-stage but fast-growing IoT adoption

- Government-led smart city projects (Dubai, Saudi Arabia)

- Increasing EV and connected vehicle pilots

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Food Processing Market Revenue, Global Presence, and Strategic Insights by 2035