Amino Acids Market Revenue, Global Presence, and Strategic Insights by 2034

Amino Acids Market Size

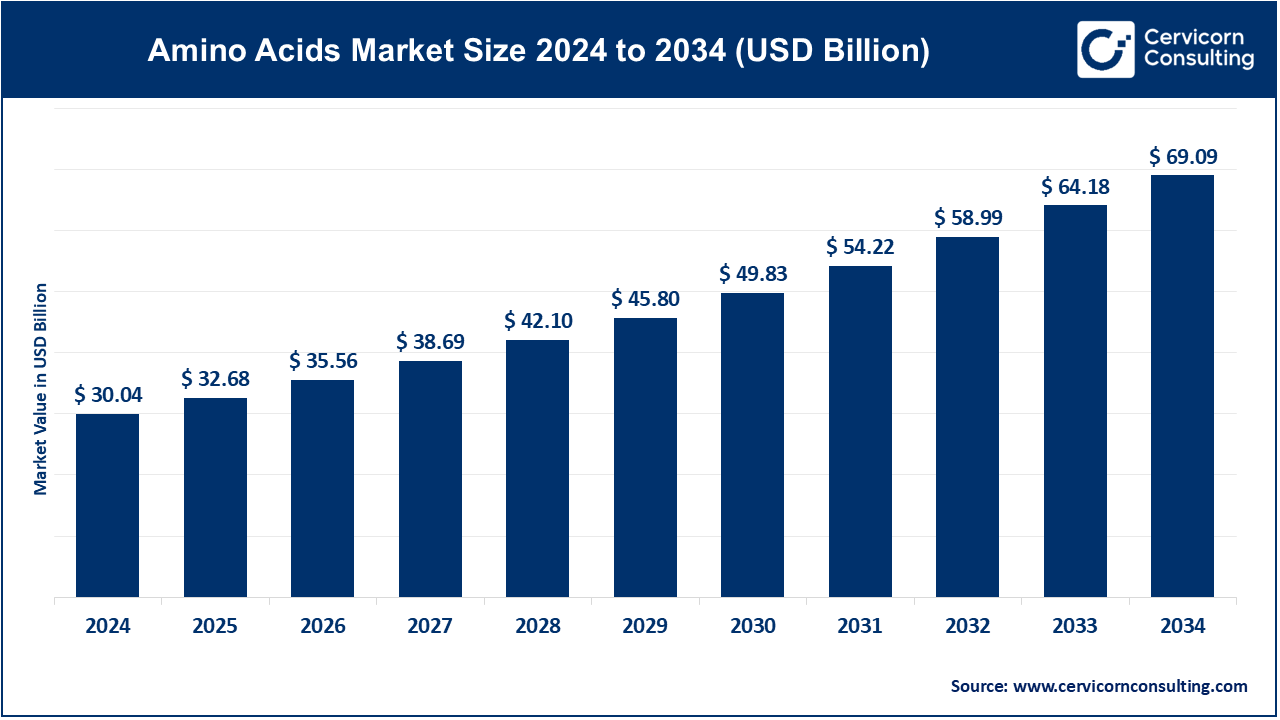

The global amino acids market size was worth USD 30.04 billion in 2024 and is anticipated to expand to around USD 69.09 billion by 2034, registering a compound annual growth rate (CAGR) of 8.69% from 2025 to 2034.

What Is the Amino Acids Market?

The amino acids market comprises the global production, distribution, and utilization of essential, non-essential, and specialty amino acids. These include lysine, methionine, threonine, valine, tryptophan, glutamic acid, alanine, branched-chain amino acids (BCAAs), and pharmaceutical-grade derivatives.

The market caters to four primary segments:

- Animal Nutrition (Largest Volume Segment)

Used to formulate precise, low-protein diets in poultry, swine, ruminants, and aquaculture. - Human Nutrition & Supplements

Includes sports nutrition, dietary supplements, medical nutrition, and functional foods enriched with amino acids. - Pharmaceuticals & Biotechnology

High-purity amino acids used in peptide drugs, biologics, cell-culture media, parenteral nutrition, and diagnostic reagents. - Industrial Applications

Used in cosmetics, specialty chemicals, biodegradable polymers, and fermentation-based manufacturing.

