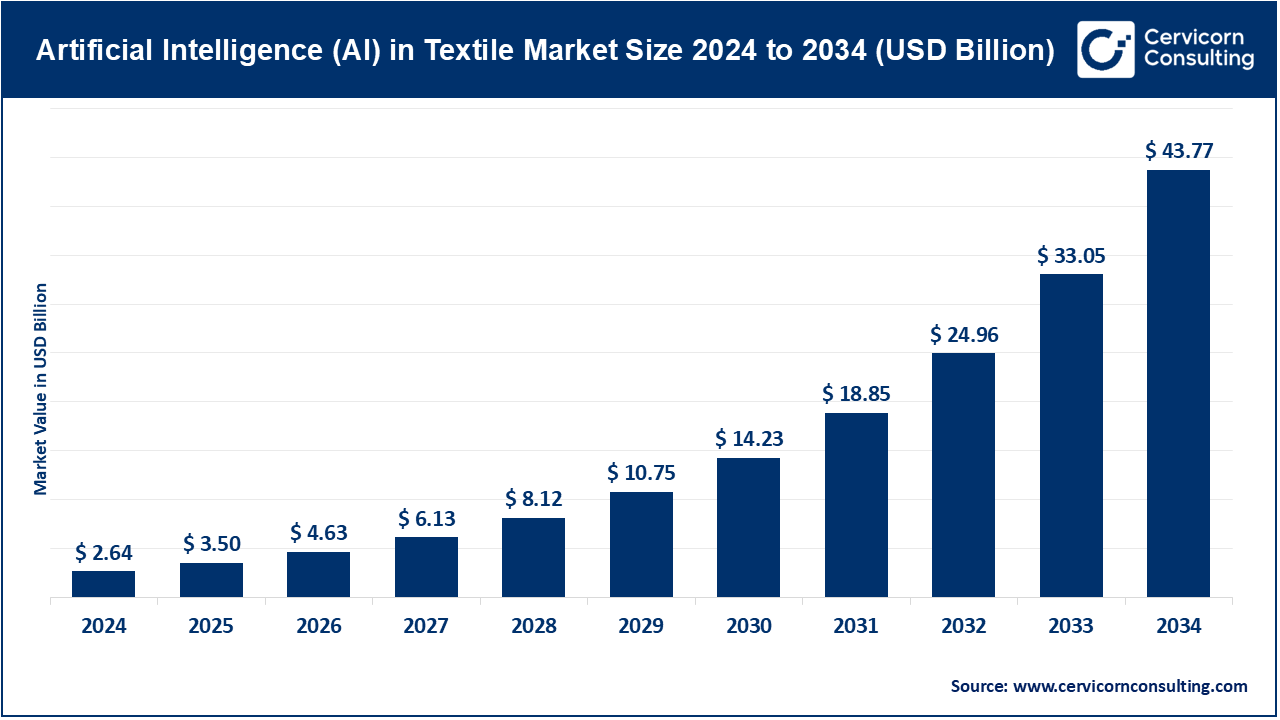

AI in the Textile Market Revenue, Global Presence, and Strategic Insights by 2034

AI in the Textile Market Size

What is “AI in the Textile Market”?

“AI in textiles” refers to the deployment of machine learning (ML), computer vision, natural language processing (NLP), generative AI, predictive analytics, and related automation technologies across textile and apparel value chains. Practical applications include automated fabric-defect inspection, predictive maintenance for looms and finishing lines, demand forecasting and inventory optimization for retailers, personalized design and on-demand manufacturing, color and pattern generation, digital twin simulations for plants and processes, robotics orchestration, sustainable materials traceability (digital product passports), and AI-driven customer experiences (search, styling, visual search). These technologies are applied at three broad levels: (1) factory floor & operations, (2) supply-chain & enterprise systems, and (3) product & customer experiences.

Growth Factors

The growth of AI in the textile market is being driven by a convergence of factors: manufacturers’ need to reduce labour-intensive inspection and rework costs and improve yield; the push for faster time-to-market and hyper-personalization from fashion retailers; rising labor costs and skilled-labour shortages in traditional textile hubs; regulatory and consumer pressure to reduce waste and increase transparency (which fuels adoption of AI-backed traceability and digital product passports).

