Artificial Intelligence (AI) in Defence Market Revenue, Global Presence, and Strategic Insights by 2034

Artificial Intelligence (AI) in Defence Market Size Overview

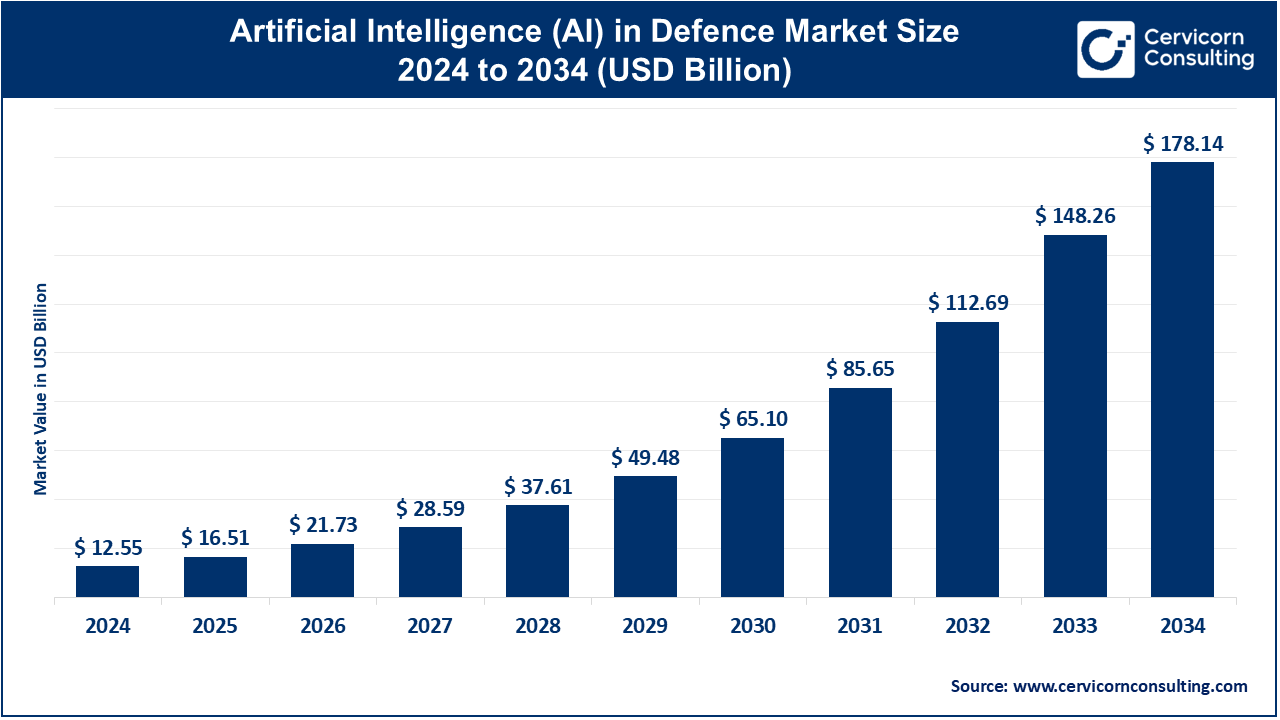

The global artificial intelligence (AI) in defence market size was worth USD 12.55 billion in 2024 and is anticipated to expand to around USD 178.14 billion by 2034, registering a compound annual growth rate (CAGR) of 30.38% from 2025 to 2034.

Some broader assessments (including dual-use aerospace and defence AI) map the market into the multi-billion and expanding range.

The common consensus: demand is accelerating rapidly, fueled by modernization, autonomy, and cyber-driven priorities.

Artificial Intelligence (AI) in Defence Market — Growth Factors

Growth in the AI in defence market is driven by the exponential rise in sensor data and the need for automated analysis; demand for faster decision cycles and human–machine teaming in contested environments; increased investment in autonomous UAVs, UGVs, and unmanned maritime vessels; advances in machine learning, computer vision, and edge-AI computing; large-scale defence modernization initiatives; rising cyber and electronic warfare threats; and the establishment of ethical, responsible AI frameworks enabling smoother procurement. Together, these factors are accelerating defence technology innovation, boosting AI integration across platforms, and creating long-term momentum for both government and industry stakeholders.

What Is the AI in Defence Market?