Amino acids are produced primarily via microbial fermentation, enzymatic transformation, or chemical synthesis, with fermentation technologies dominating due to cost efficiency and scalability.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2410

Why the Amino Acids Market Is Important

Amino acids form the building blocks of proteins and play essential roles in metabolism, muscle development, immune function, cellular repair, neurotransmission, and overall health. Their importance spans across industries:

In Animal Nutrition

Amino acids enable precise formulation of livestock diets, lowering crude-protein requirements and reducing nitrogen emissions. This makes meat, dairy, and eggs more sustainable and cost-effective.

In Human Health

Amino acids are vital in sports performance, muscle recovery, cognitive health, clinical nutrition therapies, and metabolic support.

In Pharmaceuticals

They are indispensable in peptide drug synthesis, bioprocessing, and cell-culture systems required for vaccines, biosimilars, and advanced therapies.

In Industrial Applications

Amino acids serve as bio-based raw materials for specialty chemicals, innovative materials, and cosmetic actives.

As global food demand increases and healthcare becomes more personalized, the amino acids market plays a central role in supporting innovation, sustainability, nutrition, and health outcomes.

Amino Acids Market Growth Factors

The amino acids market is expanding due to rising global livestock production, increased adoption of precision animal nutrition, and a growing emphasis on sustainable feed strategies that reduce crude protein and environmental impact; surging demand for dietary supplements, sports nutrition, and functional foods rich in amino acids; rapid growth in biotechnology, cell-culture-based drug manufacturing, and peptide therapeutics requiring high-purity amino acids.

Continuous advancements in fermentation technology that lower manufacturing costs and improve product consistency; strong industrial and government investments in Asia-Pacific, especially China, which continues to expand amino acid production infrastructure; increasing consumer focus on health, wellness, and plant-based diets that rely on amino acid fortification; and supply-chain diversification efforts that encourage new regional production capacities, collectively driving both volume and value expansion across global markets.

Top Companies in the Amino Acids Market

1. Adisseo

Specialization: Feed-grade amino acids, particularly DL-methionine, and advanced feed additives

Key Focus Areas: Precision nutrition, sustainable feed formulation, large-scale methionine production

Notable Features: One of the largest global methionine suppliers; strong portfolio supporting poultry and swine markets

2024 Revenue: Approximately CNY 15.53 billion

Market Share: A leading global supplier in the methionine segment

Global Presence: Major operations in China, Europe, and global commercial distribution

2. ADM (Archer-Daniels-Midland Company)

Specialization: Nutrition ingredients, fermentation-based products, and raw materials used in amino acid production

Key Focus Areas: Human and animal nutrition, specialty ingredients, protein and fermentation platforms

Notable Features: Massive integrated agribusiness with capabilities from raw-material sourcing to advanced nutrition solutions

2024 Revenue: Approximately USD 85.5 billion (consolidated revenue)

Market Share: Strong presence as a diversified ingredient provider supporting amino-acid value chains

Global Presence: Extensive operations across North America, South America, Europe, and Asia

3. Ajinomoto Co., Inc.

Specialization: Food seasonings, industrial amino acids, pharmaceutical amino acids, and advanced materials

Key Focus Areas: Amino-acid-based solutions for food, health, pharmaceuticals, and biotechnology

Notable Features: Pioneer in industrial amino acid production; known for MSG, lysine, glutamate derivatives, and specialty grades

2024 Revenue: Approximately ¥1,439.2 billion

Market Share: One of the world’s most influential amino-acid producers

Global Presence: Headquarters in Japan; operations in Asia, North America, Europe, and Latin America

4. AMINO GmbH

Specialization: High-purity pharmaceutical and research-grade amino acids

Key Focus Areas: Custom synthesis, GMP-quality materials for pharma and biotechnology

Notable Features: Serves niche markets requiring ultra-high quality and regulatory compliance

2024 Revenue: Estimated in the low tens of millions of USD (smaller specialty manufacturer)

Market Share: Strong in specialized pharmaceutical-grade amino acids; not active in commodity feed-grade markets

Global Presence: Based in Germany with exports across Europe and global research markets

5. Bill Barr & Company

Specialization: Ingredient distribution for feed and pet-food sectors

Key Focus Areas: Formulation support, sourcing amino acids, vitamins, premixes

Notable Features: Long-standing distributor bridging manufacturers and North American feed formulators

2024 Revenue: Estimated in the low tens of millions USD

Market Share: Regional niche distributor

Global Presence: Primarily North American operations and partnerships

Leading Trends Transforming the Amino Acids Market

1. Precision Nutrition in Livestock Production

Feed-grade amino acids enable precise diet optimization, reducing crude protein levels while maintaining weight gain and performance. This trend significantly reduces nitrogen emissions, making it central to sustainable agriculture.