The availability of affordable compute and cloud AI services (making advanced ML accessible to SMEs), plus a surge in practical computer-vision techniques for fabric defect detection and IoT-driven predictive maintenance; finally, generous public incentives and industrial digitization programs in markets like India and China that lower adoption barriers — all combining to lift investment and accelerate rollouts across the value chain.

Why is AI Important for Textiles?

- Quality & Yield — Automated vision systems find defects far faster and more consistently than human inspection, reducing scrap and rework.

- Speed & Responsiveness — AI demand forecasting and order orchestration let brands move faster from concept to shelf and reduce overstock.

- Cost Efficiency — Predictive maintenance lowers unplanned downtime on expensive knitting, weaving and finishing equipment.

- Sustainability & Traceability — AI supports circularity initiatives (digital product passports, material optimization), which regulators and consumers increasingly demand.

- Design & Personalization — Generative AI helps produce on-demand designs and enables mass personalization at scale (from pattern generation to size recommendations).

AI in Textile Market — Top Companies

Below is a profile of top technology players with their focus, notable features, revenue scale, and global reach. Most of these are horizontal technology providers offering enabling AI platforms used by textile specialists and integrators.

Microsoft Corporation

- Specialization / Focus Areas: Cloud AI (Azure AI + Azure OpenAI), digital twins (Microsoft Fabric + Azure Digital Twins), Power Platform for rapid apps, ERP/CRM integrations.

- Notable Features: Azure OpenAI, Power Apps, Dynamics integrations used by textile enterprises.

- 2024 Revenue: Over $245 billion.

- Global Presence: Strong enterprise footprint worldwide through cloud and partner ecosystems.

IBM Corporation

- Specialization / Focus Areas: Enterprise AI & hybrid cloud (Watson, Red Hat), supply-chain AI, sustainable supply-chain solutions, consultative services.

- Notable Features: IBM Garage, AI pilots for fabric forecasting and sustainability.

- 2024 Revenue: About $62.8 billion.

- Global Presence: Europe, North America, and Asia with strong consulting reach.

Google LLC / Alphabet

- Specialization / Focus Areas: Google Cloud AI, Vertex AI, Gemini, retail and fashion ML solutions, visual search, recommendation systems.

- Notable Features: ML infrastructure and visual AI pipelines supporting textile retailers.

- 2024 Revenue: Around $350 billion.

- Global Presence: Global cloud and AI deployments.

Amazon Web Services (AWS)

- Specialization / Focus Areas: Cloud AI/ML, demand forecasting, order orchestration, retail inventory optimization.

- Notable Features: Amazon Forecast, scalable ML services, retail partner ecosystem.

- 2024 Revenue: Amazon revenue $638 billion; AWS $107–108 billion.

- Global Presence: Worldwide infrastructure and partnerships.

SAP SE

- Specialization / Focus Areas: ERP and supply-chain AI, demand planning, enterprise cloud suites for textile manufacturing.

- Notable Features: Deep ERP integrations and cloud AI for textile operations.

- 2024 Revenue: Significant growth in cloud revenue in FY2024.

- Global Presence: Strong base in Europe and expanding globally.

Oracle Corporation

- Specialization / Focus Areas: Enterprise databases, cloud infrastructure, AI for supply chains and manufacturing.

- Notable Features: Autonomous database, enterprise AI stacks.

- 2024 Revenue: Growth in cloud revenue (exact textile share not disclosed).

- Global Presence: Large enterprise presence worldwide.

General Vision Inc.

- Specialization / Focus Areas: Edge AI vision sensors and NeuroMem-based cameras for inline surface inspection.

- Notable Features: Affordable inline cameras for 24/7 defect detection on continuous fabrics.

- 2024 Revenue: Private company, revenue not disclosed.

- Global Presence: Niche but growing presence in textile inspection.

Salesforce Inc.

- Specialization / Focus Areas: CRM + AI (Einstein) for personalized customer experiences, marketing automation for apparel retailers.

- Notable Features: AI for segmentation, personalization and merchandising.