The AI in defence market includes hardware, software, and services that use artificial intelligence — such as machine learning, deep learning, computer vision, sensor fusion, autonomous navigation, predictive analytics, and natural language processing — for military applications. These AI capabilities support intelligence, surveillance and reconnaissance (ISR), target tracking, autonomous platforms (drones, ground robots, maritime systems), cybersecurity, simulation and training, command-and-control decision-making, logistics optimization, and predictive maintenance. The market spans ruggedized edge AI hardware, cloud-based analytics, secure data-labeling pipelines, and system-level integration required to deploy AI in classified and mission-critical environments.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2388

Why It Is Important

AI enhances the speed, precision, and resilience of military operations by analyzing vast sensor and battlefield data far faster than humans. It shortens the OODA loop (observe–orient–decide–act), enabling rapid, accurate decision-making. AI improves force protection, supports autonomous systems that reduce risks to soldiers, strengthens cyber defence through anomaly detection, and enhances readiness through predictive maintenance. Strategically, AI-equipped militaries achieve superior situational awareness, operational tempo, and deterrence — giving nations a major advantage over adversaries.

Top Companies in the AI in Defence Market

Companies dominating this space include Lockheed Martin, Raytheon Technologies (RTX), Boeing, Northrop Grumman, and General Dynamics. Below are detailed profiles including specialization, key AI focus areas, notable features, 2024 revenue, market presence, and strategic positioning.

1. Lockheed Martin

Specialization: Integrated air and missile defence, advanced aircraft, space systems, C2/ISR, sensor fusion, hypersonic systems.

Key AI Focus Areas:

- Autonomous ISR processing

- Sensor fusion and targeting algorithms

- Edge AI integration on aircraft and missile systems

- AI-enabled command and control decision-support

- Predictive maintenance and sustainment analytics

Notable Features: Leading systems integrator for large-scale, classified programs; deep AI expertise embedded into mission systems across air, land, and sea.

2024 Revenue: $71 billion

Global Presence: Strong international footprint through FMS programs, allied partnerships, and global supply chains.

2. Raytheon Technologies / RTX

Specialization: Advanced radars, integrated air and missile defence systems, EW systems, avionics, weapons systems, aerospace technologies.

Key AI Focus Areas:

- Real-time radar signal processing

- Counter-UAS systems using computer vision

- Autonomous targeting and tracking

- Predictive logistic algorithms

- AI-enabled avionics and mission systems

Notable Features: Strength in sensor-to-effector systems enabling end-to-end AI integration from detection to engagement.

2024 Revenue: ~$80.8 billion (adjusted net sales)

Global Presence: Widely present across NATO, Asian allies, and Middle Eastern militaries; strong international partnerships.

3. Boeing (Defense, Space & Security)

Specialization: Military aircraft, satellites, rotorcraft, space systems, missiles, logistics and sustainment services.

Key AI Focus Areas:

- Autonomous aerial systems

- AI-driven maintenance and digital twin modeling

- Space analytics

- Mission-planning AI

- Computer-vision-assisted aircraft operations

Notable Features: Global aerospace leader with strong military sustainment operations that leverage AI to enhance fleet readiness.

2024 Revenue: ~$66.5 billion (company-wide)

Global Presence: Global defence contracts, partnerships with international militaries, widespread supplier network.

4. Northrop Grumman

Specialization: Autonomous systems, space systems, C4ISR platforms, advanced electronics, cyber defence.

Key AI Focus Areas:

- Autonomous drones and unmanned ground vehicles

- Sensor fusion and battlefield analytics

- AI-enabled space systems

- Cyber and electronic warfare algorithms

Notable Features: Leadership in high-end, classified national security programs; strong autonomous system capabilities.

2024 Revenue: ~$41 billion

Global Presence: Critical supplier for U.S. and allied defence systems with growing global collaborations.

5. General Dynamics

Specialization: Combat vehicles, naval shipbuilding, secure communications, IT and mission systems.

Key AI Focus Areas:

- Autonomous and robotic ground systems

- AI-enabled training and simulation

- Secure C4ISR platforms

- Predictive maintenance in naval and land platforms

Notable Features: Balanced portfolio of platforms and mission systems with a strong emphasis on secure communication and battlefield networking.

2024 Revenue: ~$47.7 billion

Global Presence: Supplies combat vehicles and naval systems globally; strong presence across NATO and allied states.

Leading Trends and Their Impact

1. Edge AI on Autonomous Platforms

AI processing is shifting to onboard systems (drones, vehicles, ships), reducing reliance on cloud or satellite links.

Impact: Faster targeting, higher survivability in GPS- or comms-denied environments, and reduced bandwidth usage.

2. Human–Machine Teaming & Explainable AI

Militaries want AI that supports — not replaces — human judgement.

Impact: New procurement requirements for traceability, explainability, and adjustable autonomy.

3. Synthetic Data & Secure Training Pipelines

Synthetic datasets and federated learning solve data scarcity while protecting classified information.

Impact: Faster, safer model development and testing.

4. AI-Powered Cyber Defence

AI is central to threat detection, anomaly recognition, and real-time intrusion response.

Impact: Stronger cyber resilience and shorter detection-to-response cycles.

5. Responsible Military AI Standards

Governments and alliances are introducing principles and frameworks for ethical military AI.