2. Health & Wellness Boom in Human Nutrition

Rising use of BCAAs, glutamine, theanine, and taurine for fitness, mental health, and immune support drives strong growth in supplements and functional foods.

3. Biotech & Pharmaceutical-Grade Amino Acids

The expansion of biologics, including peptide therapeutics, mRNA technologies, and cell-culture-based vaccine production, increases demand for ultra-high purity amino acids.

4. Sustainable and Bio-Based Manufacturing

Sterile fermentation technologies, genetically engineered strains, and continuous processing are lowering costs and enabling greater scalability.

5. Global Supply Chain Diversification

Countries are reducing dependence on imports from singular regions, encouraging new manufacturing projects in the U.S., Europe, India, and Southeast Asia.

6. Strategic Corporate Partnerships

Joint initiatives between feed producers and food manufacturers integrate amino-acid-based solutions into broader sustainability programs.

Successful Real-World Examples in the Amino Acids Market

Ajinomoto & Global Dairy Companies

Amino-acid-based feed additives such as rumen-protected lysine are used to reduce nitrogen losses, support dairy production, and improve environmental outcomes.

Adisseo’s Methionine Expansion Programs

With multiple methionine plants and global R&D centers, Adisseo has helped feed mills reformulate lower-protein diets while maintaining animal performance.

European High-Purity Amino Acid Suppliers

Companies like AMINO GmbH have successfully built high-value niches by supplying critical ingredients for peptide synthesis and regulated biotech applications.

North American Distributor Model

Bill Barr & Company demonstrates how regional distribution with strong technical support remains vital for feed and pet-food industries relying on imported amino acids.

Global Regional Analysis and Government Policy Impact

Asia-Pacific

Market Position: Largest and fastest-growing region

Demand Drivers: Rising protein consumption, expanding aquaculture, large-scale poultry production, increasing supplement usage

Supply-Side Influence: China leads global production of lysine, threonine, and vitamins

Government Role:

- Strong policies promoting bio-manufacturing and industrial biotechnology

- Incentives for fermentation technology development

- Strategic exports shaping global pricing

North America

Market Position: Strong human nutrition and animal-feed market

Demand Drivers: Growing sports nutrition market, advanced biotech sector

Regulatory Framework:

- FDA and AAFCO regulate amino acids for animal feed

- Strict GRAS requirements for human consumption

- Emphasis on supply-chain security and domestic ingredient production

Europe

Market Position: High-value pharmaceutical and specialty nutrition market

Demand Drivers: Clean-label foods, medical nutrition, sustainable livestock initiatives

Regulatory Framework:

- EFSA regulates safety and efficacy for feed additives

- Strict environmental standards accelerating precision nutrition

- Incentives supporting sustainable agriculture and animal welfare

Latin America

Market Position: Rapid growth in animal feed and poultry exports

Demand Drivers: Brazil and Mexico’s large livestock and aquaculture sectors

Challenges: Relies heavily on imports, creating opportunities for new regional production

Middle East & Africa

Market Position: Emerging but growing

Demand Drivers: Expanding dairy and poultry industries, increasing pet-food consumption

Government Role: Investment incentives for food security and livestock improvement

Government Initiatives Shaping the Market

1. China’s Bioeconomy Expansion Policies

Supporting large-scale fermentation capacity, strengthening the global supply of amino acids.

2. U.S. FDA and AAFCO Regulations

Ensuring safety and compliance for amino acids used in both human foods and animal feeds.

3. EU Feed Additive Regulations

Strict evaluation and approval requirements for amino acids used in livestock feed, encouraging high product quality and traceability.

4. Sustainability and Emissions Reduction Programs

Governments and NGOs are promoting low-protein livestock diets to reduce greenhouse gases, directly boosting the use of amino acids.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Sodium Carbonate Market Growth Drivers, Trends, Key Players and Regional Insights by 2034