- 2024 Revenue: Significant cloud CRM revenue (no textile breakdown).

- Global Presence: Global SaaS customer base.

Adobe Inc.

- Specialization / Focus Areas: Creative software + generative AI (Photoshop, Substance, Firefly) for pattern creation and digital sampling.

- Notable Features: Speeds design cycles and reduces sample waste.

- 2024 Revenue: Robust growth in creative and digital tools.

- Global Presence: Worldwide design user base.

Huawei Technologies Co., Ltd.

- Specialization / Focus Areas: Cloud, edge computing, AI chips, smart factory solutions in Chinese textile hubs.

- Notable Features: Partnerships in industrial clusters and AI-driven smart factories.

- 2024 Revenue: Large diversified revenue base.

- Global Presence: Asia-centric with global telecom and cloud expansion.

Nvidia Corporation

- Specialization / Focus Areas: GPUs and Omniverse for simulation, digital twins, fabric modeling, computer vision.

- Notable Features: GPU-accelerated training, realistic cloth simulations.

- 2024 Revenue: Significant AI-driven growth in data center and GPUs.

- Global Presence: Global AI infrastructure provider.

Siemens AG

- Specialization / Focus Areas: Industrial automation, digital twins, industrial AI agents, smart factory optimization.

- Notable Features: AI agents for manufacturing plants, integrated with automation systems.

- 2024 Revenue: Growth in industrial AI and automation divisions.

- Global Presence: Strong in Europe, Asia, and global industrial hubs.

Leading Trends and Their Impact

- Computer Vision for Inline Inspection — Automated defect detection replacing manual checks increases throughput and reduces waste.

- Generative AI & Digital Design — Shortens sampling cycles with AI-assisted design, simulation, and visualization.

- Demand Forecasting & Inventory Orchestration — Data-driven forecasting enables demand-based manufacturing, reducing excess inventory.

- Digital Twins & Simulation — Virtual plant modeling for commissioning and optimization improves efficiency.

- Sustainability & Traceability — AI enables product passports, lifecycle analytics, and transparency required by regulators.

- Edge AI for SMEs — Affordable sensors and pay-per-use AI democratize adoption for smaller textile mills.

Successful Examples Around the World

- ASOS (UK) + Microsoft: Used Azure OpenAI to enhance product discovery and personalization.

- Bestseller India + IBM: Developed Fabric.ai for AI-powered sales forecasting.

- Arvind (India) + Microsoft: Adopted Power Apps and Dynamics for textile digitization.

- Inline Fabric Inspection (Global): AI models like YOLOv8 adopted in mills for defect detection.

- AWS Order Clouds: Retailers using AWS-based AI to manage real-time order orchestration.

Global Regional Analysis — Government Initiatives & Policies

India

The Production-Linked Incentive (PLI) scheme supports textile modernization and digitization, encouraging mills to adopt AI tools alongside capacity upgrades.

China

“AI + Manufacturing” initiatives, industrial internet projects, and AI subsidies accelerate adoption in textile hubs, making China a leader in AI-powered smart factories.

European Union

The EU’s Textile Strategy and Digital Product Passport regulations push brands toward traceability, transparency, and AI-enabled lifecycle management. The EU AI Act also enforces ethical and explainable AI practices.

United States

AI adoption in textiles is led by private-sector investment, cloud providers, and startups. National AI policies indirectly support the sector through semiconductor and compute investments.

Southeast Asia, Latin America, Africa

Adoption remains in early stages, with Bangladesh, Vietnam, and Turkey piloting AI for quality inspection and predictive maintenance. International brand requirements and buyer-driven sustainability initiatives influence uptake.

Practical Adoption Challenges

- Data Quality & Integration: Many factories lack digitized data and integration-ready systems.

- Workforce Skills: Shortage of AI-trained engineers in textile clusters.

- Regulatory & Ethics: Compliance with AI governance and sustainability laws adds complexity.

- ROI Proof: SMEs demand rapid payback, making affordable edge AI and pay-as-you-go models attractive.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Wire and Cable Market Growth Drivers, Trends, Key Players & Regional Insights by 2034