Impact: Vendors must comply with rigorous standards for testing, safety, and oversight.

6. Growing Defence–Tech Ecosystem Partnerships

Primes are increasingly partnering with startups and cloud providers.

Impact: Faster innovation cycles; expanded tech supply chain.

Successful Examples of AI in Defence Around the World

1. AI-Driven Integrated Air & Missile Defence

AI-enhanced radar processing and sensor fusion now allow earlier detection and classification of threats like hypersonic glide vehicles and low-observable missiles.

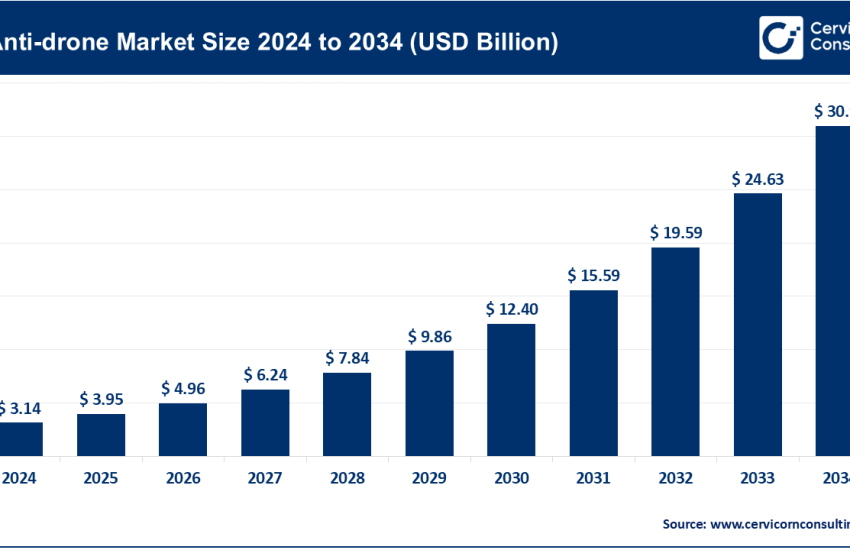

2. Counter-UAS Systems

AI-powered computer vision enables rapid drone detection, tracking, and neutralization. Countries across Europe, the Middle East, and Asia deploy these systems at bases and borders.

3. Predictive Maintenance for Aircraft & Armored Vehicles

ML models forecast component failures, reducing downtime and improving fleet readiness across major air forces.

4. Autonomous Maritime Vessels

Unmanned surface vessels equipped with AI navigation conduct ISR, mine detection, and patrol missions with minimal human involvement.

5. AI-Accelerated Signals Intelligence (SIGINT)

AI tools scan massive signal datasets to detect anomalies or hostile transmissions — a critical capability for NATO and allied forces.

Global Regional Analysis — Government Policies & Initiatives

United States

- The U.S. Department of Defense has created dedicated responsible AI strategies.

- Heavy investment in AI-enabled ISR, C2, cyber defence, autonomous systems, and joint all-domain command and control (JADC2).

- Procurement emphasizes human oversight, safety testing, and interoperability.

Impact: The U.S. remains the world’s largest spender on defence AI, shaping global supplier standards.

Europe (EU + NATO)

- NATO countries are harmonizing AI interoperability standards.

- The EU emphasizes responsible and ethical AI to balance innovation with safety.

- European Defence Fund supports cross-border AI-defence collaboration.

Impact: Emphasis on sovereignty, data governance, and interoperability encourages multinational procurement programs.

Asia–Pacific

China, India, South Korea, Japan, Australia are rapidly increasing AI-based defence investments:

- Autonomous combat drones

- AI-enhanced surveillance

- Border management systems

- Naval autonomous systems

Impact: APAC is the fastest-growing region, driven by geopolitical tensions and domestic R&D investments.

Middle East & Africa

- Strong demand for AI-enabled air defence, border security, ISR drones, and counter-drone solutions.

- Nations like UAE, Saudi Arabia, and Israel are investing in indigenous AI R&D.

Impact: High spending power and modernization needs make MEA a major importer of defence AI technologies.

Latin America

- Adoption is slower but rising, especially in AI-assisted border surveillance and crime-monitoring systems.

Impact: Emerging market with potential for growth in homeland security and defence digitalization.

What This Means for the Future

For Defence Contractors:

Emphasis on explainable AI, secure data handling, reliability in contested environments, and deep system integration capabilities.

For Governments:

Need for ethical frameworks, transparent oversight, technology talent development, and secure data ecosystems.

For Military Operators:

Shift towards hybrid human–AI teams, AI-augmented logistics, and more autonomous platforms across air, land, sea, space, and cyber domains.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Robotic Process Automation Market Revenue, Global Presence, and Strategic Insights by 2034